Minister Housing Allowance Policy Form: A Comprehensive Guide

Understanding the minister housing allowance

The minister housing allowance is a crucial financial provision granted to clergy members to assist with housing costs. This allowance serves as an essential means of support, enabling ministers to maintain their homes while dedicating themselves to their ecclesiastical duties. The significance of the housing allowance lies in its ability to help alleviate the financial burdens associated with housing, allowing ministers to focus on their congregational responsibilities without the stress of housing expenses weighing heavily on their minds.

Eligibility for the housing allowance typically requires that the individual serve in a recognized ministerial capacity, making it an intrinsic part of their compensation package. The purpose of this allowance is not only to provide financial assistance but also to recognize the unique challenges faced by clergy members in balancing their professional and personal lives.

Eligibility criteria for housing allowance

Clergy members who are ordained, commissioned, or licensed individuals serving as religious leaders generally qualify for the minister housing allowance. However, there are specific eligibility criteria that must be met. For instance, the designation of a housing allowance may vary depending on whether the minister resides in church-owned parsonages or owns their home personally.

When assessing eligibility, churches should consider factors such as the minister's role, compensation structure, and the nature of their housing arrangement. For church-owned residences, it’s essential to clearly define housing allowances to ensure compliance with IRS regulations, whereas ministers who own their homes must ensure their housing expenses align with the designated allowance.

Types of housing allowances

There are various types of housing allowances designed to accommodate different living situations faced by ministers, which include designations for those residing in church-owned parsonages, for those who own their homes, and for those who rent.

Designating a housing allowance for ministers in church-owned parsonages requires specific considerations such as the fair market rental value and maintenance costs of the property.

Ministers who own their homes must follow precise steps for the proper designation of their housing allowance, ensuring that it reflects actual expenses incurred.

For ministers renting a home, the calculation methods for their housing allowance will focus on allowable rental expenses, which may include rent, utilities, and maintenance.

Determining the appropriate amount of the housing allowance often involves guidelines that take into consideration the local cost of living and the minister's actual expenses. Churches should regularly consult sample forms for assistance in calculating an accurate housing allowance that reflects realistic living conditions.

Tax implications and reporting requirements

The tax benefits of the housing allowance are significant. This allowance can be excluded from income tax, which effectively lowers the overall taxable income for clergy members. The impact of this exclusion means that a considerable portion of a minister's income may be sheltered from tax obligations, allowing them to allocate more of their earnings towards personal living expenses.

Ministers receive a Form W-2 from their churches detailing the housing allowance, and they must report this figure accurately on their tax returns.

In case of necessary amendments—such as changes in housing expenses or adjustments in duties—ministers should be prepared to update their housing allowance across official documents promptly.

Filing considerations unique to ministers include maintaining comprehensive records of housing expenses and submitting any changes utilizing the proper IRS forms. This step is critical for ensuring adherence to regulations and avoiding potential tax liabilities.

