Get the free Form 8-K Current Report - Allstate Investor Relations

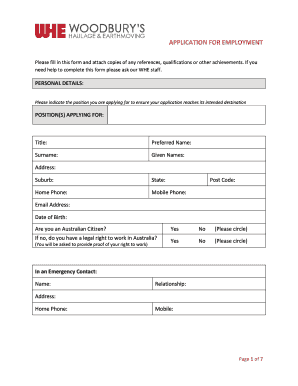

Get, Create, Make and Sign form 8-k current report

Editing form 8-k current report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k current report

How to fill out form 8-k current report

Who needs form 8-k current report?

Form 8-K Current Report Form: A Comprehensive How-to Guide

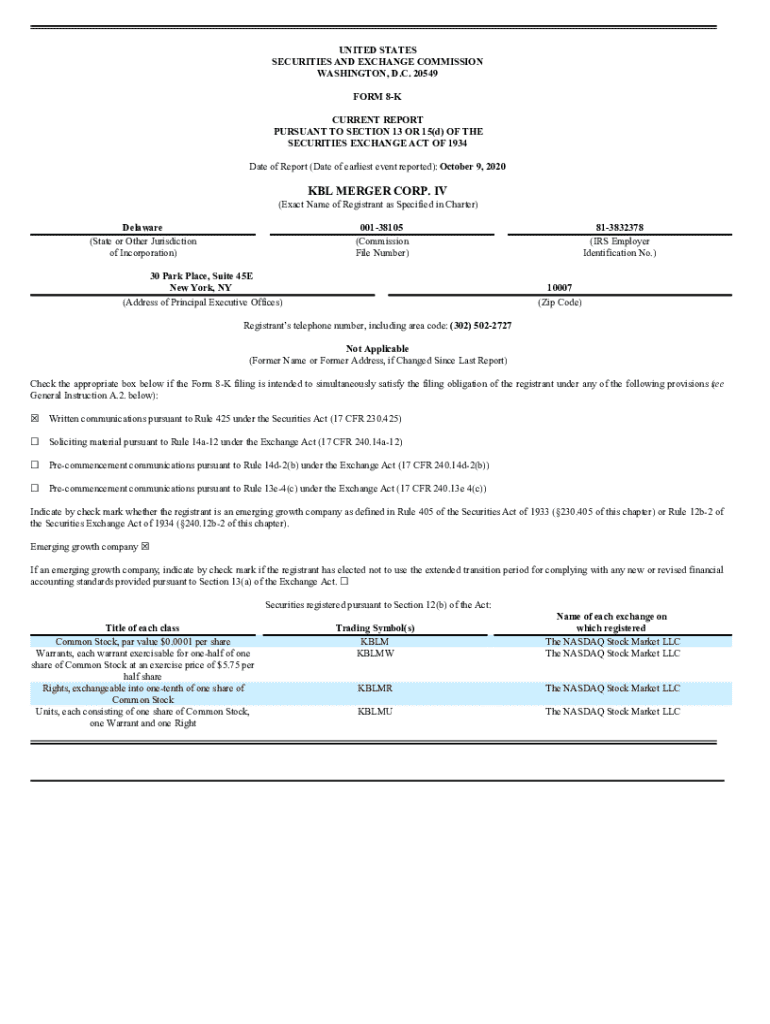

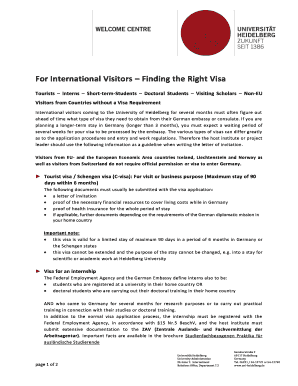

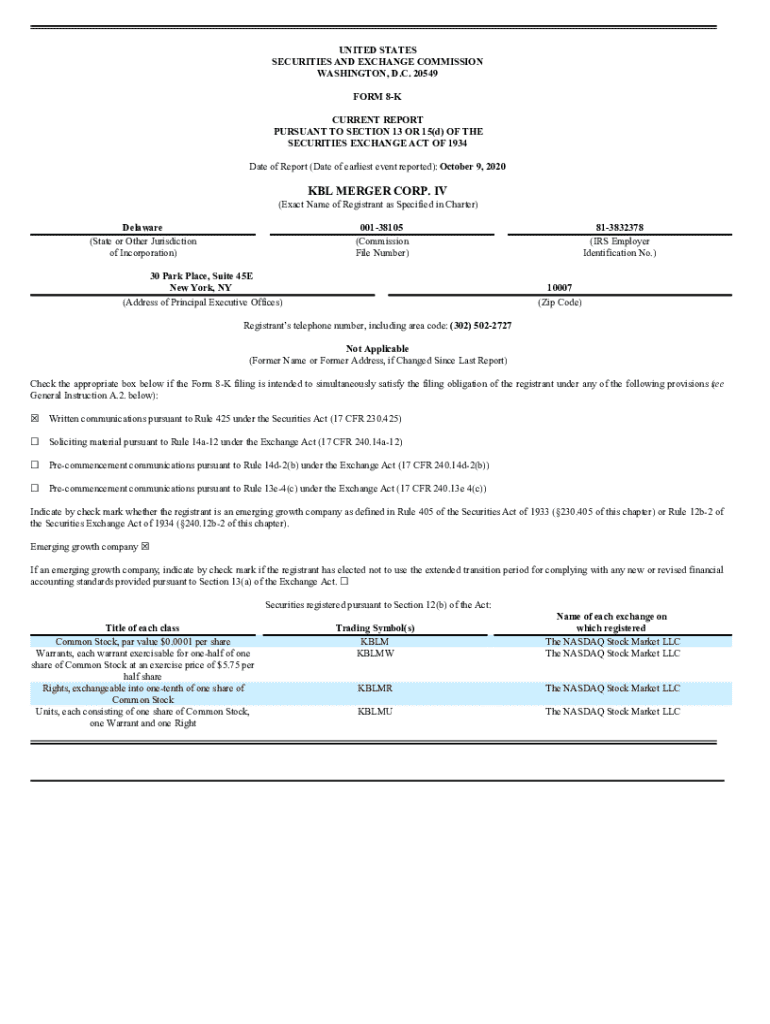

Understanding Form 8-K

Form 8-K is a critical reporting document that public companies are required to file with the Securities and Exchange Commission (SEC) whenever a significant event occurs that may be of importance to investors. This form is essential for ensuring transparency in corporate governance and helps keep stakeholders informed about notable developments.

The purpose of Form 8-K is to facilitate timely disclosures that could materially impact a company's performance, stock price, or investment decisions. It is a mechanism that empowers shareholders and investors by providing them with immediate access to information, minimizing the potential for misinformation and speculation.

The SEC plays an instrumental role in regulating the requirements and ensuring compliance with Form 8-K filings. By overseeing these filings, the SEC aims to promote fairness and transparency in financial markets, thereby bolstering investor confidence.

When to file Form 8-K

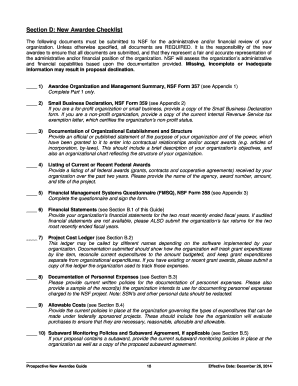

Filing Form 8-K is not optional; it is mandatory whenever certain key events transpire. The major triggers for such filings include significant corporate changes, acquisitions, or financial restatements. Understanding when to file is crucial for maintaining compliance and ensuring transparency to stakeholders.

Once an event triggering the filing occurs, it is important to submit the Form 8-K within four business days. This timeline is critical as it ensures that information reaches investors quickly, fostering an environment of transparency.

Key components of the Form 8-K

Form 8-K consists of several key sections that contain essential information regarding the nature of the event being reported. A comprehensive understanding of its structure helps in completing the form accurately.

Commonly included items within Form 8-K are as follows:

Detailed instructions for completing Form 8-K

Completing Form 8-K requires careful attention to detail and accurate reporting. To assist in this process, a systematic step-by-step guide can be highly beneficial.

To maintain accuracy and compliance, here are additional tips: Always double-check the information entered, and consider utilizing checklists during screening, to ensure no critical details are overlooked. Avoiding common mistakes can save time and prevent potential penalties.

