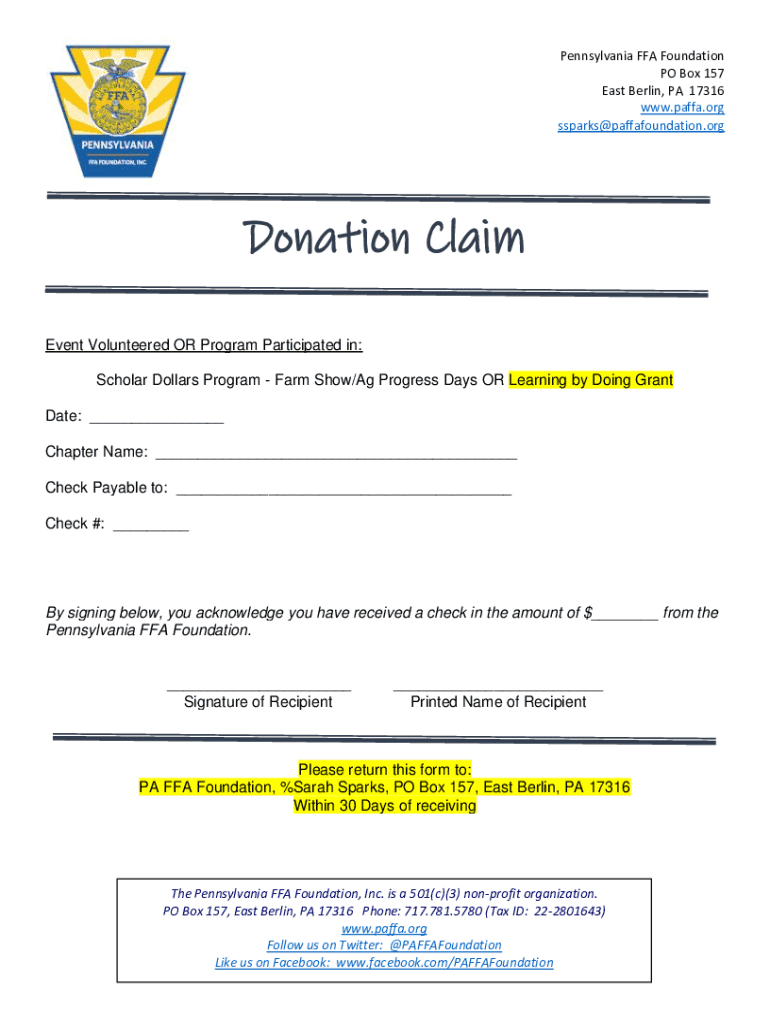

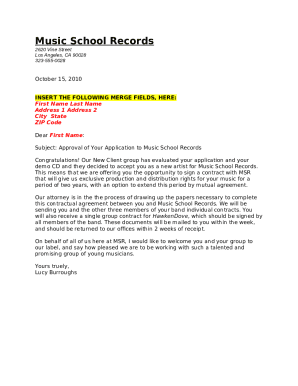

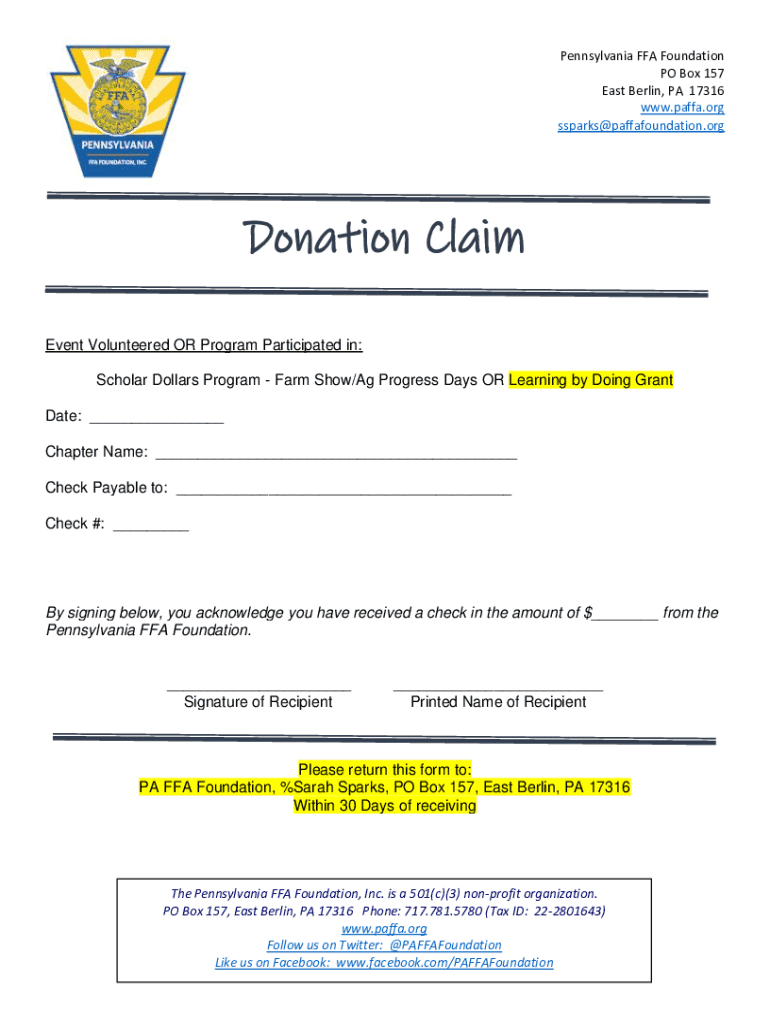

Get the free Donation Claim

Get, Create, Make and Sign donation claim

How to edit donation claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out donation claim

How to fill out donation claim

Who needs donation claim?

Donation Claim Form: A Comprehensive How-to Guide

Understanding the donation claim form

A donation claim form is a crucial document for individuals or organizations wishing to receive tax benefits from charitable contributions. This form is typically submitted to the Internal Revenue Service (IRS) along with your tax return, allowing you to formally declare your donations and claim deductions accordingly.

The importance of submitting a donation claim form cannot be overstated. It serves as evidence of your charitable contributions, helping you maximize your tax deductions while promoting transparency and accountability within the charitable sector. Understanding who needs to utilize this form is vital, including individual donors, nonprofit organizations, and entities making significant contributions to registered charities.

Types of donations covered

Donation claims encompass various types of contributions, predominantly categorized into cash and non-cash donations. Cash donations are straightforward, while non-cash donations require more detailed documentation to ensure accurate valuation and tax benefits.

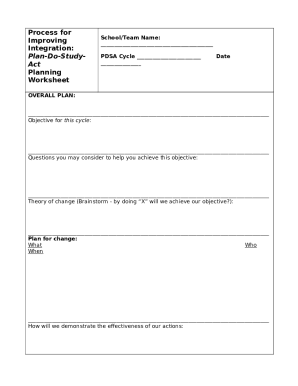

Step-by-step instructions for filling out the donation claim form

Completing the donation claim form requires meticulous attention to detail. Each section is designed to collect specific information needed to validate your claims. Here’s a breakdown of the main sections:

One common error to avoid is leaving important fields blank or providing incomplete information. Ensure you have all required supporting documents ready to substantiate your claims and cross-check your entries for accuracy.

Additional documentation and receipts

Besides the claim form itself, maintaining meticulous records of donations is fundamental for both your peace of mind and IRS compliance. Specific types of receipts should be kept, providing proof of your contributions. This includes written acknowledgment from charities, bank statements for cash donations, and any appraisals obtained for non-cash contributions.

