Get the free Metrobank Home Loan Application Form For Individuals

Get, Create, Make and Sign metrobank home loan application

Editing metrobank home loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out metrobank home loan application

How to fill out metrobank home loan application

Who needs metrobank home loan application?

MetroBank Home Loan Application Form: A Comprehensive Guide

Understanding the MetroBank home loan

MetroBank provides a range of home loan products tailored to various financial needs, making it an attractive option for potential homeowners. Whether you are buying your first home, refinancing an existing property, or investing in real estate, MetroBank's home loans are designed to offer flexibility and competitive rates. These loans play a crucial role in making home ownership accessible by providing the necessary funds to purchase or improve properties.

Key features of MetroBank home loans include fixed interest rates for a set period, a choice of repayment terms, and flexible payment options. Borrowers also benefit from personalized service, ensuring that each individual’s needs are addressed. The reputation of MetroBank as a reliable banking institution adds peace of mind when going through the borrowing process.

Additionally, factors such as no pre-termination fees and the option to avail of a loan term up to 20 years set MetroBank apart from other lenders. Coupled with attractive interest rates and various repayment schemes, borrowing from MetroBank can turn your dream home into a reality.

Eligibility criteria for applicants

To qualify for a MetroBank home loan, applicants must meet certain eligibility criteria. Typically, MetroBank requires you to be at least 21 years old upon application and not older than 65 years upon loan maturity. A steady income is crucial; the bank generally looks for a minimum monthly income threshold, which can vary based on the value of the loan you seek.

Furthermore, having a good credit score—usually above 700—is essential as it reflects your creditworthiness to lenders. Required documents for eligibility verification include proof of income, proof of identity, and additional documents based on your employment status. Self-employed individuals may need to furnish tax returns and business permits as verification of income.

Preparing to apply for the home loan

Before you fill out the MetroBank home loan application form, proper preparation is key. Start by gathering necessary documentation, which involves collecting various forms of proof to determine your eligibility for a loan. Essential documents include proof of identity such as a government-issued ID, proof of income demonstrated through payslips or tax returns, and property documentation like the title deed or purchase agreement.

Moreover, understanding the loan's terms and conditions is vital. Familiarize yourself with the interest rates, as these will directly affect your monthly repayments and overall loan cost. Assess different repayment options offered by MetroBank, understanding how long you’ll be committing to pay back your loan and any additional fees that may apply, including application and appraisal fees. Clear comprehension of these elements can help avoid unexpected financial burdens later.

