Get the free Employer Credit for Family and Medical Leave Worksheet ...

Show details

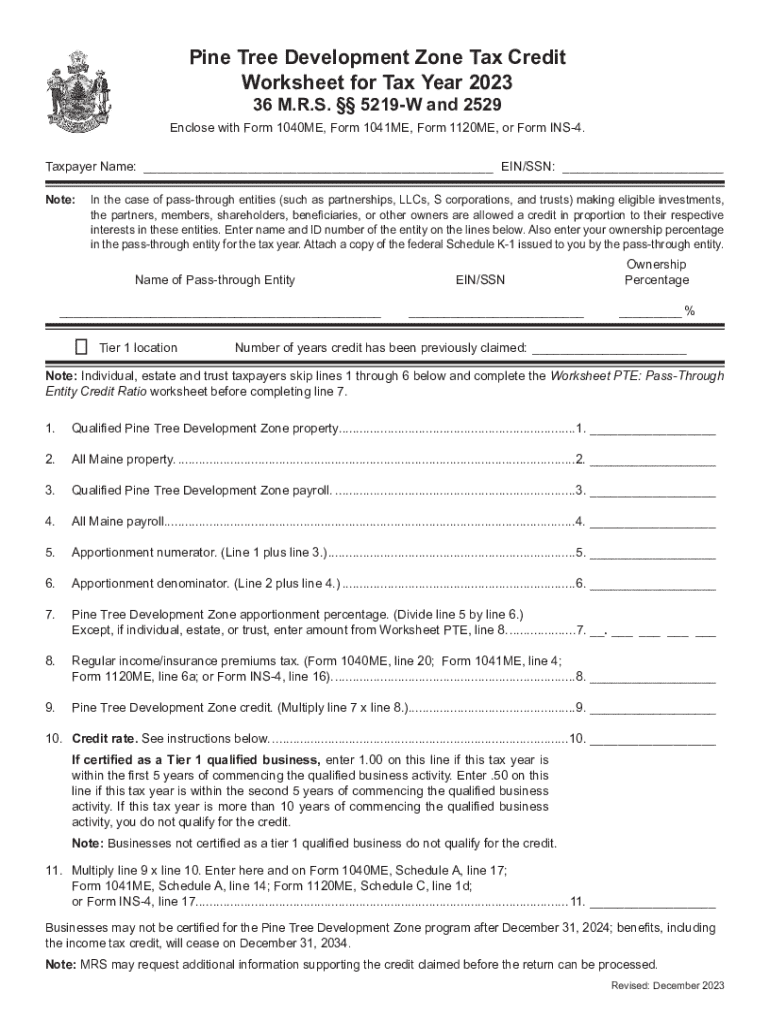

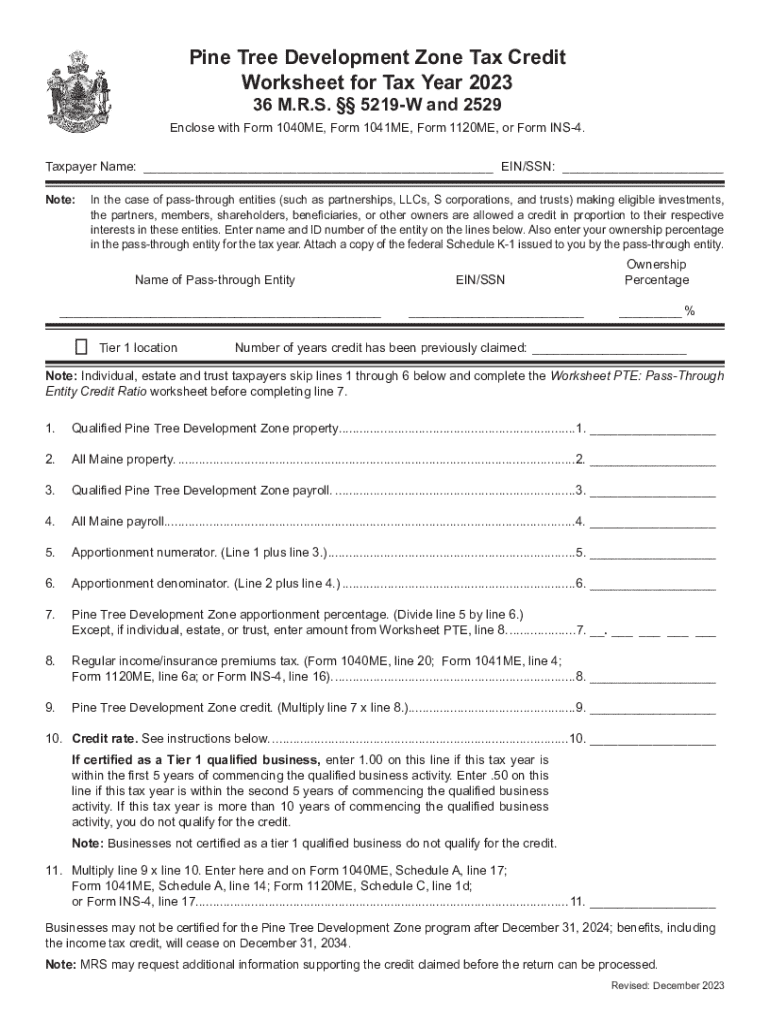

Pine Tree Development Zone Tax Credit Worksheet for Tax Year 2023 36 M.R.S. 5219W and 2529 Enclose with Form 1040ME, Form 1041ME, Form 1120ME, or Form INS4. Taxpayer Name: ___ EIN/SSN: ___ Note:In the case of passthrough entities (such as partnerships, LLCs, S corporations, and trusts) making eligible investments, the partners, members, shareholders, beneficiaries, or other owners are allowed a credit in proportion to their respective interests in these entities. Enter name and ID number of...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer credit for family

Edit your employer credit for family form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer credit for family form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employer credit for family online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit employer credit for family. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer credit for family

How to fill out employer credit for family

01

Gather necessary documents including your family's identification numbers and proof of employment.

02

Obtain the employer credit form from your HR department or company website.

03

Fill out your personal information, including your name, address, and employee ID.

04

Indicate the number of family members you are claiming for the credit.

05

Provide the necessary tax identification numbers for each family member.

06

Attach required documentation to verify your claims, such as birth certificates or tax returns.

07

Review the completed form for accuracy and completeness.

08

Submit the form to the appropriate department within your company.

Who needs employer credit for family?

01

Employees looking to receive financial assistance for their family members from their employer.

02

Families who require additional support for healthcare, education, or other essential costs.

03

Individuals seeking to optimize their tax benefits related to family support through employer-offered credits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit employer credit for family from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your employer credit for family into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I sign the employer credit for family electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit employer credit for family on an iOS device?

You certainly can. You can quickly edit, distribute, and sign employer credit for family on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is employer credit for family?

Employer credit for family refers to a tax credit available to employers that provide certain family-related benefits or support to their employees, such as paid family leave or child care assistance.

Who is required to file employer credit for family?

Employers who provide qualifying family-related benefits to their employees may be required to file for the employer credit for family in order to claim tax relief.

How to fill out employer credit for family?

To fill out the employer credit for family, employers typically need to complete the relevant tax forms, providing details about the benefits offered, the eligible employees, and the amount of credit being claimed.

What is the purpose of employer credit for family?

The purpose of employer credit for family is to incentivize employers to offer family-friendly benefits, thereby supporting employees in balancing work and family responsibilities.

What information must be reported on employer credit for family?

Employers must report information such as the types of benefits provided, the amount of qualified expenses incurred, and details about the employees eligible for these credits.

Fill out your employer credit for family online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Credit For Family is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.