Get the free Securities Subscription Agreement between the Registrant ...

Get, Create, Make and Sign securities subscription agreement between

Editing securities subscription agreement between online

Uncompromising security for your PDF editing and eSignature needs

How to fill out securities subscription agreement between

How to fill out securities subscription agreement between

Who needs securities subscription agreement between?

Understanding the Securities Subscription Agreement Between Form

Overview of securities subscription agreement

A Securities Subscription Agreement is a legal document that outlines the terms agreed upon between an investor and a company for the purchase of securities. This document plays a vital role in corporate finance, enabling companies to secure capital in exchange for equity or debt instruments. Given the critical nature of funding for business growth, these agreements have evolved significantly over time, adapting to changes in regulatory frameworks and market dynamics.

Historically, subscription agreements have transitioned from basic, informal understandings among parties to comprehensive documents that address a variety of complex issues. This evolution highlights a growing recognition of the need for clarity and legal protections for all parties involved.

Key components of a securities subscription agreement

A securities subscription agreement must include several key components to ensure that all parties understand their rights and obligations. Common elements include:

For instance, a typical representation might assert that the investor has the financial capacity to invest, while an indemnification clause might specify the responsibilities if legal issues arise post-agreement.

Differences between securities subscription agreements and purchase agreements

It’s essential to distinguish between securities subscription agreements and purchase agreements, although they are often confused. A securities subscription agreement is primarily focused on the subscription process where an investor commits to purchasing securities. In contrast, a purchase agreement finalizes the sale and transfer of securities from the issuing company to the investor.

Key distinctions include:

Regulatory framework governing securities subscription agreements

Securities subscription agreements are governed by a complex regulatory framework primarily defined by the Securities Exchange Commission (SEC) in the United States. Compliance with applicable securities laws is critical, as failure to adhere can lead to severe penalties. For instance, Regulation D, particularly Rule 506(b) and Rule 506(c), provides guidelines on how private companies can raise capital through securities offerings.

Rule 506(b) allows companies to raise unlimited funds from accredited investors, but they cannot engage in general solicitation or advertising. In contrast, Rule 506(c) permits general advertising, but all purchasers must be accredited investors. Understanding these regulations is crucial for companies to structure their securities offerings responsibly and effectively.

Advantages of using a securities subscription agreement

Using a securities subscription agreement offers several advantages for companies looking to raise capital. These advantages include:

This clarity and structure bolster investor confidence and can facilitate future fundraising rounds, as companies are viewed as organized and professional.

Disadvantages to consider

Despite the advantages, there are also disadvantages worth considering regarding securities subscription agreements, including:

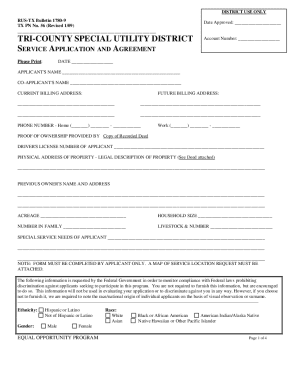

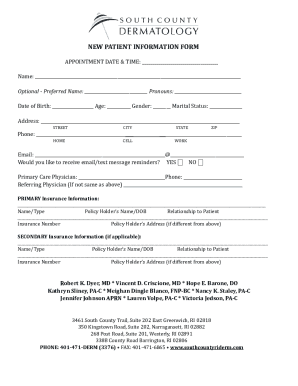

Practical steps in filling out a securities subscription agreement

Filling out a securities subscription agreement requires attention to detail. Here’s a practical step-by-step guide to completing the form:

By meticulously completing each section, all parties minimize the risk of errors and miscommunication.

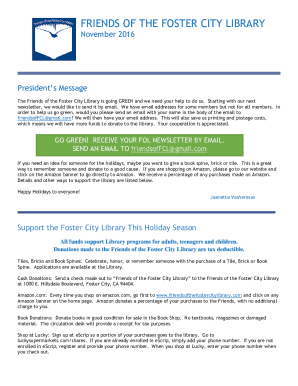

Interactive tools for creating subscription agreements

pdfFiller provides an excellent platform for simplifying the document creation process, especially for securities subscription agreements. The features offered on pdfFiller enhance the user experience significantly:

These tools make it easier for individuals and teams to manage their subscription agreements without cumbersome administrative tasks.

Common challenges in drafting and managing subscription agreements

Drafting and managing securities subscription agreements can pose several challenges. Some common pitfalls to be aware of include:

By recognizing and addressing these challenges early in the process, companies can create subscription agreements that are clear, compliant, and effective.

Best practices for managing securities subscription agreements

To ensure effective management of securities subscription agreements, it’s essential to adopt specific best practices, such as:

Implementing these practices can significantly enhance the effectiveness and transparency of the process.

Resources and tools for legal professionals

For legal professionals involved in drafting securities subscription agreements, several resources can streamline the process. Templates specific to various types of agreements help ensure compliance and foster efficiency. Additionally, toolkits and practical notes can assist in managing the various aspects of agreements and keeping abreast of best practices.

Furthermore, exploring popular topics and recent trends in securities subscription agreements can provide invaluable insights that enhance the quality of legal work produced.

Frequently asked questions (FAQs)

When preparing for a securities subscription agreement, it's common to have questions. Here are a few frequently asked inquiries:

These FAQs help clarify the critical aspects of securities subscription agreements.

Related topics to explore

Beyond securities subscription agreements, there are various related topics to consider, including other contract forms linked to securities operations. Delving into transactional law considerations can illuminate how these agreements fit within the broader financial landscape. Furthermore, conducting comparative analyses with other financial instruments can provide deeper insight into best practices and strategic considerations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send securities subscription agreement between for eSignature?

Where do I find securities subscription agreement between?

How do I make edits in securities subscription agreement between without leaving Chrome?

What is securities subscription agreement between?

Who is required to file securities subscription agreement between?

How to fill out securities subscription agreement between?

What is the purpose of securities subscription agreement between?

What information must be reported on securities subscription agreement between?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.