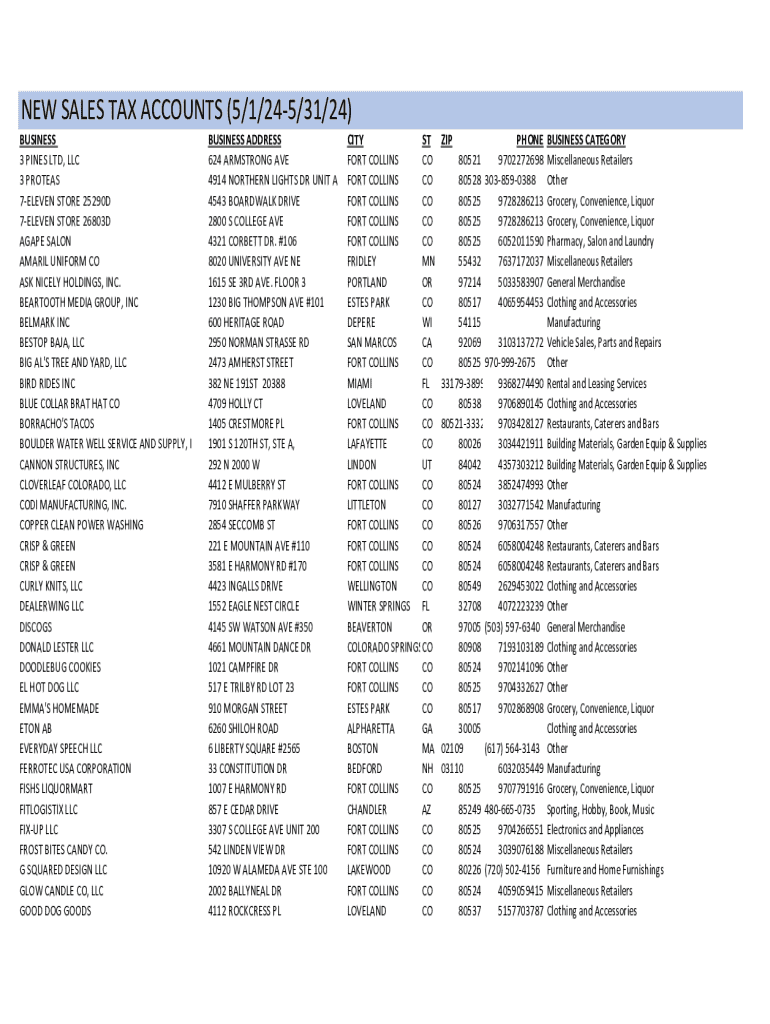

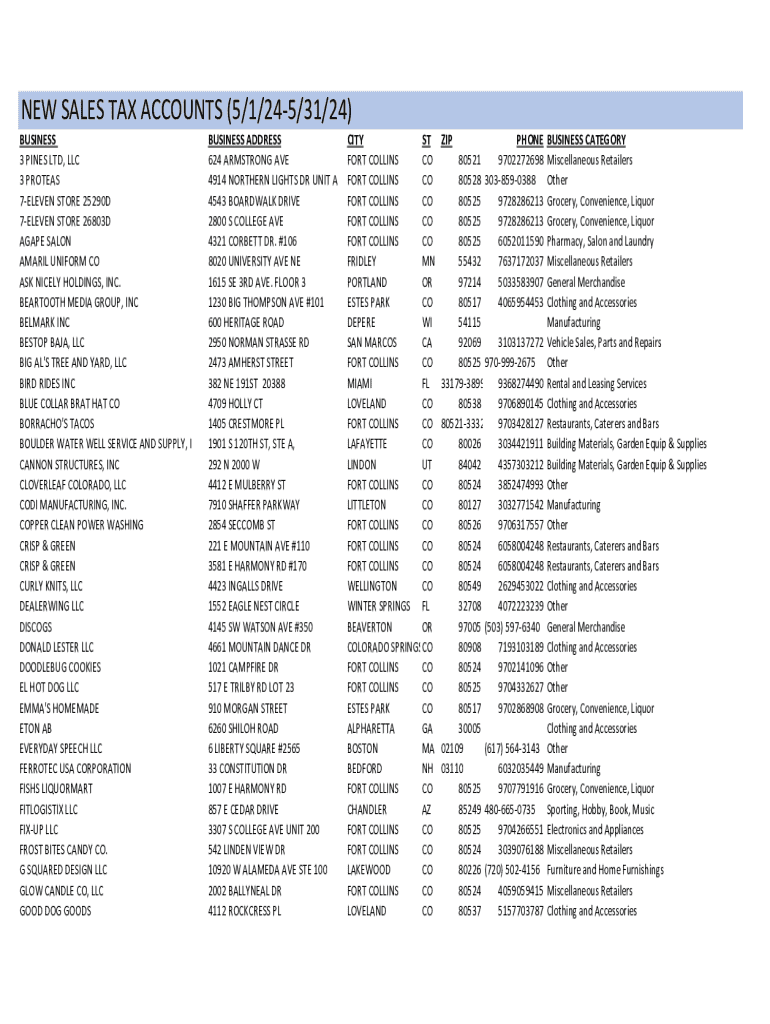

Get the free NEW SALES TAX ACCOUNTS (5/1/24-5/31/24)

Get, Create, Make and Sign new sales tax accounts

Editing new sales tax accounts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new sales tax accounts

How to fill out new sales tax accounts

Who needs new sales tax accounts?

Everything You Need to Know About the New Sales Tax Accounts Form

Understanding the new sales tax accounts form

The new sales tax accounts form is a critical document for businesses in the United States seeking to register for sales tax collection. This form is a mandatory requirement, enabling state tax authorities to keep track of businesses that operate within their jurisdictions. Completing this form not only legitimizes your business operations but also ensures compliance with state tax regulations.

Sales tax registration is vital because it allows businesses to charge sales tax on sales of tangible goods and certain services. Failing to register can lead to penalties, back taxes, and legal repercussions. Leveraging tools like pdfFiller for form management streamlines this process, ensuring that businesses can easily access, fill out, and submit their sales tax accounts form seamlessly.

Who needs to complete the new sales tax accounts form?

The new sales tax accounts form is essential for various stakeholders, particularly business owners. Anyone operating a retail space or providing taxable services must fill out this form to ensure their compliance with local sales tax laws. This demographic spans from small business owners selling goods online to larger retail chains, emphasizing the document’s broad relevance.

