What is OFAC Form: A Comprehensive Guide

Understanding OFAC and its importance

The Office of Foreign Assets Control (OFAC) is an office of the U.S. Department of the Treasury. It administers and enforces economic and trade sanctions based on U.S. foreign policy and national security goals. These sanctions can target countries, regimes, and individuals involved in terrorism, narcotics trafficking, and other threats to the national security of the United States.

OFAC plays a critical role in safeguarding the U.S. economy and promoting foreign policy objectives, which is essential in today’s globalized world. The significance of OFAC forms in ensuring compliance cannot be overstated. For businesses and individuals alike, understanding and utilizing OFAC forms is crucial for legal and economic safety.

Ensures compliance with legal requirements.

Avoids potential legal penalties and fines.

Promotes national security and economic stability.

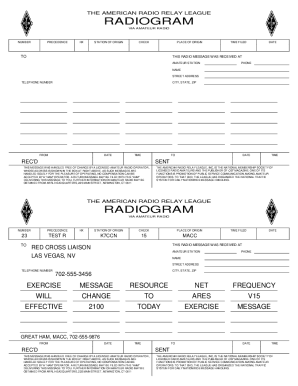

The OFAC form explained

OFAC forms serve various purposes, primarily related to the documentation and reporting of transactions affected by sanctions. These forms are essential for individuals and organizations that need to make payments or engage in business with sanctioned entities or individuals.

There are several types of OFAC forms depending on the specific action being taken. This includes applications for licenses, request for information, and petitions for removal from the Specially Designated Nationals (SDN) list.

OFAC License Application Form.

Request for Information on SDN.

Petition for removal from sanctions lists.

Key components of an OFAC form typically include the requesting party's information, details about the proposed transaction, and any relevant documentation that supports the request. Ensuring accurate completion of these fields is critical to avoiding delays or rejection.

Who needs to use an OFAC form?

Individuals and entities from various sectors often need to comply with OFAC regulations. This includes businesses involved in banking, shipping, international trade, and any dealings that could involve sanctioned countries or individuals.

Specific scenarios that require the use of an OFAC form include transactions with foreign banks, shipping goods to an affected region, or when there is a legal obligation to determine whether a party is on the sanctions list. Failure to comply can result in significant monetary penalties.

Working with foreign governments or banks.

Shipping goods to sanctioned nations.

Engaging in business with individuals on the SDN list.

Detailed instructions on how to complete an OFAC form

Filling out an OFAC form correctly requires careful attention to detail. Start by gathering all necessary documents, including identification, business information, and transaction details. It's advisable to pre-fill certain sections with as much information as possible to streamline the process.

Next, fill out the form section by section, ensuring you provide all required information. Common fields include the name of the requesting party, details of the transaction, and specific references to the relevant sanctions. After completing the form, take the time to review each section to avoid common errors.

Verify all personal and business information.

Provide detailed information on the transaction.

Check for any specific instructions related to your application.

Validating the completeness of the form can save time and prevent rejections. Consider utilizing tools such as pdfFiller for efficient form management.

Submitting your OFAC form

Once the OFAC form is complete, it's time to submit it. There are generally two main methods for submission: electronic and paper forms. Electronic submissions are typically faster and can be done via the OFAC’s official online platforms.

For paper forms, ensure that you have all signatures and documentation included before mailing. Whichever method you choose, maintain copies of everything submitted for your records. After submission, it is essential to prepare for the review process. OFAC typically provides timelines for feedback, but these can vary based on the request’s complexity.

Review submission requirements for either method.

Ensure all documentation accompanies your submission.

Stay current with OFAC timelines and follow up if necessary.

OFAC compliance best practices

Maintaining compliance with OFAC regulations is an ongoing process. Regular audits and checks of business practices are crucial to ensure adherence to updated sanctions lists and rules. Establishing a compliance program within your organization helps streamline this process.

Record-keeping is another essential aspect of OFAC compliance. Keeping detailed records of all transactions and communications relating to OFAC forms can protect you in case of audits and enhance your understanding of potential risks.

Conduct routine audits to assess compliance levels.

Maintain detailed records of all transactions.

Utilize management tools to streamline compliance efforts.

Utilizing resources like pdfFiller can empower businesses and individuals to manage documents systematically while staying informed about changes in OFAC regulations.

Frequently asked questions about OFAC forms

Many individuals have questions when dealing with OFAC forms, particularly concerning mistakes or submitting on behalf of another entity. One common inquiry is what happens if an error is made in the submission. If you realize a mistake post-submission, it is best to contact OFAC immediately and provide corrected information.

As for submitting the form on behalf of another entity, it is permissible if you have the appropriate authorization and are compliant with all guidelines. Understanding these nuances is critical in ensuring compliance.

Contact OFAC immediately for mistakes post-submission.

Ensure you have authorization to submit on behalf of others.

Familiarize yourself with specific OFAC guidelines.

Advanced considerations in OFAC compliance

As international trade evolves, the implications of OFAC compliance also change. Specific countries may have updated sanctions that directly impact businesses. Staying abreast of these updates is crucial for compliance and mitigating risks.

Looking ahead, trends in OFAC regulations are likely to shift as geopolitical circumstances evolve. Keeping a close watch on future changes can provide a strategic advantage and ensure ongoing compliance.

Monitor updates related to specific sanctioned countries.

Analyze how international events may affect OFAC policies.

Adjust compliance practices according to regulatory changes.

Interactive tools and resources

Leveraging interactive tools can significantly ease the process of filling out and managing OFAC forms. Resources such as templates and checklists are useful in ensuring that forms are completed accurately and submitted correctly.

User testimonials often highlight the effectiveness of solutions like pdfFiller, where clients share case studies about successful compliance management. These real-world examples provide insights into the practicality of various approaches and the advantages of streamlined document management.

Explore interactive templates for efficient filling.

Utilize checklists to guide compliance efforts.

Read successful case studies from pdfFiller users.

Conclusion and next steps

Establishing a workflow for ongoing OFAC compliance is essential for businesses requiring interactions with regulated parties. Incorporating tools like pdfFiller into your document management strategy can enhance efficiency while ensuring compliance with OFAC regulations.

Regularly updating your knowledge regarding OFAC changes and sanction policies will further bolster your compliance efforts, reducing the risk of penalties and ensuring safer business practices.

Implement pdfFiller in document workflows for efficiency.

Stay informed about OFAC regulation updates.

Regularly train staff on compliance standards.