Get the free See Schedule O, Statement 3

Get, Create, Make and Sign see schedule o statement

How to edit see schedule o statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out see schedule o statement

How to fill out see schedule o statement

Who needs see schedule o statement?

See Schedule O statement form: A Comprehensive Guide

Understanding Schedule O: Purpose and importance

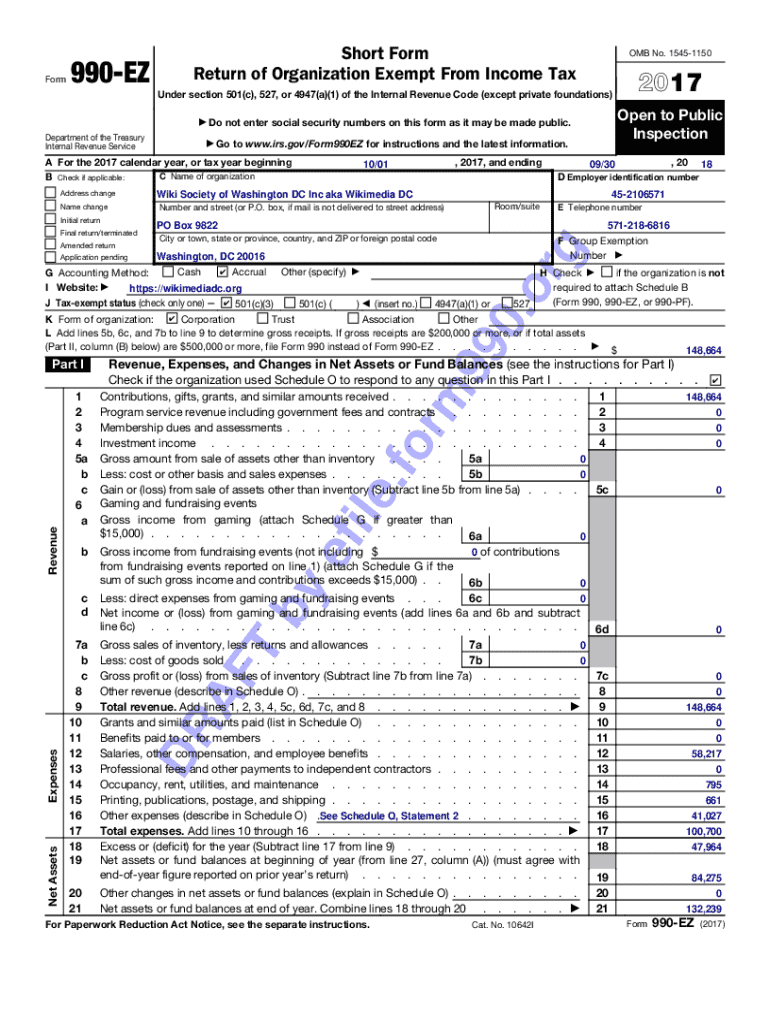

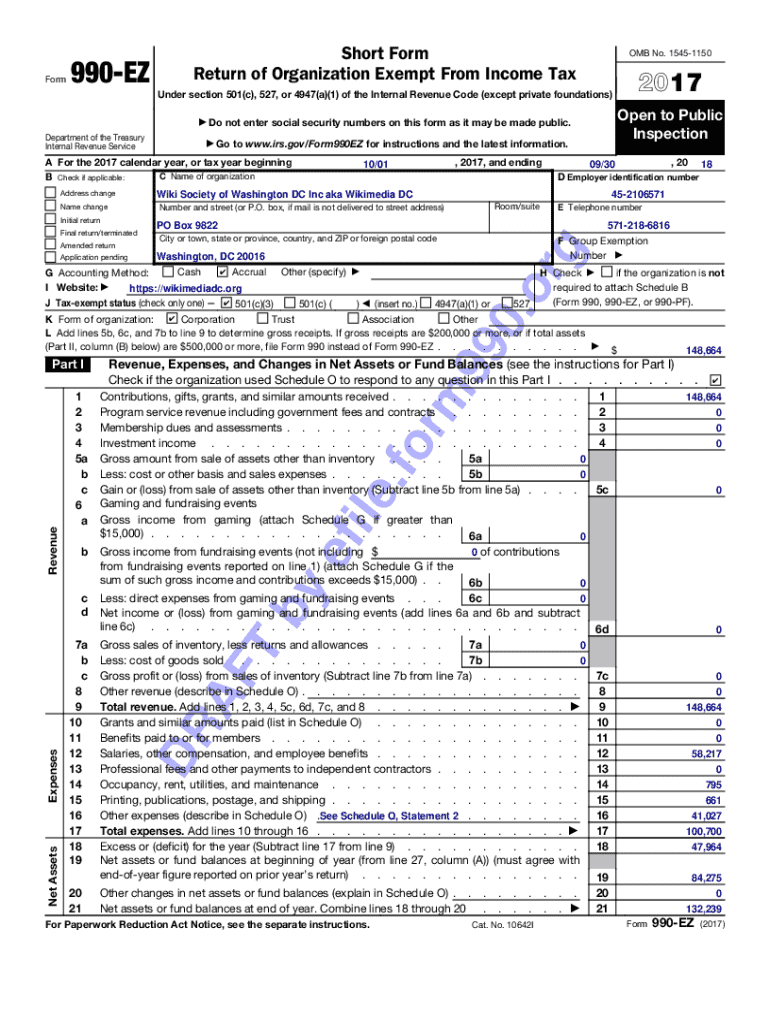

Schedule O serves as an addendum to Form 990, which nonprofits must file annually with the IRS. Its primary purpose is to provide detailed explanations of an organization’s operations, governance, and financials.

