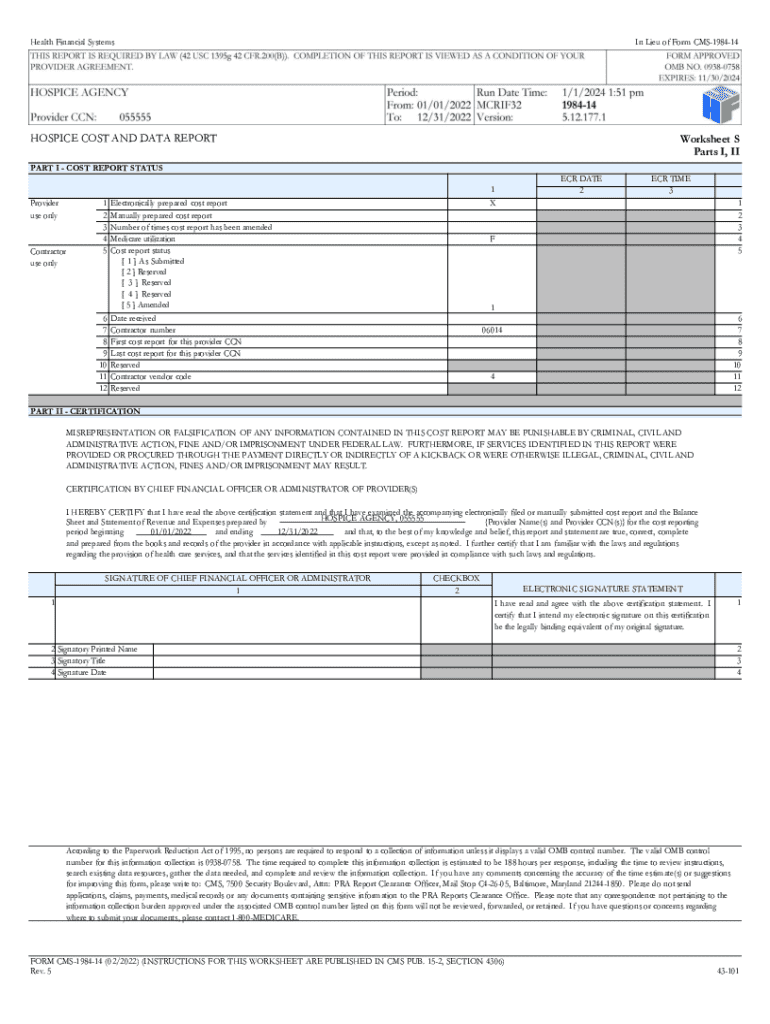

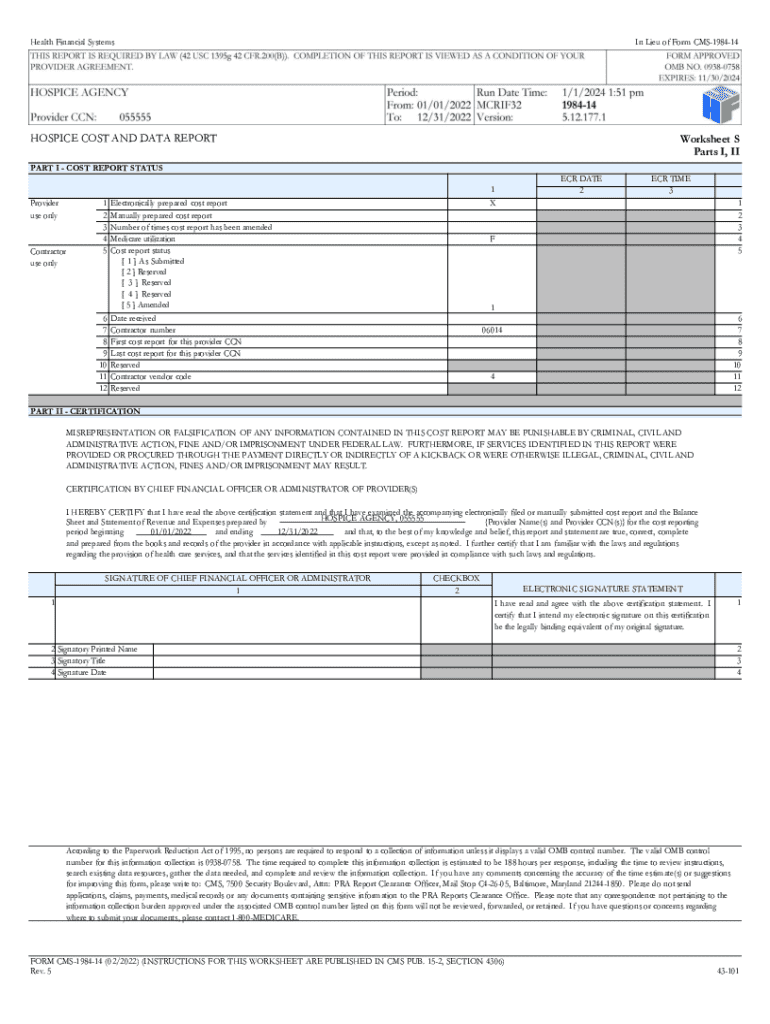

Get the free 02-22 4390 (Cont.) Rev. 5 43-101 FORM CMS-1984-14

Get, Create, Make and Sign 02-22 4390 cont rev

How to edit 02-22 4390 cont rev online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 02-22 4390 cont rev

How to fill out 02-22 4390 cont rev

Who needs 02-22 4390 cont rev?

Understanding the 02-22 4390 Cont Rev Form: A Comprehensive How-to Guide

Understanding the 02-22 4390 Cont Rev Form

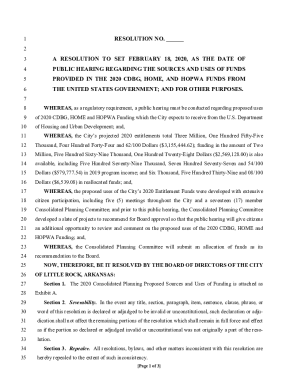

The 02-22 4390 Cont Rev Form is a crucial document used in various legal and compliance-related contexts. Its primary purpose is to facilitate the review and confirmation of certain continuous revenue streams within organizations or personal accounts. By ensuring that the form is filled out accurately and thoroughly, users can help streamline their financial processes, adhere to regulatory requirements, and mitigate potential disputes.

This form can be utilized in multiple scenarios, such as when applying for grants, during audits, or while submitting financial reports to governmental bodies. The significance of this form cannot be overstated, as errors or omissions may lead to delays, rejections, or even legal ramifications.

Who needs the 02-22 4390 Cont Rev Form?

The 02-22 4390 Cont Rev Form is essential for a diverse audience including individual taxpayers, accountants, financial analysts, and compliance officers. Essentially anyone involved in managing revenue streams or financial reporting processes may find this form pertinent. For instance, small business owners must complete this form to ensure proper reporting of income on their tax returns.

Additionally, organizations undergoing audits or applying for various funding opportunities, such as grants, might also require this document. These groups must fully understand their responsibilities to utilize this form effectively within compliance frameworks or legal stipulations.

Preparing to fill out the 02-22 4390 Cont Rev Form

Before diving into the completion of the 02-22 4390 Cont Rev Form, it's crucial to gather all necessary information and documentation. Relevant data may include previous financial statements, tax returns, and specific details regarding continuous revenue streams. Compiling this information beforehand can significantly ease the filling process and reduce the chances of errors.

Another essential aspect is organizing this data efficiently. One way to do this is by creating a checklist of all required information and documents. This strategy not only helps keep track of your progress but also ensures that no critical information is overlooked during the form completion.

