Get the free Un-Audited

Get, Create, Make and Sign un-audited

How to edit un-audited online

Uncompromising security for your PDF editing and eSignature needs

How to fill out un-audited

How to fill out un-audited

Who needs un-audited?

Understanding and Utilizing Un-Audited Forms: A Comprehensive Guide

Understanding un-audited forms and their importance

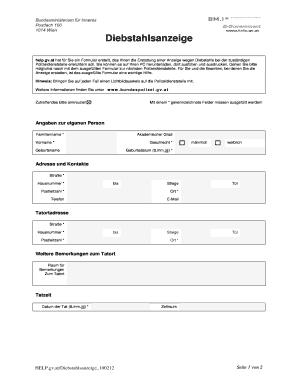

An un-audited form is a financial document that has not undergone a formal audit process, yet provides essential information regarding an organization’s financial health. These forms are crucial in both business and personal contexts, serving to record financial transactions, track expenses, and present a snapshot of financial status. Their importance stems from the need for accuracy in reporting — whether for internal decision-making or external communication with stakeholders.

Common uses of un-audited forms include financial statements for small businesses, tax returns for individuals, and budget reports for personal finance management. While these documents may not have the validation of an auditor's scrutiny, they play a significant role in financial planning and analysis. Accurate and timely reports can influence business strategies, investor confidence, and even personal financial decisions.

Key components of un-audited forms

Un-audited forms typically contain several essential elements, including basic information such as the organization name, period covered, and contact details. Financial statement items often include revenue figures, expenses, net income, and other relevant metrics that provide a clear picture of financial performance. Disclosure requirements may involve notes or statements that explain certain figures or accounting practices, ensuring transparency.

The key difference between audited and un-audited forms lies in the degree of verification. Audited forms have been reviewed by an external auditor, which lends a level of credibility and assurance. In contrast, un-audited forms carry potential implications; they may be more prone to errors or misrepresentations since they haven’t undergone independent verification. Thus, users must exercise caution when relying solely on un-audited data in decision-making scenarios.

Situations necessitating un-audited forms

There are several situations where un-audited forms are not just applicable but essential. For instance, financial reporting deadlines may necessitate the quick generation of these documents to meet compliance requirements or internal objectives. Similarly, limited scope engagements, often seen in smaller enterprises lacking audit resources, may lead to reliance on un-audited forms to assess fiscal health.

Specific industry regulations can also dictate when un-audited forms are appropriate. For example, startups may only need un-audited financial statements for initial fundraising efforts. The use of un-audited forms can influence stakeholders' perception, impacting investment decisions, loan approvals, and even employee trust.

Navigating the preparation of un-audited forms

Creating un-audited forms efficiently requires a systematic approach. Start by gathering all necessary information, which includes previous financial statements, transaction records, and relevant supporting documents. Structuring the form appropriately is crucial; it should be organized logically with clear headings and sections to enhance readability.

When filling out each section, adhere to best practices like ensuring numerical accuracy, providing a clear rationale for reported figures, and being transparent about estimations or assumptions. Additionally, common mistakes to avoid include omitting important details, using inconsistent formats or terminology, and failing to disclose necessary information. Utilizing templates, such as those available on pdfFiller, can streamline this process significantly.

Editing and customizing un-audited forms

Once an un-audited form has been drafted, utilizing pdfFiller’s editing tools can make essential adjustments easy and efficient. You can edit text and fields directly within the document, allowing for swift updates and corrections. Adding digital signatures enhances the form's legitimacy, particularly for documents that require approval from multiple parties.

Collaborative features within pdfFiller enable teams to work simultaneously on a document. This is particularly beneficial for organizations aiming to streamline their review processes and collect input from different stakeholders. Customizing forms to fit your organization's specific needs is another advantage of pdfFiller, ensuring that every un-audited form generated reflects the company's brand and operational requirements.

eSigning un-audited forms

The legal landscape surrounding digital signatures on un-audited forms is constantly evolving. It's crucial to ensure that any electronic signatures you apply comply with local and international eSignature laws, which vary from region to region. When signing an un-audited form, it's essential to follow a structured eSigning process facilitated by platforms like pdfFiller.

The eSigning process typically involves selecting the document, choosing where to sign, and confirming your identity in accordance with compliance regulations. Maintaining secure practices during this process ensures that all parties involved can trust the legitimacy of the signed document. Leveraging pdfFiller's eSigning platform not only simplifies the process but also tracks the signature status, providing a more organized approach to document management.

Managing un-audited forms with cloud solutions

Utilizing cloud-based document management solutions to handle un-audited forms offers unparalleled benefits. Accessibility is one of the most significant advantages, as team members can retrieve and collaborate on documents from anywhere, enhancing productivity. Additionally, robust security features protect sensitive information, ensuring that only authorized individuals can access and modify the forms.

Storage and retrieval options within cloud solutions allow for seamless management of documents, mitigating the risk of lost forms or outdated information hindering business operations. Collaborating in real-time enables teams to edit inputs simultaneously, providing feedback instantly and ensuring everyone is on the same page. This version control aspect helps to maintain a clear history of changes, addressing accountability and allowing for audit trails as necessary.

Compliance and best practices

To ensure the effective use of un-audited forms, compliance with relevant regulations and guidelines is essential. Organizations must stay informed about local financial reporting standards that dictate how un-audited documents should be prepared and maintained. Establishing internal best practices for accuracy, such as regular reviews and required disclosures, helps mitigate risks associated with reliance on un-audited data.

Best practices for ensuring accuracy include encouraging thorough checks of numerical data, implementing verification systems, and keeping documentation transparent. Additionally, maintaining regular updates and review processes allows for adjustments in response to changes in financial status or regulatory requirements, ensuring un-audited forms remain trustworthy and effective sources of information.

Troubleshooting common issues

Despite the advantages of un-audited forms, users may encounter common challenges. Issues such as data discrepancies, incomplete forms, or improper formatting can lead to confusion and misinterpretation. Recognizing these potential problems early can save time and prevent miscommunication, ensuring that all stakeholders have reliable information.

Solutions often involve thorough reviews, utilizing pdfFiller's tools to highlight errors, and having another set of eyes scrutinize the document before its finalization. Encouraging teams to ask questions and providing clear guidelines can help mitigate misunderstandings. pdfFiller’s FAQs regarding un-audited forms can also offer immediate assistance to common concerns that arise.

Final thoughts on un-audited forms

Proper documentation is vital for effective financial reporting and decision-making. The ability to prepare and manage un-audited forms effectively can significantly contribute to an organization’s operational agility. By leveraging tools provided by pdfFiller, such as editing capabilities, eSigning features, and collaborative cloud solutions, individuals and teams can improve their document processes, ensuring accuracy and compliance.

By understanding the intricacies of un-audited forms, users can navigate the complexities of financial documentation with confidence. Utilizing pdfFiller's features empowers users to create, manage, and optimize these crucial documents effectively, enabling greater focus on strategic growth and decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in un-audited?

How do I edit un-audited in Chrome?

Can I create an electronic signature for the un-audited in Chrome?

What is un-audited?

Who is required to file un-audited?

How to fill out un-audited?

What is the purpose of un-audited?

What information must be reported on un-audited?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.