Get the free Jeanne Steines, Accountant

Get, Create, Make and Sign jeanne steines accountant

How to edit jeanne steines accountant online

Uncompromising security for your PDF editing and eSignature needs

How to fill out jeanne steines accountant

How to fill out jeanne steines accountant

Who needs jeanne steines accountant?

A comprehensive guide to the Jeanne Steines Accountant Form

Understanding the Jeanne Steines Accountant Form

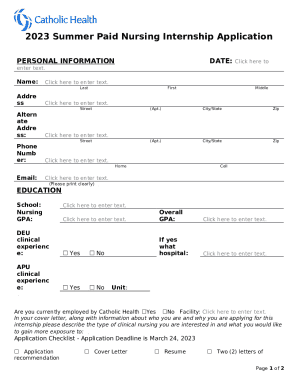

The Jeanne Steines Accountant Form is an essential document that serves a multitude of purposes in both personal and business accounting. Its primary function revolves around ensuring accurate reporting of financial data, which is critical for individual taxpayers and businesses alike. This form stands out due to its flexibility, making it applicable in various financial scenarios, from tax preparation for individuals to extensive financial reporting for small and medium enterprises.

Individuals often utilize this form during tax seasons, needing to compile and present their financial information to ensure compliance with tax regulations. For businesses, the form helps summarize earnings, expenses, and other financial metrics, offering a clear view of financial health. Its importance in establishing valid and precise financial records cannot be underscored, as it aids in informed decision-making and strategic planning.

Among its key features, the Jeanne Steines Accountant Form includes fillable fields, which facilitate data entry, and organized sections tailored for specific financial details. This structure is not only user-friendly but also complies with current accounting standards, making it a reliable choice for accurate financial reporting.

Preparing to use the Jeanne Steines Accountant Form

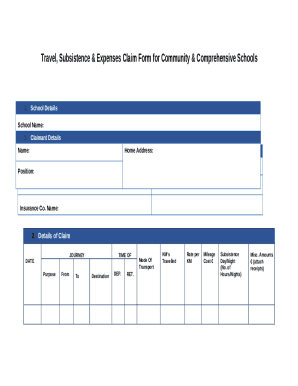

Before diving into filling out the Jeanne Steines Accountant Form, it’s vital to gather all necessary documentation. This includes financial statements, receipts for deductions, and previous tax returns. A thorough checklist ensures you have everything at your fingertips, making the process smoother. A standard checklist for preparation might look as follows:

Another critical step is to assess whether professional assistance is necessary. Consulting with a seasoned accountant can provide tailored insight, particularly if your financial situation is complex. Furthermore, utilizing pdfFiller's tools for document preparation enables users to streamline the process significantly. The platform is designed to enhance your experience by simplifying the completion of documents.

A proactive approach to understanding deadlines is also crucial. Typically, tax-related forms must be filed by April 15, but there may be additional deadlines for specific types of businesses or deductions. Be sure to check relevant tax authority announcements to stay ahead.

Filling out the Jeanne Steines Accountant Form

Completing the Jeanne Steines Accountant Form may seem daunting, but breaking it down into manageable steps can simplify the task. Start with ensuring that all personal information is accurate. This includes your name, address, Social Security number, and any relevant identification numbers for business entities.

Next, proceed to input your financial data. Organizing your information beforehand is critical, as it promotes efficiency and reduces errors. Categorize your income sources, expenses, and deductions to aid clarity. A common oversight is entering information inaccurately; hence, double-checking your figures before finishing each section is vital.

Furthermore, pdfFiller offers interactive tools such as fillable fields and templates that can save time and ensure accuracy. These features automate certain data inputs, reducing repetitive tasks and allowing you to focus on comprehensive financial representation. Additionally, they help guard against common mistakes during form completion.

Editing and customizing the form

Once you have filled out the Jeanne Steines Accountant Form, revising for clarity and correctness is the next step. This process includes ensuring that the form complies with the latest accounting standards. A best practice for making edits includes maintaining a clean version of your document; save changes using a different file name to track versions.

Furthermore, pdfFiller provides collaborative features that allow you to invite team members to review or edit the document. This capability not only enhances accuracy but also engages more stakeholders in the financial reporting process. Leveraging these features means establishing an audit trail; you can track changes, making it easier to revert to previous versions if necessary.

