Understanding the Annual Municipal Audit Form: A Comprehensive Guide

Overview of the annual municipal audit form

The annual municipal audit form serves as a crucial tool for assessing the financial health and compliance of local governments. This form is designed to record financial activity throughout the year, ensuring transparency and accountability in municipal operations. By submitting this form, municipalities demonstrate their commitment to sound financial management.

Municipal audits play an essential role in maintaining trust between local governments and their constituents. They provide a comprehensive overview of how public funds are managed and can highlight areas needing improvement. Key stakeholders in the audit process include municipal officials, independent auditors, state agencies, and, ultimately, the taxpayers who rely on accurate financial reporting.

Essential components of the annual municipal audit form

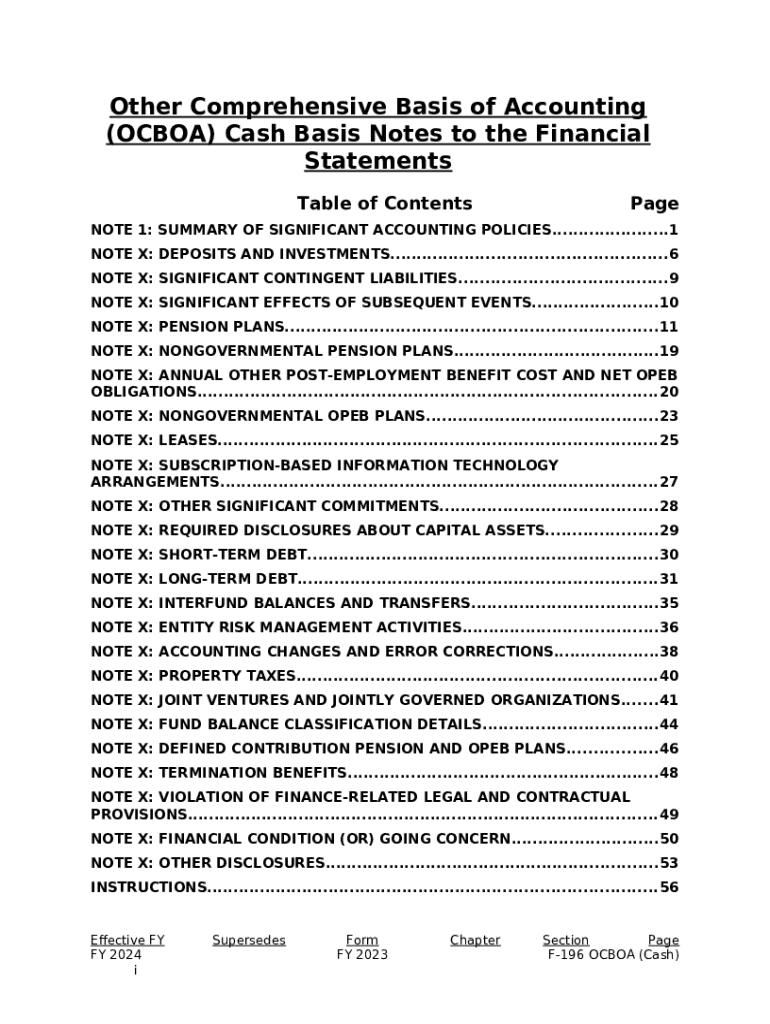

Understanding the components of the annual municipal audit form is vital for effective completion. The form typically includes several sections, encompassing general information about the municipality, financial statements, compliance data, and auditor responsibilities.

General Information: Basic data about the municipality, including name, address, and year of the audit.

Financial Statements: Detailed entries related to revenues, expenditures, assets, and liabilities.

Compliance Data: Information regarding legal and regulatory obstructions that need to be reported.

Auditor’s Responsibilities: Outline of the auditor's duties, including validating financial data and ensuring compliance.

Each section has specific instructions that guide the user through the completion process, ensuring all vital information is provided.

Step-by-step guide to completing the annual municipal audit form

Completing the annual municipal audit form requires meticulous preparation and attention to detail. Before diving into the form, certain preparation steps are essential to ensure accuracy and compliance.

