Get the free Toxic Substances Control Act (TSCA) Risk Determination ...

Get, Create, Make and Sign toxic substances control act

How to edit toxic substances control act online

Uncompromising security for your PDF editing and eSignature needs

How to fill out toxic substances control act

How to fill out toxic substances control act

Who needs toxic substances control act?

Understanding the Toxic Substances Control Act Form: A Comprehensive Guide

Understanding the Toxic Substances Control Act (TSCA)

The Toxic Substances Control Act (TSCA) is a pivotal piece of legislation enacted in 1976 in the United States. Its primary purpose is to regulate the introduction of new or already existing chemical substances. This law empowers the Environmental Protection Agency (EPA) to evaluate and manage risks associated with chemical exposure. As such, TSCA plays a vital role in ensuring the safety of chemicals used in domestic products, safeguarding both public health and the environment.

Historically, TSCA arose from concerns over increasing chemical production and usage during the mid-20th century. Over the decades, it has undergone various amendments to enhance its effectiveness, particularly in light of emerging scientific data on toxic substances. The law emphasizes an inclusive approach to chemical management, aligning regulatory processes with advancements in chemistry and toxicology.

The significance of TSCA cannot be overstated; it serves as a cornerstone for chemical safety in the U.S. By establishing a framework for risk assessment and management, TSCA has had a profound impact on public health and environmental protection. Strict regulations under TSCA deter the introduction of hazardous substances, thereby ensuring safer living conditions for society at large.

Essential TSCA forms and templates

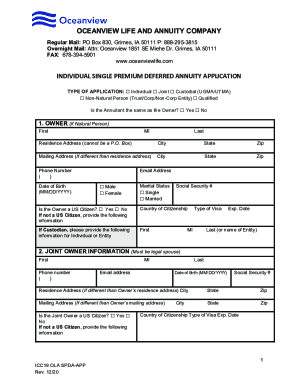

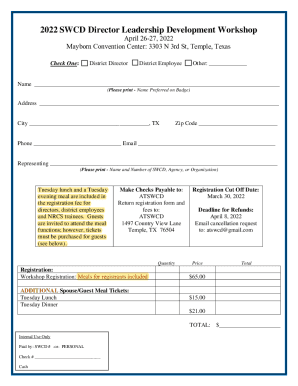

Navigating the realm of TSCA compliance necessitates familiarity with a variety of forms that ensure adherence to regulatory standards. The primary forms associated with TSCA compliance include the Import Certification Form, Pre-Manufacture Notice (PMN), and the Significant New Use Rule (SNUR). Utilizing the correct forms is critical because inaccuracies or omissions can result in compliance issues or delays in processing.

Among these, the TSCA Import Certification Form holds a particular importance. Its main purpose is to verify that imported chemicals comply with the provisions of TSCA. This form is crucial for manufacturers and importers to showcase their commitment to safety and legal compliance. In essence, using the right forms ensures a smoother import process and fosters trust in chemical safety practices.

Step-by-step guide to completing the TSCA forms

Filling out the TSCA Import Certification Form requires careful preparation. Before you begin, ensure you have all required information and documentation on hand. This typically includes details about the chemical, its intended use, and any prior regulatory interactions. Lots of individuals make the mistake of underestimating the amount of detail required, which can lead to mandatory follow-ups or worse, compliance penalties.

The sections of the form are organized logically and include pertinent fields that need to be addressed comprehensively. Typical sections include personal information regarding the importer, certification statements as per TSCA guidelines, and detailed substance identification. It is pivotal to accurately describe the chemical and its intended use to avoid discrepancies that may arise during the regulatory assessment.

To enhance accuracy while completing the form, consider utilizing interactive tools available on platforms like pdfFiller. By using their intuitive interface, you can easily navigate form fields, make edits, and sign documents online. Additionally, examining examples of completed forms can provide invaluable insights, ensuring you know what a properly filled-out form looks like.

