Get the free PROGRAM PROSPECTUS FOR BONDS

Get, Create, Make and Sign program prospectus for bonds

Editing program prospectus for bonds online

Uncompromising security for your PDF editing and eSignature needs

How to fill out program prospectus for bonds

How to fill out program prospectus for bonds

Who needs program prospectus for bonds?

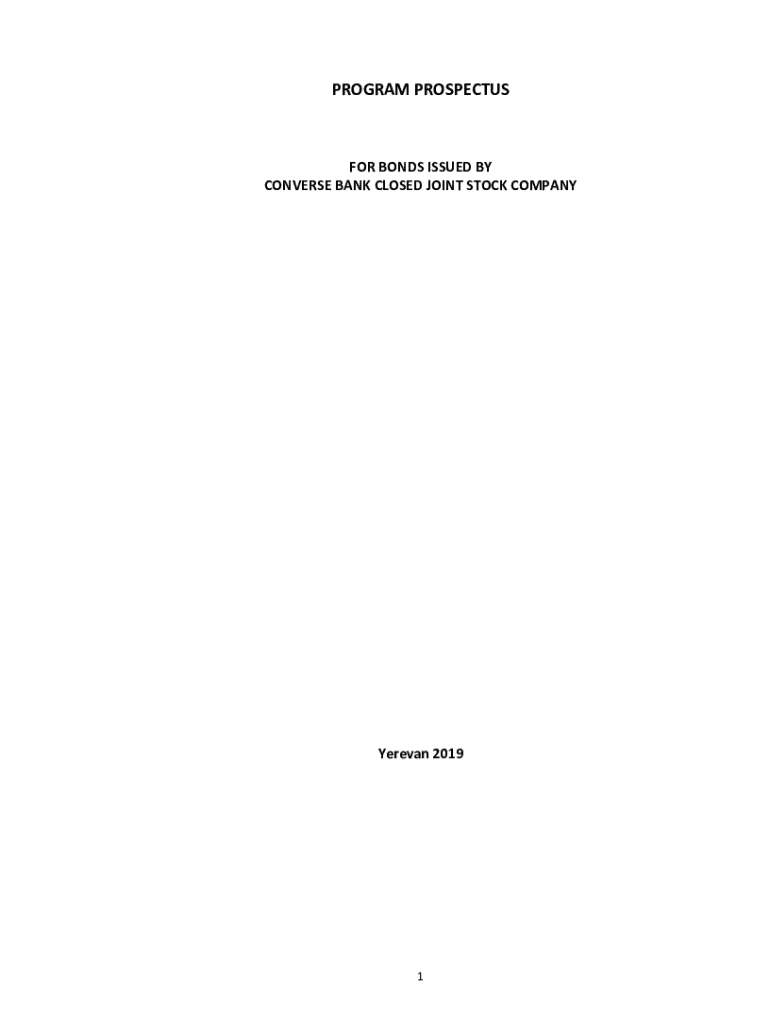

Understanding the Program Prospectus for Bonds Form

Understanding bonds and their structures

A bond represents a debt investment where an investor loans money to an entity (government, corporation) for a defined period at a fixed interest rate. Essentially, bonds are a way for organizations to secure financing while providing investors with regular interest income and the return of principal upon maturity.

Key terminologies in bond financing include coupon rate, maturity date, and face value. Each of these terms holds significant relevance to understanding how bonds function and how returns can be anticipated by investors.

There are various types of bonds, including corporate bonds, government bonds, municipal bonds, and treasury bonds, each designed for different purposes and investor needs. Benefits of investing in bonds include predictable income, diversification of investment portfolios, and a relatively lower risk compared to stocks.

Importance of a program prospectus

A program prospectus serves as a formal disclosure document that aims to provide potential investors with essential information about a bond offering. It outlines the terms and conditions of the bond, including how the proceeds will be used, the risks involved, and any income you can expect.

The key features of a program prospectus for bonds include clarity of information, simplicity for investors to understand, and transparency regarding issuing entities. Legal requirements mandate that bond issuers provide sufficient details to inform investment choices, honoring fiduciary responsibilities.

Individuals or entities looking to issue bonds should consider assembling a program prospectus. This includes state governments, municipalities, and large corporations, who need documented information to attract potential investors.