Navigating tax benefits and deductions

Claiming tax deductions via the donation claim form opens avenues to significantly reduce your taxable income. It’s essential to understand the IRS rules that govern charitable contributions. Keep an eye on limits related to adjusted gross income (AGI), as these can affect how much you can deduct.

Interactive tools and resources

Utilizing technology enhances the efficiency of managing your donation claim form. Several online tools can streamline the filling, signing, and submission processes, making it much easier to navigate.

Common questions and troubleshooting

Navigating the donation claim process can pose challenges. One of the most frequently asked questions involves the implications of a claim denial. In such cases, identifying the reasons behind the denial—the submission of incomplete forms or lack of supporting documents—is vital for corrective measures.

Best practices for donors

Maintaining organized donation records cannot be overlooked. By establishing systematic approaches to keeping track of contributions, donors can navigate tax season without undue stress. Consider utilizing spreadsheets or donation management software that aligns with your needs to make this task easier.

Related topics and further reading

In addition to mastering the donation claim form, it’s beneficial to explore further readings on various topics related to charitable giving. This not only bolsters your understanding but can also assist in maximizing the impact of your philanthropic actions.

Conclusion: Empowering your giving through smart documentation

Navigating the landscape of charitable donations can often be complex. However, utilizing tools like pdfFiller empowers users to manage their donation claims effectively, simplifying the editing, signing, and submission processes. By staying organized and informed, you can make the most of your charitable contributions, maximizing your impact through thoughtful documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit donation claim on a smartphone?

How do I fill out the donation claim form on my smartphone?

How do I complete donation claim on an Android device?

What is donation claim?

Who is required to file donation claim?

How to fill out donation claim?

What is the purpose of donation claim?

What information must be reported on donation claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.