This form allows filers to clarify any discrepancies or elaborate on specific areas that the standard form may not sufficiently address. Given that Form 990 is a public document, it can significantly impact public perception and trust in an organization.

Who must file Schedule O?

Organizations classified as tax-exempt under Section 501(c)(3) or similar sections are generally required to file Schedule O as part of their Form 990 submission. This includes public charities, private foundations, and certain nonprofits. However, the specific requirements may vary based on the organization’s revenue and activities.

Many smaller organizations filing Form 990-EZ might question if they need to submit Schedule O. While not mandatory, it’s highly encouraged to ensure comprehensive reporting and compliance.

Detailed instructions for completing Schedule O

Completing Schedule O requires attention to detail and a thorough understanding of your organization’s functions. It's structured into three parts, each focusing on different aspects of your operations.

Part : General Information

Begin by providing fundamental details about your organization, including its name, EIN, and mission statement. Ensure accuracy to avoid unnecessary delays or issues.

Common pitfalls in this section include misspelling names or incorrect EINs, which can all lead to complications during processing.

Part : Statement of program service accomplishments

This part allows organizations to showcase their primary activities, demonstrating how they fulfill their mission. Highlight your goals, key achievements, and any metrics that illustrate your impact.

For instance, if your organization provides food assistance, detail the number of meals served and testimonials from beneficiaries, as these can effectively convey your work.

Part : Other information

In this section, include any additional information that could provide context to your organization. This can be insights about governance, financial methodologies, or even recent changes to your mission.

Best practices suggest compiling relevant documentation and summarizing each point succinctly to maintain clarity and readability.

Specific instructions for different forms

Filing Schedule O accurately hinges on which Form 990 you’re submitting. The complexities increase slightly when transitioning from Form 990-EZ to Form 990, as the latter requires more comprehensive reporting.

For Form 990 filers, be prepared to provide more detailed descriptions of your programs and financial situation, while Form 990-EZ filers can keep it somewhat simpler.

Common FAQs regarding Schedule O

Addressing performance can often raise questions about Schedule O. If your submission is incomplete, the IRS may contact you for clarification, which can delay processing time.

If you need to amend Schedule O post-submission, you can do so via an amended Form 990, updating any discrepancies discovered after the fact.

Maximizing your Schedule O filing

Communication is vital when filing Schedule O. Convey your organization’s message clearly and concisely, making sure that the reviewers can understand the objectives and accomplishments without ambiguity.

Utilizing data to back your statements can make a strong impression. For example, include analytics on services delivered or the outreach impact of your organization.

Helpful tools and resources

pdfFiller provides robust tools to streamline your Schedule O filing process. Interactive features enable easy editing, ensuring that all changes are smooth and that formatting is preserved.

Access templates, samples, and IRS guidelines directly through pdfFiller to simplify the preparation process. Each of these resources equips organizations to improve clarity and completeness.

Case studies: Successful Schedule O filings

Many organizations have leveraged Schedule O to enhance transparency and stakeholder trust. One such case is the XYZ Charity, which effectively utilized the form to narrate their journey and detail the impact of their initiatives.

Through precise data reporting and clear mission statements, they saw a significant increase in funding and partnerships. Their approach demonstrates how effective communication in Schedule O can yield fruitful results for nonprofits.

Frequently encountered challenges

Filing Schedule O can come with challenges, including understanding IRS requirements and accurately presenting complex program details. Organizations often struggle with articulating their successes in a compelling yet factual manner, which is critical for gaining credibility.

To overcome these hurdles, a clear outline of your service’s highlight and its impact is crucial. Collaborating with staff and stakeholders can also provide diverse insights for filling out the form.

Support and assistance

Navigating the complexities of Schedule O doesn’t need to be overwhelming. pdfFiller offers extensive customer support and guided assistance for users throughout the filing process.

Additionally, engaging with community forums and knowledge bases can provide valuable insights from others who have successfully completed their filings.

Submit with confidence

Before submitting Schedule O, ensure you have reviewed all information thoroughly. A final checklist can be immensely helpful to confirm that all necessary data is accurate and complete and adheres to IRS mandates.

Incomplete or inaccurate filings can trigger reviews from the IRS, which can significantly delay operations and lead to unwanted penalties.

Continuous learning and updates

As IRS regulations change frequently, staying updated on the latest instructions for Schedule O is paramount for compliance. Regularly check the IRS website for new bulletins or changes in reporting requirements that may affect your organization.

Investing in ongoing education about tax filings and requirements ensures that your organization is not only compliant but also well-prepared for future challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my see schedule o statement directly from Gmail?

How can I edit see schedule o statement on a smartphone?

How do I complete see schedule o statement on an Android device?

What is see schedule o statement?

Who is required to file see schedule o statement?

How to fill out see schedule o statement?

What is the purpose of see schedule o statement?

What information must be reported on see schedule o statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.