Preparing your bond prospectus

Embarking on drafting a bond prospectus requires careful planning and consideration. Key initial considerations include understanding the target audience and outlining the essential information that needs to be communicated. The objective here is to engage potential investors while providing them with adequate information to make informed decisions.

Identifying necessary documentation is crucial. Typical components may include financial statements, risk assessments, and market analyses. Such documents ensure that the bond's offering is backed by robust data and regulatory compliance.

When structuring your prospectus, ensure it contains essential sections like the executive summary, investment overview, terms and conditions, and a clear outline of risk factors. Common mistakes to avoid include vagueness in detailing financial health and neglecting to highlight potential risks thoroughly.

Specifics of the program prospectus for bonds form

The bonds form is structured to facilitate capturing detailed information pertinent to the bond offering. Each segment of the form plays a vital role in ensuring accuracy and compliance throughout the documentation process. Understanding the nuances of this form can significantly affect the outcome of bond issuance.

Interactive tools can assist users in filling out the bonds form efficiently. Step-by-step guidance can help you input essential details accurately. Key areas that need focus include basic information, financial statements, intended use of proceeds, and legal disclosures.

Ensuring accuracy and compliance through meticulous filing is paramount to delivering a professional and trustworthy impression in the bonds market.

Editing and customizing your bonds form

Editing your prospectus can often be challenging, but tools like pdfFiller make it effortless. Features included in pdfFiller allow you to edit your document directly, ensuring all necessary adjustments can be made from any device. This ease of use is crucial for maintaining accuracy and relevance of the content in fast-moving financial markets.

Collaboration tools available within pdfFiller make it easier to share your draft with team members, gathering feedback quickly without the hassle of paper trails. Moreover, integrating e-signature solutions can expedite the approval process, ensuring that your bonds form can be executed promptly.

Managing document versions and history in pdfFiller not only promotes organization but also ensures compliance with changing regulations. This feature is particularly valuable for bond issuers needing to present updated information consistently.

Submitting the program prospectus

Once your program prospectus for bonds form is completed, the next step is submission to relevant regulatory bodies. Understanding specific submission guidelines is essential to ensuring the documents are accepted without delays.

After submission, issuers may wonder what happens next. Generally, the documents undergo review, and there may be requests for additional information. Being proactive in understanding this process can help manage expectations and streamline further communications.

Engaging effectively in this phase can significantly enhance the chances of approval.

Making your prospectus public

Disclosure requirements often vary across jurisdictions, making it imperative to familiarize yourself with local laws. Properly publishing your prospectus enhances transparency and builds trust with investors. For maximum reach, publishing online through suitable platforms is advisable to increase accessibility.

Best practices for transparency include ensuring that all risk factors are clearly outlined and providing straightforward instructions on how investors can access the necessary information. Maintaining a strong communicative link with potential investors can lead to a greater understanding of the bond offering.

Post-submission considerations

After submission, remaining vigilant about regulatory changes that could affect your prospectus is vital. Monitoring ongoing discussions in the financial landscape allows issuers to be proactive, adjusting their documentation and offering as needed.

Frequently asked questions often surround the maintenance and updates required after the initial submission. Investors expect timely information regarding ongoing performance and any material changes to the offering.

Exploring related resources

For those engaged in bond issuance, having access to templates and tools streamlines future bond process engagement. Developing a knowledge hub can provide insights into bond trends, enhancing overall market understanding.

Case studies showcasing successful bond programs can serve as vital resources for learning best practices and achieving credibility in the market.

Further assistance and support

pdfFiller offers a streamlined document management service tailored for bond prospectus creation, aiding users in drafting, editing, and submitting their bonds form seamlessly. The available customer support is well-versed in helping clients through every phase of document management.

For personalized assistance, connecting through social media and networking opportunities can enhance knowledge sharing and community engagement, enabling innovators to emerge in the bond issuance and finance sectors.

Feedback and improvements

Encouraging user feedback on the prospectus process is integral to continuous improvement. Understanding user needs allows pdfFiller to adapt features and document controls to better serve the community.

Continuous improvement not only builds stronger platforms for users but fosters greater innovation within the document management landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get program prospectus for bonds?

Can I sign the program prospectus for bonds electronically in Chrome?

Can I edit program prospectus for bonds on an Android device?

What is program prospectus for bonds?

Who is required to file program prospectus for bonds?

How to fill out program prospectus for bonds?

What is the purpose of program prospectus for bonds?

What information must be reported on program prospectus for bonds?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.