Travel Expense Form: Detailed How-to Guide

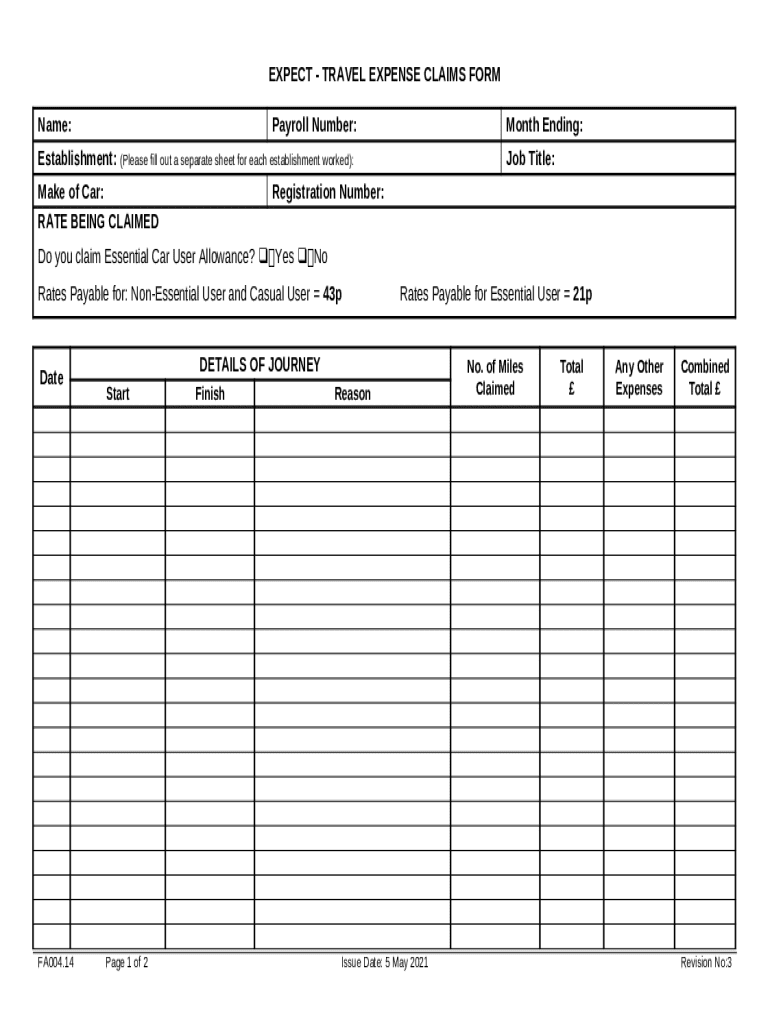

Understanding the travel expense form

A travel expense form is a document used by employees to record expenses incurred during business trips. Its primary purpose is to facilitate reimbursement from the company by providing a clear account of all expenses related to travel, including transportation, lodging, meals, and other relevant costs.

Accurate expense reporting is critical, as it helps maintain transparency in financial dealings and ensures that employees are reimbursed promptly. Inaccuracies can lead to delays, potential audits, and even disputes with accounting departments. Therefore, understanding how to fill out a travel expense form correctly is essential for both employees and financial officers.

Business trips for meetings or conferences.

Fieldwork or client visits by sales or technical teams.

Travel related to training or educational purposes.

Overview of the travel expense process

Submissions for travel expenses generally follow a straightforward process, enabling employees to report their incurred costs systematically. The key steps include preparation of documents, filling out the travel expense form accurately, and submission to the appropriate department for approval.

Understanding the timeline for approval can save headaches down the line. Employees should be prepared for potential delays, depending on the workload of the finance department or specific approval hierarchies that may exist within a company. Moreover, awareness of common pitfalls — such as not keeping detailed receipts, or misunderstanding company policies — is essential for ensuring a smooth reimbursement process.

Prepare all necessary documents and receipts before initiating the form.

Fully fill out the travel expense form accurately.

Submit to the designated finance or HR department in a timely manner.

Preparing for filling out the travel expense form

Before diving into the filling process, it’s prudent to gather all necessary documents and receipts. This not only speeds up the preparation but also reduces stress later on. Key documents might include flight itineraries, hotel invoices, meal receipts, and any transport-related charges.

Equally important is understanding company policies and guidelines associated with travel expenses. This knowledge ensures compliance and helps employees avoid potential disqualification of claims due to minor policy violations. Moreover, setting up a digital workspace can facilitate ease of access and organization, particularly if the company allows for digital submissions.

Flight itineraries must be saved and available for submission.

Hotel invoices should detail the dates and costs paid.

Meal receipts should be itemized for proper breakdown.

Record any transportation costs, including taxis or car rentals.

Step-by-step guide to completing the travel expense form

Filling in personal and travel information lays the groundwork for the travel expense form. Begin by entering required personal details such as your name, employee ID, and department. Next, detail your travel information, including the destination, travel dates, and the purpose of travel. This contextual information assists the approvers and aligns with company policies.

The next step involves itemizing your travel expenses effectively. Allocate a budget for airfare, lodging, meals, transportation costs, and any miscellaneous expenses. Having a clear breakdown allows for transparency and ensures that your report aligns with the anticipated costs outlined in the company guidelines.

