Get the free Form 1007 & its Impact on Short-Term Rental Appraisals

Get, Create, Make and Sign form 1007 amp its

How to edit form 1007 amp its online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1007 amp its

How to fill out form 1007 amp its

Who needs form 1007 amp its?

Form 1007 and its form: A Comprehensive How-To Guide

Understanding Form 1007

Form 1007, officially known as the Uniform Residential Appraisal Report, is an essential document in the mortgage application process. It provides lenders with detailed insights into a property’s value and the borrower's financial situation, serving as a pivotal component in loan approval decisions. By analyzing comparable properties, Form 1007 helps to ensure that home valuations are accurate, aiding banks and lending institutions in assessing risk.

The significance of Form 1007 in mortgage applications cannot be overstated. Lenders use this form to calculate critical figures such as Loan-To-Value (LTV) ratios and determine whether to approve a loan. Proper completion of the form can expedite the application process and enhance the likelihood of securing a mortgage.

Key components of Form 1007

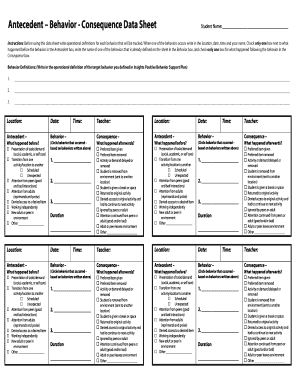

Form 1007 consists of several key sections that require detailed input. These include:

Each component is vital for a comprehensive analysis of the property and financial standing, shaping the final appraisal and lending decision.

Preparing to complete Form 1007

Before filling out Form 1007, it's crucial to gather all necessary documentation to ensure an accurate submission. Common documentation required can include:

Organizing this information efficiently will facilitate the completion of Form 1007 and improve accuracy.

Common terminology and acronyms

While completing Form 1007, familiarity with common terminology and acronyms is beneficial. Key terms include:

Understanding these terms can enhance your ability to navigate the form effectively.

Step-by-step instructions for filling out Form 1007

Filling out Form 1007 can seem daunting, but following a step-by-step approach can simplify the process. Begin with basic information input, ensuring you enter accurate property details such as the property address, type, and size.

Next, focus on compiling a detailed income analysis. This includes various income sources, ensuring to account for full-time salaries, part-time jobs, bonuses, and rental incomes. It is important to exclude any irregular or one-time incomes that may misrepresent financial stability.

Completed example of Form 1007

Seeing a filled-out example of Form 1007 can provide clarity. For instance, if we consider a property located at 123 Main Street, you would enter the property information accurately, including square footage, year built, and lot size. Income documentation should reflect combined annual earnings accurately from both primary and secondary jobs, ensuring no details are overlooked.

This visual breakdown not only demystifies the filling process but reinforces the importance of completeness and accuracy in every section of the form.

Editing and reviewing Form 1007

After filling out Form 1007, reviewing for accuracy is crucial. Common mistakes include typos in critical financial information or incorrect property descriptions, which can lead to delays or denials in mortgage applications. Inaccuracies might create confusion, so double-checking every detail should be a priority.

Using tools like pdfFiller can greatly facilitate this process. With its interactive editing features, users can quickly make adjustments directly on the form. Here are steps to edit your form digitally using pdfFiller:

eSigning Form 1007

The legality of eSigning forms has become increasingly recognized in many jurisdictions. eSigning Form 1007 is a secure method of finalizing your documentation. However, understanding legal considerations around eSignatures is essential. eSignatures can hold the same weight as traditional handwritten signatures in the eyes of the law, provided they comply with minimum security standards.

To eSign using pdfFiller, follow this step-by-step guide:

Submitting Form 1007

Once Form 1007 is completed and eSigned, it's time to submit it. Options typically include both digital and physical submissions. Digital submissions are usually faster and more secure, allowing for tracking and immediate confirmation of receipt. Conversely, mailing a physical form may lead to delays and is more vulnerable to loss.

Consider the pros and cons of each method when deciding how to submit your form. After submission, be proactive about follow-up procedures. This includes reaching out to your lender or supporting agency for status updates and understanding the next steps, such as further documentation or additional processing time.

Troubleshooting common issues

Even a well-completed Form 1007 can face rejection or delays. Common reasons for this might include missing information or discrepancies in income reporting. To avoid this, ensure all documents submitted align with the information provided on the form.

If your form faces issues, reaching out to support services can provide relief. pdfFiller offers dedicated resources for guidance, and knowing the key questions to ask when seeking help can lead to quicker resolution.

Additional templates similar to Form 1007

Aside from Form 1007, there are other relevant forms in the mortgage process that one may need. For example, Form 1003, the Uniform Residential Loan Application, captures details specifically about the loan. These forms have varying requirements and applicability depending on the lender and type of mortgage.

Accessing other templates on pdfFiller can help streamline your documentation process. Finding forms that suit your specific needs is critical in navigating the mortgage application process efficiently.

Understanding the impact of Form 1007 on the mortgage process

Form 1007 plays a decisive role in loan approval, as lenders heavily rely on this document to evaluate property value and borrower reliability. A thorough and well-prepared Form 1007 can significantly enhance your chances of securing a mortgage. Lenders look for precision and supporting data that align with their underwriting guidelines.

Real-world examples illustrate this importance; users who meticulously completed their forms and provided comprehensive supporting documents often share positive experiences. Their testimonials emphasize that proper form completion can be the difference between loan approval and rejection.

Staying compliant and up-to-date with form requirements

The requirements for Form 1007 can change based on evolving regulations. Staying informed about any updates is critical for ensuring compliance. Lenders and mortgage professionals often receive notices about recent changes, and utilizing resources like pdfFiller can ease the burden of keeping track.

Ongoing learning about form regulations is essential for users navigating this vital aspect of home financing. Engaging with community forums or subscribing to industry updates can help maintain a sharp awareness of what is required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 1007 amp its?

How can I edit form 1007 amp its on a smartphone?

Can I edit form 1007 amp its on an Android device?

What is form 1007 and its?

Who is required to file form 1007 and its?

How to fill out form 1007 and its?

What is the purpose of form 1007 and its?

What information must be reported on form 1007 and its?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.