Mechanical Business Holdings Form: A Comprehensive Guide

Understanding LLCs and their importance for mechanical businesses

Limited Liability Companies (LLCs) are popular business structures that combine the benefits of corporations with the simplicity of partnerships. For mechanical businesses, understanding the LLC framework can significantly impact operational success. The essence of an LLC lies in its ability to protect owners from personal liability while offering flexible tax configurations that benefit entrepreneurs in this field.

Forming an LLC offers several advantages for mechanical enterprises. Primarily, liability protection shields personal assets from business debts and lawsuits, providing essential security in an industry often confronted with risks and client claims. Additionally, the tax benefits available to LLCs allow business owners to avoid double taxation—a common issue with corporations—making it financially favorable.

Liability protection: Safeguards personal assets against business debts.

Tax advantages: Flexible tax arrangements and avoidance of double taxation.

Enhanced credibility: Establishes a professional image for customer confidence.

It's also imperative to grasp key terminology associated with LLCs and mechanical operations. Terms like 'members' (the owners), 'operating agreement' (the document outlining the LLC's management), and 'registered agent' (the person designated to receive legal documents) form the foundation upon which the understanding of LLCs is built.

The Mechanical Business Holdings form: A comprehensive overview

The Mechanical Business Holdings LLC form is essential for establishing a legal entity that represents various mechanical service operations. This form serves to create a formal record of your business, safeguarding it under limited liability rules while also ensuring compliance with state laws. By filling out this form, mechanical businesses can delineate their operations, ownership structure, and adherence to legal requirements.

Several legal requirements must be adhered to when completing the Mechanical Business Holdings LLC form. Typically, you must provide basic information about the business, including its name and purpose. Additionally, you must ensure compliance with state laws regarding naming conventions and licensing for mechanical services. Common uses of this form within the industry also include managing ownership stakes among partners and defining the roles of members in the business structure.

Step-by-step guide to completing the Mechanical Business Holdings form

Completing the Mechanical Business Holdings LLC form can be straightforward if approached methodically. Below is a detailed walkthrough to assist you in this process:

Business Information: Enter the LLC's name and address, alongside a brief description of the mechanical services offered.

Member Information: List all members or managers, including their roles and ownership percentages.

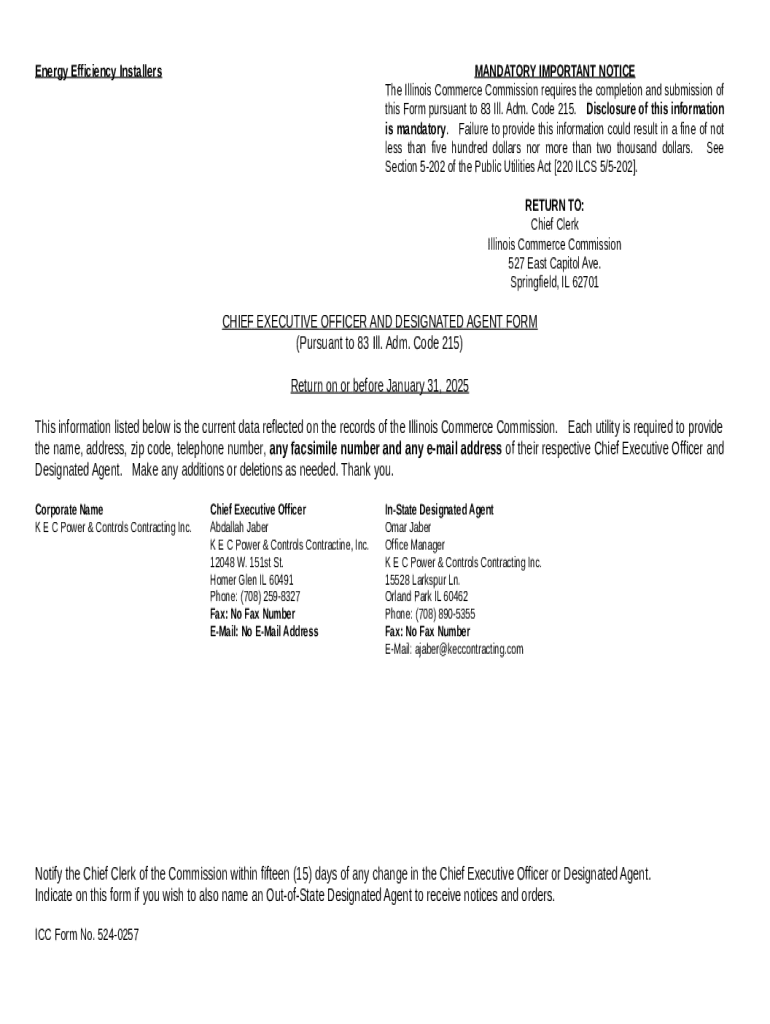

Registered Agent Details: Specify a registered agent, outlining their importance as a point of contact for legal documents and the qualifications needed.

