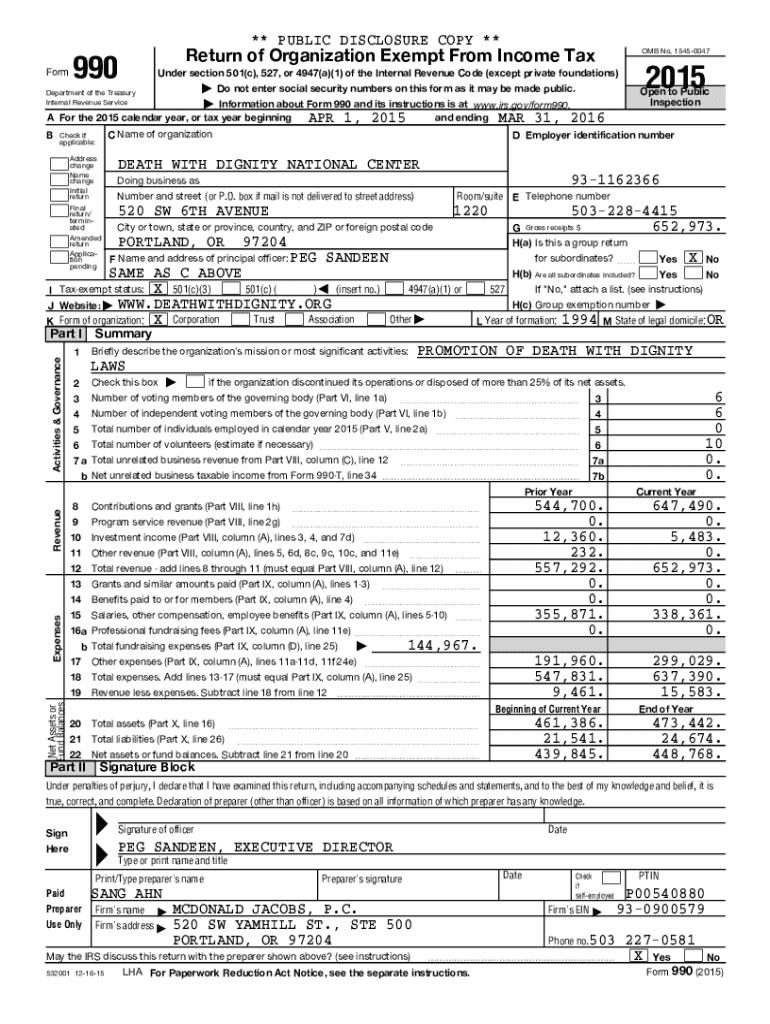

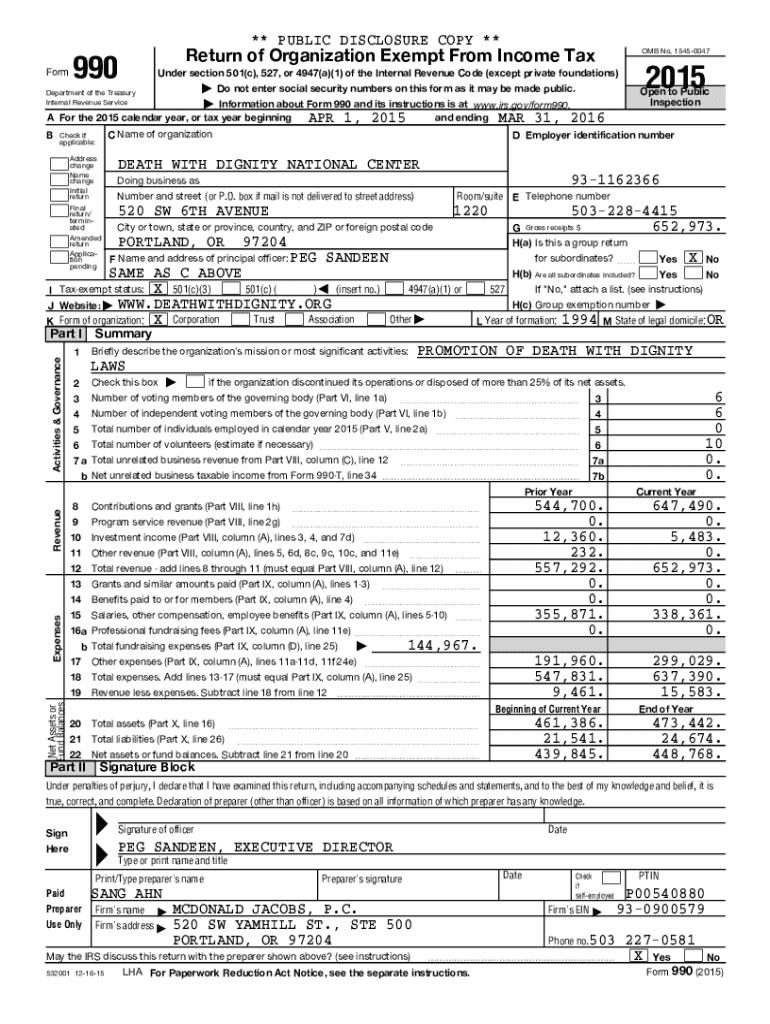

Get the free L Year of formation: 1994 M State of legal domicile: OR

Get, Create, Make and Sign l year of formation

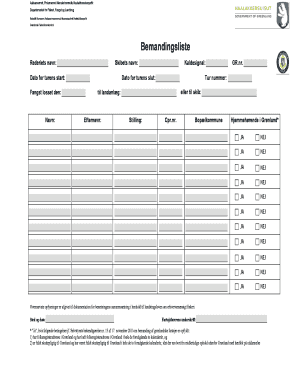

Editing l year of formation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out l year of formation

How to fill out l year of formation

Who needs l year of formation?

A comprehensive guide to the year of formation form

Understanding the year of formation form

The year of formation form serves as a critical document in the realm of business documentation, encapsulating key data about a company’s inception. It not only defines when a business officially started operating but also serves various legal and regulatory purposes throughout its lifetime.

Accurate information on this form is pivotal; it reflects the company’s standing and contributes to its credibility, especially when pursuing permits, licenses, or tax registration. Ignoring the nuances involved can lead to compliance issues down the line.

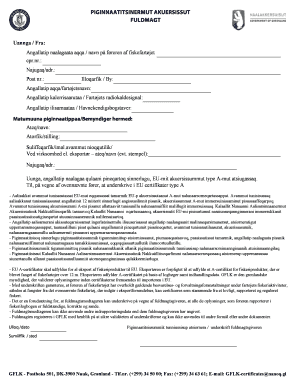

Various entities, including Limited Liability Companies (LLCs), corporations, and non-profits, need to utilize the year of formation form when officially registering with state authorities or updating their business records.

Components of the year of formation form

Essential components of the year of formation form include identifying information about the business entity. Typically, this will consist of:

Common documents that use year of formation information include incorporation papers, tax filings, and various business licenses, all of which require this data to validate the entity’s existence.

Step-by-step guide to completing the year of formation form

Completing the year of formation form is a straightforward process that involves several key steps:

Editing and revising your year of formation form

There may be occasions when you need to edit your year of formation form, perhaps due to changes in the business structure or corrections in the data provided.

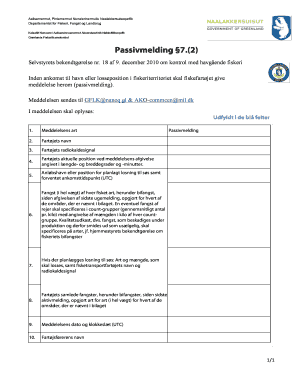

To submit corrections, you typically need to fill out a similar form, indicating the changes clearly. It’s crucial to grasp how common revisions can impact your business status, especially concerning licenses and compliance obligations.

Navigating the implications of the year of formation

Once the year of formation form is submitted, there are several legal considerations to bear in mind. This submission can affect your business licenses and permits, making it essential for your operations to be in alignment with local regulations.

