Comprehensive Guide to Business Registration PDF Form

Understanding the business registration process

A business registration form is a crucial document that legally establishes your business within a specific jurisdiction. It serves multiple purposes, including informing the government about the presence of your business, enabling you to obtain necessary licenses and permits, and protecting your business name. Completion of this form marks the transition from a business idea to a legitimate entity, which is vital for both new entrepreneurs and established businesses seeking to formalize their operations.

The importance of the business registration PDF form cannot be overstated. It provides a clear structure for compliance with local laws and regulations, enabling entrepreneurs to avoid legal pitfalls and penalties. By registering, businesses gain greater credibility with potential customers, suppliers, and partners, which can significantly enhance their market standing.

Establishes legal identity for your business

Protects your business name from being used by others

Enables access to business banking and funding options

Who needs to complete a business registration form?

Every type of business, whether it's a Limited Liability Company (LLC), Corporation, or Sole Proprietorship, must complete the business registration process to operate legally. Whether you are a solo entrepreneur or running a larger organization, registration plays a key role in shaping the legal framework of your operations. The necessity of registration often depends on the business structure, location, and specific activities undertaken.

Situations that mandate registration include starting a new business, changing the business structure, or when expanding operations into new jurisdictions. Each scenario may have its own set of legal requirements and might necessitate the completion of a business registration PDF form.

Key components of a business registration PDF form

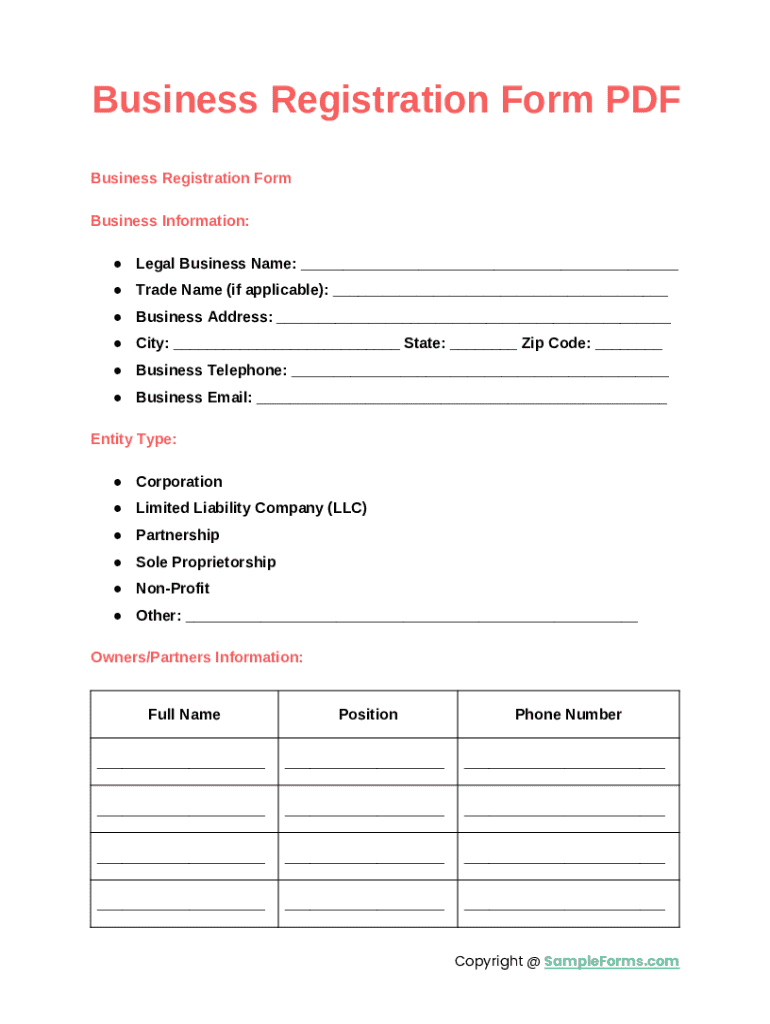

Understanding the key components of a business registration PDF form is pivotal for an effective filing. Generally, the form will require comprehensive information pertaining to the business and its owners. This ensures that the registering authority has all necessary information to process your registration accurately.

Typical required information includes essential owner details like full name, residential address, and contact number. Additionally, business specifics such as the name you intend to operate under, the type of entity, and the primary business address are critical. Depending on your business type, you may also need to attach identification documents and a concise business plan as supporting documentation.

