Get the free Commuter Benefits - OPA

Get, Create, Make and Sign commuter benefits - opa

Editing commuter benefits - opa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out commuter benefits - opa

How to fill out commuter benefits - opa

Who needs commuter benefits - opa?

Commuter benefits - OPA form: A complete guide

Understanding commuter benefits

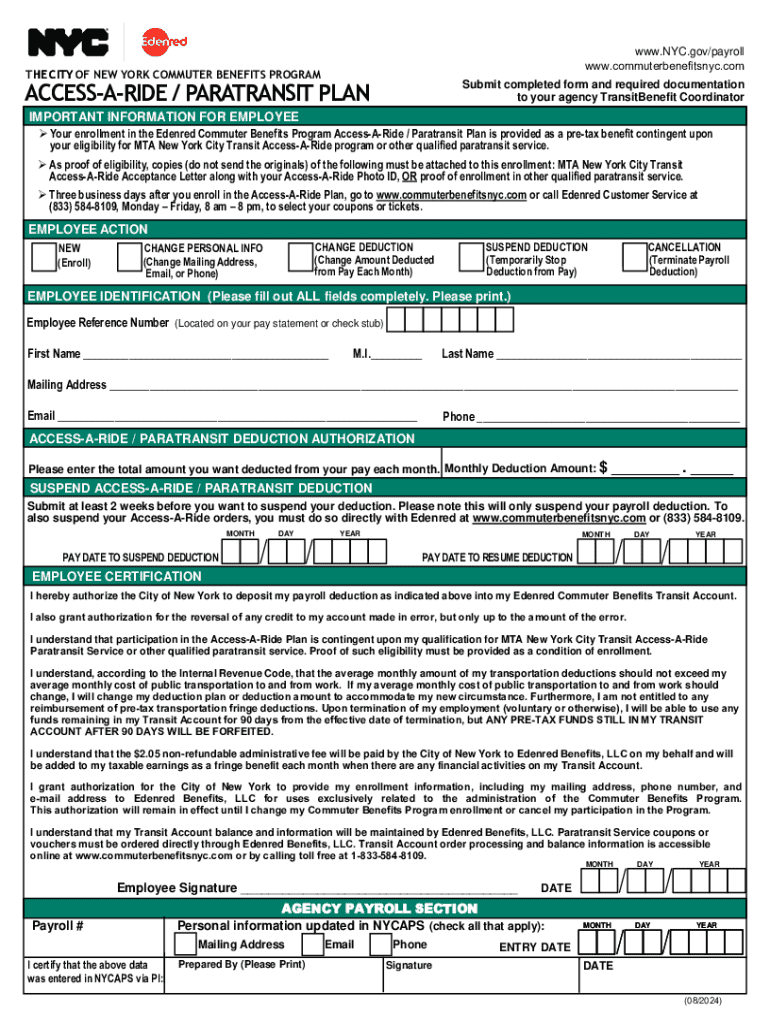

Commuter benefits are financial incentives provided by employers to help employees offset their commuting costs when traveling to and from work. These benefits can include pre-tax deductions for expenses related to public transit, parking, and even certain biking expenses. The Commuter Benefits Program is designed to encourage healthier commuting habits and reduce traffic congestion, ultimately benefiting the environment.

In today’s workplace, commuter benefits play a crucial role in employee satisfaction and retention. Companies that offer these benefits not only provide financial relief but also promote positive work-life balance and environmental consciousness, which are significant factors for most job seekers.

Features of the commuter benefits program

The Commuter Benefits Program operates by allowing employees to set aside pre-tax income to cover transportation expenses. This system reduces the taxable income, thus providing immediate tax savings. Eligibility for these benefits may vary by employer, but generally, all full-time employees who use public transportation or park their vehicles at or near the workplace can qualify.

The program offers various types of benefits tailored to different commuting styles. Commonly included are transit allowances for employees using public transport services such as buses, subways, and commuter trains, as well as parking benefits for those who prefer to drive. Additionally, some programs offer reimbursements for commuting by bike.

