Get the free EXHIBIT F - Federal Litigation

Get, Create, Make and Sign exhibit f - federal

Editing exhibit f - federal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out exhibit f - federal

How to fill out exhibit f - federal

Who needs exhibit f - federal?

Exhibit F - Federal Form: Your Comprehensive Guide

Understanding Exhibit F

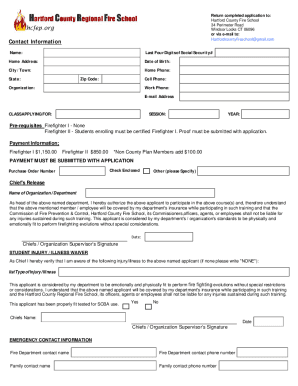

Exhibit F refers to a federal form used primarily in the context of financial disclosures, particularly by businesses and individuals involved in federal financial assistance programs. Its primary purpose is to provide a structured and standardized way to report financial information, ensuring transparency and accountability within federal funding frameworks. Understanding how to correctly complete Exhibit F is crucial for compliance with federal regulations, as inaccuracies can lead to delays in processing or even penalties.

Accuracy in reporting is more than just a requirement; it’s a commitment to integrity in financial dealings. Without precise data, federal agencies cannot assess the financial viability or risks associated with applications for financial assistance. Hence, accurate completion of Exhibit F is mandatory and essential for avoiding complications during review processes.

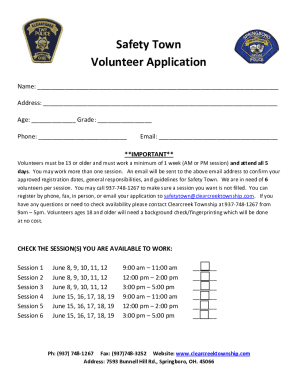

Who needs Exhibit F?

Exhibit F is particularly relevant for a variety of entities and individuals engaged in federal funding. This includes but is not limited to small businesses applying for government contracts, non-profit organizations seeking federal grants, and federal assistance programs requiring detailed financial disclosures. Understanding the scope of those who need to file Exhibit F can help streamline the application process and improve compliance.

Scenarios necessitating the use of Exhibit F may include applying for loan guarantees, grant applications, or participating in federally funded contracts. Each of these instances demands distinct financial disclosures that illustrate an applicant’s financial situation accurately. Thus, users should be aware of their specific requirements based on their funding type and purpose.

Navigating the Exhibit F form

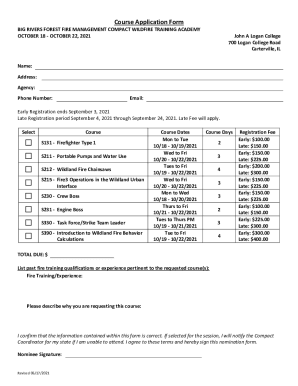

Accessing the Exhibit F form can be done through various governmental websites, primarily those associated with federal funding agencies. Typically, these forms are available in different formats, including PDFs downloadable for offline completion and online fillable forms to simplify accessibility—ideal for users comfortable with digital submissions. Having multiple formats caters to varying user preferences and technological capabilities, ensuring that all applicants can find a suitable method to complete the form.

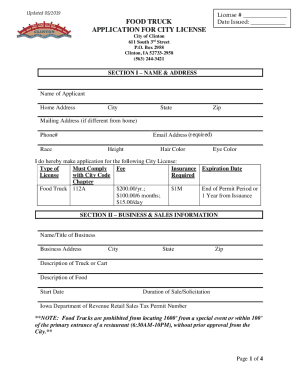

Once you have access to Exhibit F, it is vital to understand its sections. The form consists of three main parts: Identification Information, Financial Information, and Signatures and Certifications. Familiarizing yourself with these sections can significantly enhance the accuracy and efficiency of your completion process.

Form sections breakdown

Each section of Exhibit F plays a critical role in ensuring the completeness and integrity of your submission to federal agencies. In Section 1, you will provide your identification information, including your legal name, address, and contact details. This section is essential for establishing who is submitting the form.

Section 2 requires detailed financial information, including income, expenses, and other financial resources. This part demonstrates your financial stability and capability to manage any awarded funds. Lastly, Section 3 focuses on signatures and certifications. This area is vital for affirming the accuracy of the information provided and must be completed by appropriate representatives of your organization.

