A complete guide to the FINRA outside business activities form

Understanding FINRA outside business activities (OBA)

Outside Business Activities (OBA) refer to financial industry professionals engaging in any work that is not under the auspices of their primary brokerage firm. This could encompass roles in various sectors including real estate, consulting, or even volunteer work. The Financial Industry Regulatory Authority (FINRA) mandates strict regulations surrounding these activities to ensure that all members maintain the integrity of their primary responsibilities.

FINRA Rule 3270 specifically addresses OBAs, requiring registered representatives to provide written notice to their firms regarding any outside work. This is paramount for managing potential conflicts of interest and ensuring that the primary firm’s reputation remains uncompromised.

Compliance with these regulations not only protects the brokerage firm but also upholds the trust of clients and stakeholders in the financial sector. The consequences of non-compliance can lead to severe ramifications, including sanctions, fines, and career repercussions.

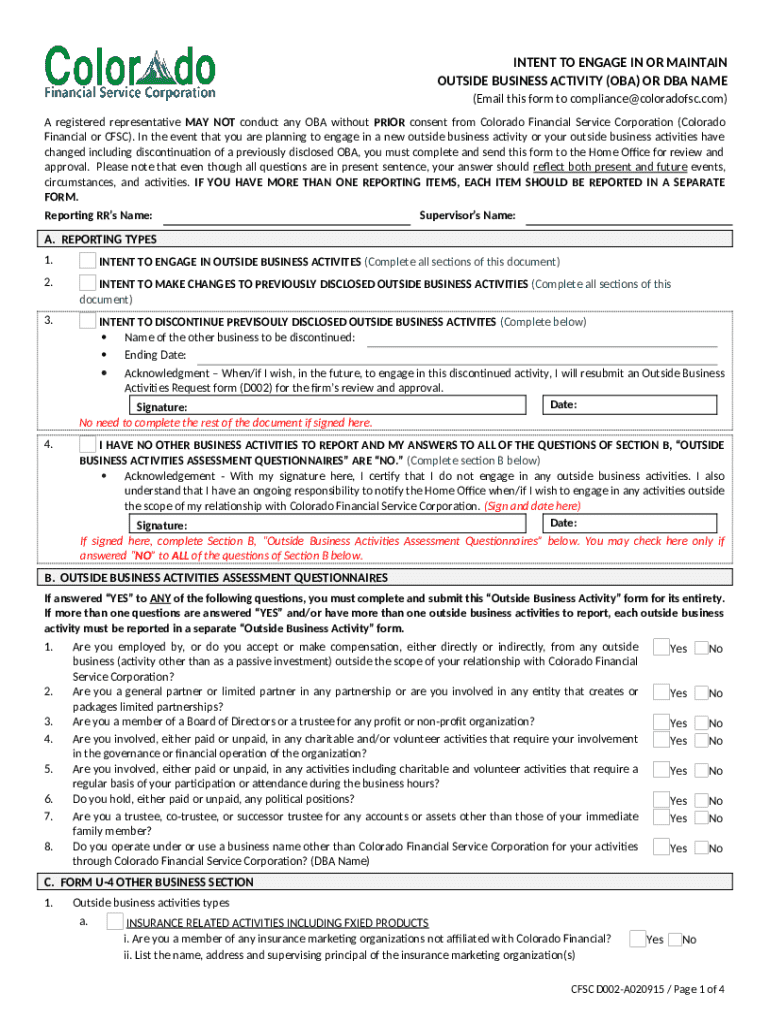

The role of the FINRA outside business activities form

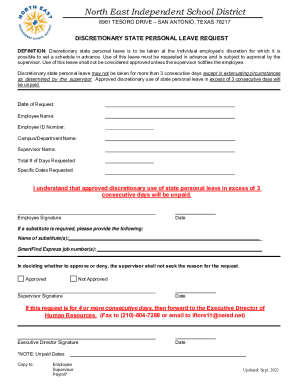

The FINRA Outside Business Activities Form plays a crucial role in the disclosure process. Its main purpose is to collect vital information about the outside endeavors of financial professionals to evaluate potential conflicts of interest. When a representative decides to pursue an external opportunity, they must submit this form to their compliance department.

Key sections of the form include:

This section requires the representative's details, including their name, contact information, and firm affiliation.

Here, professionals must describe their outside activities comprehensively, detailing the nature of the work and the potential time commitment.

This section is where the representative confirms that the information provided is accurate and acknowledges their firm’s ability to review the activities.

