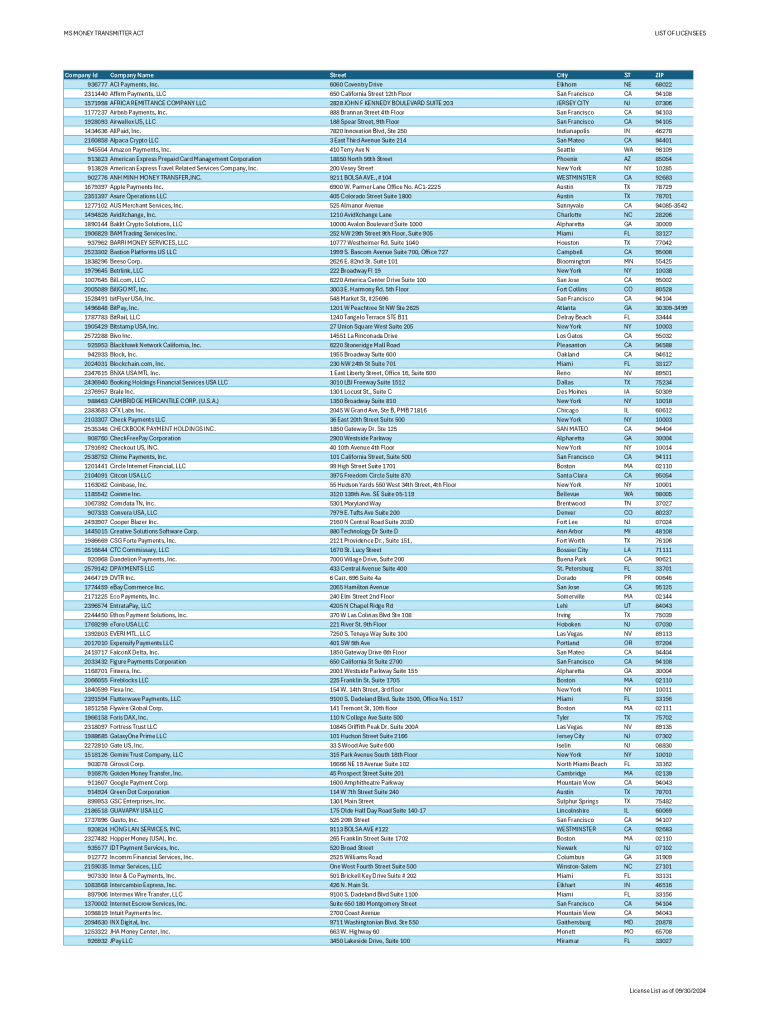

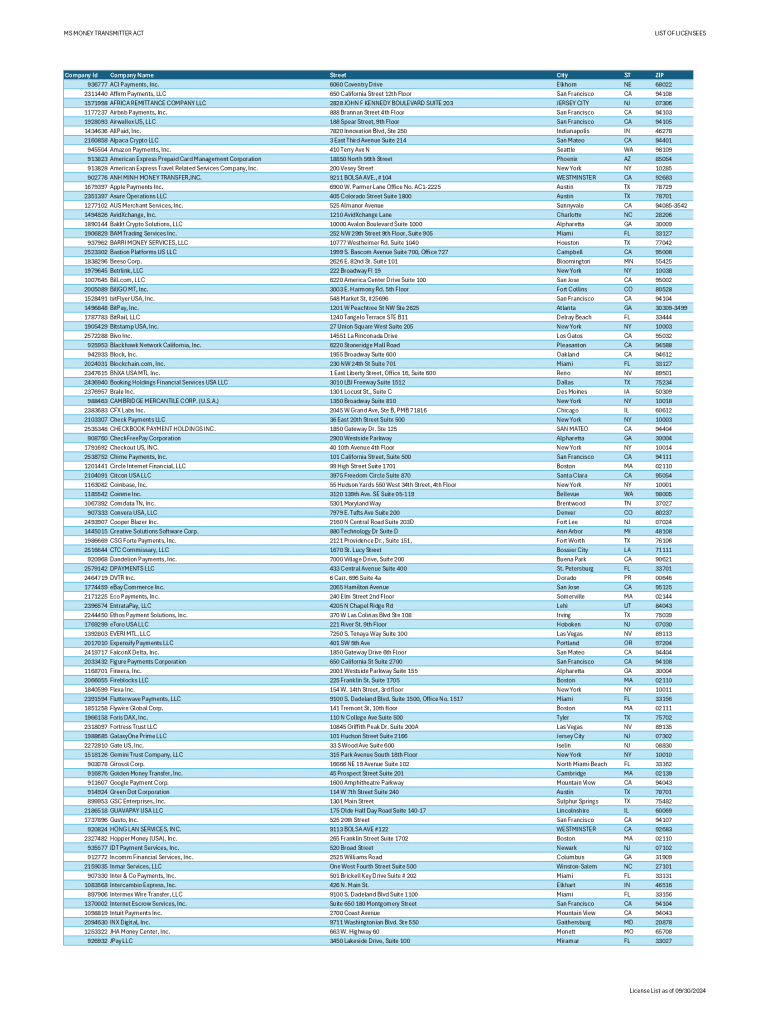

Get the free ms money transmitter act list of licensees - dbcf ms

Get, Create, Make and Sign ms money transmitter act

How to edit ms money transmitter act online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ms money transmitter act

How to fill out ms money transmitter act

Who needs ms money transmitter act?

Comprehensive Guide to the MS Money Transmitter Act Form

Overview of the MS Money Transmitter Act

The MS Money Transmitter Act serves as a legal framework for regulating the transmission of money within and outside Mississippi. Its primary aim is to protect consumers and ensure that businesses engaging in money transmission uphold high standards of financial integrity. This Act is notably significant for individuals and businesses in the state by providing necessary guidelines for operating legally in a complex financial landscape.