Step-by-step instructions for completing Exhibit F

Preparation checklist

Before diving into the intricacies of Exhibit F, a thorough preparation checklist is crucial. Gather all necessary documentation, including financial statements, prior year tax returns, and any documentation supporting claims made in the application. Common mistakes often stem from incomplete or outdated information, so ensure all documents are current and relevant. This preparation process is integral and can prevent headaches down the line.

Filling out Exhibit F: A detailed guide

Utilizing interactive tools available on pdfFiller can streamline these processes. The platform's features assist in form filling, ensuring that all sections are completed thoroughly.

Editing and managing your Exhibit F form on pdfFiller

Editing tools on pdfFiller provide a robust solution for adjusting PDF documents, including Exhibit F. Users can annotate, comment, and make corrections directly within the platform. This feature is particularly useful for tracking changes, ensuring that collaborators stay in sync and all modifications are easily managed.

For teams collaborating on the Exhibit F form, pdfFiller offers seamless collaboration tools, allowing multiple users to work simultaneously on a document. Assignment of roles can help delineate responsibilities, ensuring that every team member knows their duties without overlap.

Signing and submitting Exhibit F

Electronic signing has become the norm for submitting federal forms, and Exhibit F is no exception. pdfFiller enables users to electronically sign documents in a manner compliant with legal standards. This functionality ensures a quick and efficient process from form completion to submission.

After signing, there are various methods available for submitting Exhibit F. It can be submitted online through the respective federal agency's portal or via traditional mail if preferred. Post-submission, keep an eye out for confirmations or notifications regarding the status of your form, ensuring you’re aware of any follow-up requirements.

Troubleshooting common issues with Exhibit F

Filling out and submitting Exhibit F can sometimes lead to questions or challenges. It’s important to become familiar with common issues that often arise, such as missing information or incorrect financial reporting. Having a set of FAQs can offer insights into resolving these concerns effectively, enhancing the overall filing experience.

Get assistance

For personalized assistance, leveraging customer support options or visiting forums related to Exhibit F can be invaluable. Online communities often share tips and experiences that can provide clarity and additional guidance.

Staying updated on Exhibit F requirements

Regulatory changes can impact the requirements for Exhibit F, making it essential for users to stay informed. Regularly checking the websites of applicable federal agencies will provide the latest updates on compliance requirements and any changes to the form itself.

Solutions provided by pdfFiller, such as alert notifications and update summaries, can help users stay current and aligned with regulatory expectations.

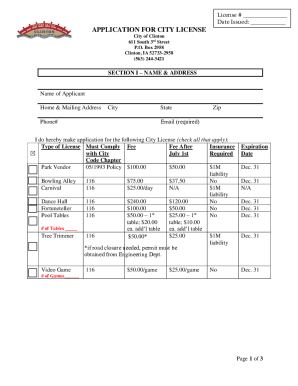

Related federal forms

Understanding how Exhibit F relates to other federal forms can enhance your readiness and comprehensiveness in federal filing. Forms like the SF-424 and the SF-LLL may request similar information. Accessing these related forms through platforms like pdfFiller can streamline the entire application process, ensuring that all necessary documents are readily available.

Additional features of pdfFiller

Navigating the complexities of federal forms like Exhibit F is made easier through pdfFiller’s cloud-based document management system. This platform offers exceptional organizational tools that allow users to effectively manage multiple federal forms in one place, reducing the potential for errors and enhancing document retrieval efficacy.

Customer testimonials highlight the straightforward user experience provided by pdfFiller, emphasizing its role in simplifying workflows for individuals and teams alike—allowing them to focus more on content quality rather than format and submission concerns.

Footer navigation

Easy access to related resources can aid users in navigating the federal forms landscape. Links to important guidelines, other forms, and support resources can significantly enhance the user experience, improving accuracy and ensuring compliance with federal expectations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in exhibit f - federal?

Can I sign the exhibit f - federal electronically in Chrome?

How do I edit exhibit f - federal on an Android device?

What is exhibit f - federal?

Who is required to file exhibit f - federal?

How to fill out exhibit f - federal?

What is the purpose of exhibit f - federal?

What information must be reported on exhibit f - federal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.