MERS mortgage language has form: Navigating the complexities of mortgage documentation

Understanding MERS and its role in mortgages

Mortgage Electronic Registration Systems (MERS) plays a pivotal role in modern mortgage processing, acting as a central database for tracking ownership and transfers of mortgage loans. Established in the 1990s, MERS was created to streamline the process of mortgage finance by providing an electronic registry that simplifies the tracking of mortgages and changes in mortgage ownership.

With MERS, mortgages are registered electronically, which reduces paperwork and expedites the closing process significantly. This integration has allowed lenders and servicers to manage their mortgage portfolios more effectively, ensuring greater efficiency and transparency throughout the lending process.

In a financial landscape increasingly reliant on technology, MERS is significant not only for lenders but also for borrowers seeking clarity and security in their home loans. Understanding how MERS functions and the specific language used in MERS documentation is essential for all stakeholders involved.

MERS mortgage language explained

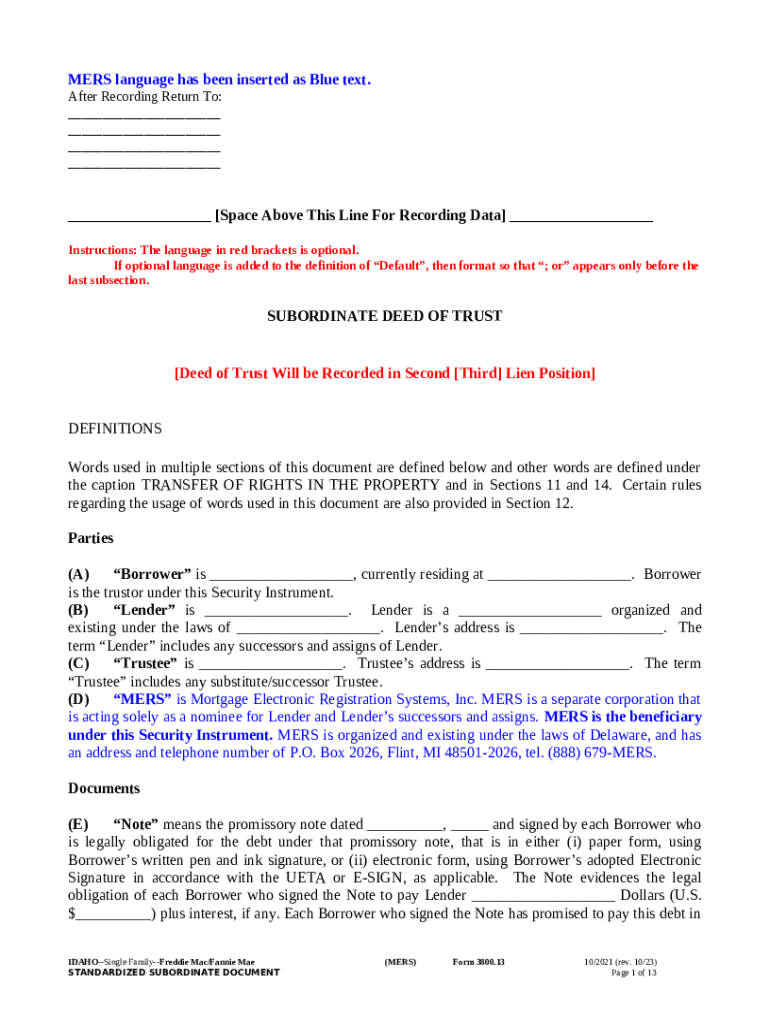

MERS mortgage language refers to the specific terminology and phrases used in the legal documents associated with mortgages registered with MERS. One of the most important terms is ‘MERS as Original Mortgagee,’ designating MERS as the initial holder of the mortgage, even if the actual lender changes over time.

Accurate language in mortgage forms is crucial to ensure legal standing and clarity for both borrowers and lenders. Any ambiguity in the language could lead to disputes regarding ownership, rights, and responsibilities, which is why understanding and utilizing the correct MERS terminology is so important in mortgage transactions.

How the MERS system functions

The MERS system operates within the mortgage lifecycle by tracking the ownership changes of mortgage loans, which begins at the closing process. Initially, when a loan is originated, the lender registers the loan with MERS, providing details such as the borrower's information, the loan amount, and the property address.

During the mortgage closing process, all involved parties ensure MERS is properly named as the mortgagee in the legal documents. This ensures that, as the loan is sold or transferred to different financial institutions, MERS maintains a consistent record of ownership. The contrast between MERS and traditional mortgage processing lies in the reduced need for chain-of-title documentation, which can be cumbersome and fraught with potential legal issues.

