Get the free 2020-2025 Form UK HMRC P60(Single sheet) Fill Online ...

Get, Create, Make and Sign 2020-2025 form uk hmrc

Editing 2020-2025 form uk hmrc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2020-2025 form uk hmrc

How to fill out 2020-2025 form uk hmrc

Who needs 2020-2025 form uk hmrc?

2 form UK HMRC form: A Comprehensive How-To Guide

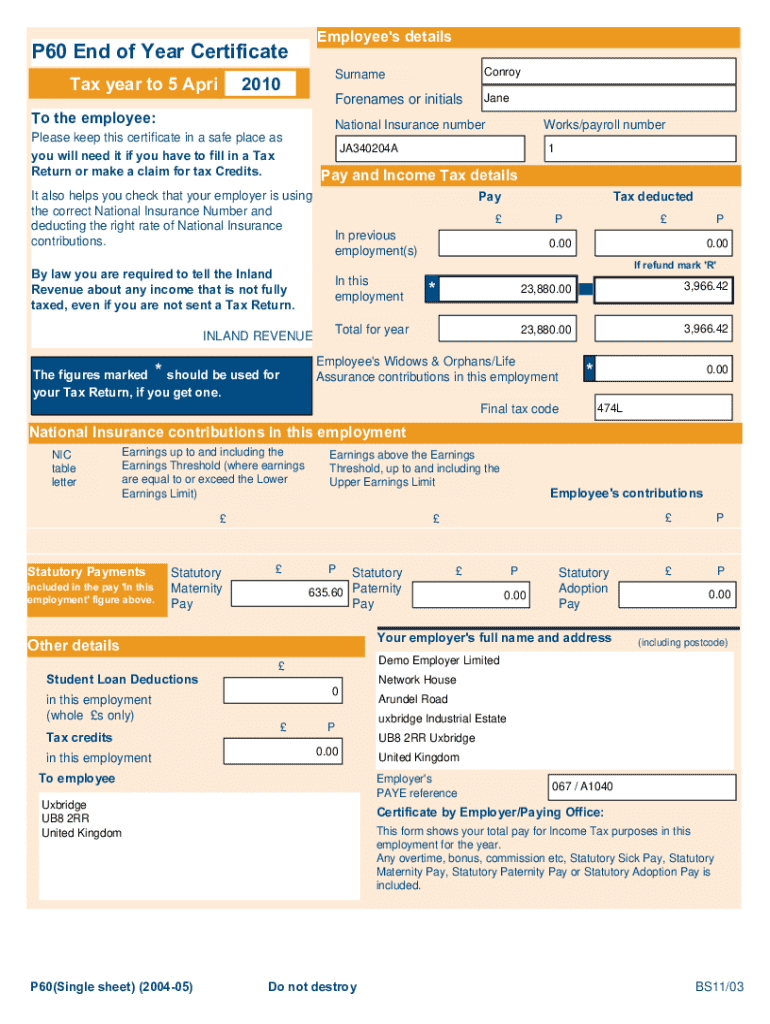

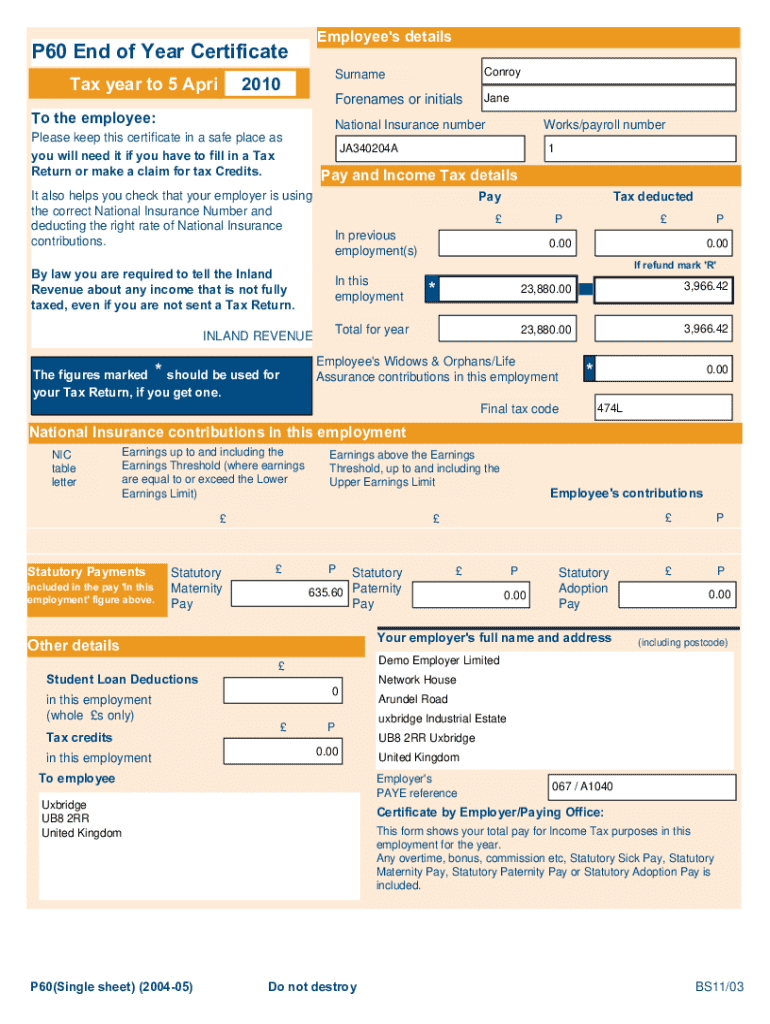

Understanding the 2 UK HMRC form

The 2 UK HMRC form plays a pivotal role for individuals and businesses navigating tax responsibilities. This form is integral for reporting income, calculating tax liabilities, and ensuring compliance with the UK tax regulations. Understanding its nuances is crucial, especially given the adjustments made in recent years that reflect changing fiscal policies. From 2020 to 2025, key changes have been introduced, enhancing clarity and usability for users.

In this section, we will delve into the significant shifts seen in the 2 HMRC form, especially those arising from the financial impacts of global events. The form now incorporates provisions for supporting the Self-Employment Income Support Scheme (SEISS) during the pandemic, showcasing its adaptability in real-world scenarios.

Types of HMRC forms available

HMRC provides a comprehensive array of forms tailored to various needs. Understanding these forms is essential for ensuring proper compliance and accurate tax reporting. Below is a list of significant HMRC forms relevant between 2020 and 2025:

Each of these forms serves specific functions and has notable deadlines for submission, such as the Self Assessment form due by 31 January each year. Being aware of these deadlines helps avoid penalties and late fees.

Step-by-step guide to completing the HMRC form

Completing the 2 UK HMRC form can be straightforward if you follow these detailed steps carefully.

Managing your HMRC documents

