Get an Elevation Certificate National Form - How-to Guide

Understanding the elevation certificate

An elevation certificate is a crucial document that provides details about the elevation of your property in relation to the Base Flood Elevation (BFE) as determined by the Federal Emergency Management Agency (FEMA). This certificate is essential for determining flood insurance rates and compliance with local floodplain management regulations. Having an elevation certificate can significantly impact your flood insurance premiums and your ability to obtain insurance in high-risk flood areas.

Elevation certificates are particularly important in regions prone to flooding, where local authorities require developers and homeowners to establish a property's elevation before construction or renovation. Without this certificate, property owners may face higher insurance costs or even restrictions on obtaining flood insurance from the National Flood Insurance Program (NFIP).

Who needs an elevation certificate

Various stakeholders often need an elevation certificate. Homeowners seeking to ensure accurate flood insurance premiums or those buying or selling property in flood-prone areas will benefit from this document. Additionally, property developers are required to obtain elevation certificates for any new constructions or major renovations. Real estate professionals and insurance agents also need this certificate to address client needs accurately and navigate flood insurance complexities.

Homeowners: Need it for accurate flood insurance premiums.

Property developers: Required for new constructions.

Real estate professionals: To assist clients effectively.

Insurance agents: Needed to evaluate risks and premiums.

Types of elevation certificates

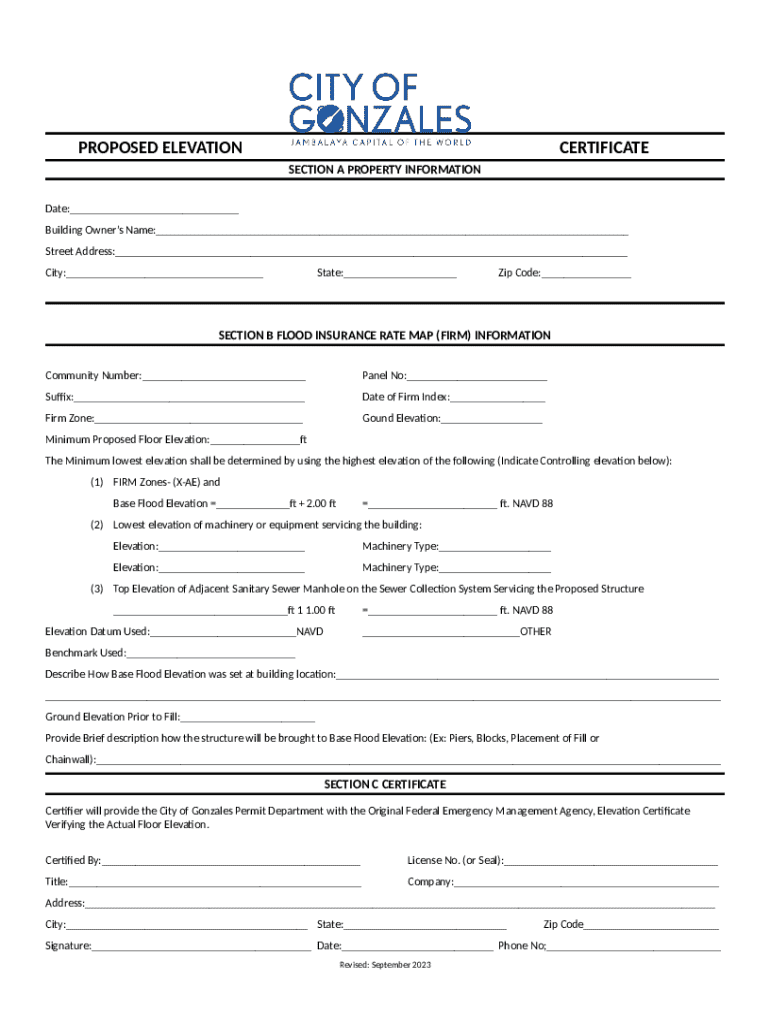

The most common elevation certificate is the FEMA Elevation Certificate, which is standardized and widely accepted across various jurisdictions. This certificate is vital in formal documentation for insurance and compliance purposes, requiring input from a licensed surveyor with experience in floodplain management. Understanding the key sections of the FEMA elevation certificate can help property owners ensure that all necessary information is accurately captured.

A few important sections within the FEMA elevation certificate include the property address, construction drawings, building diagram, and elevation data. Each of these elements plays a critical role in establishing flood risk and compliance. It is also crucial to familiarize yourself with the NFIP implications as the elevation certificate directly influences flood insurance premiums, limiting financial exposure in flood-prone areas.

NFIP implications

Elevation certificates are pivotal in determining flood insurance premiums under the National Flood Insurance Program (NFIP). Properties meeting or exceeding the BFE typically qualify for lower rates, while those below may face higher premiums. Understanding this relationship helps homeowners manage flood insurance costs effectively.

For example, a homeowner with an elevation certificate showing their property is a foot above the BFE may qualify for a significant insurance premium reduction compared to a similar home that is a foot below. Thus, proactive engagement with elevation certificate processes can yield significant financial benefits in managing flood risks.

Steps to obtain an elevation certificate

Acquiring an elevation certificate involves a structured process that requires attention to detail. The first step is to identify your need for the certificate. This can typically be done by assessing local floodplain regulations or consulting with zoning and floodplain management authorities. In some jurisdictions, specializing in nonstructural floodproofing strategies may provide guidance through this initial phase.

Identify if an elevation certificate is required for your property.

Find a qualified surveyor experienced in obtaining elevation certificates.

Request the survey, ensuring to provide all necessary site information.

