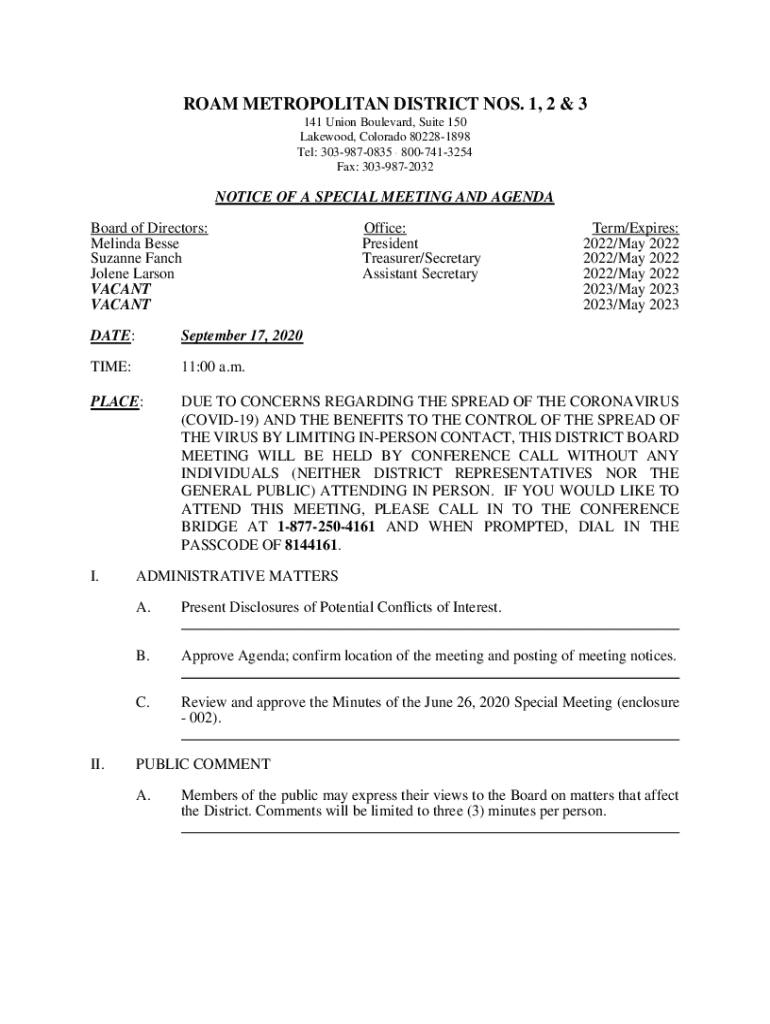

Get the free Treasurer/Secretary

Get, Create, Make and Sign treasurersecretary

How to edit treasurersecretary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out treasurersecretary

How to fill out treasurersecretary

Who needs treasurersecretary?

