New substitute W-8BEN charter form: A comprehensive how-to guide

Understanding the new substitute W-8BEN charter form

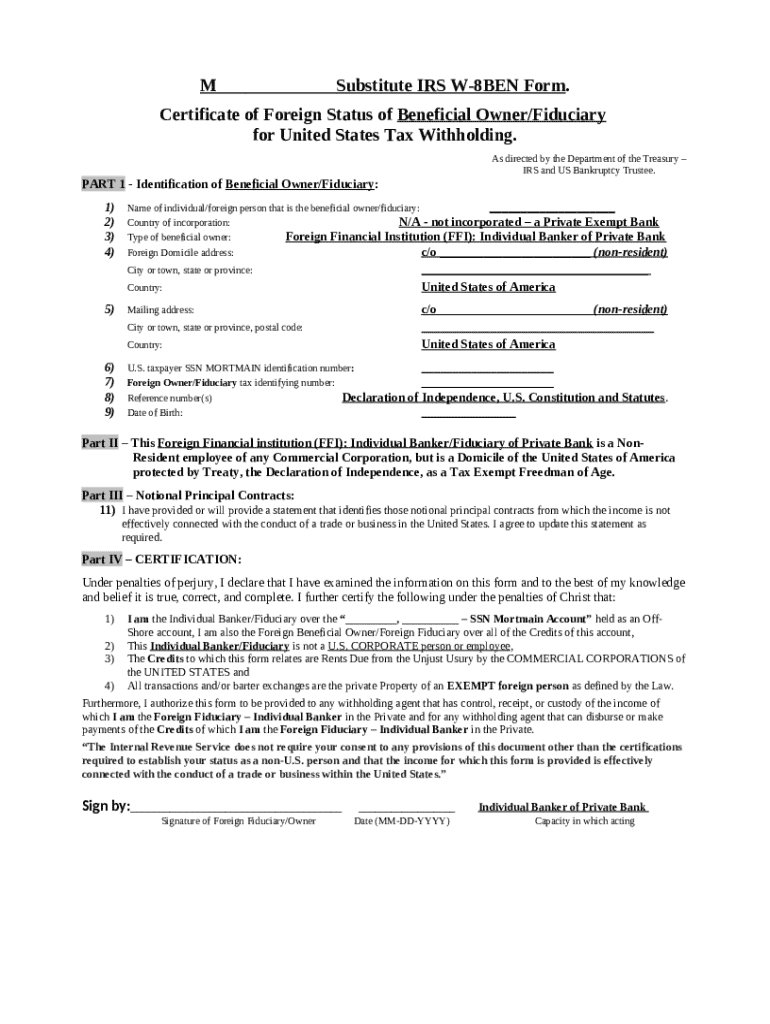

The new substitute W-8BEN charter form is a crucial document required by the IRS for foreign individuals and entities to certify their non-U.S. status for tax purposes. As part of the broader U.S. tax compliance framework, this form allows withholders to reduce or eliminate U.S. tax withholding on eligible income. The latest version of this form has introduced modifications aimed at simplifying the submission process and clarifying eligibility criteria.

The importance of the W-8BEN form in tax withholding cannot be overstated. It ensures that income originating from U.S. sources is not taxed at a higher rate than necessary. The updates in the new substitute form respond to evolving financial regulations and aim to streamline compliance for both foreign taxpayers and U.S.-based entities. Users must familiarize themselves with these changes to take full advantage of available tax benefits.

Who needs to use the new substitute W-8BEN charter form?

Foreign individuals and entities that receive income from U.S. sources typically need to submit the new substitute W-8BEN charter form to claim reduced withholding tax rates or exemptions. This includes non-resident aliens, foreign partnerships, and foreign corporations. Understanding eligibility is critical to feasible tax planning and compliance.

Individuals receiving U.S.-sourced income, such as dividends and interest.

Foreign entities conducting business in the U.S. that are subject to withholding taxes.

Those looking for tax treaty benefits, which may reduce withholding rates for individuals from specific countries.

Neglecting to submit the form can lead to higher withholding rates on income generated in the U.S., reducing the funds received and complicating tax rebates or refunds. Thus, timely and accurate submission is necessary for financial health.

Key features of the new substitute W-8BEN charter form

The new substitute W-8BEN charter form includes several key features aimed at improving user experience and compliance efficacy. Each section of the form plays a specific role, ensuring that the data provided is comprehensive and easily understood by IRS agents.