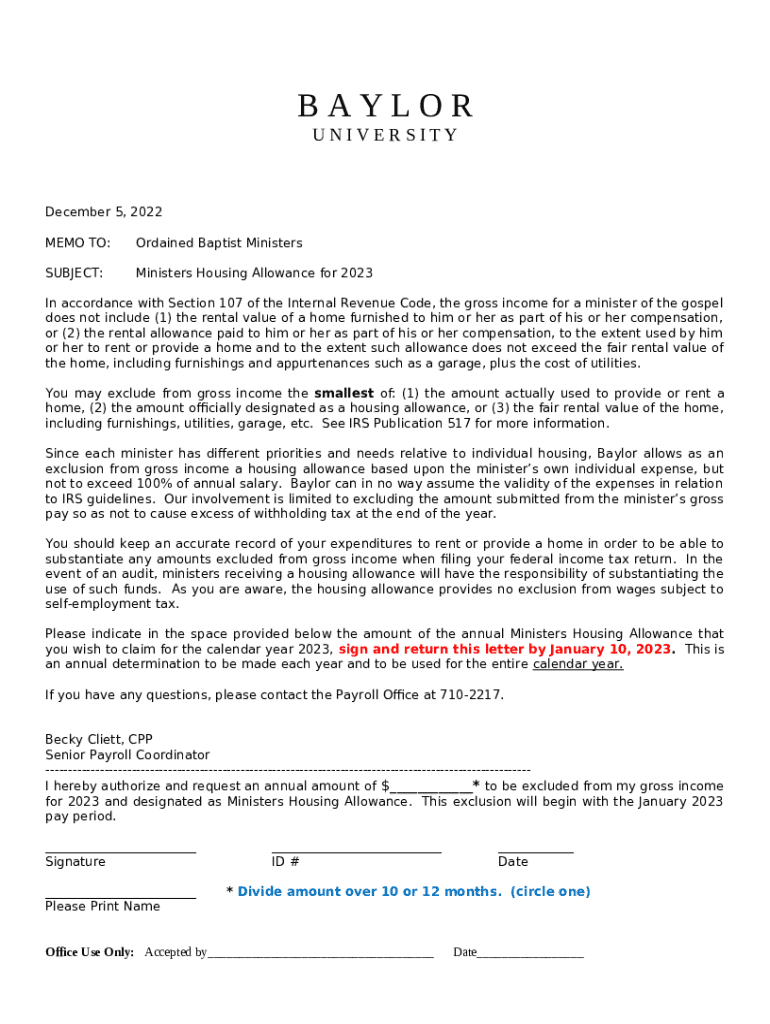

Completing the minister housing allowance policy form

Successfully completing a minister housing allowance policy form requires attention to detail and understanding of the necessary components. Essential fields on the form typically include the minister's name, their role within the church, the designated allowance amount, and the specific housing expenses being accounted for.

Ministers should provide their residential address, including any details relevant to the property type, whether owned or rented.

It's also crucial to outline the calculation methods used to determine the housing allowance amount, as this offers clarity and helps prevent misunderstandings.

Ensuring accuracy in completion is vital; thus, using platforms such as pdfFiller for seamless management, file editing, and collaboration can significantly streamline this process.

pdfFiller provides users with a cloud-based platform that allows for easy editing, signing, and collaborative efforts on the housing allowance form. Its interactive tools simplify the completion process, allowing ministers to focus on their core responsibilities while handling their housing allowance designation efficiently.

Best practices for managing housing allowance designations

Managing housing allowance designations effectively requires regular reviews and adjustments. Conducting an annual review ensures that the designated housing allowance accurately reflects current living conditions and expenses. Changes in housing market rates, inflation, or shifts in personal circumstances can all necessitate adjustments. Being proactive in these reviews helps prevent potential discrepancies in tax reporting.

Ministers should communicate openly about their housing needs with church leadership to ensure that allowances match their actual living situations.

Establishing transparency in the designation process fosters a trusting relationship between ministers and the church management, contributing to better financial planning.

In practice, real-life scenarios—such as increases in rent or changes in family size—impact housing allowances. Staying informed about these factors is critical for both churches and ministers to address any financial adjustments proactively.

Frequently asked questions (FAQs)

Common queries regarding the housing allowance often involve concerns about eligibility and exclusions. Addressing fears and misconceptions that clergy may have regarding tax liabilities helps clarify the structures in place governing the housing allowance. It is essential to demystify these policies to ensure ministers can take full advantage of the benefits available to them.

Many ministers worry about the implications of misreporting their allowance; however, proper documentation and management practices can alleviate this.

Clarity surrounding misunderstood policies can enhance compliance and promote proper filing practices.

For additional support, clergy can reach out to community forums or financial advisors specializing in clergy finances to ensure accurate and compliant management of their housing allowances.

Related resources

Compiling relevant resources can significantly enhance understanding and management of the housing allowance policy. Sample compensation reports can offer templates detailing what to include and how to structure them. This information can be beneficial for new ministers seeking clarity in their financial responsibilities.

Providing guidelines tailored for new ministers can equip them with essential financial advice as they navigate their new roles.

Collectively addressing frequent finance questions that churches often ask provides a well-rounded approach to managing housing allowances.

External resources such as online articles or financial management tools are invaluable for both ministers and their churches.

Contact and support information

Getting help with the minister housing allowance form can be easily accomplished via pdfFiller's platform. Users can reach out for support through direct contact methods, ensuring any questions or issues regarding the housing allowance policy are promptly addressed.

The availability of ongoing support resources emphasizes the commitment to assisting ministers in managing their housing allowance and ensuring compliance with necessary formalities.