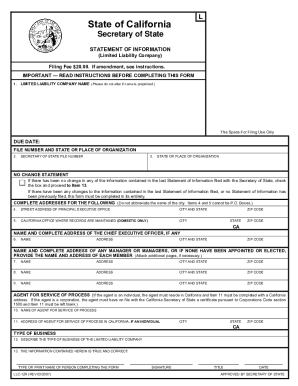

Who needs an LLC-12 form?

This form is used by domestic and foreign registered limited liability companies to register or update information about a business entity with the California Secretary of State.

What is the LLC-12 form for?

This form serves as a statement of information about the LLC registered in California. The Secretary of State makes the information provided in the form available for public use. The LLC must file this form even if it was inactive during the reporting period. If the information in the Statement changes, the LLC must file a new form.

What documents must be accompanied by the LLC-12 form?

The filler has to attach a check payable for the $20 filing fee (The filing fee is obligatory only if you file the Statement of Information for the first time.)

When is the LLC-12 due?

The LLC must submit the statement within 90 days of the registration date in California, and every two years thereafter within the filing period (calendar month).

What information should be provided in LLC-12 form?

The statement must contain the following information:

- LLC name (exactly as it is recorded with the California Secretary of State)

- Street address of principal executive office

- Mailing address of LLC

- Street address of California office (do not use any abbreviations)

- Name and address of the chief executive officer

- Name and address of any manager (or each member)

- Name and address of Agent for service

- Detailed description of the business

The representative of the LLC also has to sign and date the statement as well as print the name and title.

What do I do with the form after its completion?

The completed and signed Statement of Information is forwarded to the Secretary of State, Statement of Information Unit, Sacramento, California. It can also be delivered in person.