Get the free Mortgage Warehouse Lending

Get, Create, Make and Sign mortgage warehouse lending

Editing mortgage warehouse lending online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage warehouse lending

How to fill out mortgage warehouse lending

Who needs mortgage warehouse lending?

Comprehensive Guide to Mortgage Warehouse Lending Form

Understanding mortgage warehouse lending

Mortgage warehouse lending serves as a crucial bridge between borrowers and mortgage lenders. By definition, it refers to the short-term funding arrangements that allow lenders to finance their mortgage loans before these loans are sold to investors. This mechanism is essential as it facilitates liquidity in the mortgage market, enabling lenders to issue more loans without being constrained by their available capital.

Key players in mortgage warehouse lending include mortgage lenders (the originators), warehouse lenders (which provide short-term financing), and investors who purchase the loans. The involvement of warehouse lenders is particularly important; they allow mortgage lenders to fund loans quickly, mitigating the risk associated with capital shortages that could impact loan origination and closure.

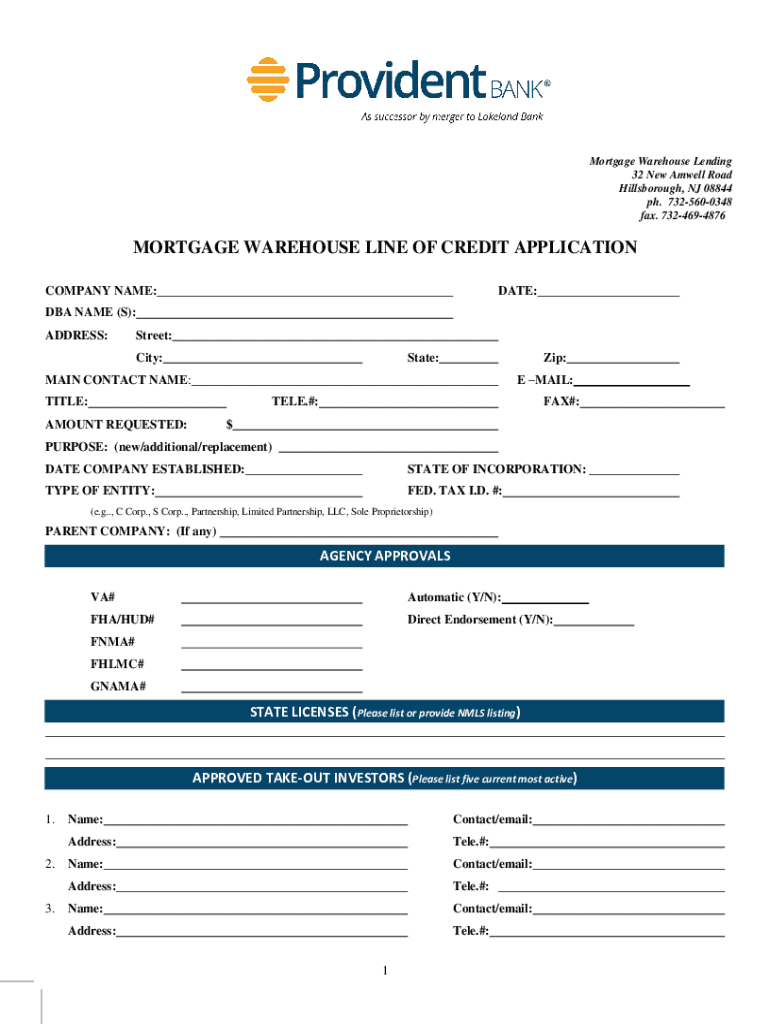

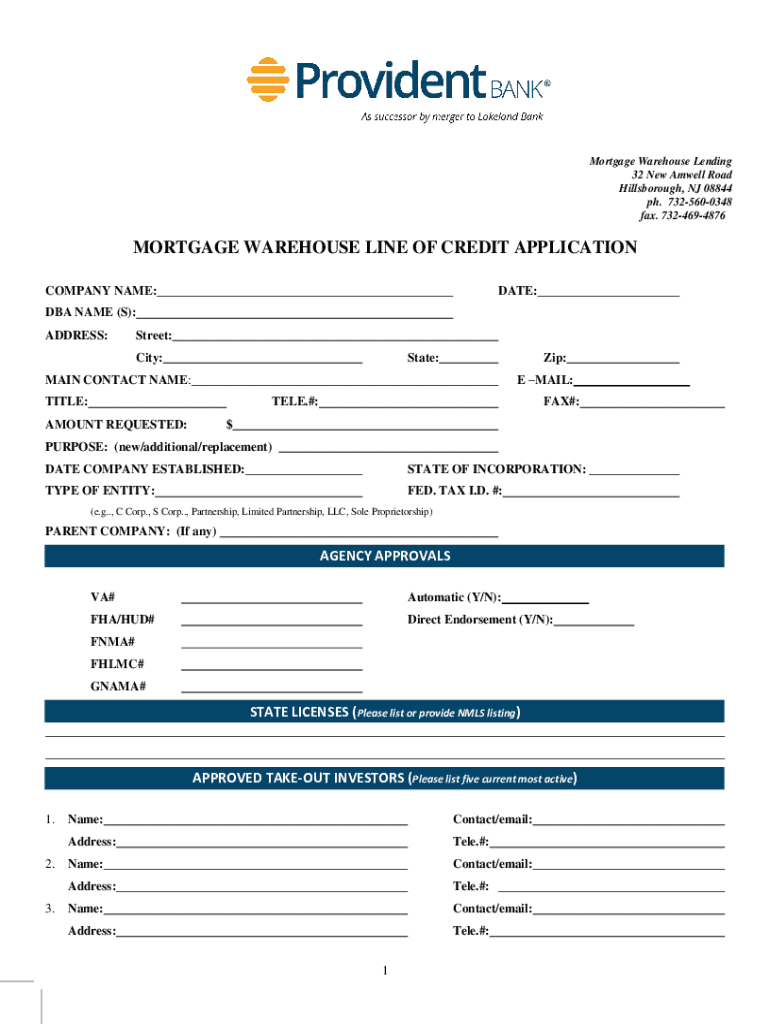

Essential components of a mortgage warehouse lending form

The mortgage warehouse lending form is a comprehensive document that captures vital details necessary for initiating the warehouse lending process. It requires specific information that helps warehouse lenders assess the mortgage application effectively.

Key sections within the form typically include borrower information, loan details, and property information. Borrower information includes personal data like name, address, and contact information. Loan details cover the amount requested, interest rates, and loan type, while property information encompasses the address, property type, and appraised value.

Additionally, other documentation is required for submission, such as income verification, credit reports, and any other supporting financial documents necessary for the lender's risk assessment.

Step-by-step guide to completing the mortgage warehouse lending form

Completing the mortgage warehouse lending form requires careful attention to detail. Here’s a breakdown of how to tackle this process efficiently.

Step 1: Gather all necessary information before starting the form. This will include personal identification, financial documents, and any related information regarding the property. Ensure you verify this information to avoid discrepancies.

Step 2: Carefully fill out the form, entering data as prompted. Pay special attention to fields concerning numbers and dates to ensure accuracy. Use consistent formatting for all entries, particularly for financial figures.

Step 3: Once the form is completed, take the time to review all sections. Common errors include typos in personal information, mismatched loan amounts, or omissions of required documents. Double-check your submitted forms against your collected information to ensure accuracy.

Using pdfFiller to enhance your mortgage warehouse lending form experience

pdfFiller significantly streamlines the mortgage warehouse lending form process. First, access the form directly on pdfFiller’s platform, where users can find various templates and documents tailored to their specific needs.

