A Comprehensive Guide to the Tax Credit Contribution Response Form

Overview of tax credit contributions

Tax credit contributions play a pivotal role in the financial landscape for many individuals and businesses. Essentially, these contributions refer to monetary donations made to qualified organizations that can translate into tax credits. The primary emphasis here is on the potential financial boon these contributions can offer when preparing one's tax return.

Engaging in tax credit contributions not only provides the satisfaction of supporting worthy causes but also enhances your financial planning efforts. Understanding the financial mechanics—including how to claim these credits and their impact on your overall tax liability—is crucial. Moreover, eligibility criteria often vary based on income, type of donation, and the recipient organization.

Contributions must be made to a qualified organization recognized by the IRS.

Claimants typically require proof of the contribution, such as receipts or acknowledgment letters.

Certain income thresholds may apply, influencing the deduction limits.

Understanding the tax credit contribution response form

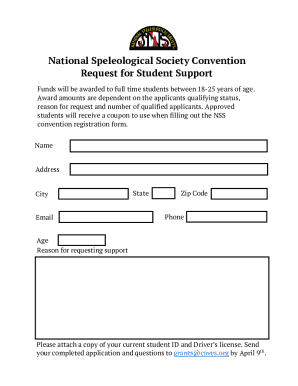

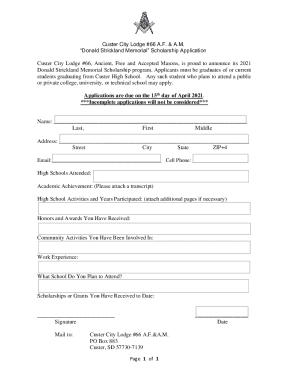

The tax credit contribution response form is a key document for individuals looking to claim tax credits based on their contributions. Its primary purpose is to collect necessary data to validate claims and preferences outlined by the IRS. This document’s details are essential to facilitate the efficient processing of claims during tax return preparations.

Completing the tax credit contribution response form accurately is vital. Any discrepancies or missing information could lead to delayed processing or even rejection of your claim. Understanding what information is required, and how to fill it out correctly, is imperative.

Personal details, including taxpayer identification number and contact information.

Details of contributions such as amounts, dates, and recipient organizations.

Calculation of any credits being claimed, ensuring accuracy in amounts.

Step-by-step guide to filling out the tax credit contribution response form

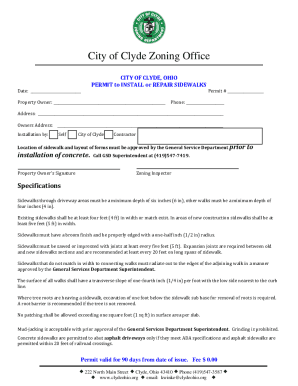

Before diving into the form itself, it's essential to ensure you have everything you need at hand. A preliminary checklist can save time and prevent errors. Start by clearly identifying the tax year for which you’re claiming the credits, as well as gathering any required documentation, such as W-2s or 1099 forms.

Detailing the sections within the form can demystify the process. Start with your personal information to establish your identity as the claimant, then proceed to outline the contribution details, ensuring accuracy in the amounts reported. Next comes the credit calculation, where precision is key. Finally, don’t forget to review the declaration section before signing.

Identify your tax year and gather all relevant documentation.

Break down your personal information accurately.

Clearly state your contribution details and validate with supporting documents.

Editing and signing your form on pdfFiller

Once you've filled out the tax credit contribution response form, utilizing pdfFiller can streamline the editing and signing process. Accessing your form is easy on the pdfFiller platform, where you can seamlessly edit necessary fields to ensure accuracy. Utilizing various editing tools, you can ensure your document is free of errors.

Adding signature fields is straightforward, and users have the option to insert comments or notes as needed. Following the eSigning process will ensure your document is officially validated before submission. Collaboration features enable team members, advisors, or financial consultants to review the document and provide feedback.

Access the relevant form through pdfFiller.

Use the editing tools to correct or update information.

eSign your document by following provided on-screen instructions.

Managing your tax credit contribution response form

Once you have finalized your tax credit contribution response form, effective management of your document becomes crucial. Saving and storing your completed forms securely is the first step. pdfFiller offers robust options for digital storage, allowing you to easily access any documents when necessary.

Sharing options through pdfFiller enable you to collaborate with financial advisors or team members for review. If need be, printing or downloading your document is incredibly simple. Ensure your completed forms are organized systematically to prevent misplacement and allow for future reference.

Utilize pdfFiller’s storage feature to save your completed form securely.

Share your document with key stakeholders through pdfFiller.

Print or download copies for your personal records.

Frequently asked questions (FAQs)

Having clarity about the tax credit contribution response form is essential. As such, many users often have similar questions surrounding the processing and management of their forms. Addressing these FAQs can alleviate potential concerns and uncertainties.

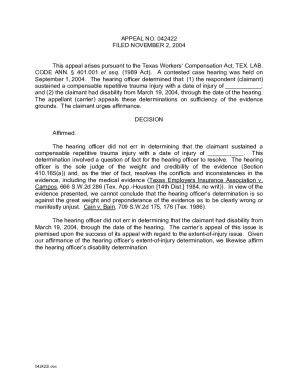

Understanding the timeline for processing typically involves a few weeks; however, this may vary based on workload and additional complexities in your submission. If you face a rejection, specific guidance on the next steps for corrections should be readily available. Moreover, it’s also possible to amend previously submitted forms if there have been significant changes or updates.

Processing times can range from a week to several weeks depending on the IRS workload.

In the event of a rejection, consult the instructions provided for correction.

Amending a previously submitted form is permissible and may require specific documentation.

Tips for maximizing your tax credit contributions

To make the most out of your tax credit contributions, maintaining meticulous records throughout the year is invaluable. Tracking each donation will encapsulate not just the amounts, but also the organizations you support, potentially leading to larger deductions. This proactive approach facilitates smoother processing of your tax credit contribution response form.

Additionally, monitoring changes in tax laws and regulations can provide insights into maximizing your credits and informing future contributions. Engaging with financial advisors can also offer strategic planning perspectives, helping you align your financial goals with philanthropic endeavors.

Keep meticulous records of all contributions made throughout the year.

Stay informed on changes to tax laws that may affect your contributions.

Consult financial advisors for personalized strategies to enhance your benefits.

Interactive tools available on pdfFiller

pdfFiller enhances your experience by offering various interactive tools that streamline the form-filling and management process. The auto-fill feature minimizes repetitive data entry, allowing users to quickly complete their tax credit contribution response forms with pre-filled information based on prior submissions.

Real-time collaboration tools empower teams to work together smoothly, ensuring accurate document completion. Furthermore, pdfFiller’s version history feature allows users to track changes made to the document over time, enhancing transparency and accountability.

Utilize the auto-fill feature for faster form completion.

Engage in real-time collaboration for effective teamwork and accuracy.

Access version history to monitor changes and updates in your documents.

Finalizing your contribution response

Prior to submitting your tax credit contribution response form, implementing a thorough review process is essential. Utilize a checklist to ensure all required sections are completed accurately. A final sweep can alleviate any concerns about missing information, providing peace of mind as you head toward submission.

Once satisfied, the form can be submitted electronically through the IRS portal, facilitating efficiency. Develop follow-up strategies to ensure your submission doesn't just disappear into the ether; tracking your form post-submission is key to confirming successful processing.

Conduct a detailed review of your form with a checklist before submission.

Submit the form electronically for a streamlined process.

Employ follow-up strategies to confirm processing of your submission.