Filing Form 8-K with the SEC

Once the Form 8-K has been accurately completed, the next step is to file it electronically with the SEC. This process involves several important steps that must be followed carefully.

Be prepared to troubleshoot common filing issues, which may include file format problems or technical errors during submission. Familiarizing yourself with support resources available on the SEC's website can also be immensely helpful.

Reading and analyzing Form 8-K filings

Analyzing Form 8-K filings requires a keen understanding of the language and terminology used. Investors and stakeholders should be equipped to filter through potentially complex disclosures to identify key information swiftly.

Historical context and evolution of Form 8-K

The regulatory landscape surrounding Form 8-K has undergone significant changes over the years. Initially introduced in the mid-1930s, the requirements for disclosures have evolved in response to financial scandals and changing market dynamics, leading to increased scrutiny and necessity for transparency.

To illustrate its impact, various cases where significant Form 8-K filings influenced stock prices and investor behavior play a critical part in understanding its importance. Companies that have faced consequences due to delayed or missed disclosures underscore the necessity for adherence to filing requirements.

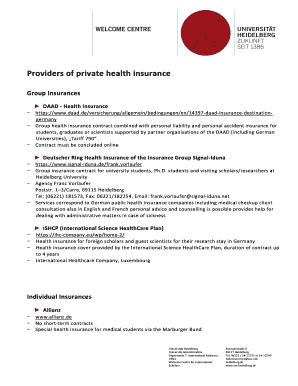

External resources and tools for Form 8-K management

Utilizing the right tools and resources can streamline the process of managing Form 8-K filings. pdfFiller, for instance, provides a robust platform that enables users to create, edit, and manage documents efficiently.

FAQs about Form 8-K

Conclusion: The essential role of Form 8-K in corporate governance

Form 8-K serves a pivotal role in corporate governance by promoting transparency and timely disclosures that affect investor decisions. It is not merely a bureaucratic requirement but an essential tool for fostering trust between corporations and their stakeholders.

By ensuring compliance with Form 8-K, companies not only avoid potential legal repercussions but also reinforce their commitment to transparency and accountability in their operations. As stakeholders become increasingly diligent in their assessment of disclosures, the importance of accurate and timely Form 8-K filings cannot be overstated.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 8-k current report without leaving Google Drive?

How do I complete form 8-k current report online?

How do I fill out form 8-k current report on an Android device?

What is form 8-k current report?

Who is required to file form 8-k current report?

How to fill out form 8-k current report?

What is the purpose of form 8-k current report?

What information must be reported on form 8-k current report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.