Get the free Application for Immediate Retirement FERS

Get, Create, Make and Sign application for immediate retirement

Editing application for immediate retirement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for immediate retirement

How to fill out application for immediate retirement

Who needs application for immediate retirement?

Application for Immediate Retirement Form - How-to Guide

Understanding immediate retirement

Immediate retirement occurs when an employee stops working and begins to receive retirement benefits immediately rather than deferring them until a later date. This option can be significantly appealing for those who feel ready to transition into retirement earlier than the standard age requirement. Immediate retirement can unlock valuable benefits while allowing individuals to preserve their physical and mental well-being.

Key benefits of immediate retirement include the ability to enjoy an enhanced quality of life, explore new hobbies, or travel without the constraints of a full-time job. Additionally, retiring immediately can provide financial peace of mind as individuals can access their pension or retirement savings sooner.

However, eligibility criteria must be carefully considered. Generally, individuals are eligible if they have reached a designated minimum age with a specified number of service years, although this can vary significantly based on the retirement plan in place.

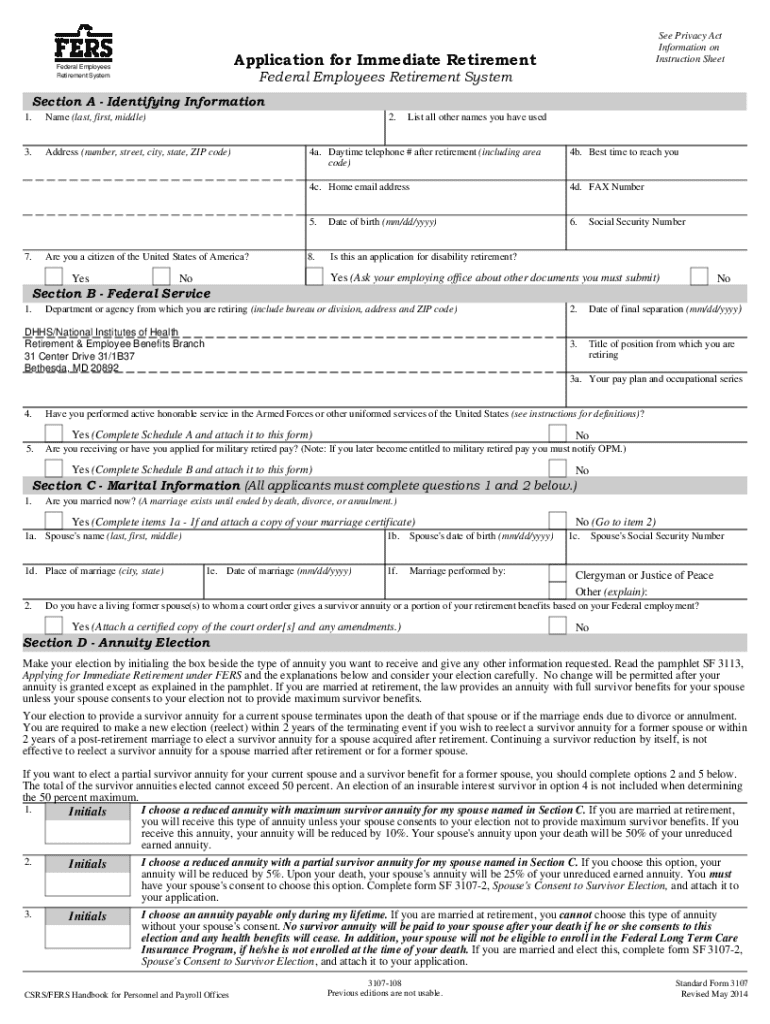

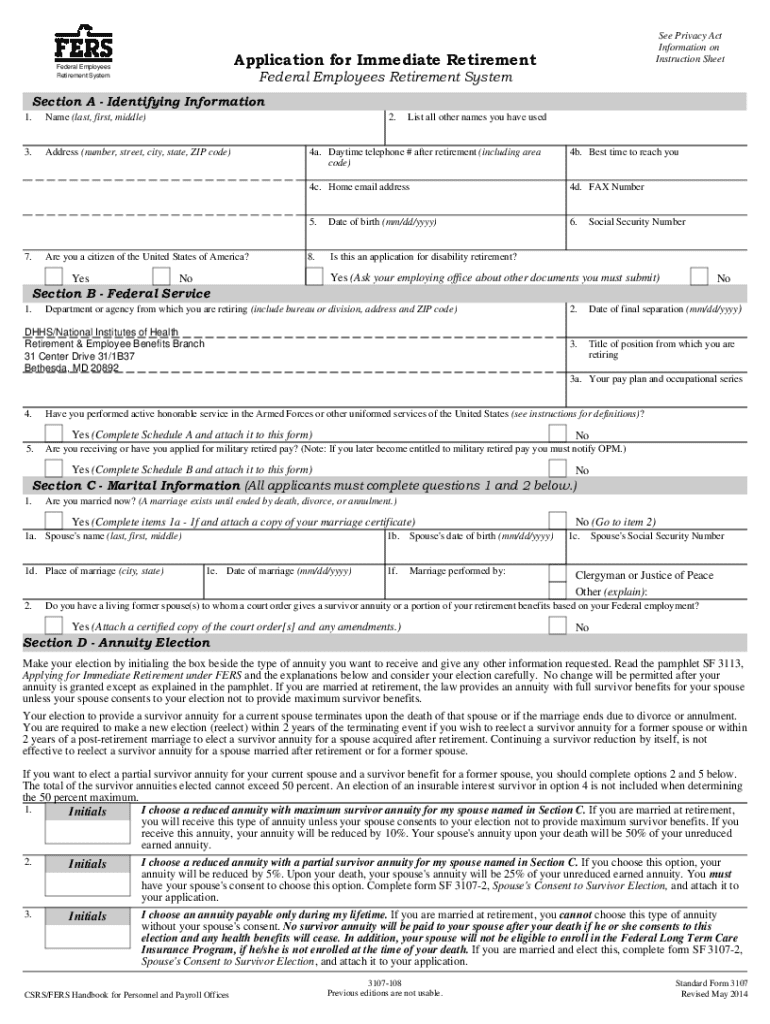

Overview of the application for immediate retirement form

The application for immediate retirement form is a crucial document that officially signals your intention to retire at once. This form outlines the necessary details regarding your employment history and choice of retirement plan, which aids the retirement board or employer in processing your request swiftly and accurately.

Providing accurate information on this form is paramount. Any discrepancies can lead to delays or even potential denial of requested benefits. Precision and thoroughness in filling out the application ensure a smoother transition into retirement.

Steps to complete the application for immediate retirement form

Completing your application for immediate retirement is a straightforward process if you follow these well-defined steps:

Tips on submitting your application

Once your application for immediate retirement is complete, it's time for submission. Know exactly where to deliver your completed form, whether it be your HR department, a retirement plan administrator, or through an online portal. Always confirm the submission methods available as they can differ by organization.

Timeliness is critical; consider submitting your application at least 30 to 60 days before your desired retirement date. This window allows sufficient time for processing. After submission, tracking your application status is advisable, which can often be done online through the respective retirement platform or via direct communication with HR.

Managing your retirement documents

Effective organization of your retirement documents is a key part of managing your transition. Utilize tools from pdfFiller to ensure that all necessary documents, including your application for immediate retirement form, are stored securely and are easily accessible. This will help streamline communication with financial advisors or family members involved in your financial planning.

Consider creating digital folders categorized by document type—for example, financial statements, tax documents, and retirement benefits information—ensuring that you have everything prepared for when you officially retire. Moreover, ensure that all sensitive information is stored securely to protect your privacy.

