Get the free North CarolinaPersonal Tax ExtensionForm D-410 ...

Get, Create, Make and Sign north carolinapersonal tax extensionform

Editing north carolinapersonal tax extensionform online

Uncompromising security for your PDF editing and eSignature needs

How to fill out north carolinapersonal tax extensionform

How to fill out north carolinapersonal tax extensionform

Who needs north carolinapersonal tax extensionform?

Understanding the North Carolina Personal Tax Extension Form: Everything You Need to Know

Overview of North Carolina personal tax extension

Filing your taxes in North Carolina can be a complex process, especially if unexpected circumstances arise, preventing you from meeting the tax deadline. Understanding tax extensions is crucial in these scenarios. A tax extension allows taxpayers extra time to prepare and submit their filed taxes without penalties, though it does not extend the time to pay any taxes owed.

The importance of filing an extension cannot be overstated. It provides you with a buffer period to ensure that your tax returns are accurate while avoiding late fees. For many individuals, especially those with complex financial situations, the extra time can alleviate a significant amount of stress, enabling thorough review and accuracy in their filings.

What is Form -410?

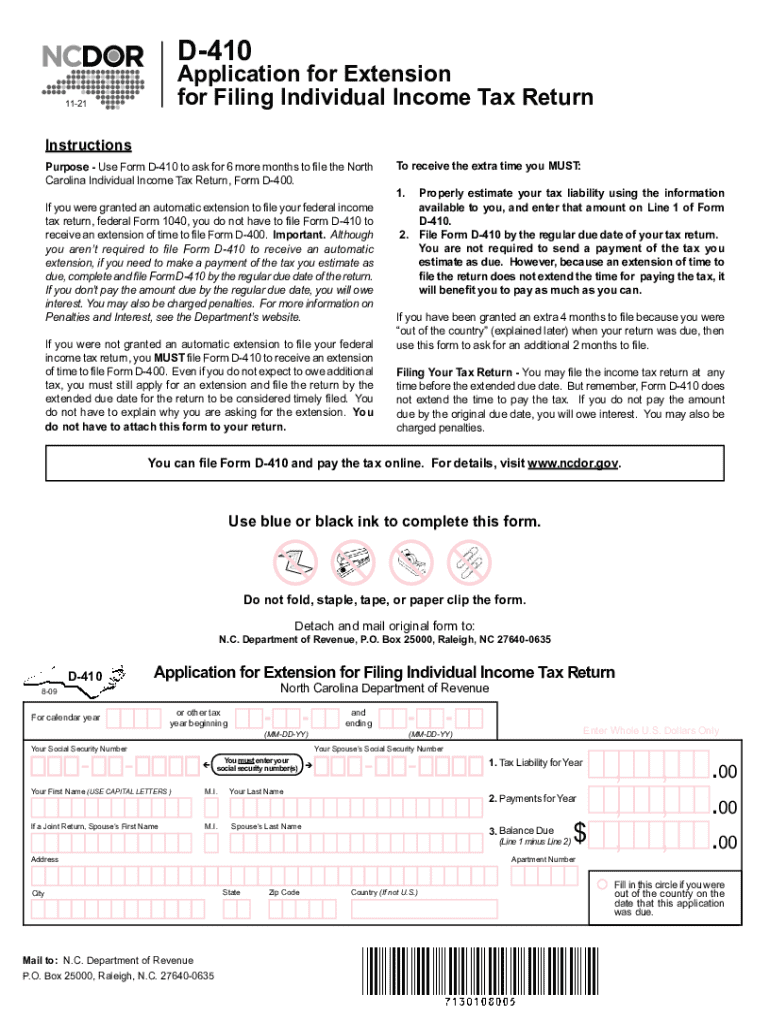

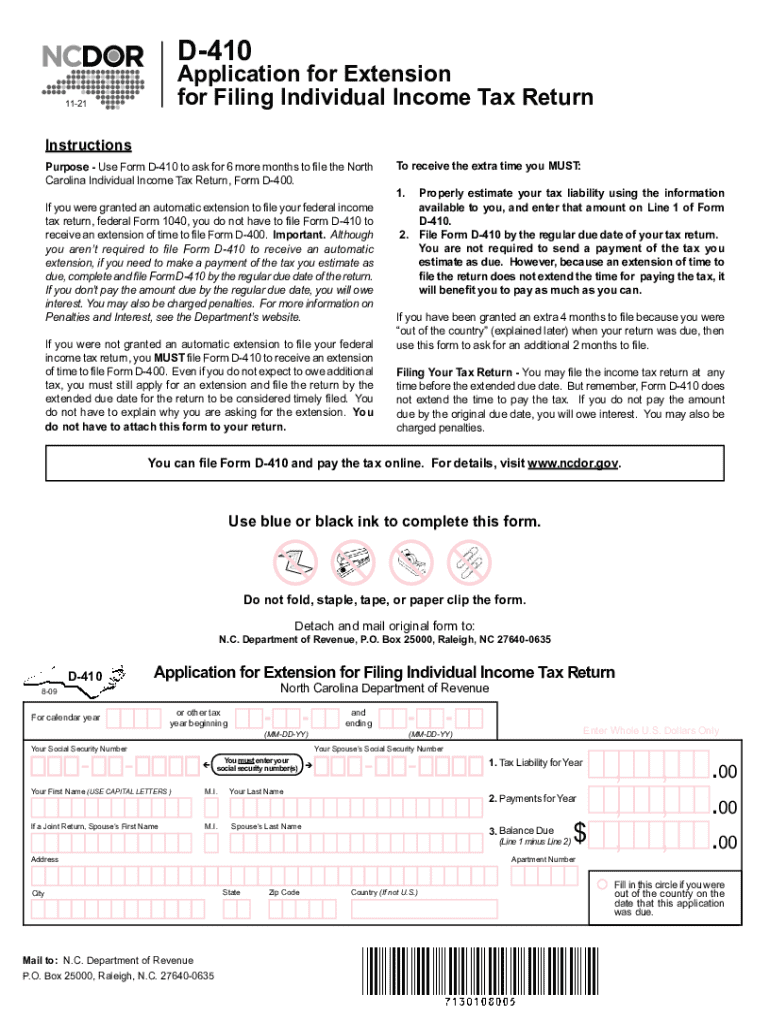

Form D-410 is North Carolina's specific form used to apply for a personal tax extension. Its primary purpose is to notify the North Carolina Department of Revenue that you are requesting additional time to file your individual income taxes. Importantly, this form must be submitted even if you do not owe any taxes, as it serves as your official request for an extension.

Individuals who need to file Form D-410 for personal tax extensions include anyone required to file a North Carolina income tax return but cannot meet the regular due date. This applies to both residents and non-residents, as long as their tax responsibility falls within North Carolina's jurisdiction.

Eligibility for filing a tax extension in North Carolina

To qualify for filing a tax extension in North Carolina, individuals must meet specific criteria. Generally, anyone who has an obligation to file a state income tax return can apply for an extension via Form D-410. This includes both full-time residents and individuals who reside outside the state but earn income sourced within North Carolina.

