Get the free Mutual FundsApplications and Forms

Get, Create, Make and Sign mutual fundsapplications and forms

Editing mutual fundsapplications and forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual fundsapplications and forms

How to fill out mutual fundsapplications and forms

Who needs mutual fundsapplications and forms?

Mutual Funds Applications and Forms: A Comprehensive Guide

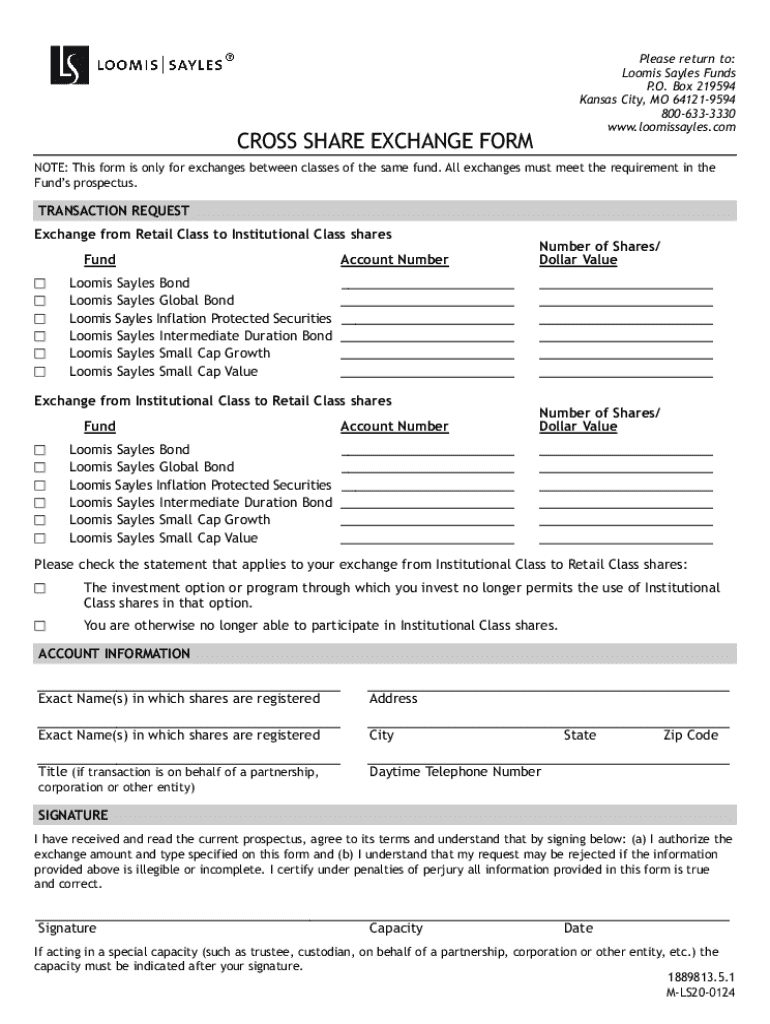

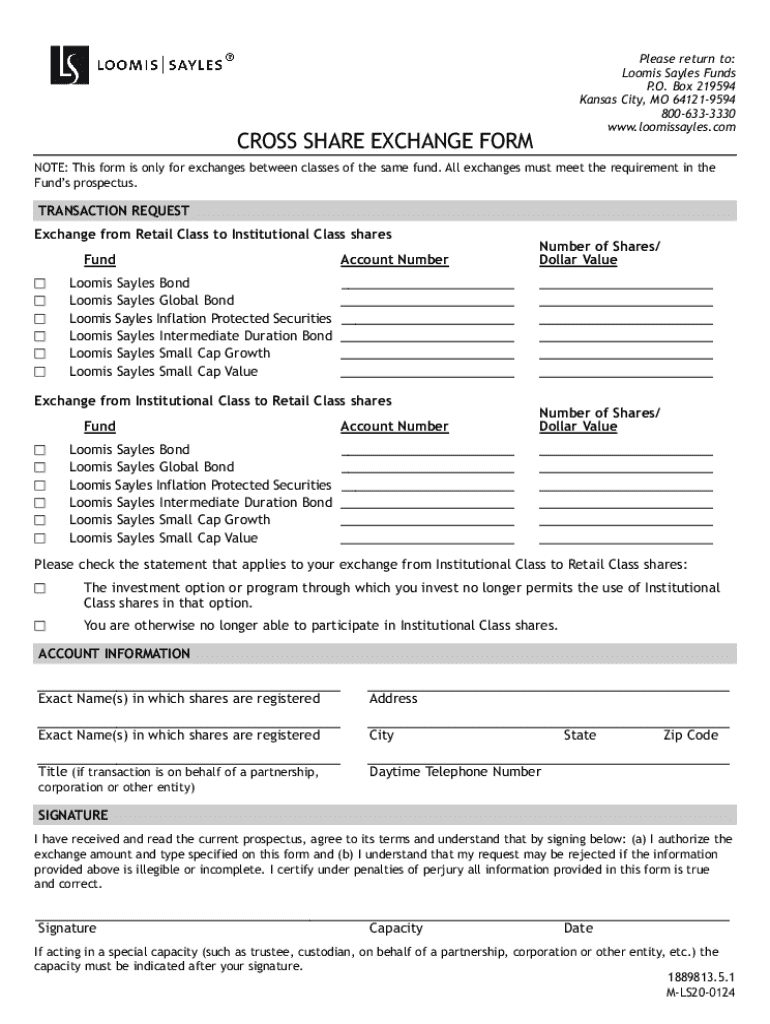

Overview of mutual funds applications and forms

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of assets, such as stocks and bonds. They provide investors access to professional management and diversification that might be difficult to achieve individually. To engage with mutual funds effectively, completing the correct applications and forms is essential, as these documents facilitate your investment, establish your identity, and conform to legal requirements.

Using accurate applications and forms is paramount. They ensure streamlined onboarding, compliance with regulatory requirements, and proper management of investments. Mistakes or omissions in these documents can lead to delays, rejections, or even financial penalties.

Types of mutual funds applications

Open-end mutual funds

Open-end mutual funds offer shares that are bought and sold at their net asset value (NAV). They do not have a fixed number of shares, which means they can issue and redeem shares on demand.

To apply for open-end mutual funds, investors typically fill out an application form that includes personal details and investment choices. This process may also involve KYC documentation.

Closed-end mutual funds

Closed-end mutual funds issue a fixed number of shares through an initial public offering (IPO), and these shares are traded on stock exchanges. Their share prices fluctuate based on supply and demand.