Includes name, address, and contact details

Specifies business name, type, and operational address

May include identification, business plans, or licenses

Each section of the form captures essential data that enables the registration authority to validate your application. One common mistake to avoid is rushing through the form, which can lead to errors or incomplete submissions that delay approval.

Filling out the business registration PDF form

Effectively completing the business registration PDF form can significantly enhance the chances of a smooth registration process. Begin by carefully reading the instructions provided with the form; each jurisdiction may have unique requirements or updates. Next, gather all necessary documents and information before starting to fill out the form. This preparatory step ensures you don’t miss crucial details.

As you fill out the form, leverage clear and precise language. Provide accurate information to avoid unnecessary delays. After completing the form, it’s wise to review it several times for typographical errors or misinformation before submission. For a perfect filing experience, consider using templates provided by pdfFiller. These templates simplify the process, ensuring all fields are structured correctly and reducing the likelihood of mistakes.

Read all instructions thoroughly before starting

Gather all required documents and information

Review for errors before final submission

Filing requirements and regulations

Filing requirements often vary significantly from state to state, making it essential to familiarize yourself with your local regulations. Some states may require additional licenses or registrations depending on your business activities, while others might have specific deadlines for submissions. Failing to comply with these requirements can lead to interruptions in your business operations, so thorough research into state-specific guidelines is paramount.

In some cases, businesses might also need to register with federal agencies, especially if they are involved in regulated industries or plan to operate across state lines. Federal registrations may include obtaining an Employer Identification Number (EIN) or specific permits that are industry-dependent. Understanding the distinction between federal and state requirements helps to ensure you cover all bases during the registration process.

Vary by jurisdiction; essential to check local guidelines

May be required depending on business activities

Failing to register can lead to legal issues, fines, or shutdowns

Types of businesses and registration differences

Navigating the landscape of business types is crucial when considering registration. Limited Liability Companies (LLCs) and Corporations are popular structures, each with distinct advantages and disadvantages. LLCs provide flexibility and personal liability protection, while Corporations offer a more formal structure with potential tax benefits. Understanding these nuances can significantly influence your registration path.

Moreover, distinguishing between S Corporations and C Corporations is essential, especially from a tax perspective. While S Corporations allow profits and losses to pass through directly to owners’ tax returns, C Corporations are taxed separately at the corporate level. This difference can sway your business strategy and must be accounted for when completing the business registration PDF form.

Flexible management structure, personal liability protection

Formal management, potential tax benefits, attracting investors

S provides tax pass-through; C faces corporate-level taxation

Interactive tools and resources

Utilizing interactive tools can simplify the business registration process significantly. pdfFiller offers a robust platform for document management, enabling users to edit, sign, and collaborate on forms seamlessly. This cloud-based approach means you can access your documents from any device, which is particularly beneficial during a mobile business environment where time and convenience are paramount.

Additionally, frequent questions about business registration often arise, including the necessity of certain documents or the implications of specific forms. pdfFiller provides a section dedicated to clarifying these queries, offering users detailed answers and guidance to eliminate confusion and streamline their registration experience.

Edit documents directly within the platform with ease

Easily eSign documents without paper hassle

Answers to common questions about the registration process

Maintaining compliance after registration

Registration is just the beginning; maintaining compliance is crucial for the longevity and success of your business. Staying informed about the specific registration requirements in your state can help ensure that you avoid penalties. Most states require regular updates or renewals of business licenses or registration to remain in good standing. Failure to adhere to these ongoing responsibilities can result in legal consequences or operational suspensions.

Additionally, businesses may have other reporting requirements, such as Beneficial Ownership Information (BOI). Understanding local and state compliance obligations enables businesses to navigate their operational landscape legally and effectively, safeguarding their reputation and driving growth.

Keep registration current to avoid penalties

Ensure compliance with ownership disclosure requirements

Learn local regulations to maintain good standing

Need help? Resources and support options

For many entrepreneurs, navigating the registration process can be daunting. Therefore, seeking out assistance is often a beneficial move. Numerous resources, both free and paid, exist to help you through the complexities of business registration. Various organizations offer consulting services that can guide you through the form-filling process, provide advice specific to your industry, or even assist you in navigating local regulations.

Furthermore, community-based resources and workshops often serve as excellent support networks. These can include small business associations, chambers of commerce, or online forums where fellow entrepreneurs share their experiences and tips. Knowing where to turn for help can significantly ease the registration process and enhance your business's chances of success.

Seek professional help for guidance in complex situations

Participate in local resources for additional support

Engage with peers for tips and shared experiences