Benefits of utilizing MERS for lenders and borrowers

MERS provides significant benefits to both lenders and borrowers. For lenders, one of the primary advantages is the streamlined mortgage registration process enabled by MERS, allowing for faster processing times and reduced administrative burdens. This efficiency often translates directly into cost savings, enabling lenders to offer more competitive rates.

Borrowers also reap benefits from MERS loans, including enhanced tracking of their mortgage accounts and transparency regarding loan transfers. With MERS, borrowers have a clear record of their mortgage history, which can help in understanding their rights and obligations throughout the life of the loan. Moreover, the standardized processes associated with MERS can simplify the experience for first-time homebuyers.

The MERS registration process

Registering a loan with MERS can be broken down into several key steps. First, the lender must create a MERS account, providing necessary information about the institution and its authorized representatives. Following this, the loan must be entered into the MERS system, which requires basic loan details and borrower information.

The necessary documentation includes the mortgage note, security instrument, and any associated loan origination documents. Common pitfalls during registration include incorrect information entry, failure to designate MERS properly as the mortgagee, or overlooking to record subsequent transfers of beneficial interest in the mortgage.

Legal considerations involving MERS language

When it comes to designating MERS as the mortgagee, there are significant legal implications to consider. Primarily, the designation allows MERS to enforce the terms of the mortgage and pursue foreclosure, should the need arise. However, this has led to disputes over whether MERS has proper standing in courts to initiate legal proceedings, which has resulted in varying case law across different jurisdictions.

It's also essential for borrowers to understand their rights in relation to MERS documents. Clarity regarding loan terms and conditions, as well as understanding obligations towards MERS, can prevent legal challenges and ensure the borrower is fully informed about their loan status.

FAQs about MERS and its mortgage language

Understanding how MERS interacts with public land records is a common inquiry. MERS loans are recorded in a centralized electronic system rather than individual county land records, which can streamline the way titles are managed but can also lead to confusion regarding public ownership records.

What happens if a borrower defaults on a loan registered with MERS? In default situations, MERS facilitates the process for lenders to take necessary actions, including foreclosure.

Are there limits on the types of loans that can use MERS? Generally, MERS can be used for most residential mortgages, although it’s essential to check specific state regulations on the subject.

MERS for different stakeholders

For lenders, leveraging MERS effectively can enhance service offerings significantly. A few tips include establishing service-level agreements that promote transparency and maintaining communication with borrowers about how MERS impacts their loans. Lenders should also prioritize training staff to handle MERS-related queries adeptly.

Borrowers, on the other hand, should come prepared with key questions when engaging with lenders about MERS usage. Inquiries about how MERS impacts loan servicing or what documentation is required at closing can clarify many concerns. Additionally, understanding consumer protection measures tied to MERS can empower borrowers throughout the mortgage lifecycle.

The future of MERS in mortgage transactions

The ongoing evolution of the MERS system illustrates a shifting landscape in mortgage transactions. Increasingly, there is a focus on technology integration, such as utilizing blockchain for enhanced security and transparency in transactions. This innovation has the potential to drastically improve the accuracy and reliability of mortgage documentation.

Predictions for MERS and mortgage processes moving forward suggest greater automation and improved efficiencies in document management. Stakeholders will benefit from more reliable data tracking, while borrowers will experience enhanced access to their mortgage records, affirming MERS’ crucial role in streamlining the mortgage system.

Working with pdfFiller for MERS mortgage language

As users navigate the complexities of MERS mortgage language, pdfFiller provides a user-friendly platform for creating and editing MERS compliant forms. The cloud-based nature of pdfFiller ensures users can access documents from anywhere, collaborating seamlessly across teams.

With pdfFiller, eSigning and managing documents are made simple, removing obstacles that typically hinder timely processing. This ease of use is essential as it aligns perfectly with the needs of those looking to adopt MERS in their mortgage transactions, supporting stakeholders throughout the documentation process.

Common mistakes in MERS mortgage forms

Filling out MERS forms requires careful attention to detail. Common mistakes include incorrect borrower details, failing to properly identify MERS as the mortgagee, or poorly formatted documentation. These errors can lead to delays in approval or even legal complications.

To ensure compliance with MERS requirements, best practices include double-checking all entries for accuracy, utilizing templates provided by pdfFiller, and training personnel in the specific language and requirements of MERS documentation to minimize errors.

Resources for further learning

For those seeking to deepen their understanding of MERS mortgage language, pdfFiller offers comprehensive guides and templates specifically tailored to MERS. Participating in webinars and workshops can also enhance knowledge regarding navigation and compliance in mortgage documentation.

For personalized assistance with MERS forms, reaching out to customer support channels provided by pdfFiller can make the difference when confronting challenges in document management.