Additional considerations for immediate retirement

Retiring immediately carries several implications that you need to navigate carefully. The impacts on benefits and insurance can vary significantly based on your retirement plan. It’s wise to consult with a financial advisor to ascertain how your health insurance and pension benefits will be affected. The early withdrawal of retirement savings may also have tax implications worth thoroughly understanding.

Also, keep abreast of any recent changes in retirement policy, as these can affect your decision and planning strategies. Be proactive in seeking answers to common FAQs about the immediate retirement application process, as the landscape can shift in response to policy adjustments.

Interactive tools and resources

pdfFiller offers a range of interactive features that can significantly enhance your document management. By utilizing templates related to retirement planning, you can streamline the organization of your forms, making it easier to focus on the necessary steps as you transition into retirement.

Moreover, pdfFiller has support resources available that can answer many of your questions regarding the immediate retirement application form. Ensure that you leverage these tools to minimize mistakes and maximize your understanding of the process.

Common errors in the application process

As with any form-filling process, errors are common during the completion of the application for immediate retirement form. Frequent mistakes include missing signatures, incorrect information in personal details, or misunderstanding the requirements for retirement plan options. Recognizing these issues ahead of time can prevent delays in the processing of your application.

Using tools like those from pdfFiller can assist in double-checking the application to avoid these errors. It’s also highly recommended to seek assistance, particularly if you are a first-time applicant navigating this complex terrain.

Real-life scenarios and experiences

Understanding the personal impacts of successfully completing the application for immediate retirement can be invaluable. Testimonials from individuals who have navigated this process underscore the importance of thorough preparation and the positive outcomes of a well-managed retirement transition.

Case studies indicate how support during the application process contributes to smoother transitions. Individuals recount how the right tools paired with strategic planning helped alleviate their concerns, ensuring a seamless shift into retirement life.

Final thoughts on immediate retirement

Embarking on the journey towards immediate retirement is an exciting yet challenging endeavor. Empower yourself with knowledge about the application for immediate retirement form to ensure a smooth experience. Consider utilizing innovative tools from pdfFiller to support you in every step of this process.

As you take the next steps toward retirement, remember that careful planning and addressing potential issues early on can lead to a fulfilling transition into this new phase of life. With the right information and resources, you can embrace your immediate retirement with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send application for immediate retirement for eSignature?

How do I edit application for immediate retirement online?

How do I edit application for immediate retirement on an iOS device?

What is application for immediate retirement?

Who is required to file application for immediate retirement?

How to fill out application for immediate retirement?

What is the purpose of application for immediate retirement?

What information must be reported on application for immediate retirement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.