Get the free MORTGAGE-BACKED SECURITIES (63

Get, Create, Make and Sign mortgage-backed securities 63

Editing mortgage-backed securities 63 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage-backed securities 63

How to fill out mortgage-backed securities 63

Who needs mortgage-backed securities 63?

An In-depth Guide to Mortgage-Backed Securities 63 Form

Understanding mortgage-backed securities (MBS)

Mortgage-backed securities (MBS) are financial instruments that pool multiple mortgage loans, allowing investors to buy shares in a collection of mortgages. The income generated from these loans—primarily through monthly mortgage payments—streams to investors as returns. This system enables banks to originate more loans by freeing up capital, which subsequently fuels the housing market through increased availability of mortgage financing.

MBS play a pivotal role in financial markets, enhancing liquidity and providing a means for investors to participate in the real estate market indirectly. They are structured in various forms, such as pass-through securities and collateralized mortgage obligations (CMOs), each with distinct features that cater to different investor needs.

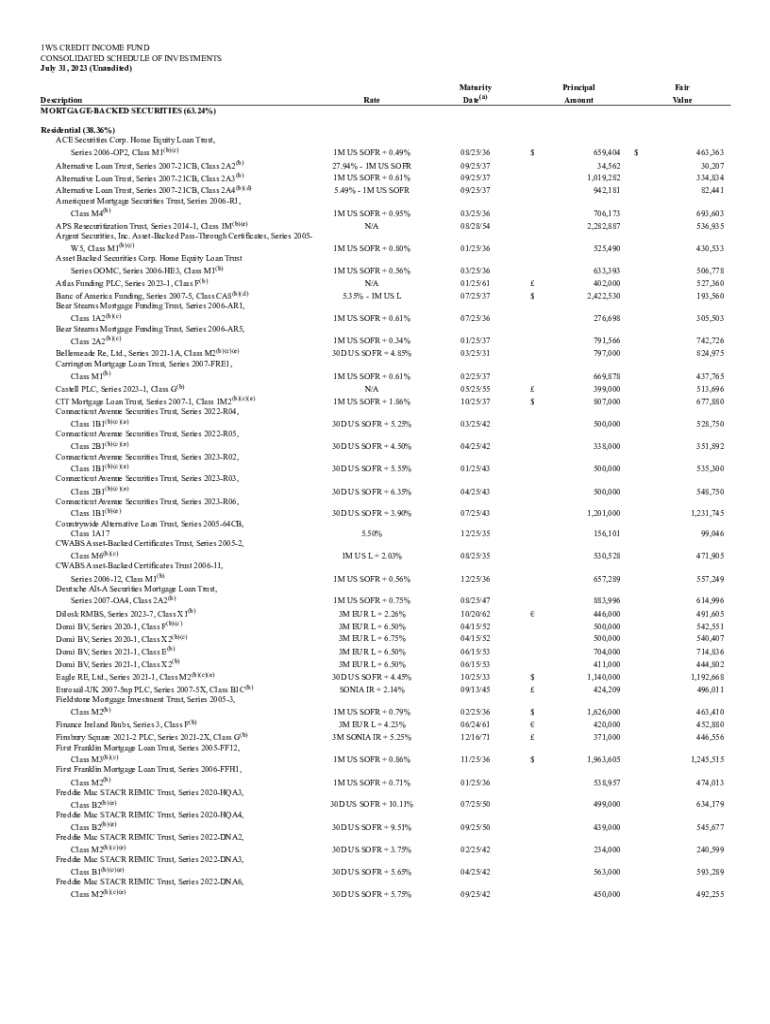

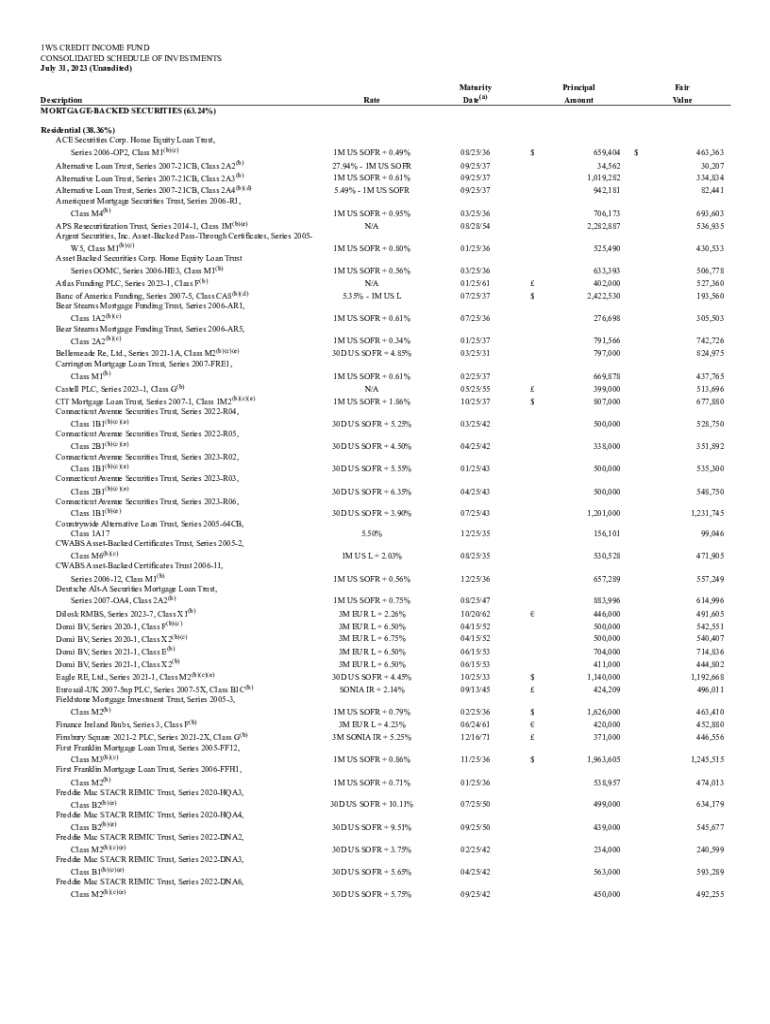

The 63 Form is integral to understanding the financial landscape surrounding MBS. This form enables issuing organizations to provide critical information about the securities they offer, ensuring transparency and compliance with regulatory frameworks. Thus, stakeholders in the MBS market rely on the 63 Form to make informed investment decisions.

The mortgage-backed securities 63 form: A closer look

The 63 Form is essentially a reporting tool required by regulatory bodies to standardize information and facilitate transparency in the MBS marketplace. This form outlines essential data about the securities being offered, allowing stakeholders to assess the risks and returns associated with different mortgage assets.

Within the 63 Form, several key components are necessary. These include identification information about the issuer, detailed descriptions of the underlying mortgage loans, and specified risk assessments associated with those assets. Let's break this down further:

Purpose and significance of the 63 form

Filing the 63 Form is essential for regulatory compliance. Regulatory agencies, such as the Securities and Exchange Commission (SEC), mandate thorough reporting to ensure that the market remains transparent and operates fairly. This requirement protects both individual and institutional investors from undue risk and fosters trust in the market.

Moreover, the 63 Form benefits stakeholders by offering clear insights into the financial health of MBS. Specifically, the form contributes to transparency in financial reporting, which is crucial for effective risk management. By understanding the specific details provided in the form, investors can better gauge potential returns as well as the risks tied to economic fluctuations.

Step-by-step guide to completing the mortgage-backed securities 63 form

Before filling out the 63 Form, certain preliminary requirements must be met to ensure the accuracy and completeness of your submission. This includes gathering all necessary documentation, such as issuer registration details and pertinent financial statements. Stakeholders often face common challenges while filling out this form, including misinterpretation of required fields or missing crucial data. It’s vital to approach the form with thorough preparation.

To aid in the completion process, it's beneficial to consider each section carefully. Here’s a detailed breakdown:

To ensure accuracy during this process, it’s essential to double-check all entries. Common mistakes include inputting incorrect data or overlooking vital details. Taking a moment to review your work can prevent potential legal issues or rejection of your submission.

