Essential Single-Family Rehabilitation Loan Form: Your Complete Guide

Overview of the essential single-family rehabilitation loan form

The essential single-family rehabilitation loan form serves as a fundamental instrument for homeowners and investors seeking financing for property enhancements. This form simplifies the process of applying for loans designed specifically to support necessary repairs and improvements that maintain property value and livability. Recognizing its importance can lead to significant opportunities in the housing market.

Eligibility for this loan generally includes criteria such as a demonstrated ability to repay the loan, a valid Social Security number, and property ownership. Various income levels and credit scores are accepted, making it accessible to a broader audience. Understanding these criteria can streamline the application process and set realistic expectations.

Financial flexibility for rehabilitation projects.

Potential to enhance property value.

Support for sustainable and energy-efficient upgrades.

Understanding the rehabilitation loan process

Navigating the rehabilitation loan process involves several steps that ensure you understand your options and obligations as a borrower. The first phase typically starts with thorough preparation through a pre-application checklist, where you'll gather necessary information about your financial status and property details.

After preparation, you’ll submit required documentation, including income verification and property assessments. Once submitted, the processing timeline can vary based on the lender, but typically ranges from a few weeks to a couple of months, depending on the complexity of your project.

Structural repairs, such as fixing roofs or foundations.

Upgrades enhancing energy efficiency, like insulation or new windows.

Improvements catering to accessibility needs, ensuring all individuals can navigate the home safely.

Interactive tools for application assistance

pdfFiller provides several interactive tools that streamline the application for the essential single-family rehabilitation loan form. These tools not only enhance user experience but also help potential borrowers make well-informed decisions throughout the process.

The online eligibility tool allows users to quickly assess their qualification for the loan, reducing the effort spent applying without knowledge of eligibility. Meanwhile, an interactive loan calculator enables prospective borrowers to estimate costs accurately, taking into account total repairs and renovations planned.

Online eligibility tool for quick assessments.

Interactive loan calculator provides cost estimates.

Document checklist helps streamline required paperwork.

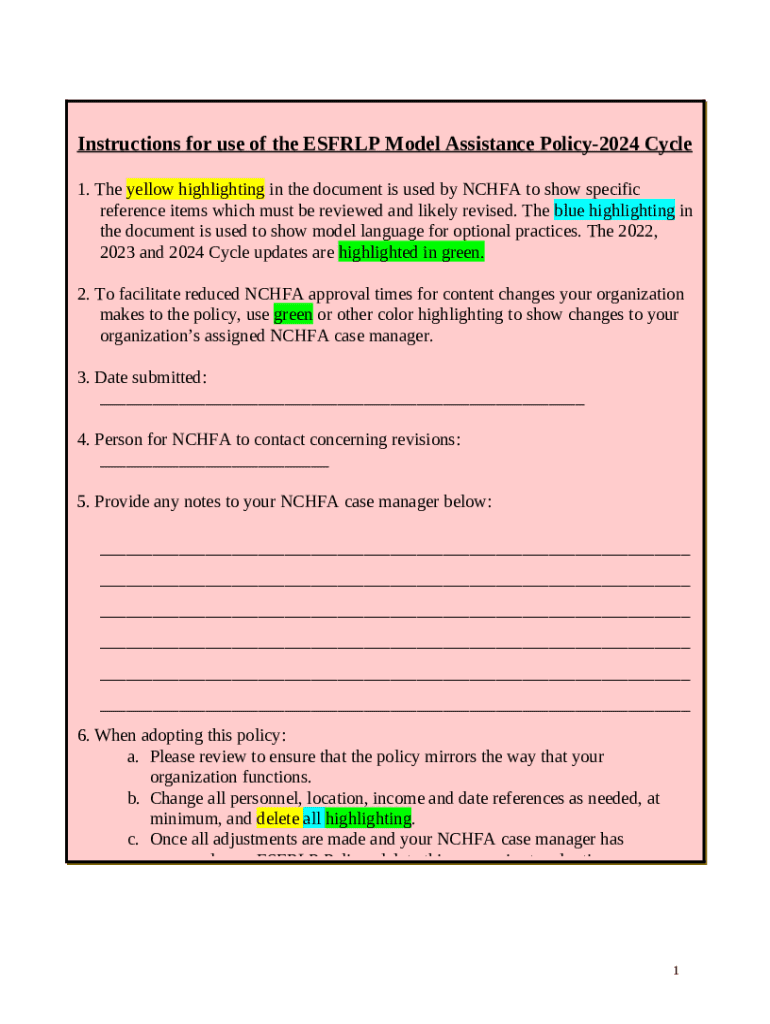

Detailed instructions for filling out the essential form

Filling out the essential single-family rehabilitation loan form may seem daunting; however, clear, section-by-section guidance can simplify the process. Start with the personal information section, which includes your name, address, and contact details. It’s crucial to ensure this information is accurate to prevent processing delays.