Section for personal and business information, including name, address, and tax identification details.

Detailed guidelines for claiming tax treaties, providing clarity on eligibility.

Certification section where users must attest to the accuracy of the information provided.

An enhanced review and submission process to ensure forms are submitted correctly.

These enhancements distinguish the new substitute W-8BEN charter form from its predecessors by incorporating feedback from users and tax professionals, making it less prone to errors.

Step-by-step guide to filling out the new substitute W-8BEN charter form

Filling out the new substitute W-8BEN charter form is a straightforward process if you follow these steps carefully.

Enter your full name, country of citizenship, and current address accurately.

Follow the guidelines provided to claim any tax treaty benefits that apply to your situation.

Sign the form in the designated area, affirming the truthfulness of the information provided.

Double-check all entries for accuracy; even minor inaccuracies can lead to complications.

Choose between submitting the form electronically or via traditional paper submission based on the requirements of the entity requesting the form.

By following these steps meticulously, you can enhance the likelihood of successful processing of your W-8BEN form.

Editing and managing your W-8BEN form with pdfFiller

pdfFiller offers a robust suite of tools that can simplify the editing and management of your W-8BEN form. One of the key features is the ability to make real-time edits, ensuring your form is always current and accurate.

Easy-to-use editing tools that allow you to modify any field on the W-8BEN form.

Collaboration features that enable team members to review and provide input directly on the document.

Secure eSigning capabilities ensure that your signed form is legally compliant and easily submitted.

These features empower users to maintain control over their documents while simplifying the filing process, making pdfFiller a valuable resource for managing your new substitute W-8BEN charter form.

Common mistakes to avoid when submitting your form

Submitting your new substitute W-8BEN charter form without due diligence can lead to several mistakes that complicate the process. Recognizing potential pitfalls is the first step to ensuring a smooth experience.

Incorrect or missing information, such as an invalid country code or omission of required details.

Failure to update the form if there are new income sources or changes in residency.

Misunderstanding tax treaty implications; ensure you are aware of specific treaty benefits.

Neglecting to sign the form; electronic forms sometimes lack proper signature verification.

Best practices include developing a checklist for required fields and setting reminders to review the form when circumstances change.

How often should you update your W-8BEN form?

The need to update your new substitute W-8BEN charter form can arise from various triggers. It's essential to recognize when a resubmission is necessary to maintain compliance and take advantage of potential benefits.

Changes in personal circumstances, such as a change in residency or citizenship.

New sources of income that may not have been included in the previous submission.

Expiration of specific treaty benefits that need to be reviewed and possibly resubmitted.

Establishing a regular review schedule can help ensure that your form is kept up to date and compliant with the latest tax regulations.

Digital signatures and their acceptance for the new W-8BEN form

Digital signatures are becoming increasingly accepted in the context of tax forms, including the new substitute W-8BEN charter form. Using a digital signature not only speeds up the submission process but also enhances security.

Follow IRS guidelines to ensure your digital signature meets all requirements for legal endorsement.

eSigning through pdfFiller ensures compliance with the legal standards required for tax forms.

The convenience of digital signatures enhances the speed and efficiency of form submission.

Utilizing pdfFiller for eSigning means your W-8BEN form is processed securely and keeps you informed about the compliance landscape.

Resources for further assistance with the W-8BEN form

Navigating the complexities of tax forms like the new substitute W-8BEN charter form can be daunting. Fortunately, numerous resources are available to aid in understanding and completing the form correctly.

FAQs available on the IRS website that address common queries regarding -W-8BEN forms.

Guidance documents offered by pdfFiller that elaborate on form submission procedures.

Customer support options through pdfFiller’s platform that provide personalized assistance.

Equipped with these resources, users can navigate the complexities of the new substitute W-8BEN charter form with greater confidence and accuracy.

Importance of compliance and staying informed

Compliance with tax regulations concerning the W-8BEN form is essential for all foreign individuals and entities. Legislative changes can impact withholding rates and tax treaty provisions, making it crucial to stay informed.

Monitor updates from the IRS regarding any changes in tax laws that affect the W-8BEN.

Utilize pdfFiller’s platform to receive updates and materials that explain evolving tax requirements clearly.

Engage with tax professionals to stay proactive about compliance and leverage applicable treaty benefits.

By employing these strategies, individuals and teams can optimize their tax planning and compliance strategies while utilizing the features offered by pdfFiller for document management.