Minnesota Durable Power of Attorney PDF Template Form: A Comprehensive Guide

Understanding durable power of attorney in Minnesota

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to appoint another person, referred to as the agent or attorney-in-fact, to manage their affairs, even when they become incapacitated. This critical legal instrument is tailored for people who want to ensure their financial and healthcare decisions are made by someone they trust, regardless of their mental condition.

The importance of a Durable Power of Attorney lies in its ability to safeguard your interests when you are unable to communicate your wishes. This can happen due to illness, accident, or age-related decline. A DPOA ensures that your responsibilities—such as managing bank accounts, handling investments, or making health care decisions—are taken care of efficiently by a designated person.

It’s crucial to distinguish between a general and a durable power of attorney. While both provide authority to an agent, a general power of attorney becomes void upon the principal’s incapacitation, whereas a durable power of attorney remains effective during incapacity. This feature makes DPOA particularly vital for long-term planning.

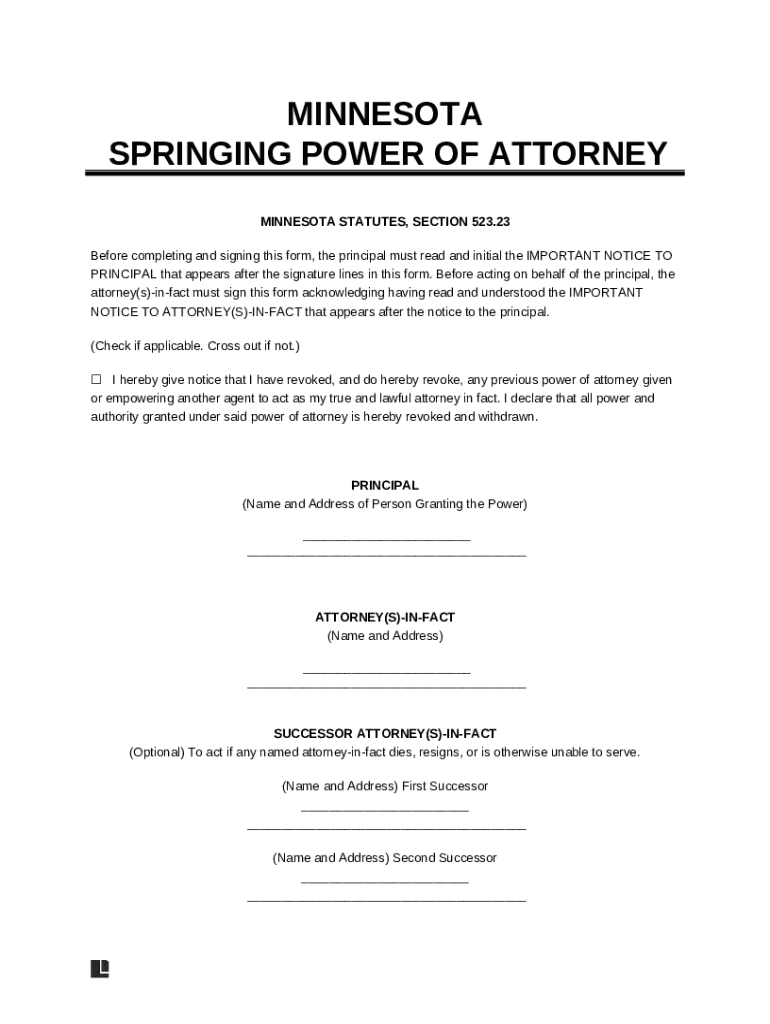

Key components of a durable power of attorney form

The Minnesota Durable Power of Attorney form is composed of several fundamental elements. Understanding these components is essential for effective document preparation and usage.

This section requires the full name, address, and contact information of both the principal and the agent. Accurate identification is crucial to avoid confusion.

Clarifying when the power of attorney goes into effect (immediately or upon a specific event) and how long it will last is vital for legal clarity.

The powers granted to the agent need to be explicitly outlined, including financial management, health care decisions, and any specific limitations or preferences.

Minnesota law mandates specific witnessing procedures and notarization to validate the document, protecting both the principal and the agent.

Benefits of using a PDF template for durable power of attorney

Using a PDF template for your Minnesota Durable Power of Attorney form offers several unique advantages. Being able to access and edit a fillable template makes the process less daunting. Many users appreciate the remarkable accessibility granted by PDF documents. You can access them from any device and share them without losing formatting.