Efficient organization of your HMRC documents enhances overall productivity and compliance. Here are several techniques for effective management:

Implementing these best practices keeps your HMRC documents organized and ready for any audit or inquiry.

Interactive tools to enhance your HMRC experience

Utilizing interactive online tools can greatly improve your experience when dealing with HMRC forms. Tools like pdfFiller provide features for document management that make the process easier. Some key functionalities include:

These features not only streamline the process but also ensure that your documents meet HMRC standards.

Common questions and troubleshooting

Navigating HMRC forms can lead to various questions. Here are some frequently asked ones related to the 2 HMRC form:

Being proactive in seeking answers can alleviate stress and streamline compliance.

Advantages of using pdfFiller for HMRC forms

pdfFiller stands out as a premier solution when it comes to managing HMRC forms. Here’s how it simplifies the document creation process:

Numerous user testimonials underline the effectiveness of pdfFiller, highlighting efficiency and accuracy in filling out HMRC forms.

Staying updated on future HMRC changes

Keeping up with changes in tax laws and HMRC forms is crucial for compliance. Here are some strategies to remain informed:

Implementing these tactics will ensure you are not only compliant but also prepared for any upcoming changes in tax regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2020-2025 form uk hmrc on an iOS device?

Can I edit 2020-2025 form uk hmrc on an Android device?

How do I fill out 2020-2025 form uk hmrc on an Android device?

What is 2020-2025 form uk hmrc?

Who is required to file 2020-2025 form uk hmrc?

How to fill out 2020-2025 form uk hmrc?

What is the purpose of 2020-2025 form uk hmrc?

What information must be reported on 2020-2025 form uk hmrc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.