Additionally, out-of-state retailers and remote sellers need to be aware of their responsibilities, especially since states are enacting laws that require them to collect sales tax, regardless of their physical presence in that state. This shift in regulation means that even online merchants must assess their obligations regarding sales tax registration.

Preparing to fill out the new sales tax accounts form

Before you begin filling out the new sales tax accounts form, collecting the necessary information and documentation is vital. Key pieces of data include your business identification numbers such as the Employer Identification Number (EIN), state registration numbers, and details regarding your legal business entity structure. Additionally, you must gather financial and tax information to ensure accurate reporting.

It's beneficial to organize your documents systematically. Creating a checklist can streamline the process, ensuring you don't miss any crucial details while completing the form. Confirming the accuracy of your reported figures will also prevent potential delays in the registration process.

Step-by-step guide: filling out the new sales tax accounts form

To fill out the new sales tax accounts form efficiently, follow this step-by-step guide. Start by creating your pdfFiller account, which allows for easy document management. Signing up is straightforward — simply visit the pdfFiller website and fill out the registration form, or use an existing account if available.

Once your account is set up, navigate to the pdfFiller dashboard. From here, you can locate the new sales tax accounts form in the templates section. As you begin to fill out the form, pay careful attention to each section to ensure complete and accurate information is provided.

