Maxima Public Liability Insurance Form: A Comprehensive Guide

Understanding Maxima Public Liability Insurance

Public liability insurance safeguards individuals and businesses against claims made by third parties for injury or damage. This coverage becomes essential when liability risks are high, such as when visitors are on your business premises or when your work may impact others. Maxima Public Liability Insurance plays a pivotal role in ensuring that policyholders can address potential legal claims without suffering financial hardship.

Maxima Public Liability Insurance not only safeguards financial assets but also helps maintain your business's reputation. A well-structured policy can cover legal fees, compensation claims, and payouts for damages associated with liability cases. This is crucial for business owners, freelancers, and professionals operating in today's litigious environment.

Provides financial protection against third-party claims.

Covers legal defense costs associated with claims.

Ensures business continuity during challenging times.

Types of coverage offered

Maxima Public Liability Insurance offers several coverage types tailored for various industries and businesses. Understanding these differences can aid in selecting the appropriate policy that meets specific needs.

Common inclusions in Maxima coverage include:

Bodily injury protection covers claims for injuries sustained by third parties on your premises.

Property damage coverage addresses damages to third-party properties resulting from your business activities.

Legal costs encompass expenses related to defending against claims or lawsuits.

Moreover, customization is possible through various instruments and endorsement options to meet specific business needs, allowing policyholders to tailor their coverage based on operational risks.

Eligibility criteria for Maxima Public Liability Insurance

Eligibility for Maxima Public Liability Insurance is open to a wide range of individuals and businesses. Applicants can include sole traders, partnerships, and limited liability companies. To qualify, businesses must demonstrate effective risk management practices and comply with industry regulations.

Certain professions may find that having this insurance is crucial. For example, businesses involved in construction, retail, or services that frequently interact with the public can significantly benefit. The insurance helps mitigate financial risks associated with potential claims and is often a requirement for various business licenses.

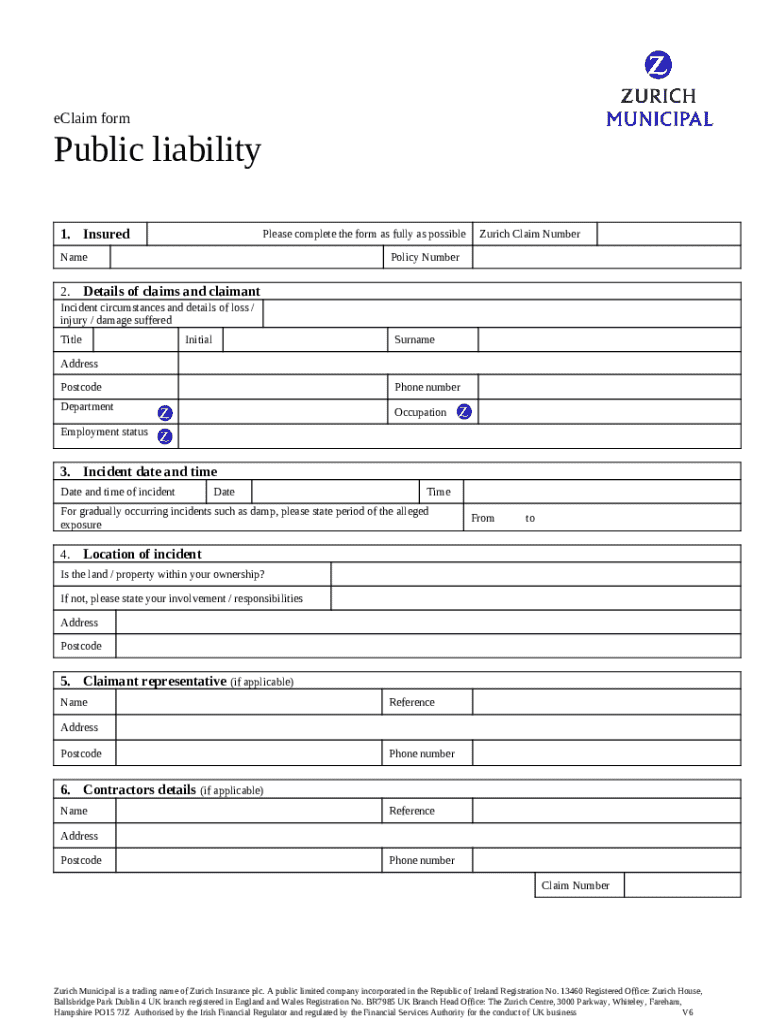

Detailed insights on the Maxima Public Liability Insurance form

Filling out the Maxima Public Liability Insurance form requires attention to detail. The form consists of several sections that need to be accurately completed to avoid delays in processing your application.