Certification statements and their importance

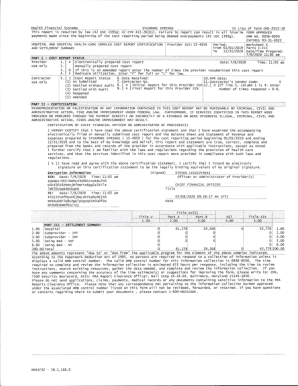

Certification statements in the TSCA Import Certification Form are crucial declarations that affirm the compliance of imported substances with TSCA mandates. Two main types of certification statements exist: positive and negative. A positive certification indicates that the imported chemical complies fully with TSCA requirements. This embraces both safety standards and reporting obligations, ensuring that the chemical is safe for use in the U.S.

Conversely, a negative certification applies to scenarios where the substance is not yet subject to TSCA regulations, or the importer is aware of specific non-compliance issues. Knowing when to employ each type of statement is vital for maintaining legal status and ensuring the safety of chemical imports. Misrepresenting compliance can lead to severe repercussions, including fines or forced recalls, making it essential to understand the implications of each certification.

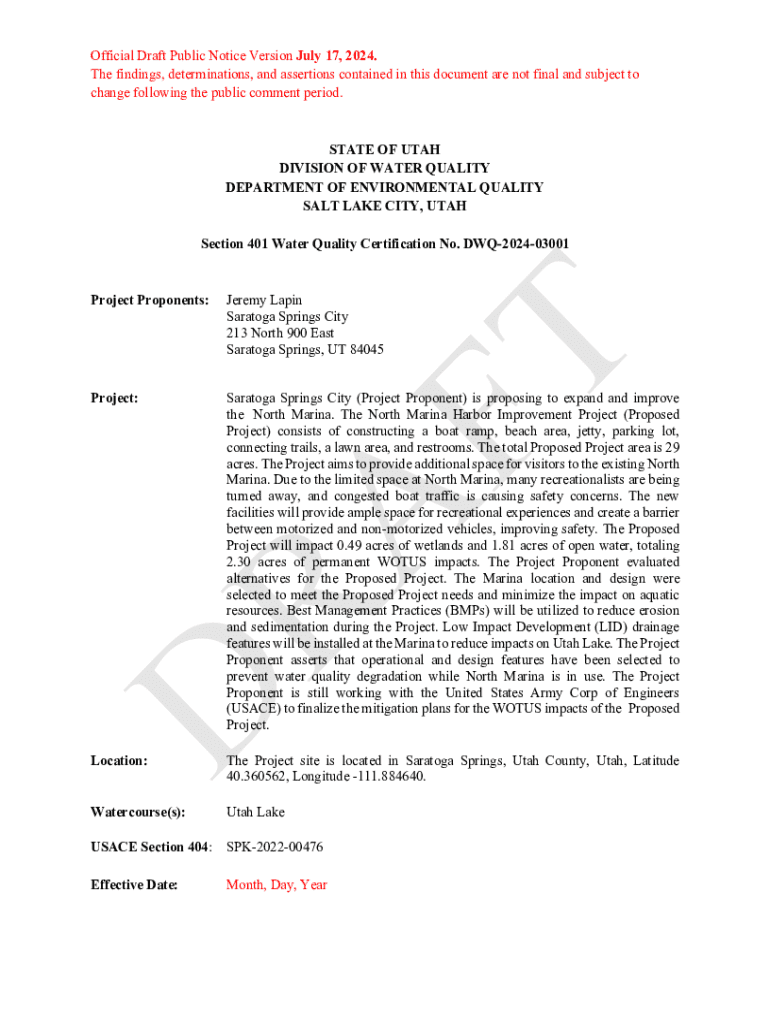

Special considerations for importing new chemicals

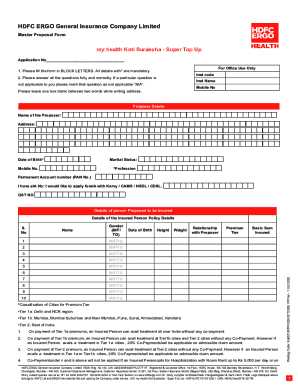

Importing new chemicals entails specific regulations under TSCA, particularly under Section 5(e) Orders. These orders mandate that new chemical manufacturers and importers must register their substances with the EPA. This means you must submit a Pre-Manufacture Notice (PMN) before any manufacturing activity begins, ensuring that the effects on human health and the environment are adequately evaluated prior to any use.