Editing and customizing your form

One of the standout features of pdfFiller is its robust editing tools, which allow you to enhance your new sales tax accounts form seamlessly. After filling out the form, you can add additional information or disclosures that may be relevant to your business context. This functionality is particularly useful for businesses with unique circumstances or specialized services that require extra clarification.

Once the form is tailored to your specifications, make sure to electronically sign and date the form within pdfFiller to ensure its validity. This electronic signature feature is not only convenient but also secure and compliant with legal standards.

Submitting your new sales tax accounts form

After completing and customizing your form, the next step is submission. You will have several options, including online submission via pdfFiller and traditional offline methods. Submitting electronically has the advantage of immediacy and often provides a confirmation receipt on submission.

If you choose to submit the form online, follow the guided prompts within pdfFiller. Make sure to keep a copy of your submission confirmation, as this can serve as evidence of compliance and protect you in case of disputes regarding your registration status.

Post-submission actions and what to expect

Once your new sales tax accounts form has been submitted, it’s essential to monitor its status. You can regularly check your application status through your pdfFiller account or by contacting the local tax authority. Common issues may arise regarding the accuracy of provided information or additional required documentation.

Expect a timeframe for approval that may vary by state, typically ranging from a few days to several weeks. During this period, it's advisable to keep an eye on your email for any communication from tax officials.

Managing your sales tax accounts within pdfFiller

Once your sales tax account is approved, you can conveniently manage all documentation within your pdfFiller account. You can easily access approved certificates and other related documents through the platform. Additionally, if there are changes to your business information post-registration, pdfFiller allows for quick updates, ensuring your records are always current.

Navigating the pdfFiller dashboard for account management tasks is user-friendly. The ability to track changes, access forms, and submit updates without hassle enhances the overall efficiency of managing sales tax documentation.

Frequently asked questions (FAQs) on the new sales tax accounts form

Several common concerns often arise regarding the new sales tax accounts form. For instance, many users question what to do if they make a mistake on their form. Typically, you can resubmit a corrected form; however, contacting the tax office for specific instructions is advisable.

Another frequent query pertains to the registration timeframe. While most registrations are processed within a few days, some states may take longer, especially if additional documentation is required. Lastly, missing a deadline can lead to penalties, but in many cases, tax agencies offer options for amending late filings.

Best practices for sales tax compliance

Ensuring consistent sales tax compliance is crucial for all businesses. Regular updates are imperative, as tax laws can evolve, and your business model may also change. Utilizing pdfFiller for ongoing document management provides an effective solution to address compliance effectively.

Integrating sales tax management into your daily business processes will not only simplify compliance but also foster a culture of accountability within your organization. Staying informed about recent tax law changes and actively updating your records will yield long-term benefits.

Explore related documents and forms

Beyond the new sales tax accounts form, pdfFiller offers access to a variety of other sales tax forms unique to different states. Understanding these forms and how they can work in conjunction with your sales tax registration is beneficial for comprehensive tax management.

It is essential to compare different tax forms related to sales tax to ensure that all obligations are met, especially when operating across state lines. Utilizing pdfFiller's platform makes it simple to start with other necessary documents, promoting efficiency in your sales tax management process.

Engagement and community support

Joining the pdfFiller user community can provide invaluable support as you navigate the complexities of the new sales tax accounts form and other related documentation. Engaging with fellow users facilitates the sharing of experiences and best practices, enhancing your document management capabilities.

Additionally, connecting with pdfFiller through social media can keep you updated on the latest features, resources, and helpful tutorials. Being an active participant in community discussions can also enrich your understanding and usability of the platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit new sales tax accounts from Google Drive?

How do I edit new sales tax accounts in Chrome?

Can I create an eSignature for the new sales tax accounts in Gmail?

What is new sales tax accounts?

Who is required to file new sales tax accounts?

How to fill out new sales tax accounts?

What is the purpose of new sales tax accounts?

What information must be reported on new sales tax accounts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.