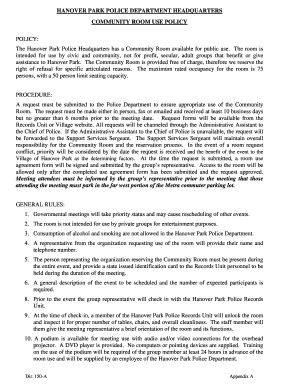

Comprehensive Guide to the Treasurer Secretary Form

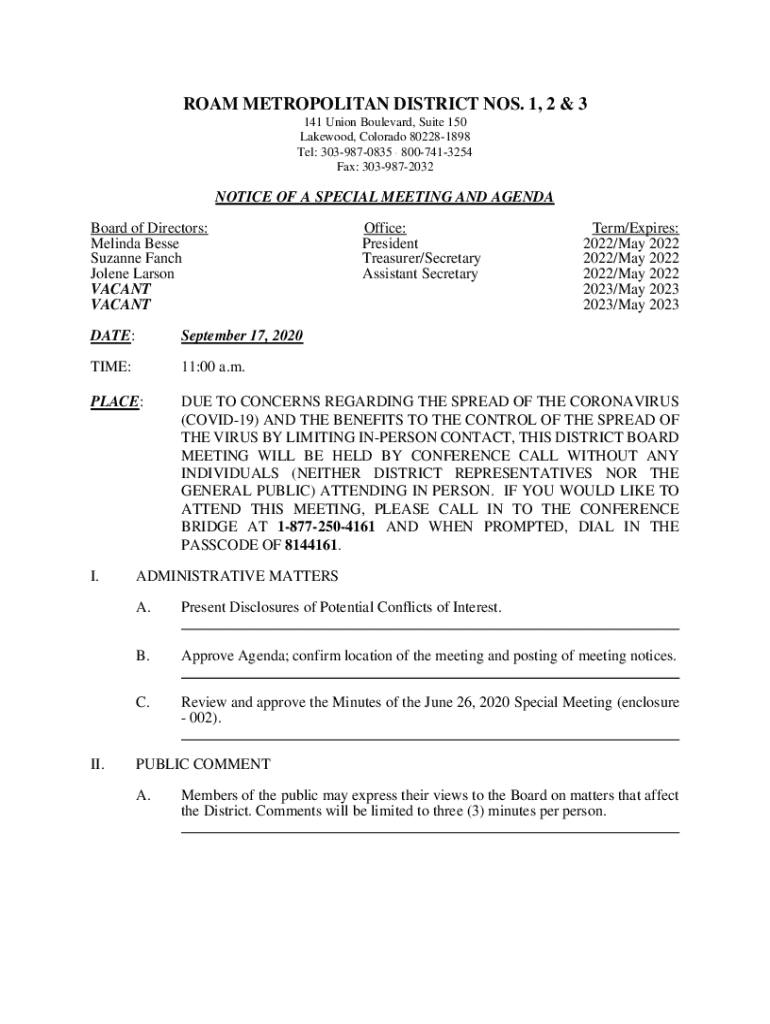

Understanding the treasurer secretary form

The treasurer secretary form serves as a vital document in managing the financial and administrative tasks required by various organizations, particularly nonprofits, unions, and clubs. This form is primarily used to report financial data and ensure comprehensive documentation that supports transparency and accountability within the organization. By accurately completing this form, treasurers and secretaries can provide a clear picture of the financial health of their organizations.

Accurate record-keeping is essential to any organization’s credibility and operational success. It allows stakeholders to make informed decisions based on reliable data. Additionally, the essential roles of the treasurer and secretary in document management facilitate better financial oversight and operational efficiency, highlighting their collaborative importance in ensuring compliance with regulations and organizational policies.

Essential components of the treasurer secretary form

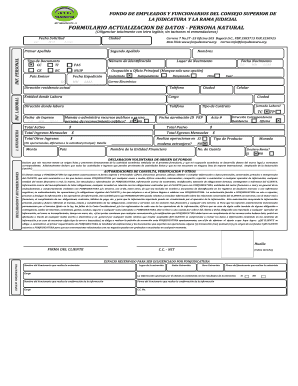

Every treasurer secretary form includes several essential components that ensure it fulfills its purpose effectively. Firstly, the financial reporting section outlines key financial metrics, such as income, expenses, and net assets. Additionally, proper signature areas are included to validate the document once completed, along with compliance checklists to guide users in adhering to necessary regulations.

Required information for completing the form includes elements such as the date of submission, organization details including name and address, and the personal information of the treasurer and secretary. One common mistake when filling out the form is neglecting to double-check for accuracy, leading to potential compliance issues or misrepresentations of financial status.

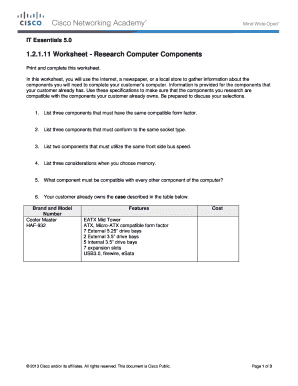

Step-by-step instructions for filling out the treasurer secretary form

Filling out the treasurer secretary form accurately is critical for effective financial reporting. Begin by preparing to fill out the form. Gather necessary documents, such as financial statements, budget reports, and previous forms, to facilitate a comprehensive and accurate reporting process.