Gather all financial records and previous audit reports to aid in accurate reporting.

Assign a team or individual responsible for completing each section of the form to enhance accountability.

A detailed walkthrough of filling out each section can prevent common mistakes. For instance, accurately inputting financial data and ensuring all compliance requirements are met is vital. Be particularly cautious with figures, as discrepancies can lead to audits being flagged for review.

Tips for editing and finalizing your audit form

Once the initial draft of the annual municipal audit form is complete, reviewing and finalizing the document is the next critical step. Utilizing best practices for document reviews enhances clarity and correctness.

Conduct thorough proofreading for spelling and numerical errors.

Use pdfFiller’s editing and eSigning features to make amendments promptly.

Ensure proper collaboration among team members to incorporate different insights and expertise.

Engaging all stakeholders in the review process can provide different perspectives and catch errors that might have been overlooked.

Submitting the annual municipal audit form

The submission process for the annual municipal audit form involves understanding specific requirements and timelines. Ensuring timely submission is crucial to avoid penalties or legal consequences.

Municipalities typically have specific deadlines for submitting the audit form, often mandated by local or state regulations.

Ensure that the necessary approvals from municipal officials and auditors are obtained before submission.

Moreover, municipalities can choose different submission methods, whether electronic or paper-based, which should align with jurisdictional guidelines. Tracking the status of submissions can provide peace of mind and ensure no steps are missed.

Managing audits with pdfFiller

pdfFiller offers robust document management solutions that streamline the handling of the annual municipal audit form. Users can leverage a cloud-based platform to access, edit, and store documents securely.

Cloud-Based Document Storage: Safely store and organize your audit forms in a centralized location.

Collaboration Features for Teams: Intra-team communication tools facilitate effective collaboration to improve form accuracy and completeness.

Utilizing these benefits through pdfFiller enhances the overall management of municipal audits, enabling teams to function efficiently and effectively.

Troubleshooting common issues with the annual municipal audit form

While completing the annual municipal audit form, common challenges may arise that can affect the ease of the process. Problems such as missing information or misunderstandings of compliance issues can derail submission efforts.

Missing Information: Ensure that all sections of the form are filled completely. Use checklists to verify.

Understanding Compliance Issues: Familiarize yourself with regulations governing municipal finances to avoid compliance pitfalls.

If mistakes occur post-submission, knowing how to rectify them promptly is essential. Seek out available resources for assistance.

Related forms and templates for municipal audits

In addition to the annual municipal audit form, other essential documents complement the audit process. These include budget forms and financial reporting forms, all of which serve different functions.

Budget Forms: Essential for planning and comparing financial expectations against actual results.

Financial Reporting Forms: Used to report periodic financial summaries and fulfill reporting requirements.

Understanding the relationship between these forms and the annual municipal audit form helps to reinforce a comprehensive audit strategy.

Frequently asked questions (FAQs) on the annual municipal audit form

Frequently asked questions concerning the annual municipal audit form often revolve around the nuances of the process. Key inquiries may include how to interpret compliance data or timelines for submission.

What are the consequences of late submission?

How can I ensure compliance with audit requirements?

Clarifying these misconceptions is vital for municipalities to navigate the audit process smoothly.

Contact information for support

For further assistance regarding the annual municipal audit form, pdfFiller provides excellent customer support. Users can reach pdfFiller through various channels for form-related questions, which helps ensure confidence when submitting audit forms.

In addition to pdfFiller, many government resources can offer invaluable guidance to ensure compliance and completion.

Recent updates and changes to audit requirements

Staying informed about recent legislative changes affecting municipal audits is essential for compliance. Various states have updated their auditing rules, affecting form requirements and processes. Regularly reviewing these changes ensures that municipalities can adapt and maintain compliance with evolving standards.

Changes in regulatory compliance requirements.

Updates to financial reporting formats.

Municipalities should frequently engage in professional development and training to remain aligned with these changes to foster transparency and accountability.