Comprehensive Guide to Business Forms

Understanding the business form

A business form serves as a foundational document that establishes the structure and legal identity of a business. It defines how a business operates, its responsibilities, and tax implications, becoming a critical component for entrepreneurs and business owners. The decision on which business form to adopt impacts everything from operations to liability and tax obligations.

In various industries, business forms play a significant role in organizational structure and compliance. They provide clarity on ownership, management, and financial responsibilities. For instance, while a corporation allows for growth through public investments, a sole proprietorship may suit someone seeking a simple, straightforward operation.

Efficiency – Suitable forms streamline operations and legal adherence.

Credibility – Well-defined structures enhance business reputation.

Liability Protection – Some forms, like LLCs and corporations, provide personal asset protection.

Types of business forms

Choosing the right business form is crucial and can be narrowed down to several primary types, each with distinct characteristics. Understanding these types will inform your choice based on your business goals and needs.

Sole proprietorships

Sole proprietorships are the simplest form of business, owned and operated by a single individual. This structure is straightforward to establish and involves minimal compliance requirements.

Single ownership, complete control, and all profits retained by the owner.

Ease of setup, low cost, and straightforward tax reporting.

Unlimited personal liability and limited funding options.

Partnerships

Partnerships can be formed between two or more individuals who agree to share profits and losses. This structure allows for shared decision-making and pooling of resources.

General partnerships and limited partnerships, each with different liability levels.

Shared responsibilities and flexible management.

Joint liability risks and potential conflicts among partners.

Corporations

A corporation is a legal entity separate from its owners, providing limited liability protection to shareholders. Incorporating can attract investment through the sale of shares.

Subject to double taxation on corporate income and dividends.

Pass-through taxation, avoiding double taxation at the corporate level.

Focused on furthering a social cause with tax-exempt status.

Limited liability, enhanced credibility, and perpetual existence.

Higher formation and ongoing compliance costs.

Limited liability companies (LLCs)

LLCs combine the characteristics of corporations and sole proprietorships, providing liability protection while allowing profits to pass through to personal income without facing corporate taxes.

Flexible management structure and personal liability protection.

Tax flexibility and reduced personal risk.

Less formalities compared to corporations, making them easier to manage.

Cooperatives

Cooperatives are associations owned and operated by a group of individuals for their mutual benefit. They offer a democratic structure where each member has a voice in management.

Member-owned organizations focused on serving members’ needs.

Profit-sharing and collective decision-making.

When shared resources and collective goals align among members.

Selecting the right business structure

Choosing the appropriate business form begins with clarifying your business goals. This decision relies heavily on various factors influencing how your business will operate and grow.

Consider the business’s size, industry, and management complexity.

Assess your ability to attract investors or secure loans.

Understand how your choice will affect your tax responsibilities.

Once these factors are evaluated, creating a comparison chart can greatly assist in identifying which business structure aligns best with your objectives.

