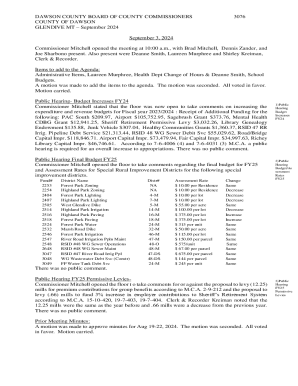

Get the free january 76

Get, Create, Make and Sign january 76

How to edit january 76 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out january 76

How to fill out january 76

Who needs january 76?

A comprehensive guide to the January 76 form

Overview of the January 76 form

The January 76 form is a pivotal document often required in various financial and tax-related situations. It serves as a critical tool for individuals and businesses to report their income, deductions, and other pertinent financial data for a specific reporting period. Understanding its significance is essential for ensuring compliance with tax regulations, navigating audits, and making informed financial decisions.

Various entities, including self-employed individuals, freelancers, and small business owners, may be required to fill out the January 76 form. Completing this form accurately and on time is paramount, not just for meeting legal obligations but for avoiding potential penalties that could ensue from errors or omissions.

Understanding the components of the January 76 form

The January 76 form comprises several essential sections, each requiring specific information from the user. Breaking down the form into components helps in easier navigation and enhances accuracy during completion. Typically, users will find sections related to personal information, financial data, and certification amidst other crucial details.

Familiarity with terminology associated with the January 76 form is also important. Terms such as 'deductible expenses', 'gross income', and 'adjusted gross income' have specific meanings that impact how information is reported. Understanding these terms helps users provide clear and correct information, thus minimizing the risk of mistakes.

Step-by-step guide to filling out the January 76 form

Before diving into the details of completion, proper preparation is key. Gathering all necessary documentation such as income statements, previous year’s tax returns, and receipts for deductions can streamline the process. Tools like pdfFiller are highly recommended for their efficiency in handling PDF forms.

Now, let’s break down the filling process into manageable sections:

Several common mistakes can trip users up, such as failing to include all required signatures or submitting incomplete information. Make it a practice to cross-check your entries before submission to avoid these pitfalls.

Editing and managing the January 76 form

Managing your January 76 form is greatly simplified using pdfFiller's suite of editing tools. With its user-friendly interface, you can edit various parts of your PDF seamlessly, ensuring your information remains up-to-date and accurate. Collaboration is encouraged, especially for teams that may require input from multiple individuals.

Saving and sharing your completed form is equally straightforward. Options include saving in different formats, such as PDF or DOCX, making it easy to retrieve the document when necessary. For secure sharing, pdfFiller also provides features that ensure your forms remain confidential.

eSigning the January 76 form

The advent of electronic signatures has revolutionized how we handle documents like the January 76 form. eSigning offers not only convenience but also a level of legal credibility that traditional signs may not easily provide. By using pdfFiller, you can ensure your signature is valid and recognized by various institutions.

To navigate the eSigning process on pdfFiller, simply select the eSign feature, upload your form if not already done, and follow the prompts to add your signature. It’s a seamless process designed to uphold the integrity of your document while making it easy for you to finalize where necessary.

FAQs about the January 76 form

Questions often arise surrounding the January 76 form, and it's essential to clarify these for effective completion. One common concern is what to do if you make a mistake on the form. In such instances, it’s advisable to amend your submission promptly. Most tax offices provide guidelines on how corrections should be handled.

Another frequent question is where to submit the completed form, which may differ depending on your location or situation. Always consult local tax authority resources for clear submission guidelines to avoid delays.

Additional tips for document management

Effectively managing forms like the January 76 form goes beyond just completion. Implementing best practices for document storage is key to ensuring that you can quickly access or retrieve necessary forms in the future. Utilize cloud-based solutions like pdfFiller to keep your documents organized and searchable.

While take on the task of filling out forms is often straightforward, some cases may require the assistance of a professional. Consulting a tax advisor or accountant can be beneficial, especially when complex financial situations or uncertainties arise.

Using interactive tools on pdfFiller

Interactive tools offered by pdfFiller enhance the user experience by providing features that make document handling more efficient. Tools like drag-and-drop editing or automated filling accelerate the process and ensure users can focus on accuracy rather than the technical aspects of form management.

Accessing and utilizing these interactive features is straightforward. pdfFiller's intuitive interface allows even those with minimal tech experience to navigate the platform effectively. Engage with these features to maximize your productivity and ensure a smoother document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit january 76 on a smartphone?

Can I edit january 76 on an iOS device?

How do I edit january 76 on an Android device?

What is january 76?

Who is required to file january 76?

How to fill out january 76?

What is the purpose of january 76?

What information must be reported on january 76?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.