Get the free Your Comprehensive Tax Prep Checklist

Get, Create, Make and Sign your comprehensive tax prep

How to edit your comprehensive tax prep online

Uncompromising security for your PDF editing and eSignature needs

How to fill out your comprehensive tax prep

How to fill out your comprehensive tax prep

Who needs your comprehensive tax prep?

Your Comprehensive Tax Prep Form: A Step-by-Step Guide

Understanding your comprehensive tax prep form

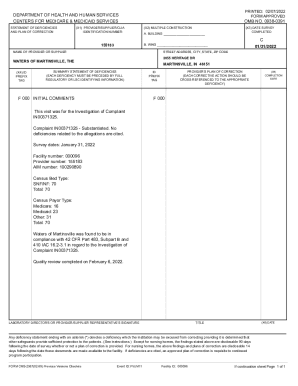

A comprehensive tax prep form is a crucial document used during tax season that consolidates all necessary information for individuals and businesses to prepare their tax returns efficiently and accurately. This form streamlines the process, ensuring taxpayers gather all required data in one place, reducing the risk of missing critical information.

Accurate tax preparation is vital not only for compliance with tax regulations but also for optimizing potential refunds and minimizing audits. The information contained in your comprehensive tax prep form dictates how your tax obligations are calculated, making it essential to understand its components thoroughly.

pdfFiller simplifies the tax preparation process through its user-friendly platform, allowing you to create, edit, eSign, and manage your tax prep forms seamlessly from any device with internet access. This feature ensures that your documents are always up-to-date and accessible when you need them.

Essential documents needed for filing your taxes

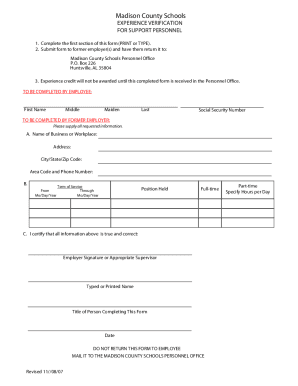

Gathering the right documents is indispensable for completing your comprehensive tax prep form correctly. Here’s a list of essential documents you’ll need:

Filling out your comprehensive tax prep form

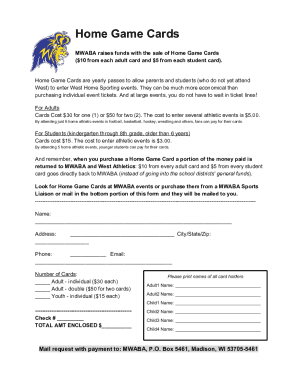

Once you have gathered all necessary documents, filling out your comprehensive tax prep form involves a systematic approach. Here’s a step-by-step breakdown of how to complete it:

To avoid common errors, always double-check your entries, confirm figures, and review documentation. Make use of pdfFiller’s platforms to minimize errors with real-time editing capabilities.

Utilizing pdfFiller for your form needs

Managing your tax prep form becomes easier with pdfFiller's intuitive features designed specifically for tax preparation. You can access and use pdfFiller’s tax prep capabilities to enhance your filing experience.

Moreover, pdfFiller offers interactive tools such as an auto-save functionality to prevent loss of information and a template library to help you find various forms needed for your specific tax situation.

Collaborating and managing your tax documents

Sharing your comprehensive tax prep form with advisors or family members is seamless through pdfFiller. By utilizing the platform's collaboration features, you can invite others to view or edit your documents without compromising their security.

This collaborative approach not only enhances your efficiency but also reassures you that important information is shared securely.

Frequently asked questions (FAQs)

When navigating tax preparation, you may have several questions. Here are some FAQs to provide clarity:

Specialized support options

For those who prefer a hands-on approach to tax preparation, numerous resources are available. Do-it-yourself tax preparation can be successfully accomplished for many individuals.

Preparing for next year's taxes

Effective tax preparation isn't just limited to tax season; it involves ongoing organization throughout the year. By adopting a proactive approach, you set yourself up for success in future filings.

Your path to confident tax filing

Filing taxes can be daunting, but having a structured plan and the right tools helps build confidence. With your comprehensive tax prep form and pdfFiller’s innovative features, you can navigate the tax landscape effectively.

Tailored solutions for diverse tax situations

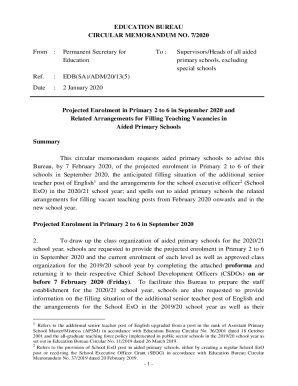

Tax preparation isn't one-size-fits-all; different situations require specific approaches, especially for self-employed individuals, families, and business owners. Here’s how you can tailor your tax approach:

Staying updated: Tax tools and tips

Remaining informed about tax changes and deadlines is fundamental to successful tax preparation. Regularly updating your knowledge can provide significant advantages.

Engaging with the tax preparedness community

Joining the tax preparedness community can be beneficial as you navigate your tax journey. Online forums, social media groups, and webinars provide valuable platforms for sharing experiences, asking questions, and learning from others.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the your comprehensive tax prep in Gmail?

Can I edit your comprehensive tax prep on an iOS device?

How do I edit your comprehensive tax prep on an Android device?

What is your comprehensive tax prep?

Who is required to file your comprehensive tax prep?

How to fill out your comprehensive tax prep?

What is the purpose of your comprehensive tax prep?

What information must be reported on your comprehensive tax prep?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.