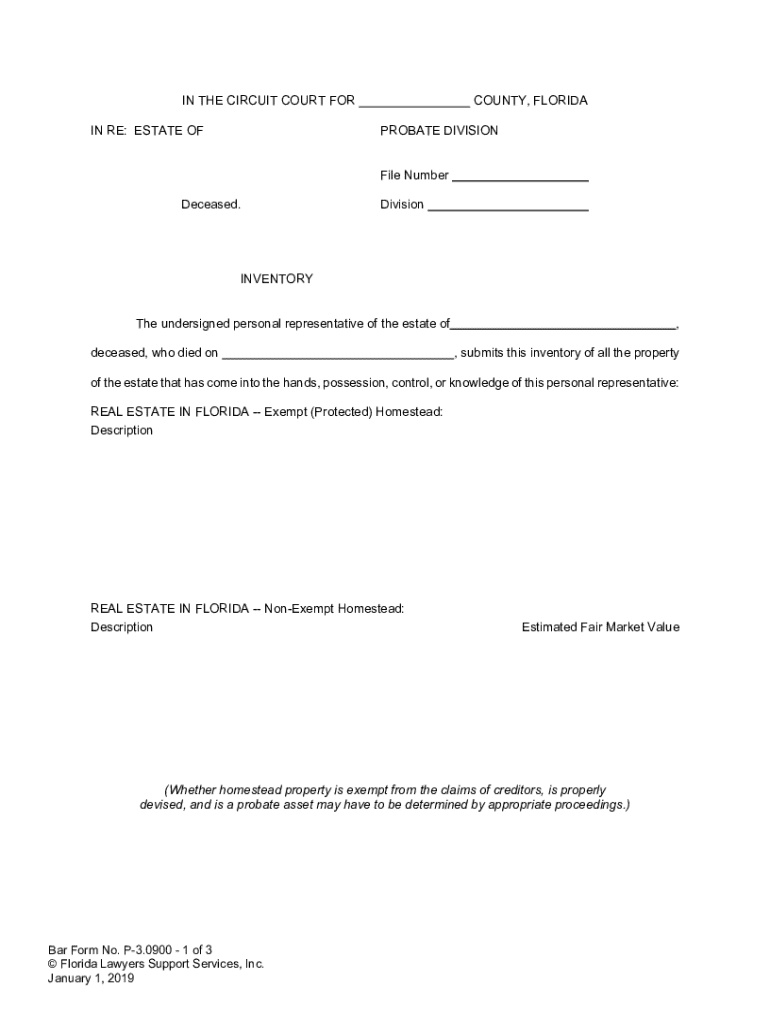

Get the free ESTATE OF File No. Division Deceased. PETITION TO ...

Get, Create, Make and Sign estate of file no

How to edit estate of file no online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estate of file no

How to fill out estate of file no

Who needs estate of file no?