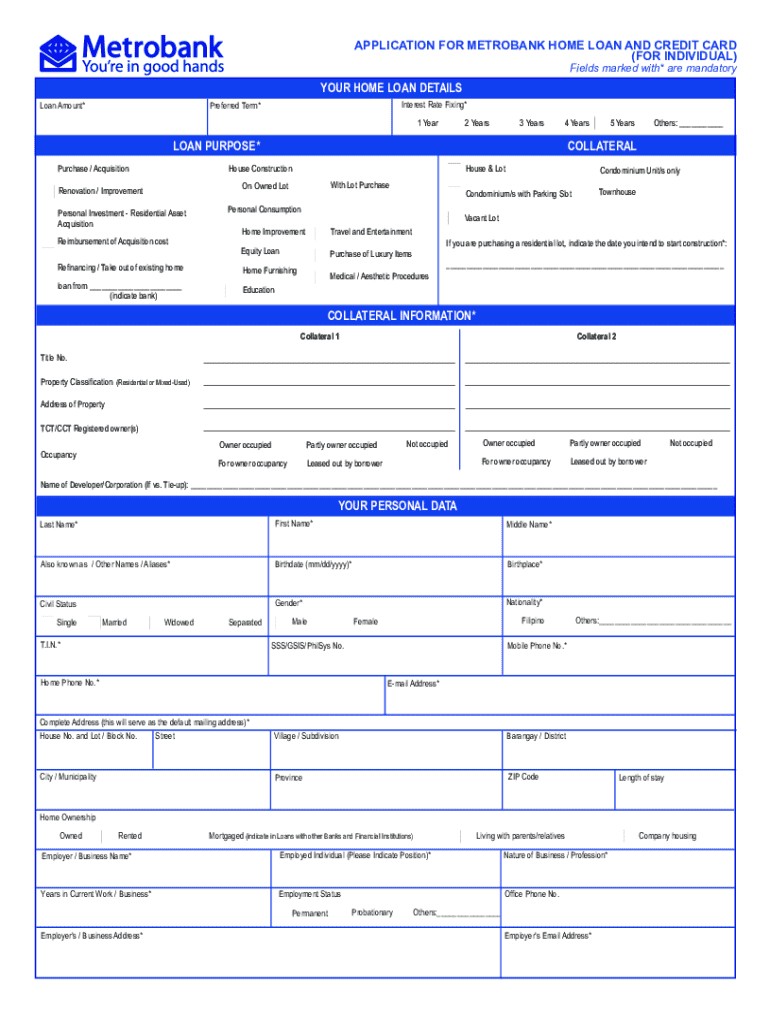

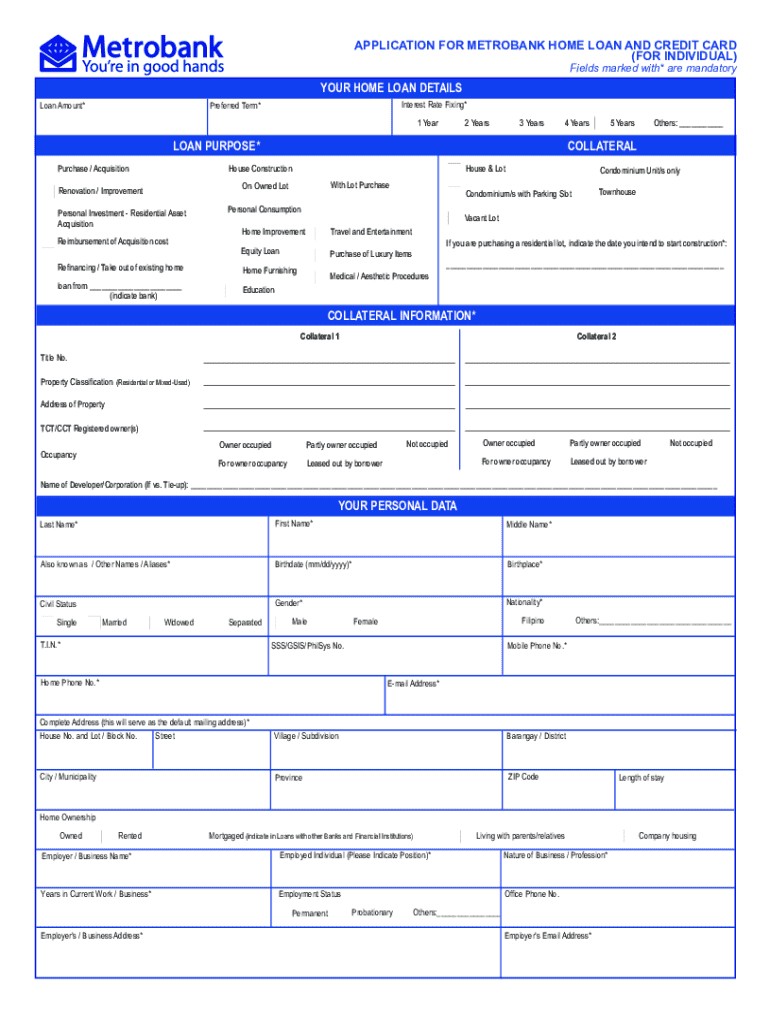

Completing the MetroBank home loan application form

The MetroBank home loan application form is readily accessible online. You can find the form directly on pdfFiller, where you can register or log in to access the necessary resources. Once you're ready to fill out the application, approach this task with mindfulness and precision.

Begin by entering personal information such as your full name, contact details, and marital status. Next, provide employment and financial details, which include your current employment information, salary specifications, and any existing assets or liabilities that could impact your application. Finally, detail the loan specifics—how much you intend to borrow, the purpose of the loan, and your preferred repayment period. Ensure that all fields are filled accurately to avoid delays in processing.

Editing and managing your application

Once you submit the application, any necessary corrections can be made easily through pdfFiller. This platform allows users to make updates after initial submission, which can be beneficial if you realize an error or need to change some details. Additionally, it enables you to save drafts, providing an opportunity to revisit and refine your application before final submission.

To keep track of your application, consider using online tools provided by MetroBank to monitor your application's status. Following up through the phone or the online portal is recommended. Typically, applicants can expect to receive updates on their application status within 3 to 5 business days, depending on the completeness and accuracy of the provided documentation.

Signing and finalizing your home loan application

With pdfFiller, eSigning offers a convenient and secure way to finalize your application. The benefits of eSigning include the ability to sign documents from anywhere without needing to print or physically send anything. This feature is accessible directly within the pdfFiller platform, making the signing process quick and efficient.

To electronically sign your application, simply follow the guided steps provided by pdfFiller. Once your application is signed, the next step is to submit it to MetroBank. Utilize the platform to ensure that your completed application is sent securely, and confirm receipt of your application shortly after submission—this will ensure you are informed about the next steps moving forward.

Frequently asked questions (FAQs)

Throughout the application process, you may have specific questions. One common inquiry relates to the processing time of the application, which can generally vary; however, you should expect a timeline of 3 to 5 business days. In the case of a loan denial, asking for feedback on the decision can provide insights into areas for improvement if you wish to reapply in the future.

Another prevalent issue for applicants revolves around adjusting the loan amount after submission. Generally, any adjustments should be discussed with your loan officer as soon as possible, and be prepared to provide additional documentation to support any changes. Addressing concerns about interest rates and repayment is crucial—remember that rates can be influenced by market conditions even after your application is submitted, so having a conversation with your representative can be invaluable.

Related articles and resources

For those interested in home loan tips and tricks, several articles delve into best practices for securing favorable loan conditions. Understanding the implications of your credit score when applying for a home loan can significantly influence your experience and outcomes, aiding in effective financial planning.

Additionally, on pdfFiller, you can find a variety of financial forms that are available for editing and printing, which may complement your loan application process or help in managing other financial documents.

Related categories

MetroBank offers various financial services beyond home loans—understanding these can enhance your financial journey. For example, personal loans and auto loans can also be advantageous depending on your needs. Alongside these loan types, MetroBank provides adjacent services such as insurance products and investment options, allowing customers to secure comprehensive financial planning tailored to their individual situations.

Engaging with these diverse offerings can help you take full advantage of what MetroBank has to provide, ensuring your financial health is holistically managed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find metrobank home loan application?

Can I sign the metrobank home loan application electronically in Chrome?

How do I fill out the metrobank home loan application form on my smartphone?

What is metrobank home loan application?

Who is required to file metrobank home loan application?

How to fill out metrobank home loan application?

What is the purpose of metrobank home loan application?

What information must be reported on metrobank home loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.