Get the free ProAll Financial Services - Financing for Your Concrete Mixer

Get, Create, Make and Sign proall financial services

Editing proall financial services online

Uncompromising security for your PDF editing and eSignature needs

How to fill out proall financial services

How to fill out proall financial services

Who needs proall financial services?

A comprehensive guide to the Proall financial services form

Overview of Proall financial services form

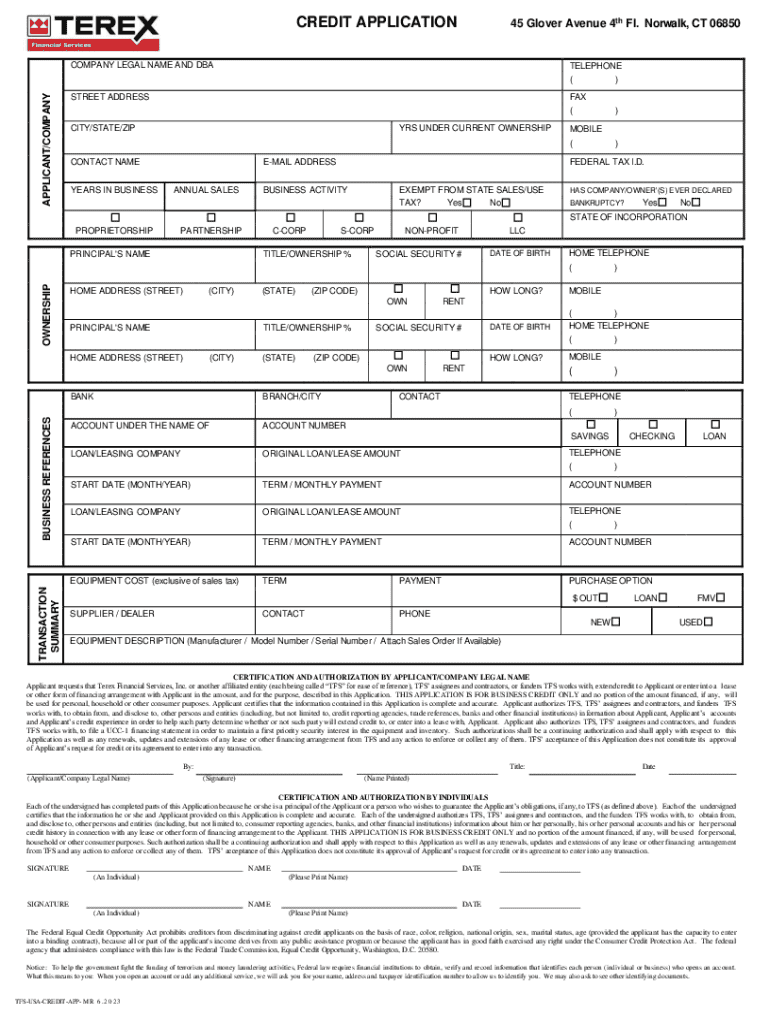

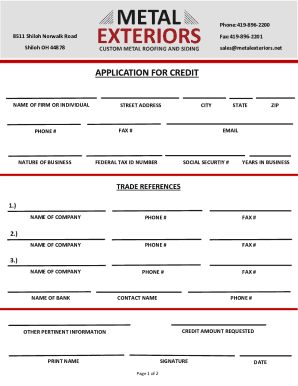

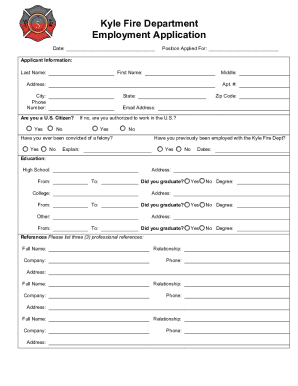

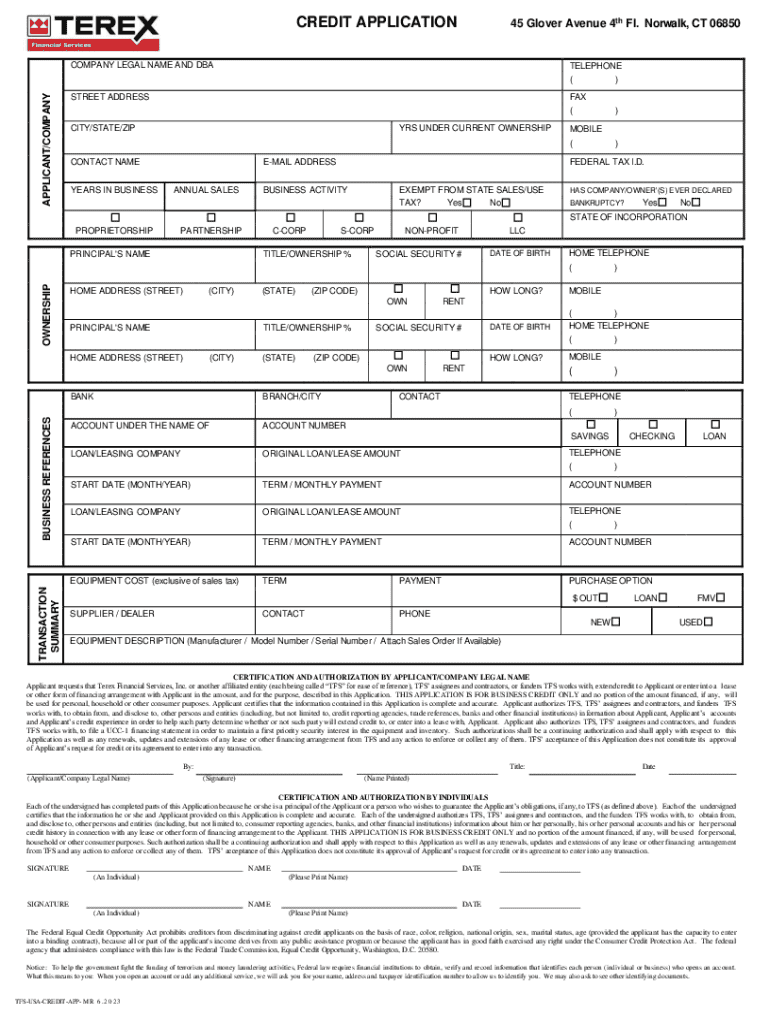

The Proall financial services form is a dedicated template designed to streamline the financial documentation process for both individuals and organizations. This form acts as a structured guide that collects essential financial information, making it easier to assess and provide tailored financial services. In an industry where accuracy and clarity are critical, this form serves as the foundation for effective communication between clients and financial service providers.

The importance of the Proall financial services form cannot be overstated. It acts as a significant tool for record-keeping and provides a consistent format for sharing information while simplifying the client onboarding process. From gathering personal and financial details to specifying the required services, this form supports financial advisors in tailoring their offerings effectively.

Benefits of using the Proall financial services form

Utilizing the Proall financial services form offers numerous benefits that can enhance the effectiveness of financial service interactions. One of the primary advantages is streamlined document creation. This form eliminates the cumbersome task of drafting unique documents from scratch, allowing users to focus on providing data rather than producing paperwork.

Accessibility is another hallmark of the Proall financial services form, given its cloud-based nature. Users can initiate, complete, and manage their forms from any location with internet access. This cloud solution facilitates collaboration among team members and financial advisors, ensuring that everyone is on the same page and has immediate access to needed information.

Step-by-step guide to filling out the Proall financial services form

Filling out the Proall financial services form starts with preparation. First, it's crucial to identify the required information, which typically includes basic personal details, financial specifics, and information about services desired. Gathering supporting documents ahead of time—such as income statements, tax returns, or investment summaries—can simplify the filling process.

Navigating the form becomes easier once you understand its structure. The main sections include Personal Information, Financial Overview, and Services Required. Each of these sections is designed to capture the relevant data necessary for providing effective financial services.

Completing the form involves careful data entry. Accurate information is crucial, so it’s beneficial to double-check entries and ensure your data is precise. Common mistakes include typographical errors and omission of required fields, which can delay processing.

Lastly, before submitting the form, review all entries thoroughly. Confirm that each section is complete and accurate, as this will expedite processing. Once satisfied, follow the prescribed final submission process, which may involve clicking a 'Submit' button or downloading the completed document for direct sharing.