To purchase shares in closed-end funds, investors will often need to go through a brokerage, requiring simplified forms that typically focus on their trading account information.

Exchange-traded funds (ETFs)

ETFs combine features of mutual funds and stocks, allowing trading throughout the day on exchanges like stocks. ETFs can be actively or passively managed and often have lower fees.

When applying for ETFs, the application may be more brokerage-focused, detailing the accounts through which you wish to trade these funds.

Key forms needed for mutual fund investments

Investor application form

The investor application form is fundamental for initiating your investment. It collects key data points such as your name, address, Social Security Number (SSN), and investment objectives.

Filling out this form correctly is vital. Investors should pay attention to detail, including the investment amount, choice of fund, and beneficiary designations where required.

Account setup and registration forms

When setting up an account, forms vary based on the type of account: Individual, Joint, or Trust. Each account type has distinct requirements and necessitates specific information.

Completing account setup forms often involves clear instructions on how to submit required documentation and whether any specific signatures are required.

KYC (Know Your Customer) documentation

KYC documentation is essential for combating money laundering and ensuring investor identity is verified. Typically, you need to provide documents like a government-issued ID, proof of address, and sometimes proof of income.

This documentation can often be submitted with your application forms or may need to follow specific channels dictated by the fund's regulations.

Investment amount and payment instructions

When filling out mutual fund applications, it's crucial to clearly specify your intended investment amount. Many forms will include sections for specifying how you plan to fund your investment.

