Get the free Finance, Bursaries & Loans

Get, Create, Make and Sign finance bursaries amp loans

How to edit finance bursaries amp loans online

Uncompromising security for your PDF editing and eSignature needs

How to fill out finance bursaries amp loans

How to fill out finance bursaries amp loans

Who needs finance bursaries amp loans?

Finance Bursaries & Loans Form: A Comprehensive Guide

Overview of finance bursaries & loans

Finance bursaries and loans are essential tools for students and individuals seeking financial assistance to fund their education or personal development goals. A bursary is typically a non-repayable financial aid award given based on financial need, without any strings attached, while a loan requires repayment with interest over time. Understanding the nuances of these options can significantly impact your financial planning.

The importance of financial support in education cannot be overstated. With the rising costs of tuition and living expenses, financial aid plays a crucial role in making education accessible. For many, bursaries alleviate the burden of student loans, while loans can provide immediate funding when needed.

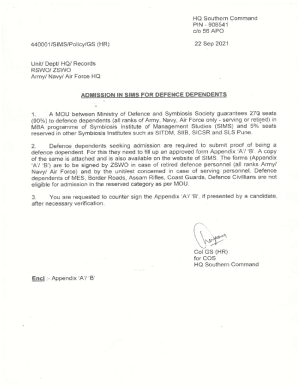

Understanding the finance bursaries & loans form

The finance bursaries & loans form is a crucial document for anyone looking to apply for financial support. This form acts as a formal request for financial assistance and serves to collect the necessary information from applicants to determine their eligibility. Whether for educational expenses, personal development, or other financial needs, accurately completing this form is essential.

Common use cases for bursaries and loans include funding for higher education, vocational training, or even business start-ups. Knowing the eligibility criteria, such as income limits, academic performance requirements, and residency status, can significantly affect your chances of receiving assistance.

Components of the finance bursaries & loans form

The finance bursaries & loans form consists of several key sections that need to be filled out carefully. Each section has critical requirements that must be met for the application to be considered.

Filling out the finance bursaries & loans form

Completing the finance bursaries & loans form can initially feel daunting, but breaking it down into manageable steps can make the process smoother. Start with the personal information section. Ensure that every detail is accurate to avoid unnecessary delays in processing.

In the financial information section, report income accurately by providing documentation for all income sources. Be transparent about your assets and expenses, and provide clear examples to illustrate your financial situation.

Editing and managing your application

After submission, you might find the need to edit your application. Tools like pdfFiller offer easy access to your submitted forms, allowing you to make necessary changes promptly. Collaborating with family or academic advisors is also beneficial, as they can provide insights or help ensure that the form is completed accurately.

Using cloud storage features allows for managing multiple documents effectively. This secure access not only keeps your documents organized but also enables updates from anywhere, ensuring that you have the most current information available.

Submitting your application

Once you have filled out and reviewed your finance bursaries & loans form, it’s time for submission. You can choose between online submission, which is often faster, or traditional mail. Be aware of key submission deadlines to avoid missing out on potential funding opportunities.

After you submit your application, you should receive confirmation via email or a notification through the platform used. Knowing what to expect can ease anxiety and keep you informed about the next steps in the process.

After submission: what’s next?

After submitting your finance bursaries & loans form, tracking the status of your application is essential. Most institutions provide tools for applicants to check their application progress, which can help you stay informed.

Be prepared to respond promptly to any additional requests for information. Understanding the possible outcomes, whether it's approval, denial, or a request for more information, helps you navigate the process confidently.

FAQs on finance bursaries & loans

Frequently asked questions about finance bursaries & loans often pertain to eligibility and the appeals process. Knowing what documentation you need can guide your application process. If your application is denied, inquire about how to appeal the decision and ask for detailed feedback.

Additionally, understanding the loan repayment process before taking out a loan is crucial. This knowledge can help you plan your finances appropriately and seek guidance on managing repayments effectively.

Navigating scholarship & loan opportunities

A variety of bursaries are available, each catering to different needs and backgrounds. Researching and applying for multiple scholarships and bursaries can maximize your financial support and significantly reduce your educational costs.

Networking with peers and other fund providers can also uncover less-known opportunities. Building these relationships can lead to insightful advice and potential financial aid offers.

Testimonials and success stories

Real-life experiences of individuals who secured funding through bursaries and loans provide valuable insights. Many applicants have shared their journeys, detailing how financial support bolstered their education and career paths.

Advice from former applicants can illuminate common challenges and effective strategies for a successful application. Learning from their stories can empower future applicants to navigate the process successfully.

Tools & resources available on pdfFiller

pdfFiller offers a suite of interactive tools that streamline the creation, editing, and management of the finance bursaries & loans form. Features like eSignature capabilities and collaboration options enhance the overall user experience.

Utilizing cloud storage not only makes it easy to access documents anytime, anywhere but also ensures that your important documents are always safe and up to date.

Contact information for additional support

For further assistance, reaching out to financial aid offices can clarify doubts and provide guidance on the application process. Establishing a line of communication with educational advisors can also help guide your decisions regarding financial aid.

Taking the initiative to seek out support is critical for ensuring you maximize the potential of financial resources available to you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in finance bursaries amp loans?

How do I edit finance bursaries amp loans on an iOS device?

How do I fill out finance bursaries amp loans on an Android device?

What is finance bursaries amp loans?

Who is required to file finance bursaries amp loans?

How to fill out finance bursaries amp loans?

What is the purpose of finance bursaries amp loans?

What information must be reported on finance bursaries amp loans?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.