Editing and managing your form in pdfFiller

pdfFiller offers extensive editing capabilities for the Proall financial services form. Users can modify text entries easily, ensuring that the form stays up-to-date without starting over. The platform allows for comments and annotations, which can enhance collaboration during the review process. This is especially useful when multiple team members are required to contribute information or feedback.

Managing document versions is a vital feature, allowing users to access previous iterations of the Proall financial services form. This functionality tracks changes made over time, providing a clear audit trail that can be helpful in auditing and compliance scenarios.

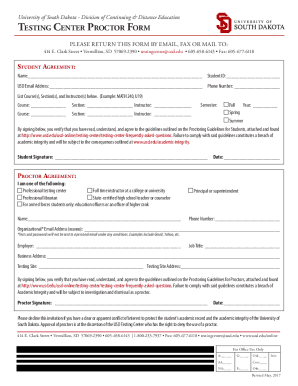

Signing the Proall financial services form

Digital signatures are becoming an integral part of financial transactions, and the Proall financial services form aligns seamlessly with this trend. eSigning offers a quick and secure way to finalize documents, providing both the sender and recipient with a record of agreement. With the growing demand for speed and efficiency, eSigning saves time while ensuring compliance with legal standards.

The process of eSigning with pdfFiller is straightforward. Users can place their electronic signatures directly on the document, allowing for immediate acknowledgment of terms. This not only expedites the agreement process but also ensures that the signed documents maintain their integrity and security through encryption methods.

Organizing and storing your financial documents

Keeping financial documents organized is essential for effective management and reference. Using best practices, such as categorizing documents into folders based on type—like income statements, tax documents, or investment records—can facilitate easy access. Maintaining a regular review schedule for your financial documents ensures everything is up-to-date.

Secure storage strategies are also crucial. Utilizing a reliable platform like pdfFiller for storing financial forms not only provides additional security but also ensures that your documents are easily accessible from anywhere. With cloud-based storage, your important paperwork is protected against loss or unauthorized access.

Use cases for the Proall financial services form

The Proall financial services form is ideal for various scenarios within the financial services sector. Whether for personal finance consultations, small business loan applications, or even complex investment strategy discussions, this form provides a consistent format for gathering necessary information. Its versatility makes it applicable in countless financial service engagements.

Many individuals and organizations frequently ask questions regarding the use of this form. Key inquiries revolve around the types of financial services that require this form, how often it should be updated, and whether customizations are possible to meet specific needs. Users often find that the form's adaptability and clear instructions minimize confusion and improve communication with service providers.

Unique features of pdfFiller for financial services forms

Comparing pdfFiller with traditional form fillers reveals numerous advantages suited for financial documentation. Unlike paper forms that are prone to loss or misplacement, pdfFiller allows users to manage everything electronically. The complete range of editing, collaboration, and eSigning features in one unified platform enhances productivity and eliminates the hassle of dealing with multiple tools.

User testimonials frequently highlight the advantages of utilizing pdfFiller for financial services. Users report increased efficiency, improved organization, and enhanced security when managing their financial documents, validating the platform's design for modern financial service needs.

Troubleshooting common issues with the Proall financial services form

Like any structured process, filling out the Proall financial services form can come with its challenges. Common errors often stem from misunderstanding the required information or form sections. Identifying these errors early and knowing how to resolve them–for instance, by confirming the required fields or re-reading instructions–can save time and frustration.

For users encountering persistent issues or complex errors, seeking professional assistance can help in both understanding the form better and advising on the next steps. If all else fails, contacting pdfFiller’s customer support provides an avenue to quickly address concerns and get back on track.

Moving forward with your financial goals using the Proall financial services form

Completing the Proall financial services form is just the beginning of a commendable financial journey. After submission, the next steps should focus on integrating the insights gained from the document into your broader financial planning process. This may involve reviewing limitations, identifying opportunities for growth, or consulting with financial advisors based on the data provided.

Long-term, effectively managing financial documents using tools like pdfFiller can enhance your overall efficiency and decision-making capabilities. Over time, users often find that streamlined documentation directly correlates with achieving their financial goals, empowering them with a clearer view of their financial landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute proall financial services online?

How do I edit proall financial services online?

How can I fill out proall financial services on an iOS device?

What is proall financial services?

Who is required to file proall financial services?

How to fill out proall financial services?

What is the purpose of proall financial services?

What information must be reported on proall financial services?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.