Beyond accessibility, a PDF template provides flexibility for editing and customization, allowing you to cover all necessary areas specific to your situation. You can easily add, remove, or modify content to suit your unique needs.

Security is another essential feature of using a PDF template. By employing platforms like pdfFiller, your sensitive information is protected through encryption and security measures, ensuring that only authorized parties have access to your financial and health care decisions.

Step-by-step guide to completing the Minnesota durable power of attorney form

Filling out the Minnesota Durable Power of Attorney PDF template can be straightforward if you follow a well-structured approach. Below is a step-by-step guide to help you through the process.

You can find the downloadable Minnesota Durable Power of Attorney form on pdfFiller. Simply search the document and click to download the fillable version.

Make sure to enter the principal’s and agent’s full names, addresses, and contact details. Double-check for typos or errors, as accurate information is crucial.

Clearly list the powers you wish to grant your agent. Be explicit about any limitations to ensure your wishes are respected.

Before signing, go through a checklist of essentials to ensure all necessary sections are completed correctly and your intentions are clear.

In Minnesota, the document must be signed by you, the principal, and witnessed by at least one other person, and notarization is also strongly advised to add extra legality.

Once completed, store the document in a safe yet accessible place. Consider sharing copies with your agent and close family members to prevent any future disputes.

Interactive tools for enhancing your experience

pdfFiller elevates your durable power of attorney experience through interactive tools that make document management seamless. Using pdfFiller’s editing tools, users can customize their DPOA forms as needed, adding or removing provisions based on their circumstances.

Another valuable feature is the eSigning functionality. This digital signature option allows principals and agents to sign documents without the need for face-to-face meetings. This is particularly beneficial for individuals or families spread across different locations.

Collaboration options also enhance the utility of the platform. Users can easily share their documents with family members, attorneys, or trusted advisors, enabling feedback and collaboration on important end-of-life decisions.

Challenges and considerations when using durable power of attorney

While a Durable Power of Attorney is a powerful tool, it’s essential to understand the challenges and considerations involved in its use. Granting power to an agent comes with inherent risks, as this person has significant authority over your financial and health-related decisions.

You should carefully consider whom you grant this authority and under what circumstances. Additionally, situations can arise that necessitate the revocation of a Durable Power of Attorney, such as changes in the relationship with your agent, or if you regain mental competence and wish to revoke the power previously granted.

Moreover, when including this document in your estate planning, it is crucial to coordinate it with other legal documents, such as wills and trusts. Each document serves a purpose, and harmonizing their provisions can prevent conflicts and ensure your overall wishes are honored.

Common questions about Minnesota durable power of attorney

As individuals consider establishing a Durable Power of Attorney, several common questions often arise, highlighting the document's significance and nuances.

If your agent is unable to act, consider naming a successor agent in your DPOA. This ensures that someone you trust is always available to manage your affairs.

Your agent can make financial decisions on your behalf, so it’s crucial to choose someone responsible and trustworthy to handle your finances.

Without a DPOA, family members may have to go through the courts to gain authority to manage your affairs, a process that can be lengthy, costly, and stressful.

Legislation and updates surrounding power of attorney in Minnesota

Legal frameworks governing Durable Power of Attorney documents can evolve, and Minnesota is no exception. Understanding current laws and regulations enables individuals to stay compliant and make informed decisions regarding their powers of attorney.

Recent legislative changes may impact how Durable Powers of Attorney are executed, including notarization requirements and electronic signature acceptance. Keeping abreast of these updates is crucial for ensuring your document remains valid and enforceable.

User experiences and testimonials

Many individuals and families have turned to pdfFiller to navigate the complexities of creating durable power of attorney documents. Testimonials reveal that users appreciate the intuitive design of the platform that simplifies the document creation process.

Success stories often highlight the ease of sharing and collaborating on documents, especially in situations involving family planning. Users report that having a structured template helps them feel more empowered while managing their health and financial affairs.

Exploring alternatives to durable power of attorney

While a Durable Power of Attorney is essential for many, it’s also worth considering alternatives, especially if specific needs arise. For instance, a Health Care Directive can serve as a powerful companion document, specifying your medical treatment preferences in case you cannot communicate them.

Additionally, individuals might explore designating a legal guardian during their incapacitation, providing a different route to ensure care and decision-making aligns with their wishes. Understanding these alternatives helps individuals make informed decisions tailored to their circumstances.