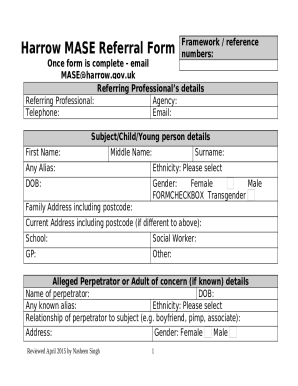

Signing and securing the Jeanne Steines Accountant Form

After completing the form, the next important step is to secure your signature. Electronic signing is a streamlined method offered by pdfFiller, allowing users to eSign their documents without extensive delays. eSignatures are legally valid, meaning they hold the same weight as traditional hand-written signatures for accounting documents, ensuring compliance and credibility.

For additional protection, address how to safeguard sensitive data. pdfFiller provides robust data protection features, including password protection and data encryption. Sharing documents securely can also enhance privacy, so ensure that sensitive information is only shared with trusted parties and through secure channels.

Managing your Jeanne Steines Accountant Form

Staying organized is key to effectively managing your completed Jeanne Steines Accountant Form and other financial documentation. pdfFiller offers a seamless organizational system through folders and tags, making it easy to retrieve necessary documents at a moment's notice. This functionality is particularly beneficial during tax season when multiple forms and reports may need to be accessed quickly.

Post-completion, save and export your form in various formats suitable for your needs. pdfFiller supports formats including PDF, Word, and Excel, allowing for further editing or integration with other accounting software. This adaptability enhances your workflow, ensuring that regardless of your accounting tasks, you can pivot easily to meet demands.

Troubleshooting common issues

While working with the Jeanne Steines Accountant Form, you may encounter several common issues, particularly relating to form compatibility or technical difficulties on the pdfFiller platform. It's essential to be aware of the most frequent challenges, such as file format errors or difficulties in sending forms for signatures.

If you experience such issues, pdfFiller provides excellent customer support options. Users can access help centers for direct assistance and utilize community forums where they can gain insights from other users' experiences. Knowing how to troubleshoot problems can save you time and ensure your documentation process remains uninterrupted.

Case studies and examples

The real-life applications of the Jeanne Steines Accountant Form reveal its versatility and effectiveness. Numerous individuals and businesses have successfully navigated their financial reporting and tax preparation using this form. One notable case involves a small business owner who managed to streamline their quarterly reports by using the Jeanne Steines Accountant Form in conjunction with pdfFiller’s tools, significantly reducing the time spent on financial documentation.

User testimonials emphasize how functionalities such as eSigning and easy editing transformed their experience. Many users highlight that the interactive nature of pdfFiller not only improved accuracy but also enhanced collaboration within teams, which ultimately led to better-informed decisions based on reliable financial data.

Frequently asked questions (FAQs)

Navigating the Jeanne Steines Accountant Form may raise several questions. For instance, do users need to fill out this form every year? Typically, yes; consistent reporting is crucial for maintaining accurate financial records. Another common query involves whether individuals can edit the form after submission. pdfFiller allows users to make adjustments even post-submission as long as they adhere to document management protocols.

Leveraging pdfFiller effectively can maximize your experience. Familiarize yourself with all available features and consider using templates to save time when filling out forms in the future. This knowledge allows for smoother future filings, helping meet deadlines efficiently.

Advanced tips and best practices

Maximizing efficiency with the Jeanne Steines Accountant Form requires leveraging all of pdfFiller's extensive features. For instance, integrating cloud storage solutions allows users to access their documents from anywhere, making it easier to complete and share forms on the go. Additionally, building a well-defined workflow for regularly managing forms can greatly enhance productivity.

Keep abreast of evolving trends in accounting and finance management to further enhance your expertise. Resources such as accounting blogs, webinars, and courses can provide valuable insights. Staying updated on these trends not only improves your individual knowledge but also benefits your organization as it adapts to financial changes more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit jeanne steines accountant straight from my smartphone?

How do I fill out the jeanne steines accountant form on my smartphone?

How do I fill out jeanne steines accountant on an Android device?

What is jeanne steines accountant?

Who is required to file jeanne steines accountant?

How to fill out jeanne steines accountant?

What is the purpose of jeanne steines accountant?

What information must be reported on jeanne steines accountant?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.