Airfare: Include round-trip, one-way, and any necessary upgrades.

Lodging: Specify nightly rates, locations, and booking references.

Meals: Breakdown meal costs and categorize as per diem or actuals.

Transportation: List expenses such as taxis, ride-shares, or rental cars.

Miscellaneous: Include other relevant expenses like tips and fees.

Using pdfFiller for filling and managing the travel expense form

pdfFiller offers robust capabilities that simplify the process of filling out and managing the travel expense form. With tools for editing PDFs directly, employees can enter their information quickly without worrying about formatting issues or lost information. Additionally, the eSigning feature allows for immediate digital signatures, enhancing the speed of approvals.

Collaborating with team members becomes easier with pdfFiller's sharing features. You can upload your travel expense form directly to the platform, ensuring everyone who needs to review it can do so from anywhere. Utilize interactive tools such as templates to save time on future reports and to keep track of submissions and approvals efficiently.

Edit PDFs easily by entering information directly.

eSign the form without needing to print and scan.

Collaborate with team members by sharing documents seamlessly.

Submitting the travel expense form

Identifying the correct submission channels is crucial to successful expense reporting. Companies usually have designated procedures and specific departments that handle these forms, often the finance or HR teams. Deadlines for submission can vary greatly between organizations, so it's vital to stay informed and follow up with approvers if necessary.

Understanding the approval workflow will spare employees from unnecessary stress. Typically, the approval process may involve several layers, especially in larger organizations, so maintain open communication with your approvers to ensure a smoother experience. Familiarize yourself with best practices for continuous updates and transparency throughout the submission process.

Submit to appropriate departments like finance or HR.

Keep track of submission deadlines for timely processing.

Maintain communication with approvers for updates.

Handling reimbursement queries and issues

Even with meticulous preparation, sometimes claims can be rejected or questioned. Common reasons for claim rejections include missing receipts, expenses that exceed policy limits, or claims for non-reimbursable items. Employees must ensure they have supporting documents ready and understand the basis of the rejections to address issues effectively.

If queries arise, a systematic approach to addressing and resolving issues can save time and reduce frustration. Contacting the finance department directly for clarification often expedites the process. Keep the lines of communication open, and make sure to follow up appropriately to reach resolutions swiftly.

Be prepared for common rejection reasons by knowing the policies.

Document issues and maintain organized records.

Reach out to finance for clarifications and follow-ups.

Additional considerations for travel expenses

Understanding the tax implications of travel reimbursements is essential and varies by location. Some expenses may be considered taxable income, while others can be written off. Being knowledgeable about these distinctions can significantly impact your overall financial liability and ensure compliance with local regulations.

Many companies use per diem rates for meals and lodging, which establish a daily allowance to streamline expenses in a manageable way. Familiarizing yourself with how these rates work can simplify the reporting process, allowing for quick calculations and compliance with company policies that favor standard expense allowances. Additionally, maintaining records for future reference and audits is a best practice that should not be overlooked.

Be aware of tax implications regarding travel reimbursements.

Understand how per diem rates function for meal allowances.

Keep organized records for audits and compliance.

Tips for effective travel expense management

Staying organized during travel can drastically reduce stress when reporting expenses. Develop a habit of storing receipts immediately upon incurring costs—whether digitally via invoicing apps or in a designated envelope if collecting paper receipts. This proactive method helps avoid scrambling for lost documents when it's time to fill out the travel expense form.

Utilizing mobile apps for tracking expenses in real-time is another strategy to streamline the process. Many apps integrate directly with expense reporting tools, allowing users to automate portions of their reports. Finally, creating a routine for expense reporting—for instance, dedicating time at the end of each trip to organize and submit expenses—can reduce workload and streamline processes, ensuring that your reimbursements are received promptly.

Organize receipts immediately to avoid losing documentation.

Use mobile apps to track expenses in real-time.

Establish a routine for timely expense reporting.

Frequently asked questions (FAQs)

Employees often find themselves with questions when managing travel expenses. In the case of a lost receipt, it’s essential to check if your company allows for affidavit submissions or alternative documentation as exceptions. For those combining personal and business travel, companies usually require a clear demarcation; always consult your company’s travel policies to avoid confusion.

To ensure compliance with company policies, regularly review them before every business trip. Each company's rules can differ significantly; being aware of these can save time and potential reimbursement issues after the fact.

If a receipt is lost, check for alternative documentation options.

Always clarify company policies on personal travel expenses.

Review policies regularly to avoid confusion and errors.

Conclusion and quick links

Navigating the travel expense form can be significantly simplified by adhering to the guidelines laid out in this guide. Key takeaways include keeping organized records, understanding company policies, and utilizing pdfFiller for an efficient and effective document management experience—all critical components for successful and timely expense reporting.

For further assistance and access to online tools that streamline the travel expense report process, leverage pdfFiller’s platform. It offers a range of resources tailored to ensure user satisfaction and efficiency in managing your travel-related documents.

Review and stay updated on company’s travel expense policies.

Utilize pdfFiller tools for accurate and efficient expense reporting.

Keep a digital archive of completed travel expense reports for future reference.