Interactive tools and resources for filing the 63 form

When it comes to filling out the 63 Form, tools like pdfFiller provide invaluable support. pdfFiller offers online solutions for form creation, enabling users to access and manage their documents efficiently from anywhere. The seamless editing features and eSigning capabilities make it particularly advantageous for teams and individuals dealing with MBS-related documentation.

With pdfFiller, users can easily customize the 63 Form according to their needs, streamlining the filing process.

Best practices for managing mortgage-backed securities documentation

Maintaining compliance with regulatory bodies is not just a formal obligation but a way to promote financial health in the market. Organizing MBS documentation systematically makes it easier to respond to audits or inquiries efficiently. Stakeholders must prioritize efficient document management strategies to reduce risk and improve operational performance.

pdfFiller acts as a multi-functional tool that enhances document management by offering real-time collaborative editing, version control, and the advantages of cloud storage. By leveraging these features, organizations can ensure that their documentation stays current, accurate, and compliant.

Common questions and answers about the mortgage-backed securities 63 form

Questions often arise regarding potential errors on the 63 Form. If you encounter any inaccuracies within the file, it's crucial to address them promptly. Typically, you would need to file an amended form to rectify any mistakes discovered after submission. Additionally, the frequency of filing depends on the specific securities involved; irregular issuances may require less frequent submissions.

Lastly, it's beneficial to know key contacts for filing issues, including your state’s regulatory body and the services provided by pdfFiller for technical assistance.

Future trends in mortgage-backed securities and regulatory changes

As the landscape for mortgage-backed securities continues to evolve, regulatory changes are expected to emerge frequently. Regulatory bodies are likely to refine the compliance frameworks governing MBS to enhance transparency and security. This could include modifications to the current 63 Form, addressing the complexities of increasingly diversified mortgage portfolios.

Technology will play a significant role in shaping the future documentation processes. Innovations in data security, real-time analytics, and automated compliance monitoring stand to revolutionize how stakeholders manage MBS documentation.

Conclusion and next steps

The Mortgage-Backed Securities 63 Form is not only a necessary regulatory document but also a tool for transparency and trust in financial markets. Its role in reporting vital information helps stakeholders make educated investment decisions. Remember to utilize pdfFiller for efficient document management throughout your MBS journey—its features are tailored to enhance your workflow and ensure compliance.

By staying informed about future changes in MBS regulations and utilizing effective documentation practices, you will be well-equipped to navigate the complexities of mortgage-backed securities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mortgage-backed securities 63 from Google Drive?

How do I make changes in mortgage-backed securities 63?

How do I complete mortgage-backed securities 63 on an Android device?

What is mortgage-backed securities 63?

Who is required to file mortgage-backed securities 63?

How to fill out mortgage-backed securities 63?

What is the purpose of mortgage-backed securities 63?

What information must be reported on mortgage-backed securities 63?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.