Operating Agreement Provisions: Include necessary elements in the operating agreement, ensuring customization to fit the specific operations of your mechanical business.

Filing the Form: Identify where to submit the completed form, noting any associated fees and expected processing times.

Editing and modifying the Mechanical Business Holdings form

Updates to the Mechanical Business Holdings LLC form are often necessary due to changes in ownership, services, or operational structure. Recognizing when and why updates are needed can prevent legal complications and ensure your business remains compliant. For editing, utilizing an online platform like pdfFiller simplifies the process. It offers tools to adjust details seamlessly, ensuring all changes reflect accurately in your documentation.

However, it’s crucial to be aware of the legal implications of modifying the LLC form. Changes may require re-filing or notifying relevant state bodies, depending on the nature of the updates. Thus, keeping a meticulous record of any changes and ensuring timely filing with your state can save future headaches.

Signing the Mechanical Business Holdings form

Following the completion of the Mechanical Business Holdings LLC form, securing the necessary signatures from all members is critical. Each signature signifies consent and acknowledgment of the business terms outlined in the agreement. E-signatures through pdfFiller provide a legally binding and convenient method to obtain signatures, ensuring that the document is finalized promptly.

Best practices for obtaining signatures include clearly communicating the expectations to each member and ensuring they know the document's implications. Tools like pdfFiller simplify collaboration and tracking of signatures, which is particularly useful if signing occurs across multiple locations or for members who are hard to reach.

Common challenges in filing for a Mechanical Business Holdings

Filing the Mechanical Business Holdings LLC form can present several challenges, especially for first-time business owners. Commonly faced issues may include misunderstandings regarding DBA registrations and how they interact with LLCs. Entrepreneurs often grapple with implications surrounding the need for separate tax treatment and bank accounts for their LLC bearing multiple business operations.

Addressing these challenges involves understanding local regulations and seeking professional advice if necessary. Staying informed about requirements can prevent potential pitfalls, allowing mechanical industry professionals to navigate the setup process smoothly. Establishing lines of communication between members regarding shared responsibilities can also mitigate confusion.

Comparing LLCs vs. other business structures for mechanical enterprises

When choosing a business structure for your mechanical enterprise, evaluating the differences between LLCs and corporations is essential. LLCs provide flexibility in management and fewer regulatory burdens, but corporations may offer advantages in attracting investors or scaling operations. Also, if your mechanical operations span various sectors, establishing multiple LLCs may be beneficial to separate liabilities and simplify tax reporting.

Tax treatments present differences as well; LLCs allow pass-through taxation, which might lead to lower tax liabilities compared to sole proprietorships or partnerships. For individuals operating in the mechanical sector, recognizing these distinctions can guide informed decisions on structuring their business.

Real-life examples of mechanical business LLCs

Exploring case studies of successful mechanical business LLCs illuminates how these entities effectively operate. For example, one LLC might encompass multiple DBAs, each handling a different aspect of mechanical work, such as automotive repair and HVAC services. This structure allows them to streamline operations while maintaining a clear brand identity for each service.

Conversely, another example could be multiple LLCs managing distinct operations to mitigate risk exposure. For instance, separating an electrical service from a plumbing business under two LLC tiers provides financial protection if one facet underperforms. Lessons learned from these examples include the importance of tailoring business structures to service lines and keeping tax implications under consideration.

Best practices for managing your mechanical business

Successfully managing an LLC requires ongoing compliance and a keen understanding of financial operations. Mechanical business owners should remain aware of compliance requirements such as annual reporting and tax filings to maintain the LLC’s good standing. Regularly updating the operating agreement as circumstances evolve—like changes in ownership or new service offerings—ensures your LLC remains relevant and compliant.

Financial management tips include budgeting for both anticipated and unexpected expenses uniquely tied to the mechanical industry. Utilizing tools like pdfFiller for document management offers efficient collaboration with team members and facilitates adherence to regulatory standards.

Utilizing digital tools for efficiency and compliance

The rise of digital platforms has significantly impacted how mechanical business owners manage documentation. pdfFiller's features allow users to edit documents, eSign securely, and collaborate seamlessly from any location. This cloud-based document management system automates processes that can be time-consuming when handled manually, ensuring efficiency and compliance.

Interactive tools within pdfFiller can further simplify the process of filing and managing LLC documents. For instance, users might find templates that tailor to their specific needs in the mechanical sector, enhancing the overall accuracy and speed of form completion. Leveraging these resources can minimize errors and streamline your business operations.

Conclusion of the process: Ensuring a smooth operation

The significance of properly managing your Mechanical Business Holdings LLC form cannot be overstated. Accurate and timely documentation is crucial for maintaining your LLC's integrity and operational efficiency. Embracing tools like the pdfFiller platform allows for seamless operations, from form management to document collaboration.

As your mechanical business grows, the impact of maintaining proper documentation becomes increasingly vital. A commitment to precision in your LLC operations can foster substantial growth, adaptability, and long-term success in this competitive industry.