Moreover, the year of formation plays a significant role in determining your tax responsibilities. Failing to accurately report this information can unfortunately lead to complications with tax authorities.

Maintaining good standing with state authorities is often dependent on the timely and accurate submission of this form, echoing the importance of diligent documentation.

Interactive tools for year of formation form management

Using pdfFiller simplifies the process of managing the year of formation form. With tools designed for effective editing, users can navigate complex requirements without hassle.

The eSignature tools available on pdfFiller enhance efficiency, allowing for swift approvals that maintain compliance. Additionally, team collaboration features enable multiple stakeholders to participate in the documentation process seamlessly.

Addressing frequently asked questions

Common questions surrounding the year of formation form include:

Unique considerations by business type

The year of formation requirements can vary significantly depending on the type of business entity. For instance, LLCs and corporations typically face stricter documentation requirements due to their complex structures.

Non-profits and sole proprietorships may have different forms suited to their specific operational needs, impacting how they report their formation year. Understanding these nuances is essential for proper compliance and operational continuity.

Key benefits of using pdfFiller for your year of formation form

One of the standout advantages of using pdfFiller is the ability to access your year of formation form anytime, anywhere. This flexibility is crucial for busy business owners and teams who require immediate access to documentation.

The cloud-based solution offered by pdfFiller enables streamlined document management and enhances compliance by reducing errors through guided features. This ensures that users can concentrate on growing their business without being bogged down by administrative tasks.

Related topics to explore

Furthering your understanding of the year of formation form can open up insights into other essential business documentation. Explore the business formation process, uncover the importance of annual reports, and discover additional necessary business forms to enhance your compliance and operational readiness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in l year of formation without leaving Chrome?

Can I create an eSignature for the l year of formation in Gmail?

How can I fill out l year of formation on an iOS device?

What is l year of formation?

Who is required to file l year of formation?

How to fill out l year of formation?

What is the purpose of l year of formation?

What information must be reported on l year of formation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.