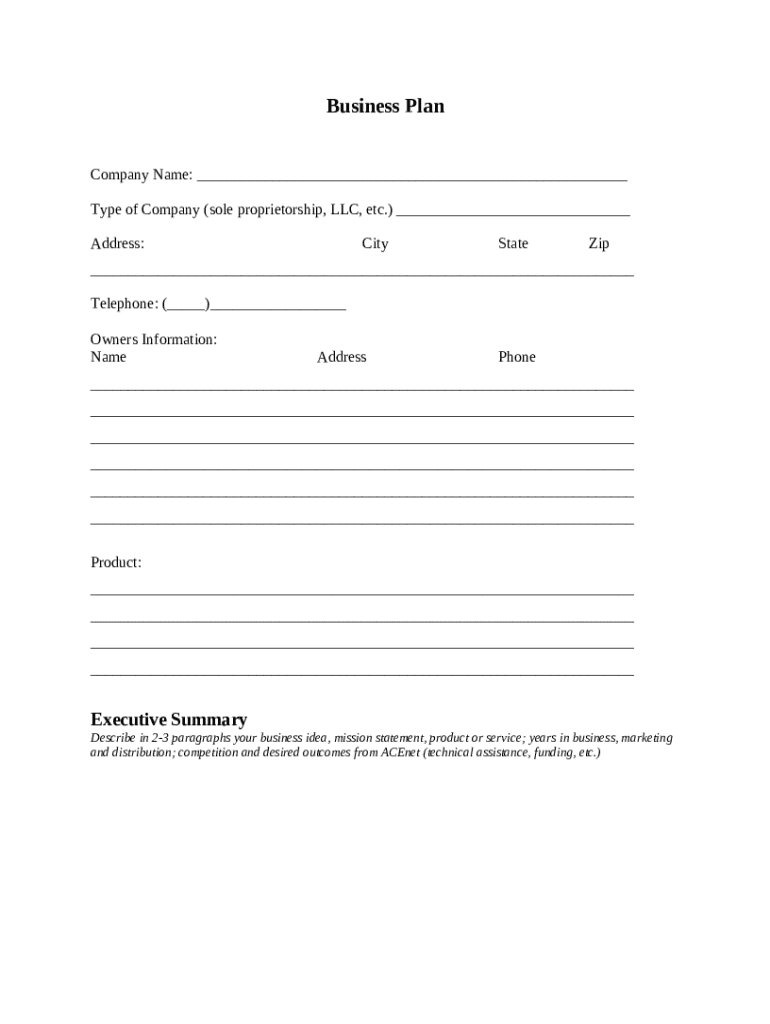

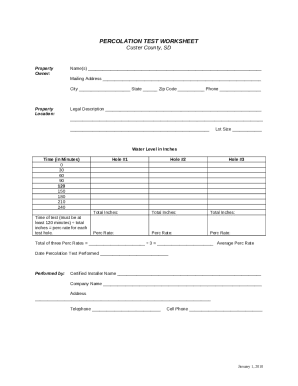

Completing your business form

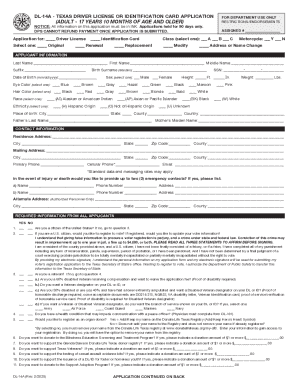

Filling out a business form accurately is vital to ensure compliance and operational integrity. Start by gathering the necessary information and documents required.

Ensure the name is unique and complies with state regulations.

Include detailed personal and professional backgrounds.

Clearly define the type of services or products offered.

Provide accurate estimates of projected earnings and expenses.

Carefully navigate through each section of the form, verifying you understand the requirements. Common errors include missing information or inaccurate data that could delay the approval process.

Double-check all entries against official documents to avoid discrepancies.

Consult available resources or ask professionals to ensure clarity on regulations.

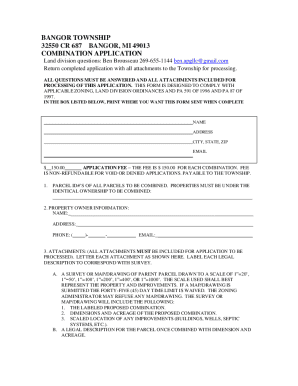

Filing your business form

Once you complete your business form, the next step is to file it with the appropriate state agency. Familiarize yourself with the filing process to prevent unnecessary delays.

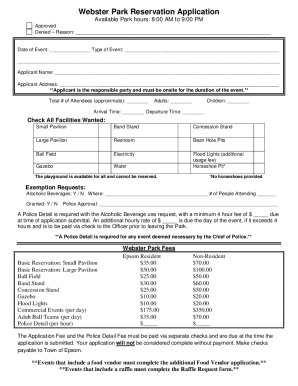

Typically, forms are submitted to your state’s Secretary of State or business registration agency.

Be prepared for any associated fees, which can vary significantly by state and business type.

Compile all required documentation to accompany your form submission. This may include identification documents, financial records, and any supporting agreements.

Personal identification, business plan, and bylaws (for corporations).

Use checklists and professional services as needed.

Managing your business form over time

After filing, managing your business form becomes an ongoing responsibility. Compliance with state and federal regulations requires diligence and regular updates.

Stay informed of legal changes affecting your business structure and requirements.

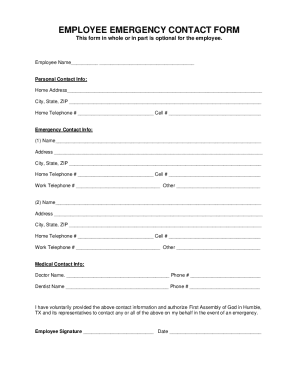

Maintain accurate and organized records to support compliance and operational efficiency.

If your business structure changes, effective procedures must be in place to update or amend your business form. This could involve filing new forms or notifying the state agency of changes.

Follow the stipulated guidelines for amendments to ensure legitimacy.

Consider hiring a lawyer or business advisor if complexities arise.

Using interactive tools for business forms

Utilizing interactive tools for business forms can significantly enhance your document management experience. Tools like pdfFiller provide user-friendly features that simplify document creation and modification.

Easily make changes to existing forms and eSign directly online.

Enable effective teamwork by allowing multiple users to access and edit documents simultaneously.

Adopting a cloud-based document solution like pdfFiller provides accessibility and convenience, ensuring that you can manage your business forms from virtually anywhere.

Access your documents anytime from any device.

Benefit from robust security measures protecting sensitive information.

FAQs about business forms

Addressing common questions surrounding business forms is essential for aspiring entrepreneurs and established businesses alike.

Evaluating your business model and goals will help in selecting the most appropriate structure.

The process varies by state and form type; however, it generally takes a few hours to a few weeks.

Each structure has unique tax obligations that can significantly impact your finances.

Expert tips for business documentation

Successful document management is crucial for maintaining a well-run business. Implementing best practices can prevent miscommunication and oversight.

Use clear labeling and folder structures to keep documentation accessible.

Leverage encryption tools and secure storage solutions to protect vital data.

When complexities arise, seeking professional assistance becomes essential. Knowing when to hire a lawyer or accountant can save time and avoid pitfalls.

Consider professional advice for unconventional or high-stakes business decisions.

Explore local small business development centers for free or low-cost assistance.

Additional information

Industry-specific regulations also influence business forms. Being aware of particular requirements can facilitate smoother operations. Local resources provide additional support for business owners navigating this landscape.

Different industries often have specific compliance rules impacting form selection.

Research local organizations that can assist you in understanding state-specific procedures.

Look into pdfFiller's features tailored for business needs, making form management intuitive.