Mississippi’s Act not only safeguards consumers by enforcing compliance among money transmitters but also contributes to a robust financial ecosystem. Adhering to this Act is critical for businesses, especially those involved in electronic transfers and currency exchanges, to avoid hefty fines and legal repercussions. Key figures indicate that many businesses thrive when they comply with state laws, enhancing their reputation and trustworthiness.

Understanding the MS Money Transmitter Laws

The MS Money Transmitter laws create a solid regulatory environment, defining what constitutes money transmission and who needs a license. Essentially, any individual or business that engages in receiving or transmitting money as a service must adhere to the licensing requirements specified in the Money Transmitter Act. This includes not only traditional banking institutions but also payment processors and digital currency exchanges.

In comparison to other states, Mississippi’s regulations may appear stricter or more lenient, depending on the specific requirements imposed. For instance, while some states require more extensive documentation for licensing, Mississippi ensures its process is streamlined yet effective in promoting compliance. Failing to comply can lead to significant legal consequences, including heavy fines and the revocation of your license to operate.

Types of money transmission activities covered

The MS Money Transmitter Act encompasses a range of money transmission activities to ensure comprehensive regulation. This includes electronic money transfers, where funds are transmitted through digital channels, and prepaid access products like prepaid debit cards, which can be used for future purchases. Additionally, foreign currency exchange services fall under the Act, emphasizing the need for compliance within a global financial context.

Determining whether your specific activity falls under the jurisdiction of the MS Money Transmitter Act can be nuanced. It’s essential for businesses to review the definitions within the Act closely, seeking legal counsel if necessary, to clarify any ambiguities regarding their services.

The MS Money Transmitter Act form: A step-by-step guide

Preparing to fill out the form

Before embarking on the application process, it’s crucial to gather all required documentation. This includes proof of business registration, financial statements, and identification documents for key personnel. Being thorough in this preparatory stage can expedite your application process significantly.

Having key information ready is equally important. You'll need details like your business structure, the geographical areas you plan to serve, and specific details regarding the services you intend to provide. Organizing this information will streamline the form-filling process.

Detailed instructions for completing the form

While filling out the form, it’s crucial to avoid common mistakes. Ensure all information is accurate and matches your official documents. Double-check or even triple-check your entries to prevent any discrepancies that could delay the approval process.

Submission process for the MS Money Transmitter Act form

Where and how to submit

Once your form is completed, the next step is submission. You can conveniently submit your MS Money Transmitter Act form online through platforms like pdfFiller, which allows for quick and secure submission. Alternatively, if you prefer the traditional route, you can submit a physical copy via mail to the designated department.

For physical submissions, ensure that you follow the specific mailing instructions outlined by the Mississippi Department of Banking and Consumer Finance. This may include double-checking that all required documents are included and signed.

Expected timeline for license approval

The timeline for license approval varies, typically ranging from several weeks to a few months. Factors such as the completeness of your application, the accuracy of the submitted information, and the current workload of the Department can all impact processing times. Monitoring the status of your application is advisable, as any need for additional information will be communicated during this period.

Frequently asked questions (FAQs)

One common question arises: what should you do if your application is denied? It’s crucial to review the reasons for denial provided by the department and address those specific issues. You may appeal the decision or reapply once corrections have been made. Staying informed and proactive in rectifying the problem can increase chances of success upon re-application.

How can you update your information post-submission? If any changes occur after your initial submission, notify the Mississippi Department of Banking and Consumer Finance immediately to ensure your records are up-to-date. Clarifications on the renewal process can usually be found directly on their website or by contacting their office for personal guidance.

Tools and resources for managing your MS Money Transmitter Act compliance

Managing compliance effectively can be significantly enhanced by utilizing document management tools like pdfFiller. This platform enables users to edit, sign, and collaborate on documents from a single, cloud-based location. It’s incredibly useful for businesses maintaining compliance, as easy document access streamlines communications and ensures records remain organized.

Additionally, staying informed on changes in the law is vital for compliance. Regularly checking relevant regulatory updates will keep your business ahead of any new requirements or amendments to existing legislation. Furthermore, accessing additional support and educational materials provided by pdfFiller can streamline your ongoing compliance efforts.

Importance of compliance monitoring

Implementing best practices for continuous compliance is crucial. Regular audits of your processes and record-keeping practices can help identify areas that need improvement. A proactive approach towards compliance means businesses can adapt to new regulations swiftly, minimizing risks associated with outdated practices.

Periodically reviewing and updating licensing information is also essential. This ensures that all documentation is accurate, reflective of current practices, and compliant with state laws. Utilizing interactive tools for ongoing management further facilitates this process, making compliance easier and less time-consuming.

Additional considerations

As technology evolves, its role in money transmission becomes increasingly significant. Innovative platforms are emerging, reshaping how transactions occur and subsequently influencing regulatory considerations. Companies must stay current with industry trends, understanding that adaptability is key to navigating regulatory landscapes effectively.

Regulatory changes can also impact compliance workflows. Therefore, establishing a sustainable workflow that integrates systems like pdfFiller ensures efficiency in compliance management. This approach allows businesses to respond proactively to both technological advancements and legal updates, ensuring ongoing adherence to the MS Money Transmitter Act.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ms money transmitter act on a smartphone?

How do I complete ms money transmitter act on an iOS device?

How do I edit ms money transmitter act on an Android device?

What is ms money transmitter act?

Who is required to file ms money transmitter act?

How to fill out ms money transmitter act?

What is the purpose of ms money transmitter act?

What information must be reported on ms money transmitter act?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.