Get the free 40 per share

Get, Create, Make and Sign 40 per share

How to edit 40 per share online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 40 per share

How to fill out 40 per share

Who needs 40 per share?

40 Per Share Form: Your Comprehensive How-To Guide

Understanding the 40 per share form

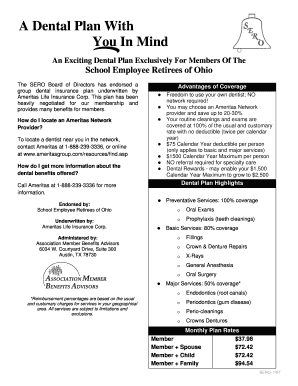

The 40 per share form is a critical document utilized in equity compensation, allowing employees and other stakeholders to report their stock options effectively. This form serves as an official report outlining the details of shares sold or received, ensuring accurate tax reporting and compliance with financial regulations.

Understanding its purpose is essential for both employees and employers. It helps clarify the number of shares, the sale price, and other pertinent details involved in stock transactions, which can significantly impact an individual's financial health and tax obligations.

Who needs this form?

The 40 per share form is essential for several parties involved in equity compensation. Primarily, it is relevant for individuals receiving stock options, who must accurately report their stock transactions to avoid discrepancies in tax filings.

Importance of accurate form filling

Ensuring accurate details on your 40 per share form is crucial. Incorrect information can lead to serious issues, including penalties from tax authorities or discrepancies in financial reporting. Therefore, meticulous attention to detail is paramount.

Common pitfalls often arise during the completion of this form. One frequent mistake involves miscalculating stock options, which can have widespread tax implications. Additionally, failing to report changes in personal information, such as a change of address or name, can complicate future transactions and filings.

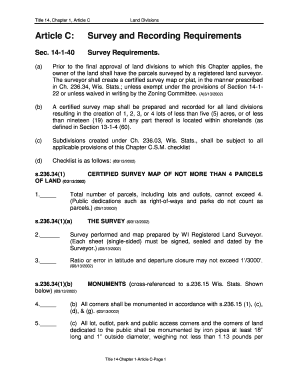

Step-by-step instructions for filling out the 40 per share form

Filling out the 40 per share form can be straightforward if you follow a structured approach. Here are the key steps to take:

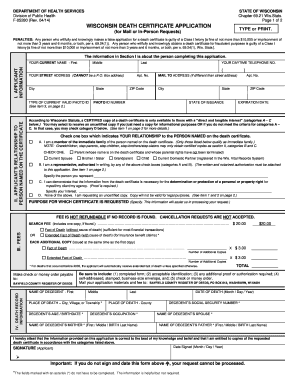

Editing the 40 per share form on pdfFiller

pdfFiller simplifies the editing process for your 40 per share form with a range of intuitive tools. If mistakes occur or details change, you can easily make corrections directly in the document.

Additionally, you can add comments or annotations to clarify specific aspects of the form. Signing the document digitally ensures a streamlined process, with steps for secure eSignature integration easily accessible on the platform.

Managing the 40 per share form with pdfFiller

Once your 40 per share form is completed, managing it effectively is crucial. pdfFiller’s cloud storage allows for easy access and organization of your documents, making retrieval simple and efficient.

For those working with HR or financial advisors, securely sharing your completed form is a straightforward process within pdfFiller, facilitating collaboration and ensuring confidentiality.

Frequently asked questions about the 40 per share form

Best practices for handling equity compensation

In navigating equity compensation, it's essential to grasp the different types of stock options relevant to the 40 per share form. These options can impact both your immediate financial standing and long-term tax obligations.

Timing your stock sales is also crucial; market conditions and personal financial goals should influence your decisions. By being strategic, you can maximize the benefits of your equity compensation while minimizing tax liabilities.

Related templates and tools on pdfFiller

pdfFiller offers not only the 40 per share form but also other related templates for managing equity compensation efficiently. Exploring these resources can provide additional insights and streamline your documentation processes.

Utilizing interactive tools from pdfFiller can greatly enhance how you track stock performance and valuations. These features can be invaluable in managing your equity compensation effectively.

User success stories

Many users have successfully streamlined their equity compensation processes by leveraging the 40 per share form through pdfFiller. Case studies show improved compliance rates and faster processing times, helping employees focus on their core responsibilities rather than getting bogged down in paperwork.

Next steps after filling out your 40 per share form

After submitting your 40 per share form, it’s important to have a plan for managing what comes next. Keeping a checklist can help ensure you address all subsequent steps, such as confirming receipt with your HR department or financial advisor.

Staying updated on changes to equity compensation regulations or shifts in company policies will also benefit you in the long run. Engaging with financial advisory resources can keep your knowledge current and help navigate the complexities of your compensation package.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 40 per share to be eSigned by others?

Where do I find 40 per share?

How do I make changes in 40 per share?

What is 40 per share?

Who is required to file 40 per share?

How to fill out 40 per share?

What is the purpose of 40 per share?

What information must be reported on 40 per share?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.