Moreover, the Significant New Use Rules (SNURs) serve a vital purpose as they allow the EPA to inform companies about novel uses for chemicals previously found to be safe in different contexts. Before utilizing a chemical in a new manner or for a new application, it is imperative to check if it falls under SNURs. By complying with these rules, companies contribute to ongoing safety assessments while ensuring regulatory responsibility in chemical management.

Managing your TSCA documentation

Effective documentation is key to successful TSCA compliance. Storing and accessing TSCA forms through a cloud-based solution, such as pdfFiller, provides numerous advantages. Cloud storage not only allows for secure, off-site access but also enhances collaborative efforts among teams working on compliance. Several individuals find this particularly beneficial when multiple stakeholders need to review or contribute to the same document.

Additionally, tracking submission and compliance dates can be simplified through strategic documentation management. Setting up reminders and using compliance monitoring tools helps prevent missed deadlines, which could otherwise lead to penalties. Implementing systematic document management processes ensures that your TSCA compliance strategy remains proactive rather than reactive.

Updates and amendments to TSCA

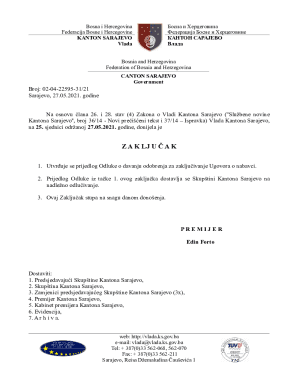

In recent years, TSCA regulations have undergone significant updates, particularly following the Frank R. Lautenberg Chemical Safety for the 21st Century Act in 2016. This amendment shifted the landscape of chemical regulation, enhancing the EPA's authority regarding chemical assessments and increasing the transparency of the chemical regulatory process. New requirements can impact how businesses approach TSCA compliance, particularly relating to the importation of hazardous substances.

Keeping abreast of updates is essential for stakeholders involved in chemical importation. Resources available through the EPA provide critical information on changing regulations, including guidance documents and regulatory frameworks. Subscribing to email alerts or regularly checking the EPA website can help organizations stay informed about important compliance requirements and changes to existing laws.

Frequently asked questions about the TSCA forms

When engaging with TSCA forms, common queries often arise regarding compliance. One of the most frequently asked questions pertains to timelines for submission: stakeholders wonder how long they have to submit the Import Certification Form before receiving shipments. Typically, the form should be filed prior to the import date to prevent delays. Other common concerns include understanding specific requirements for registering new chemicals and navigating certification protocols.

Troubleshooting common issues with form submissions also ranks high on the list of frequently asked questions. Problems often arise due to incomplete forms or typographical errors that can affect processing times. Maintaining a checklist while completing the forms can effectively minimize these issues, ensuring that all required fields are addressed correctly before submission.

Expert insights and perspectives

Interviews with environmental compliance experts provide valuable perspectives on the challenges associated with TSCA compliance. Many professionals emphasize the importance of rigorous monitoring practices and proactive documentation strategies for facilitating seamless adherence to TSCA requirements. For example, a case study might involve a company struggling with its chemical inventory, which ultimately improved its compliance by leveraging document management solutions like pdfFiller.

Real-world examples demonstrate that companies successfully navigating the complexities of TSCA regulations often share certain traits: they prioritize accuracy, stay informed about regulatory changes, and adopt technological solutions that streamline compliance processes. By analyzing such case studies, new entrants to the industry can glean important lessons on effective TSCA document management and compliance strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit toxic substances control act from Google Drive?

How do I edit toxic substances control act straight from my smartphone?

How do I edit toxic substances control act on an Android device?

What is toxic substances control act?

Who is required to file toxic substances control act?

How to fill out toxic substances control act?

What is the purpose of toxic substances control act?

What information must be reported on toxic substances control act?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.