The OPA form: Purpose and importance

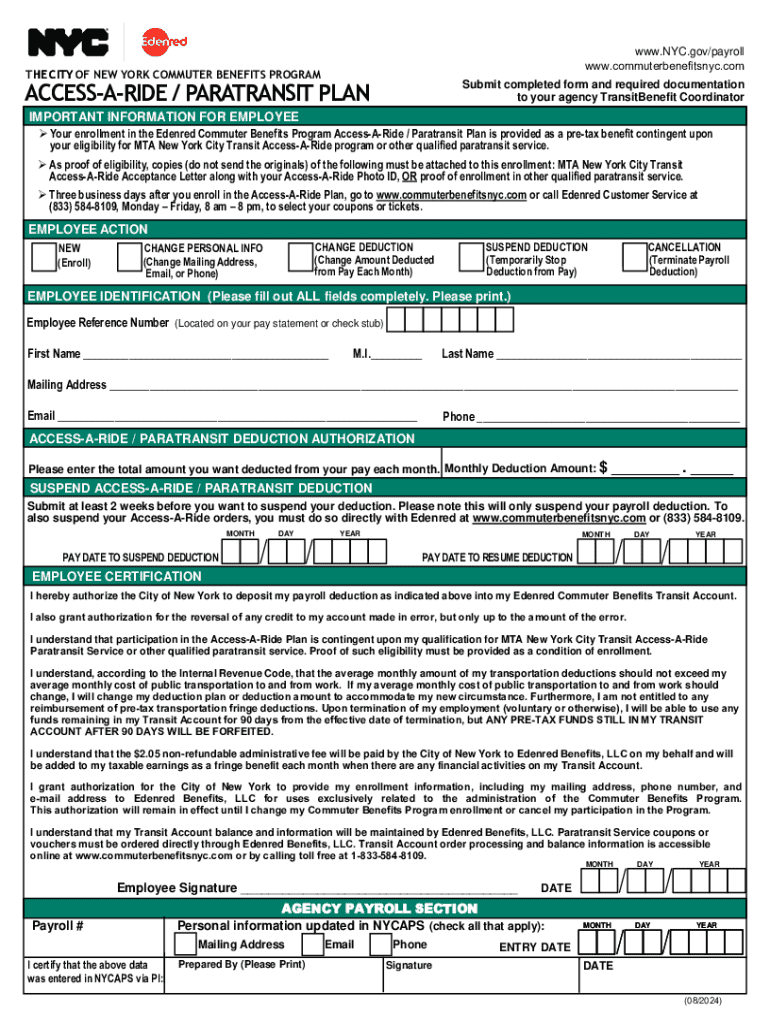

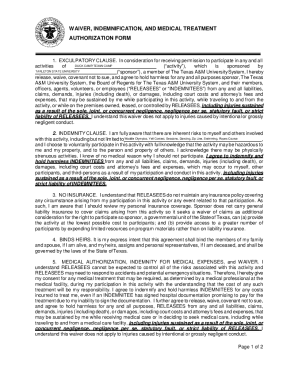

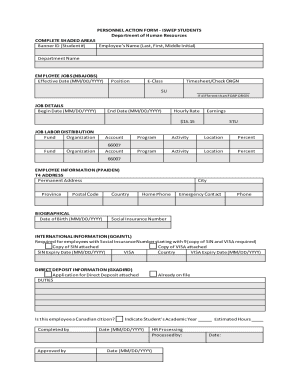

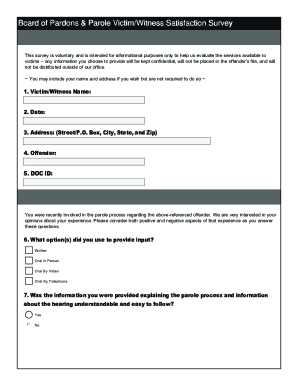

The OPA (Order for Payment of Allowance) form is instrumental in the Commuter Benefits Program as it serves as the official request for the commuter benefits allowances. Filling out this form correctly is vital to ensure employees receive the necessary reimbursements or allowances. The OPA Form captures essential details such as the employee's name, employer's information, and the specific allowance types they wish to opt for.

With the OPA Form, employees can systematically document their commuting benefits, allowing for smoother processing by the HR or finance departments. By providing this structured approach, employers can manage benefits efficiently while ensuring compliance with IRS guidelines.

Step-by-step guide to completing the OPA form

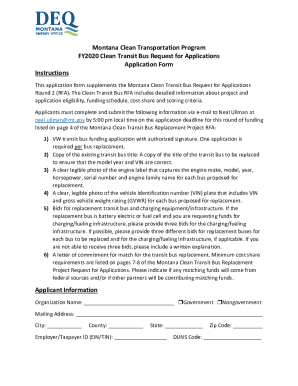

Before starting to fill out the OPA Form, it is important to gather all the necessary documents. Employees should prepare their ID, proof of employment, and any relevant documentation that might accompany their transit passes. Ensure you have all information regarding your commuting costs readily available.

When completing the OPA Form, it’s key to follow the structured sections, which include:

Common pitfalls to avoid when filling out the OPA Form include missing out on transcription errors which could lead to delayed processing or incorrect benefits amounts. Double-check all entries for accuracy and ensure completeness before submitting.

Editing and managing your OPA form

Once you've filled out your OPA Form, managing the document is essential. pdfFiller offers great tools for editing, allowing users to make necessary changes post-filling. This includes correcting any input errors and adding signatures and dates digitally.

Moreover, saving and sharing your OPA Form is simple. Consider utilizing cloud storage options provided by pdfFiller for seamless access from anywhere, facilitating collaboration with your HR or project teams regarding any revisions that might be required.

Additional considerations and tips

To maximize your commuter benefits effectively, it's wise to combine different types of benefits if your employer allows. For example, if you utilize both public transport and parking, ensure to take advantage of all available allowances to maximize savings.

Staying informed about changes to the commuter benefits is crucial. Follow updates on pre-tax limits and other regulations that can influence your benefits. Regularly accessing resources from your HR department can ensure you are well-equipped to make informed decisions.

Navigating related documents

It's also important to track related documents that accompany the OPA Form. This includes IRS compliance guidelines specific to commuters and enrollment forms that establish eligibility for these benefits. Having these documents on hand can significantly streamline the application process.

To access these documents on pdfFiller, engage with interactive tools that provide efficient means of searching and managing your forms. This ease of access can greatly enhance your overall experience during the benefits enrollment period.

Frequently asked questions (FAQs)

Here are some frequently asked questions that employees often have when going through the OPA Form process:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find commuter benefits - opa?

How do I make changes in commuter benefits - opa?

How can I edit commuter benefits - opa on a smartphone?

What is commuter benefits - opa?

Who is required to file commuter benefits - opa?

How to fill out commuter benefits - opa?

What is the purpose of commuter benefits - opa?

What information must be reported on commuter benefits - opa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.