Next, move on to the property details, where information regarding the structure and condition of the property is collected. Lastly, the financial information section requires you to provide insights into your income, existing debts, and other financial obligations. Be prepared with all documentation to improve your chances of approval.

Double-check all personal information for accuracy.

Ensure property details are as specific as possible.

Provide comprehensive financial information to avoid misunderstandings.

Editing and managing your rehabilitation loan form

Once your rehabilitation loan form is completed, managing and editing it efficiently is vital. With pdfFiller's editing tools, making changes to your document can be accomplished easily, ensuring that any required adjustments can be done without hassle. You can log into your account, locate your form, and utilize the edit features to modify your document as necessary.

Accessing your document from anywhere is another major advantage of using a cloud-based platform like pdfFiller. Whether you are at home or on the go, you can quickly pull up and edit your rehabilitation loan form as needed, ensuring you're always prepared for the next steps in your application.

Use editing tools in pdfFiller for easy modifications.

Access your form from any device with internet connectivity.

Share the form with stakeholders to facilitate collaboration effectively.

eSignature integration for seamless workflow

Adding eSignatures to your essential single-family rehabilitation loan form elevates the application process by making it more accessible and efficient. To add eSignatures, simply navigate to the signing section within the form on pdfFiller, where users can select or create their electronic signatures.

The legal implications of eSigning are significant; electronic signatures are recognized as valid and binding in many jurisdictions, which means you can complete transactions with confidence. Once the form has been signed, pdfFiller also provides tracking capabilities, allowing you to monitor the status of your document throughout the process.

Follow step-by-step instructions for adding eSignatures.

Understand the legality of electronic signatures.

Track your document status post-signing for updates.

Frequently asked questions about the rehabilitation loan form

Even with careful preparation, uncertainties may arise during the submission of the essential single-family rehabilitation loan form. One common question is 'What if I encounter issues during submission?' In such cases, it's best to reach out to customer service for immediate assistance or consult the support sections within pdfFiller.

A prevalent concern involves the waiting period—'How long does it take to receive a loan decision?' This varies, but generally, you can expect to hear back within a few weeks of submission, contingent on numerous factors including the complexity of your case.

Immediate support from customer service for submission issues.

Typical timelines for loan decisions to set expectations.

Options for modifying loan requests after submission.

Real-life success stories

Real-life examples of homeowners transforming their properties with the rehabilitation loan can be incredibly motivating. For instance, consider a family in a suburban neighborhood who leveraged the essential single-family rehabilitation loan form to convert a dilapidated property into their dream home. Their successful project not only improved their quality of life but also uplifted the entire block’s property values.

These transformations are often accompanied by testimonials from satisfied homeowners who have benefited from the process. They highlight lower energy bills, enhanced safety features, and the overall joy of living in a refreshed space, underscoring the impact a rehabilitation loan can have.

Case studies showcasing significant home renovations.

Personal testimonials celebrating the success of the process.

Illustrations of improved neighborhood aesthetics and property values.

Support and customer service

When engaging with the essential single-family rehabilitation loan form, having access to robust customer support can make all the difference. pdfFiller provides various channels for users to seek assistance, including dedicated support teams that can answer specific questions and provide guidance on completing the form accurately.

In addition to direct support, users can benefit from community forums where individuals share experiences, offer tips, and provide insights based on their journey with the rehabilitation loan process. These interactions create a supportive network that can significantly ease the experience of navigating the loan application.

Access reliable customer support through various channels.

Participate in community forums for insider knowledge and support.

Utilize platform resources for further guidance and assistance.

Compliance and legal disclaimers

When using the essential single-family rehabilitation loan form, it's crucial to understand compliance and legal implications associated with document sharing and storage. pdfFiller adheres to strict privacy policies, ensuring your personal data remains protected. Before beginning the application process, familiarizing yourself with these policies can help you navigate potential privacy concerns.

Moreover, upon using pdfFiller's services, you acknowledge and agree to the terms and conditions set forth by the platform. Understanding these guidelines ensures a smooth and trustworthy experience, mitigating risks and enhancing security.

Understand privacy policies governing document security.

Acknowledge terms and conditions for compliant usage.

Ensure awareness of legal implications when submitting forms.

Related forms and resources

In addition to the essential single-family rehabilitation loan form, there are several related forms and resources that may enhance your experience as a homeowner or investor. By exploring additional documentation tailored for rehabilitation, you'll discover opportunities to improve your property further.

Furthermore, connecting with qualified contractors and accessing community resources to facilitate your renovations can streamline the process. Engaging with platforms that offer contractor referrals can also ensure quality workmanship during your rehabilitation project.

Links to additional rehabilitation loan-related forms.

Access forms specific to homeowner assistance.

Resources to connect with reputable contractors for project support.