Get the free Principal Credit Real Estate Income Trust Form 10-Q Quarterly ...

Get, Create, Make and Sign principal credit real estate

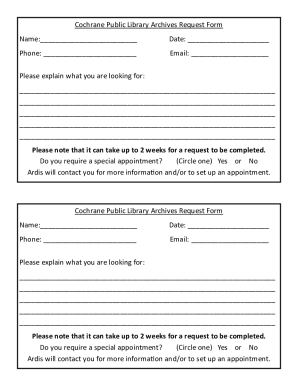

Editing principal credit real estate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out principal credit real estate

How to fill out principal credit real estate

Who needs principal credit real estate?

Comprehensive Guide to the Principal Credit Real Estate Form

Understanding the principal credit real estate form

The Principal Credit Real Estate Form is a pivotal document in the landscape of real estate transactions. This form serves to assess the creditworthiness of prospective buyers or investors, simplifying the process of acquiring financing. Without a clear understanding of this form, individuals and teams can face obstacles while attempting to secure funding for property endeavors. It plays a fundamental role in the underwriting and approval processes of loans and mortgages.

Importance cannot be overstated; the Principal Credit Real Estate Form ensures that lenders gather vital information about a potential borrower’s financial health. It integrates seamlessly into the broader financing scheme, linking with various legal and financial assessments necessary to enable secure and efficient real estate transactions.

Key components of the principal credit real estate form

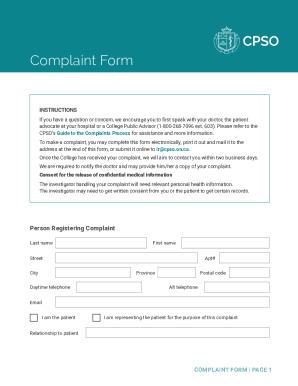

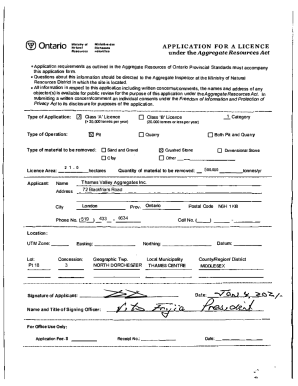

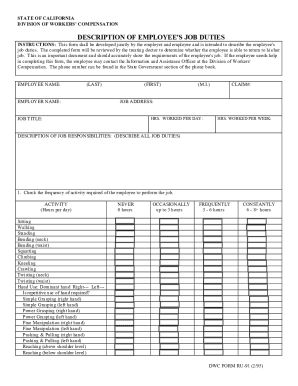

The Principal Credit Real Estate Form consists of several key components that enable lenders to evaluate the applicant’s credit risk. The information required usually includes personal identifiers such as name, address, and Social Security number, alongside business-related data for entities applying for credit. Lenders need accurate financial data including income disclosures, assets, and existing liabilities to perform a comprehensive assessment.

Additionally, legal disclaimers and agreements included in the form ensure compliance with federal and state regulations, safeguarding interested parties while the form interacts with loan agreements and property appraisals.

Filling out the principal credit real estate form: step-by-step instructions

Filling out the Principal Credit Real Estate Form necessitates careful attention to detail. To break it down effectively, this process can be categorized into several sections requiring specific information:

To minimize errors during data entry, double-check all information before submission. Common pitfalls include incorrect income figures and outdated credit information, which can lead to unnecessary delays and complications in processing.

Editing and customizing the principal credit real estate form

pdfFiller offers powerful editing tools for the Principal Credit Real Estate Form, allowing users to customize the document easily. This includes adding comments or notes in key areas to clarify specific points or provide additional context. Depending on the necessity, you can save multiple versions of the form for various purposes, maintaining adaptability in your documentation.

These features enable better organization and personalization of the Principal Credit Real Estate Form, effectively streamlining the compilation process.

eSigning and submission process

The eSigning process for the Principal Credit Real Estate Form through pdfFiller is not only streamlined but legally valid. This means that eSignatures hold the same weight as traditional handwritten signatures in real estate transactions. Ensure all parties have reviewed the document before proceeding with eSigning.

After submission, keep an eye on notifications for immediate updates and follow-up actions necessary to keep the application process moving.

Managing your principal credit real estate form efficiently

Effective management of the Principal Credit Real Estate Form requires diligence in both storage and tracking. With pdfFiller, completed forms can be securely stored in the cloud, ensuring they are accessible anywhere and at any time.

These organizational strategies can enhance productivity and ensure that important documentation does not become misplaced or mismanaged.

Understanding compliance and legal considerations

Completing the Principal Credit Real Estate Form involves navigating various legal requirements. Adherence to the provisions of local and federal regulations is essential in maintaining compliance during the documentation process. Users must familiarize themselves with legalities surrounding lending and property transactions to avoid penalties.

By using pdfFiller’s compliance-related tools, users can mitigate the risk of errors in their Principal Credit Real Estate Form submissions.

Case studies: successful use of the principal credit real estate form

Exploring real-world applications of the Principal Credit Real Estate Form can illuminate its efficacy. For instance, many successful applicants have documented their financials accurately, leading to quicker loan approvals. One case involved a small real estate investment firm that utilized the form diligently, securing financing for multiple projects without major setbacks.

These stories bring to light that diligence in filling out the Principal Credit Real Estate Form can lead to favorable financing outcomes.

Support and assistance with the principal credit real estate form

pdfFiller recognizes the potential complexity in navigating the Principal Credit Real Estate Form and provides tailored customer support to assist users. Whether you're facing issues filling out the form or require guidance on the editing features, help is readily available.

With these resources, individuals and teams can feel empowered to tackle the complexities of real estate financing efficiently.

Latest trends and insights in real estate financing

The dynamics of principal credit in real estate are continuously evolving. Today, the integration of technology has transformed how transactions are processed, including the way forms such as the Principal Credit Real Estate Form are utilized. Industry experts predict a rise in eTransactions as more lenders embrace digital solutions.

Understanding these trends can equip users to remain ahead of the curve in the competitive real estate environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify principal credit real estate without leaving Google Drive?

How do I fill out the principal credit real estate form on my smartphone?

Can I edit principal credit real estate on an iOS device?

What is principal credit real estate?

Who is required to file principal credit real estate?

How to fill out principal credit real estate?

What is the purpose of principal credit real estate?

What information must be reported on principal credit real estate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.