Key terminology defined

Understanding key terms is crucial in accurately completing the 02-22 4390 Cont Rev Form. Some of the terminology includes:

Step-by-step guide to completing the form

Accessing the 02-22 4390 Cont Rev Form is straightforward with pdfFiller. Begin by visiting the platform and utilizing the search function to locate the specific form. Once found, you have the option to either complete it online or download it as a PDF.

For complete accuracy, it's vital to fill out each section properly. Let's break down each part of the form:

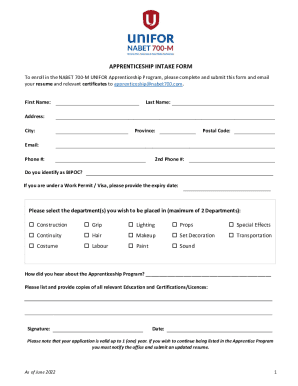

Section 1: Personal information

This section typically includes spaces for your name, contact information, and any relevant identification numbers. Make sure to input this information precisely as it appears on other official documents to avoid discrepancies.

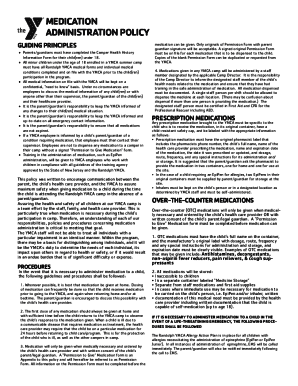

Section 2: Financial details

In this section, you will encounter critical financial questions, which may require details about your revenue sources, expenses, and assets. Here, accuracy is paramount; ensure you double-check your figures. Common mistakes in this section include misreporting revenue or omitting expenses.

Section 3: Declarations and signatures

This final section mandates your confirmation of the information provided. You must sign and date the form, acknowledging the accuracy of your responses. Utilizing pdfFiller's eSigning feature is the most efficient way to complete this step.

Editing and managing your 02-22 4390 Cont Rev Form

Once you have filled out the 02-22 4390 Cont Rev Form, you may need to make edits or add clarifications. pdfFiller offers robust editing tools allowing users to modify text, insert comments, and highlight important sections effectively.

When working collaboratively, sharing the form with team members is easy with pdfFiller’s sharing options. Team members can view, comment, or edit the document in real-time, enhancing teamwork and reducing the time taken to finalize the form.

Common challenges and solutions

While filling out the 02-22 4390 Cont Rev Form, some users face challenges that can hinder the completion process. Among the most frequently encountered issues are misinterpretation of questions, missing information, and technology-related problems.

To address these issues, it’s essential to review the form carefully prior to starting. Ensuring you have a clear understanding of each section can minimize errors. Additionally, if technology issues arise, consult pdfFiller's customer support for immediate help.

Submitting the completed 02-22 4390 Cont Rev Form

Before submitting the 02-22 4390 Cont Rev Form, conduct a final review to confirm that all required fields are filled, and all necessary documentation is attached. A good practice is to create a submission checklist to avoid overlooking any critical components.

pdfFiller simplifies the submission process, allowing you to choose between electronic submission or printing the form. Opting for electronic submission often leads to faster response times, and tracking the status of your submission can be facilitated through pdfFiller’s integrated tools.

Post-submission steps

After submitting the 02-22 4390 Cont Rev Form, it's important to manage expectations regarding timelines for processing. Depending on the nature of the submission, the timeframe can vary. Checking back regularly and preparing for follow-up communications is a smart strategy.

Utilizing pdfFiller for document management post-submission allows you to store and retrieve your submitted forms easily. Maintaining organized digital records will facilitate future submissions and enhance your overall document management efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 02-22 4390 cont rev in Gmail?

How do I edit 02-22 4390 cont rev in Chrome?

Can I create an electronic signature for the 02-22 4390 cont rev in Chrome?

What is 02-22 4390 cont rev?

Who is required to file 02-22 4390 cont rev?

How to fill out 02-22 4390 cont rev?

What is the purpose of 02-22 4390 cont rev?

What information must be reported on 02-22 4390 cont rev?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.