Get the free Global Credit Card Application Form.cdr

Get, Create, Make and Sign global credit card application

How to edit global credit card application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out global credit card application

How to fill out global credit card application

Who needs global credit card application?

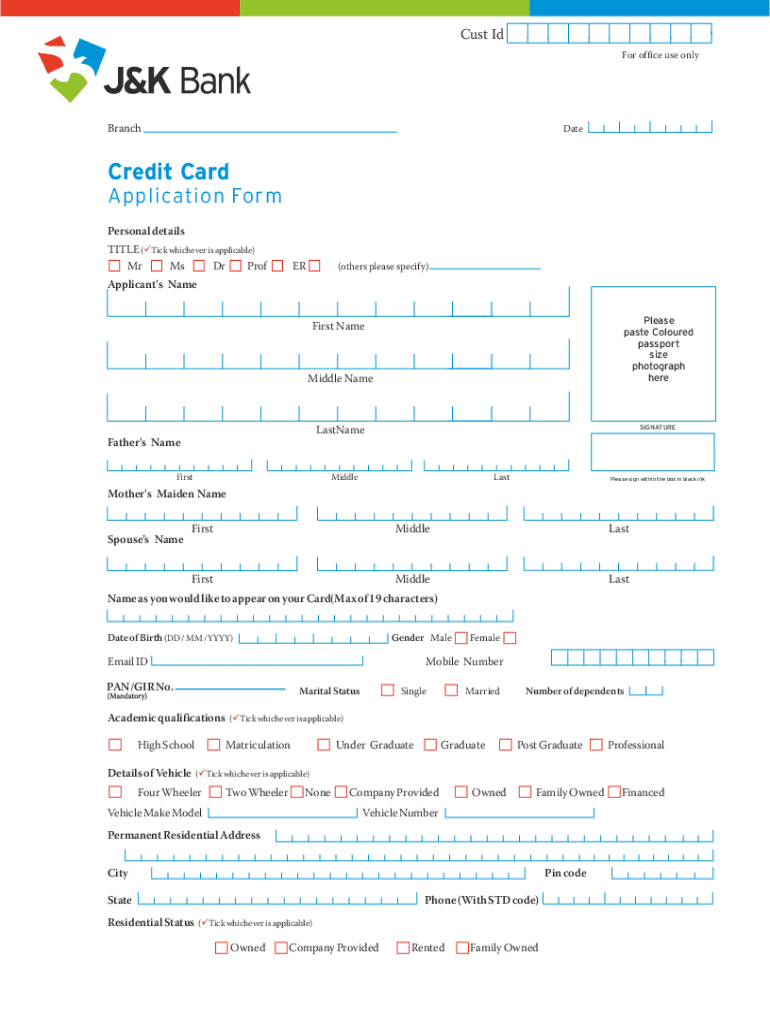

A Comprehensive Guide to the Global Credit Card Application Form

Understanding global credit card applications

Global credit card applications allow individuals from various countries to apply for credit cards that can be used internationally. These cards often offer specific benefits for travelers or those making purchases in multiple currencies. Understanding how these applications function can simplify the application process and enhance your spending capabilities while abroad.

Global credit cards work by linking your creditworthiness to an international network, enabling you to make purchases in different currencies without incurring excessive fees. The benefits can include lower foreign transaction fees, travel rewards, and enhanced consumer protections. By applying for a global credit card using the right form, you can access the extensive benefits these cards offer.

The primary benefits of applying for a global credit card include improved travel convenience, rewards such as cashback or travel points, and building international credit history. These advantages make the application process all the more appealing whether you travel frequently or manage varying expenses in different currencies.