A comprehensive guide to the estate of file no form

Understanding the estate of file no form

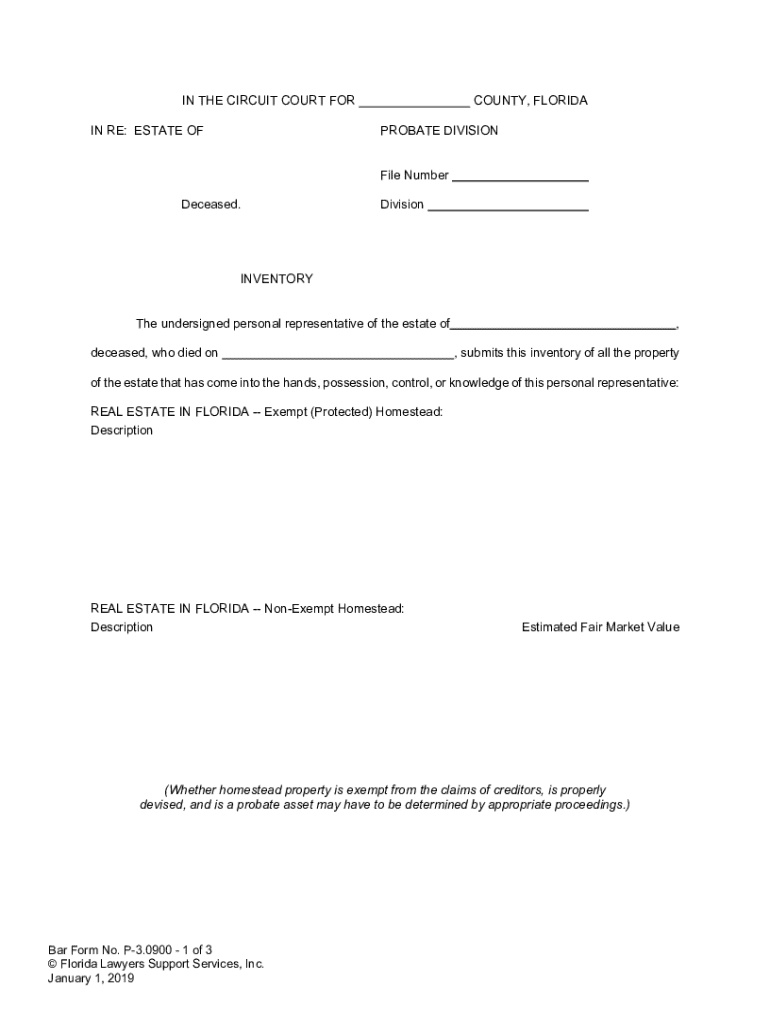

The estate of file no form serves a critical function in the world of estate management, enabling individuals to consolidate and declare their assets, liabilities, and other essential information regarding their finances. This form essentially acts as a formal record of an individual's financial standing at the time of filing. The purpose of this documentation extends beyond mere record-keeping; it ensures transparency and accountability during the management of estates, especially in legal proceedings such as probate.

Proper documentation can significantly affect the management process, influencing how estates are settled, taxes are assessed, and inheritance is divided among heirs. Inadequate or incorrect filings may lead to legal disputes, prolonged probate processes, or financial repercussions for surviving relatives.

What to include in your estate of file no form

Completing the estate of file no form requires careful attention to detail. The required information can be categorized into three primary sections: personal data, asset declarations, and liabilities and debts. Each segment provides necessary insights necessary for a thorough assessment of the estate.

When filling out the form, ensure you provide accurate and honest information. This will help avoid complications later on in the estate management process, such as potential audits or disputes over the ownership of assets.

Step-by-step instructions for filling out the estate of file no form

Filling out the estate of file no form can seem daunting, but breaking it down into manageable steps can simplify the process significantly. Below are detailed instructions to guide you.

Step 1: Gather necessary documents

Before you start filling out the form, gather all essential documents. These may include:

Step 2: Completing the form

As you fill out the estate of file no form, ensure each section is completed accurately. Here are some tips for making this process easier:

Step 3: Review and edit your form

After completing the form, take the time to review and proofread your entries. Ensure all information is precise and up-to-date.

Utilize tools like pdfFiller to edit the document effortlessly, ensuring clarity and professionalism before submission.

Interactive tools for managing your estate of file no form

Managing the estate of file no form becomes hassle-free with interactive tools such as pdfFiller. This platform offers a user-friendly interface to edit PDFs, eSign documents, and collaborate securely.

FAQs related to estate of file no form

With the complexities surrounding the estate of file no form, you might have several questions. Here are some commonly asked ones:

Common mistakes to avoid in the filling process

Accurate completion of the estate of file no form is crucial. However, many individuals make common mistakes that can lead to complications. Here are several pitfalls to watch out for:

Understanding the implications of mismanagement

The implications of mismanaging the estate of file no form can be severe. Legal consequences often arise from incorrect filings, which can lead to challenges in court and potential loss of assets.

Additionally, financial repercussions such as estate taxes and fees may incur if the filings are deemed incorrect or fraudulent. Proper management of documentation ensures both legal compliance and financial security for heirs.

Resources for support and further learning

Navigating the complexities of estate management can be overwhelming, but numerous resources are available to assist you throughout the process. Legal professionals can provide personalized guidance on the estate of file no form.

Testimonials and case studies

Numerous individuals have successfully managed the estate of file no form with the help of tools like pdfFiller. For example, one family encountered challenges in organizing their financial details, but by using pdfFiller, they streamlined their document management process, ensuring accuracy and timely submission.

Many users have noted the ease of eSigning and storing their forms securely in the cloud, emphasizing how pdfFiller transformed their estate management experience.

Related topics for further exploration

The estate of file no form is one piece of a larger puzzle in estate management. Expanding your knowledge on related topics can provide deeper insights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in estate of file no?

Can I sign the estate of file no electronically in Chrome?

Can I edit estate of file no on an iOS device?

What is estate of file no?

Who is required to file estate of file no?

How to fill out estate of file no?

What is the purpose of estate of file no?

What information must be reported on estate of file no?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.