Special cases, such as military personnel and their families, have unique considerations when applying for an extension. Active-duty service members may use specific provisions related to their service, which could impact both their filing and payment deadlines. Similarly, non-residents must ensure they provide accurate information pertaining to their income earned in North Carolina to qualify for an extension.

How to obtain Form -410

Obtaining Form D-410 is straightforward. North Carolina's Department of Revenue provides the form on its official website, where individuals can easily access the necessary documentation. The form can be filled out online or downloaded for physical completion.

To download the form, visit the North Carolina Department of Revenue's website, navigate to the forms section, and locate Form D-410. Once downloaded, you can fill out the form manually or use software tools that allow you to edit PDFs easily, enhancing your overall document management experience.

Step-by-step instructions to complete Form -410

Step 1: Provide personal information

Commence the process by entering your name, address, and Social Security number at the top of Form D-410. Accurate personal details are crucial as they tie your extension request directly to your taxpayer profile.

Step 2: Indicate tax year and type of form

Next, specify the tax year for which you are requesting the extension. You'll also need to indicate if the form is for an individual or a joint return. This section is vital for delineating your request for record-keeping purposes.

Step 3: Calculate your estimated tax liability

The form requires a section where you estimate your tax liability. Calculate the expected amount owed based on your income and applicable deductions. If you believe you owe taxes, it is essential to make an estimated payment when submitting your extension.

Step 4: Sign and date the form

Finally, ensure that you sign and date the form. Unsigned forms can lead to processing delays or rejection. By signing, you are affirming that the information provided is accurate and complete to the best of your knowledge.