Key features of global credit card application forms

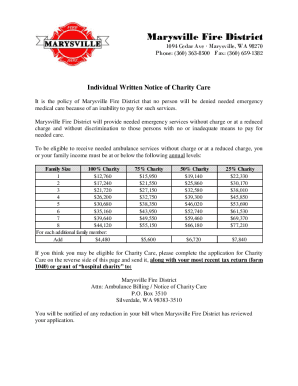

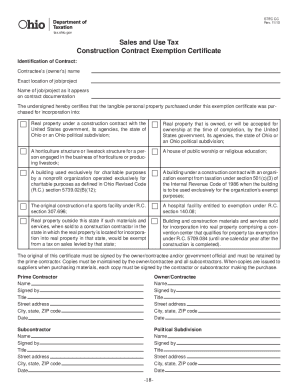

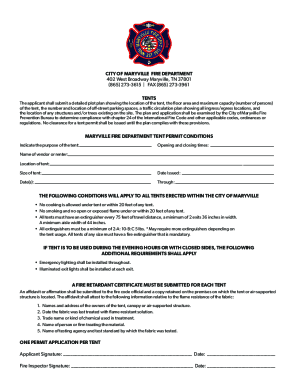

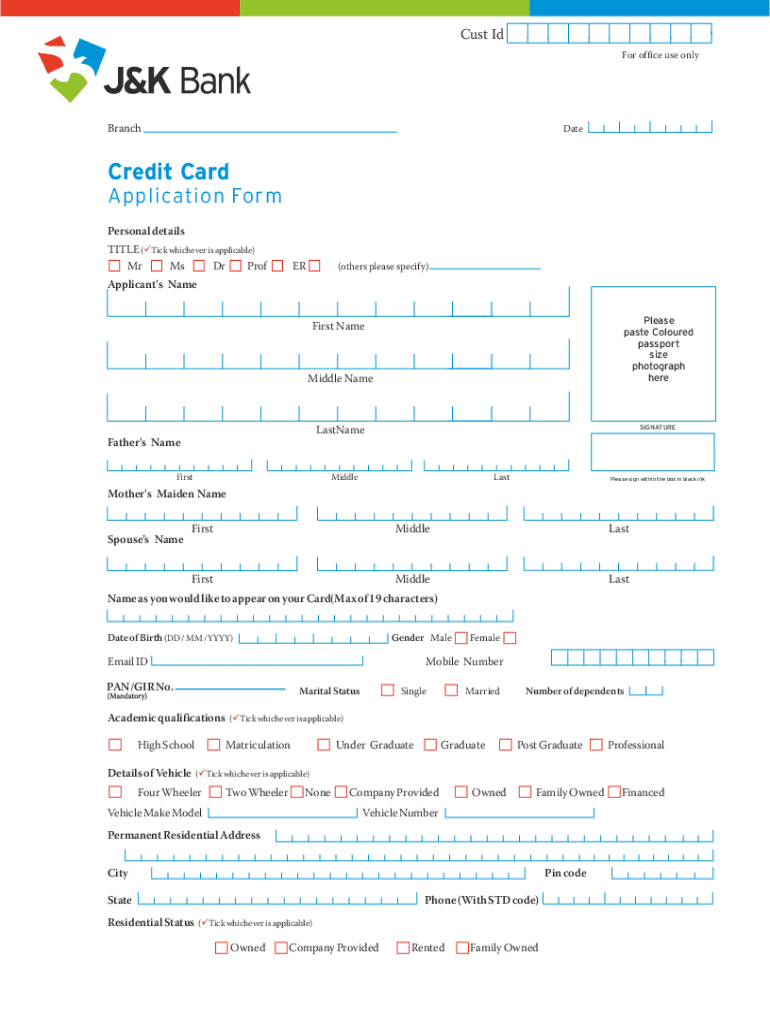

When examining a global credit card application form, it's important to identify several key features that ensure you provide the necessary information for a successful application. Look for forms that clearly outline required documentation, such as proof of identity, proof of address, and financial statements.

Information you will need to provide typically includes your personal details, income, employment status, and financial obligations. Common mistakes to avoid while completing the application include providing inaccurate information, neglecting required documentation, and overlooking terms and conditions.

Step-by-step guide to completing the global credit card application form

To ensure your application is completed accurately and efficiently, follow this step-by-step guide:

Managing your global credit card application

Once you've submitted your application, managing its status is crucial. Many credit card issuers provide a tracking system where you can check the status of your application online. This system reduces anxiety since you won’t have to wait in the dark about whether your application was received or is under review.

After submission, maintain communication with your issuer. They may reach out to you for additional information or clarification regarding your application. Being proactive about potential follow-up questions allows for a smoother approval process.

Enhancing your credit card experience

After approval, using pdfFiller’s tools can significantly enhance your credit card experience. Its platform allows you to edit PDFs and collaborate on shared applications efficiently. This functionality can be particularly useful if you're working with a team on travel plans or shared expenses related to your credit card usage.

Once you have your global credit card, familiarize yourself with its features, including reward programs, cash-back opportunities, interest rates, and fees. This knowledge not only empowers you to make informed spending decisions but also helps in maximizing the benefits your card offers.

Troubleshooting common application issues

Even the best-prepared applicants can face issues. If your application is rejected, it’s essential to take proactive steps. First, understand the reasons behind the rejection, which can vary from minor errors to credit history concerns. This knowledge helps you address the underlying issues before reapplying.

Contacting customer support is another avenue worth considering for assistance. When reaching out, prepare your application details and explain your situation clearly. Customer service representatives can guide you through the next steps to rectify any issues.

Comparisons and alternatives

When considering a global credit card, comparing rates, rewards, and benefits among different cards is crucial. Use tools available on pdfFiller to create side-by-side comparisons that highlight what is most beneficial for your financial situation. Such comparisons will empower you to choose a card that aligns with your spending habits.

Additionally, exploring alternatives to traditional credit cards is worthwhile. Options like peer-to-peer lending might provide an avenue for financing needs without the commitments that credit cards often require. As the financial landscape evolves, understanding all available options can enhance your overall financial strategy.

Frequently asked questions about global credit card applications

Staying informed about credit management

Engaging in ongoing credit education is vital. Sign up for workshops and webinars that focus on credit management strategies to empower yourself. Many financial institutions regularly update their offers or hosting educational content, which can keep you informed on best practices.

Stay connected with online forums and communities focused on financial literacy. Sharing experiences and asking questions can provide insights into managing credit effectively and making the most out of your global credit card.

Site navigation: How to use pdfFiller for all your document needs

Navigating pdfFiller is intuitive, especially for users looking for document creation solutions. Apart from the global credit card application form, the platform offers a wide array of document templates. You can easily access these by searching directly for forms or exploring categories available on the site.

Leverage advanced features like editing PDFs, adding eSignatures, and collaborating with team members to create a comprehensive approach to all your financial documentation needs. pdfFiller’s user-friendly interface ensures that you can manage your documents seamlessly, regardless of your location.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit global credit card application from Google Drive?

How do I complete global credit card application on an iOS device?

How do I edit global credit card application on an Android device?

What is global credit card application?

Who is required to file global credit card application?

How to fill out global credit card application?

What is the purpose of global credit card application?

What information must be reported on global credit card application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.