Key sections include:

Personal Information Section: Captures basic details of the applicant including name, address, and contact information.

Coverage Needed Section: Specifies the type of coverage and amount of insurance requested.

Business Details Section: Provides information regarding the nature of your business operations and risk factors.

Common errors include omitting critical information or providing inaccurate details. It's vital to ensure all information is complete and correct, as this will streamline the application process and facilitate quicker approval.

Step-by-step guide to completing the Maxima Public Liability Insurance form

Completing the Maxima Public Liability Insurance form can seem daunting, but breaking it down into manageable steps makes it easier. Start with preparing your information and gathering all necessary documents.

Follow these steps to ensure a successful application:

Gathering Your Personal Information: Ensure you have valid identification, proof of business registration, and any licenses required.

Specifying Coverage Requirements: Decide on the insurance amounts and types of coverage that apply to your business.

Detailing Business Operations: Clearly outline what your business does to help insurance providers assess risk accurately.

Reviewing and Assembling Documents for Submission: Once the form is filled, cross-check for accuracy and completeness before sending it off.

Taking the time to ensure correctness and clarity in your application can significantly reduce processing times and potential issues with claims in the future.

Editing and managing your Maxima insurance form with pdfFiller

Thanks to pdfFiller’s cloud-based platform, managing your filled Maxima Public Liability Insurance form is seamless. Editing tools are user-friendly, allowing you to make any necessary changes efficiently.

Key features include:

Easy editing: Modify text or add additional information without hassle.

Electronic signing: Sign your documents digitally and securely.

Collaborative features: Invite team members or stakeholders to review and edit the document.

Cloud storage: Safely store your form in a secure digital environment accessible from anywhere.

Using pdfFiller to manage your documents not only saves time but also enhances the overall experience of handling important paperwork.

Frequently asked questions (FAQs) about Maxima Public Liability Insurance

After submitting the Maxima Public Liability Insurance form, many applicants have questions regarding the process. Understanding these queries can provide clarity.

What happens after submitting the form? – The insurance provider will review your application and reach out if they require further information.

How to make changes post-submission? – Contact customer support to guide you through the amendment process.

Key timelines for approval and coverage activation typically range from a few days to a couple of weeks, depending on the complexity of the application.

Tips for handling claims include documenting incidents thoroughly and contacting your insurance representative promptly.

Real-life scenarios and case studies

Understanding the practical implications of Maxima Public Liability Insurance can be gleaned from real-life scenarios. Businesses have benefitted significantly from this type of coverage, demonstrating its vital role in risk management.

For instance, a local café faced a liability claim after a customer slipped on a wet floor. With Maxima Public Liability Insurance, they were able to cover legal expenses and avoid severe financial repercussions, thus continuing their operations without interruption.

Testimonials from users emphasize how this insurance has provided peace of mind while conducting business, enabling them to focus on their passions without the weight of undue risk.

Contact and support information

Navigating the insurance landscape may evoke questions, and knowing where to seek support is key. Maxima Public Liability Insurance provides dedicated avenues for assistance with form-filling and policy inquiries.

For general queries, customer support can be reached through their website, and assistance is available via phone or email as well. Agents are knowledgeable about policy terms and can guide users through the nuances of their coverage.

Exploring additional insurance forms and resources

For those interested in broader coverage options, pdfFiller hosts various related insurance forms, providing resources for multiple types of insurance needs. A comparison of different forms available can enlighten users on comprehensive options available in the market.

This exploration ensures that insurance seekers find the best solutions tailored to their diverse requirements, allowing for informed decision-making when navigating complex insurance landscapes.