A common misunderstanding about the form is that it is merely a procedural hurdle. In reality, it's a vital compliance tool that protects both the firm and the individual. Accurate and timely submissions are critical in this regard.

Filling out the FINRA OBA form

Filling out the FINRA OBA form is a straightforward process when approached methodically. Here is a step-by-step instruction guide to assist in completing the form efficiently:

Collect all relevant details about your outside business activities, including the nature of the work, employer details, and expected time requirements.

Begin by entering your personal information correctly, followed by a detailed account of your outside activities, ensuring all descriptions are comprehensive.

Do not underestimate the importance of accuracy in this form. Double-check your entries for spelling errors and inconsistency in work descriptions.

Effective disclosure is paramount. Being transparent about your activities helps establish trust with your firm, allowing them to support you while ensuring compliance with FINRA rules. Remember to assess potential conflicts of interest thoroughly.

Editing and managing the FINRA OBA form

Once the FINRA OBA form is completed, managing the document effectively is essential, especially as your outside activities evolve. Utilizing a platform like pdfFiller can significantly streamline this process.

With pdfFiller, you can easily edit your form by:

Easily upload your completed forms to pdfFiller for editing or conversion into different formats.

Utilize pdfFiller’s form tools to highlight aspects of the form, add comments, or make necessary adjustments.

Collaboration features allow teams to share the form with relevant parties, gather feedback, and make revisions seamlessly. This aids in maintaining up-to-date disclosures that reflect your current outside activities.

The significance of eSigning the FINRA OBA form

eSigning the FINRA OBA form through pdfFiller carries several benefits for compliance. The digital signature process allows for immediate authorization which expedites the review and approval process necessary for regulatory compliance. Further, integration with pdfFiller's eSignature feature ensures that signatures are captured securely and efficiently.

The legal validity of eSignatures in financial documents is well-established, providing assurance that electronically signed forms hold up under scrutiny in case of audits or compliance checks. This feature also allows financial professionals to manage their documents remotely, facilitating timely submissions.

Common challenges and solutions in OBA compliance

Navigating compliance can be daunting, especially when identifying potential risks associated with outside activities. Common challenges include not disclosing certain activities that could present conflicts of interest and facing regulatory scrutiny due to incomplete submissions.

Addressing these issues involves understanding regulatory requirements in detail. Best practices for recordkeeping and reporting include:

Create a well-defined document checklist to guide your submissions and periodic reviews.

Engage in continual education about regulatory changes associated with FINRA, emphasizing the implications of OBA.

When in doubt, always consult compliance professionals for clarity on regulatory requirements.

Case studies of financial professionals who effectively managed compliance challenges highlight the importance of diligent recordkeeping and proactive disclosure, proving essential in maintaining their professional integrity.

Ongoing management of outside business activities

Maintaining compliance with outside business activities is not a one-time task; it requires ongoing management. Keeping records updated is critical to reflect any changes in your outside business commitments. Regular communication with your firm regarding changes helps maintain transparency.

By regularly reviewing disclosure requirements, professionals can avoid missteps that could lead to compliance violations. It is beneficial to schedule routine check-ins to assess your status and update the necessary documentation as outside activities evolve.

Additional considerations for compliance

Adapting to trends in FINRA enforcement actions is essential for all financial professionals engaged in outside business activities. Emerging risks associated with OBA necessitate a proactive approach to compliance.

Preparing for FINRA examinations involves creating a compliance readiness checklist, which includes:

Maintain thorough records of all outside business activities to present during examinations.

Continually assess staff understanding of OBA regulations and their implications during training.

Integrate compliance into the organizational culture, making it a shared responsibility.

The role of internal training and education cannot be understated, fostering an environment where compliance is prioritized, thereby minimizing risks associated with outside business activities.

Leveraging pdfFiller for streamlined compliance

pdfFiller stands out as a comprehensive document management solution, especially for financial professionals navigating the complexities of the FINRA outside business activities form. With its focus on accessibility and security, users gain peace of mind knowing their documents are safely stored.

Beyond simple document editing, pdfFiller also offers features that enhance ongoing compliance education and refresh essential knowledge about FINRA rules. Regular updates and resources ensure that users are equipped to handle any regulatory changes effectively.

Final thoughts on maintaining compliance with FINRA rules

Staying informed about the nuances of FINRA regulations is a continual process. Engaging with compliance support services can provide additional insights and recommendations on navigating your external activities.

Ultimately, a commitment to ethical practices and transparency in all business dealings off the books will enhance professional integrity, fostering trust among clients and stakeholders alike.