The platform provides interactive tools for managing documents, including editing features that allow users to modify forms directly in the browser, eSigning options to expedite document finalization, and collaboration tools for teams to work together seamlessly.

Best practices for managing your mortgage warehouse lending documents

Managing mortgage warehouse lending documents effectively is key to ensuring a smooth application process. Start by organizing and storing your completed forms in a logical structure. Consider using folders for different applicants or loan types to make retrieval easier.

Compliance with lender requirements is crucial; ensure all documents meet specified standards. Regularly update your storage and management practices to stay compliant with changing regulations. Additionally, prioritize secure document sharing by utilizing password protection and encryption options, especially when transmitting sensitive financial information.

Understanding the funding process in mortgage warehouse lending

After you submit the mortgage warehouse lending form, several steps unfold before you receive funding. It is essential to understand what happens next. Initial verification by the warehouse lender will assess the loan application to ensure it meets their standards.

The process can either be 'wet' or 'dry' funding. In wet funding, the funds are disbursed immediately after closing, while dry funding involves disbursement only after all documentation has been verified and conditions are met. Typically, you can expect a timeframe for loan processing ranging from a few days to a couple of weeks, depending on the lender's efficiency and the completeness of your submission.

Key benefits of using pdfFiller for mortgage warehouse lending

pdfFiller enhances the entire document management process for mortgage warehouse lending. The platform allows you to access documents from anywhere, making it ideal for users on the go. You can manage documents effortlessly, whether you are at the office or traveling.

Collaboration features enable your team to work seamlessly together, improving communication and reducing the time taken to finalize documents. Further, pdfFiller implements robust security measures, safeguarding sensitive information to provide peace of mind while handling financial documentation.

Frequently asked questions about mortgage warehouse lending forms

Understanding the nuances of mortgage warehouse lending forms can be challenging. Here are some frequently asked questions to clarify common concerns.

Exploring additional features of pdfFiller relevant to warehouse lending

Besides facilitating document management, pdfFiller offers additional features that enhance the efficiency of mortgage warehouse lending. The platform integrates seamlessly with other document services, enhancing overall productivity.

Users can customize templates to fit various lending needs, ensuring that each form is tailored to specific requirements. Furthermore, updates regarding regulatory changes in lending practices are easily followed within the pdfFiller platform, keeping users informed and compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mortgage warehouse lending from Google Drive?

How can I send mortgage warehouse lending for eSignature?

How do I complete mortgage warehouse lending on an Android device?

What is mortgage warehouse lending?

Who is required to file mortgage warehouse lending?

How to fill out mortgage warehouse lending?

What is the purpose of mortgage warehouse lending?

What information must be reported on mortgage warehouse lending?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.