Step-by-step guide to completing mutual funds applications

Preparing essential documents

Before diving into filling out applications, you should prepare essential documents. Typical prerequisites include identity proofs, address verifications, and past investment statements.

Organizing these documents beforehand can expedite the application process, ensuring you have all necessary information at hand.

Filling out the application form

When completing your application form, it's crucial to understand each section thoroughly. These typically include personal information, financial details, and investment choices. The personal information section often looks simple but may require specific formatting for identifiers such as Social Security Numbers.

Reviewing and validating information

Once the form is filled out, take the time to review and validate all information. This step is crucial to prevent errors that could delay your application. One effective approach is to create a checklist for accuracy.

Double-checking entries can save you from common pitfalls, ensuring that all details, especially numerical values like investment amounts, are correct.

eSigning and submitting your applications

The importance of eSigning forms

eSigning has become a staple in the modern investment landscape, streamlining the entire application process. It offers various benefits, such as immediate processing and ease of use.

Moreover, eSignatures hold legal validity in numerous jurisdictions, making them an acceptable form of authorization for investment applications.

How to eSign using pdfFiller

Using pdfFiller to eSign your applications is straightforward. After filling out your form, follow these steps:

Methods for submitting applications

You can submit your mutual fund applications via various means, primarily depending on your preference and the fund's requirements. The two most common methods are:

Tracking your mutual funds application status

Understanding application processing times

Application processing times for mutual funds can vary significantly based on several factors, including the type of fund, the volume of applications, and the specific policies of the fund manager. Generally, expect a timeframe ranging from a few days to several weeks.

How to check application status

Most mutual fund companies provide online portals or customer service lines specifically for checking application status. You can typically find instructions on how to access these services on the fund's website.

What to do if your application is delayed

If your application is delayed, the first step is to contact the fund's customer support, armed with your application reference number. They can provide insights on the issue and how to resolve it.

Managing your mutual funds portfolio

Tools provided by pdfFiller for portfolio management

Utilizing tools offered by pdfFiller can enhance your portfolio management experience. The platform integrates several interactive tools designed to simplify tracking and updating your mutual fund investments efficiently.

Understanding mutual funds statements

Regular statements will provide insights into your investment performance. Look for key information such as total investment value, fee disclosures, and transaction summaries.

Making changes to your investment

If you need to make changes to your investment, the process often involves filling out additional forms or submitting requests through your fund’s online platform. It's best to consult the fund’s guidelines for the most effective procedure.

Troubleshooting common issues

Errors in applications

Common errors in mutual fund applications include misspellings, incorrect Social Security Numbers, and failure to provide required documentation. Addressing these at the start can prevent processing delays.

Document acceptance issues

If your documents are rejected, check the reasons provided carefully. Resubmitting corrected or additional documents as soon as possible can help resolve these issues.

Communication with fund managers

Establishing effective communication with fund managers is essential for resolving issues. Always keep records of your inquiries and follow up regularly to ensure your concerns are addressed.

FAQs on mutual funds applications and forms

Often, potential investors have questions regarding the application process, such as the time required for processing, how to adjust investment amounts after submission, or the differences between various funds. Addressing these common questions is crucial for guiding users effectively through the process.

Some particular inquiries might involve requirements specific to different investment accounts, or questions around KYC documents—clarifications that can make the application process smoother.

Best practices for managing mutual fund documents

Organizing your mutual fund documents can significantly streamline your investment management. Utilizing digital formats helps keep everything accessible while ensuring safety. You can leverage platforms like pdfFiller for document management, making the process efficient.

By leveraging pdfFiller’s features for document handling, you can streamline your processes effectively, ensuring that you have the right forms and applications easily accessible when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the mutual fundsapplications and forms form on my smartphone?

Can I edit mutual fundsapplications and forms on an Android device?

How do I fill out mutual fundsapplications and forms on an Android device?

What is mutual funds applications and forms?

Who is required to file mutual funds applications and forms?

How to fill out mutual funds applications and forms?

What is the purpose of mutual funds applications and forms?

What information must be reported on mutual funds applications and forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.