Complete the elevation certificate form accurately, paying attention to critical sections.

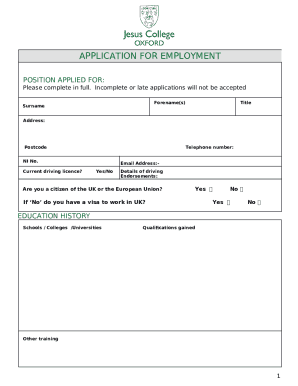

Finding a qualified surveyor can significantly impact the outcome of this process. Look for certified professionals who understand local floodplain regulations and possess credentials. During your selection process, inquire about their experience specific to elevation certificates and request recent references to confirm their reliability.

Requesting the survey

When you request the survey, you will need to provide specific information, including property documentation and any previous elevation certificates if available. Understanding the associated costs is also vital as they can vary based on location, property type, and surveyor’s rates. On average, homeowners might expect to pay anywhere from $300 to $1,000 for an elevation certificate.

Completing the form

Completing the national form requires careful attention to detail. The form consists of multiple sections that detail the property's characteristics and elevation information. Specifically, focus on the building diagram and elevation data sections, as accurate representation is crucial. Correctly documenting these details ensures authenticity and compliance, helping prevent future issues with flood insurance claims.

Key considerations when obtaining an elevation certificate

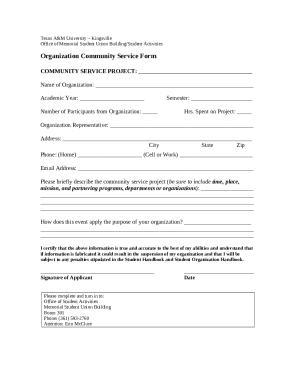

As you navigate the process of obtaining an elevation certificate, there are key considerations to bear in mind. First is the documentation you will need to provide. This includes essential property documents such as deeds, previous elevation certificates, zoning permits, and any relevant building permits. Ensuring all required documents are ready will streamline the submission process.

Understanding the accuracy of the data you provide is equally important. Misrepresentation or inaccuracies in the elevation data may lead to complications with flood insurance, potentially causing higher premiums or invalidating your coverage. Double-check data points and consult your surveyor to ensure all entries are correct and compliant with both FEMA and local regulations.

Review and approval process

After submitting your elevation certificate, you can expect a review process from the appropriate authorities. Typically, local zoning or floodplain management offices conduct this review to confirm compliance with existing regulations. Depending on the jurisdiction, you might receive feedback or additional requests for information if there are concerns regarding your application.

Understanding this review process will help you remain informed and prepared should any complications arise. Maintaining ongoing communication with the surveyor and local authorities can streamline responses to any requested adjustments, ensuring a smoother overall experience.

Using your elevation certificate

Once you have an elevation certificate in hand, the next important step is submitting it for the NFIP. This submission typically involves providing the certificate to your insurance agent, who will incorporate the information into your flood insurance policy. Having an elevation certificate can significantly reduce your premiums, but you must leverage the data points effectively and ensure all information aligns with your insurance provider's requirements.

In addition to submitting your certificate, it is essential to monitor when updates are necessary. Changes to your property, including renovations, expansions, or any alterations affecting the structure's elevation, necessitate an updated elevation certificate. Not only does this ensure ongoing compliance, but it also protects you from unexpected insurance liabilities as conditions evolve.

Common mistakes to avoid

Navigating the elevation certificate process can be complex, and several common mistakes can hinder your success. One frequent issue is misunderstanding FEMA requirements, resulting in incomplete or incorrect submissions. To mitigate this risk, familiarize yourself with requirements outlined in the FEMA program policy manual and other related documents.

Note the need for accuracy in section entries.

Ensure compliance with local regulations and codes.

Consult with experts to clarify challenging requirements.

Moreover, overlooking local regulations can significantly affect your certificate's approval. Local zoning ordinances may include specific compliance requirements that differ from FEMA’s guidelines. Staying updated through local newsletters or communications from zoning officials can aid in understanding these nuances, effectively preparing you to meet both local and national standards.

Conclusion: Embracing digital tools with pdfFiller

The elevation certificate process can be daunting, but embracing digital tools like pdfFiller simplifies document management. With pdfFiller, you can effortlessly edit and manage PDF forms, including elevation certificates, from any location. The platform's cloud-based solutions enable team collaboration, helping streamline document processes involved in obtaining and maintaining compliant elevation certificates.

Moreover, pdfFiller empowers users to maintain up-to-date documentation, ensuring ongoing compliance with regulations. By utilizing their robust features, you can stay organized and ensure that property management practices effectively mitigate risks related to flooding and insurance compliance, contributing to enhanced property reliability and sound decision-making.

Frequently asked questions (FAQ)

Costs can vary based on geography and property characteristics, typically ranging from $300 to $1,000.

The timeframe can range from a few days to several weeks, often depending on the complexity of the property and the surveyor's workload.

Only a licensed surveyor can accurately complete the form, ensuring compliance with FEMA's requirements.

If your property lies within designated flood zones and meets specific criteria, alternative assessments may be necessary.

Interactive tools

Use this calculator to budget for obtaining your elevation certificate effectively.

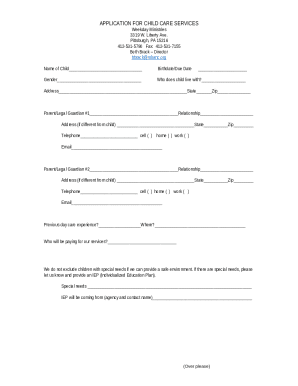

This checklist outlines all necessary documents you will need for the elevation certificate process.