Common mistakes to avoid when filling out Form -410

Common pitfalls when completing Form D-410 can lead to unacceptable mistakes that might delay your extension request. Incomplete information is one of the foremost issues. Omitting parts of your personal data or financial details could result in rejection, requiring you to resubmit your application—adding stress during an already congested time.

Additionally, miscalculating your estimated taxes is another frequent error. Always double-check your figures to avoid any discrepancies that might raise red flags during processing. Utilizing tax software or calculators can significantly reduce the chances of making these costly mistakes.

Key deadlines for filing the extension

To successfully obtain an extension, it's crucial to be aware of the submission deadlines. Form D-410 should generally be filed by the original tax deadline, which is usually April 15th. However, if the deadline falls on a weekend or holiday, it shifts to the next business day. Failing to file Form D-410 by this date can result in penalties.

Understanding payment deadlines for state taxes is equally important. If you expect to owe taxes, payment should accompany your request for extension to avoid interest or penalties. This includes making estimated payments by the original due date—or risk incurring additional fees.

Payment options and instructions

When filing Form D-410, you must consider how to pay your balance due succinctly. North Carolina offers multiple payment options which can be utilized when you file for an extension. Electronic payment is often the simplest route; you can utilize the North Carolina Department of Revenue's online services.

Alternatively, payments can be made via check or money order, sent alongside your completed Form D-410. Ensure that all payments are addressed correctly to avoid any delays in processing. Keep accurate records of your payment methods and amounts for your future reference.

Where to mail your completed Form -410

Once you have completed your Form D-410, knowing where to mail it is essential for timely processing. The North Carolina Department of Revenue designates specific addresses based on whether you are sending payment with your extension request. Ensure that you select the correct address from the instructions provided with the form.

Consider using a checklist before mailing your form to ensure everything is in order. Confirm that all sections are completed, the form is signed and dated, and that payments are included if applicable. A thorough review can prevent unnecessary processing delays.

North Carolina tax extension FAQs

Understanding what happens if you miss the filing deadline is critical. If you fail to submit Form D-410 in time, you increase the risk of incurring penalties and interest on amounts due. However, if you file your tax return eventually, you can mitigate these consequences as long as the tax is paid in full.

An extension does not affect your overall tax liability or refund eligibility; it merely shifts the deadline for filing your return. However, overdue payments may still accrue interest penalties. Consultation with a tax professional is advisable for thorough understanding, especially if particular scenarios apply, such as late payments.

Utilizing pdfFiller for a seamless document management experience

Managing tax documents such as Form D-410 becomes easier with pdfFiller. It allows you to edit PDFs seamlessly, ensuring that your forms are completed with accuracy. The platform's eSigning feature enables you to sign your documents electronically, facilitating a smooth submission process.

Additionally, pdfFiller supports collaboration, allowing multiple team members to review and edit documents securely online. The convenience of accessing your documents from anywhere through a cloud-based solution simplifies the tax management process, reducing the logistical challenges associated with traditional filing methods.

Additional tips for managing your taxes in North Carolina

Keeping accurate records is essential when managing your taxes in North Carolina. Ensure that all necessary documents are organized and readily available. This includes W-2s, 1099s, and receipts for deductions, which could significantly impact your tax liability or refund.

Using tax software can enhance your overall experience by guiding you through the preparation process. Many programs are available that can assist in maximizing deductions, ensuring compliance with state tax laws, and simplifying the filing of all necessary forms.

Resources for further assistance

For specific questions regarding tax extension procedures in North Carolina, reaching out to the North Carolina Department of Revenue is advisable. They provide up-to-date information on tax laws and regulations, ensuring you understand your obligations thoroughly.

Additionally, various online tools can assist with tax extensions and calculations. Utilizing resources like the North Carolina Department of Revenue's website can arm you with insights and tools necessary to navigate your state taxes effectively, putting you in a better position for compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my north carolinapersonal tax extensionform directly from Gmail?

Can I create an electronic signature for signing my north carolinapersonal tax extensionform in Gmail?

Can I edit north carolinapersonal tax extensionform on an iOS device?

What is north carolina personal tax extension form?

Who is required to file north carolina personal tax extension form?

How to fill out north carolina personal tax extension form?

What is the purpose of north carolina personal tax extension form?

What information must be reported on north carolina personal tax extension form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.