Understanding financial reporting requirements is also essential; organizations may have different needs based on jurisdiction or internal policies. Next, input your personal and organization details. Clearly write the organization’s name and address, and fill in personal information for both the treasurer and secretary to establish accountability.

After filling out the financial section, ensure that all data is reviewed for compliance and accuracy. Double-check the entries, get necessary management approvals, and then finalize the document with proper signatures and submission protocols.

Tools and resources for managing the treasurer secretary form

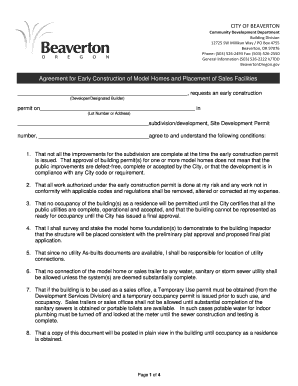

Utilizing tools like pdfFiller can streamline the process of managing the treasurer secretary form. With interactive editing tools, users can easily modify forms, and the platform’s step-by-step editing features enhance user experience significantly.

Integration of eSignature features empowers users to sign documents electronically, cutting down on paperwork while staying compliant. Additionally, collaboration features allow teams to share documents securely with real-time editing and feedback capabilities, fostering a collaborative environment.

Troubleshooting common issues with the treasurer secretary form

Even with meticulous attention to detail, issues may arise when submitting the treasurer secretary form. Common errors include incomplete information or miscalculations that can lead to rejection. When this occurs, it is important to promptly rectify them by reviewing the submission and correcting any inaccuracies.

Handling rejected forms often involves clear communication with the governing body that oversees the submissions. They may provide specific feedback or requirements needed for resubmission. If additional assistance is necessary, consulting with a financial professional or accountant can provide clarity and guidance in correcting any errors.

Best practices for utilizing the treasurer secretary form

Implementing best practices is crucial for maximizing the effectiveness of the treasurer secretary form. Begin by conducting periodic reviews and updates to the data entered, ensuring all financial information remains current and accurate. Maintaining transparency in all financial documentation fosters trust among stakeholders and supports the integrity of the organization’s financial practices.

Planning ahead for each fiscal period is another best practice; it helps in anticipating financial trends and potential issues that may arise. Timely and accurate submission of the treasurer secretary form allows organizations to remain compliant while accurately reflecting their financial health.

Related forms and documentation

Alongside the treasurer secretary form, there are several related forms that organizations should also be aware of. These include the Local Union Annual Financial Report Form, Per Capita Tax Reporting Forms, and various Expense Report Samples that facilitate the tracking of organization-specific expenditures, such as mileage and airfare.

Understanding the importance of these forms in conjunction with the treasurer secretary form is crucial. They collectively contribute to the organization’s overall financial governance, ensuring that all necessary reporting is coordinated and comprehensive.

Recent updates and announcements

Staying informed about recent updates is vital for compliance with filing requirements and timelines related to the treasurer secretary form. Organizations may encounter changes in procedures or documentation needs, making it essential to review any official announcements regarding these changes.

Upcoming deadlines for submission should be monitored closely, ensuring organizations fulfill reporting obligations on time, thus avoiding penalties or compliance issues. Additionally, any news impacting the responsibilities of treasurers and secretaries must be acknowledged for proper organizational alignment.

Frequently asked questions about the treasurer secretary form

Individuals often have questions regarding the treasurer secretary form, especially when it comes to handling the complexities of documentation. One common inquiry is, 'What if I lose the form?' In such cases, it's advisable to contact the overseeing body promptly for guidance on obtaining a replacement form to ensure compliance.

Another frequent question pertains to changes in board members during the reporting period. It's crucial to document any changes accurately on the form and maintain transparency. Questions regarding electronic submissions also arise; many organizations now accept electronic submissions of the form, expediting the process and enhancing convenience for the users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the treasurersecretary in Gmail?

How do I edit treasurersecretary straight from my smartphone?

How do I edit treasurersecretary on an Android device?

What is treasurersecretary?

Who is required to file treasurersecretary?

How to fill out treasurersecretary?

What is the purpose of treasurersecretary?

What information must be reported on treasurersecretary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.