Get the free pacific-coast-shipyards-pension-fund-sfa-lock- ...

Get, Create, Make and Sign pacific-coast-shipyards-pension-fund-sfa-lock

How to edit pacific-coast-shipyards-pension-fund-sfa-lock online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pacific-coast-shipyards-pension-fund-sfa-lock

How to fill out pacific-coast-shipyards-pension-fund-sfa-lock

Who needs pacific-coast-shipyards-pension-fund-sfa-lock?

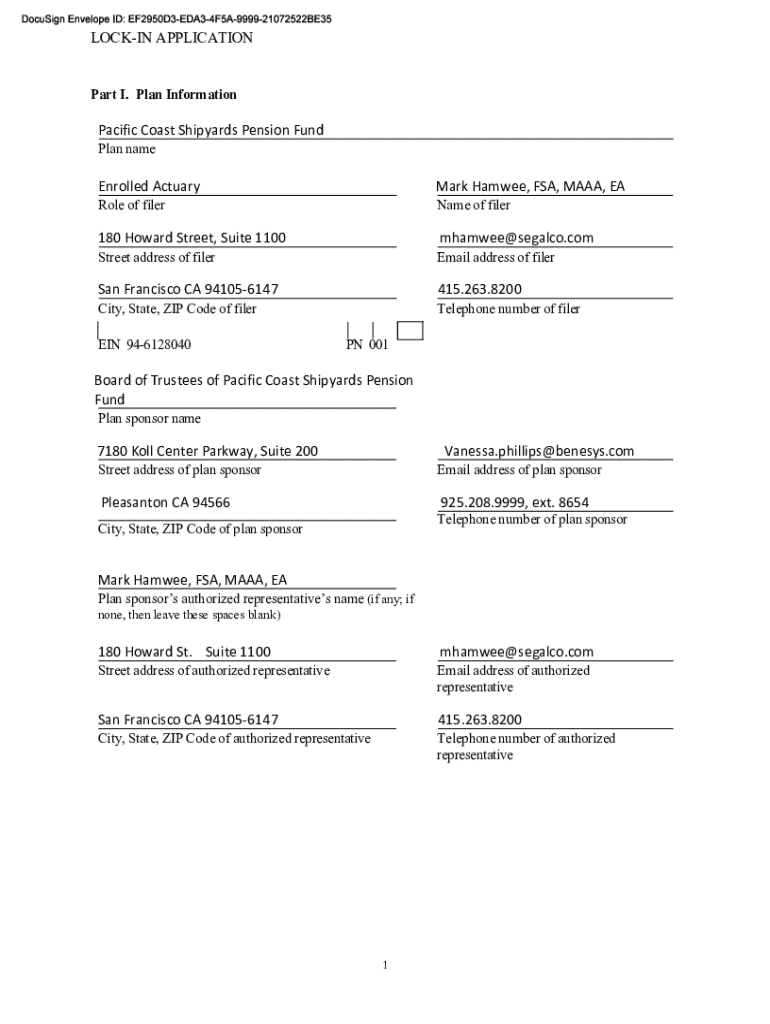

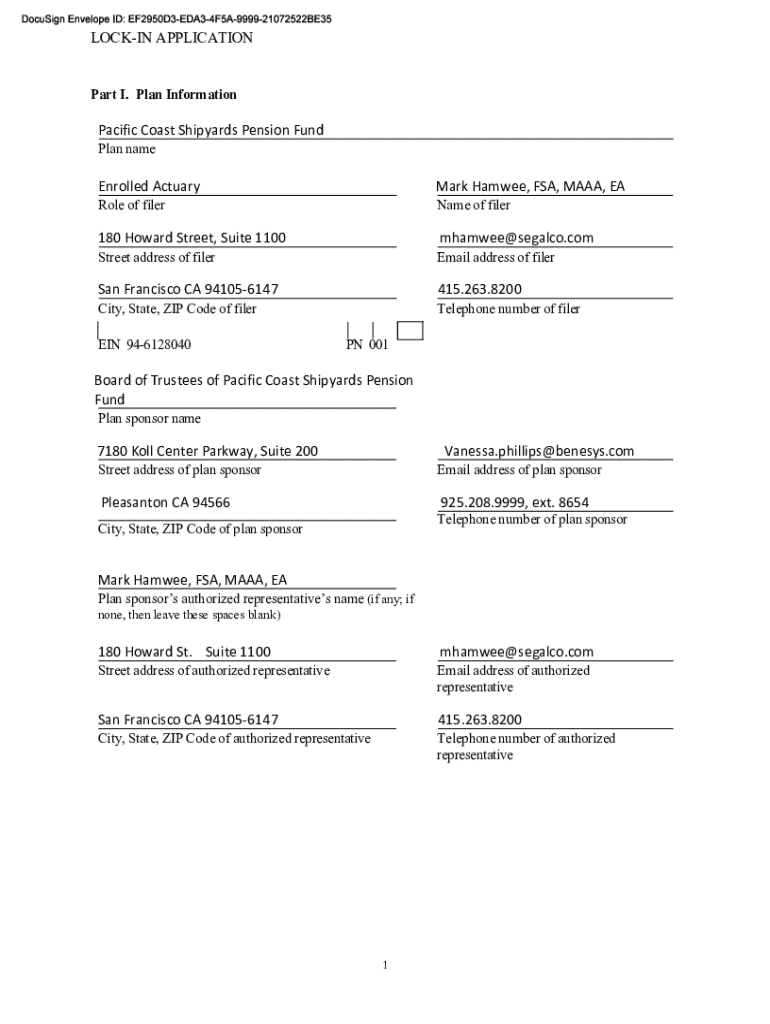

Guide to the Pacific Coast Shipyards Pension Fund SFA Lock Form

Understanding the Pacific Coast Shipyards Pension Fund

Established to cater to the needs of maritime workers along the West Coast, the Pacific Coast Shipyards Pension Fund has been crucial for many retirees and their families. Its historical roots can be traced back to the mid-20th century, emphasizing collective bargaining to ensure equitable retirement benefits for shipyard employees. Over the years, the fund has adapted to economic shifts and legislative changes, maintaining its relevance and commitment to financial security for its participants.

Participants in the pension fund typically enjoy several key benefits. These include annuity payments upon retirement, survivor benefits for their loved ones, and potentially disability coverage, making the fund an essential aspect of their financial planning. As such, understanding the fund's structure and provisions is critical for participants to maximize their benefits.

Special Financial Assistance (SFA) - An overview

Special Financial Assistance (SFA) is a critical component of the Pacific Coast Shipyards Pension Fund, designed to support participants facing significant financial distress. This mechanism serves as a safety net, particularly for individuals whose pensions may be underfunded or at risk due to broader economic conditions affecting pension management. Thus, understanding the purpose and scope of SFA can empower participants to take proactive steps in securing their financial futures.

Eligibility for SFA under the Pacific Coast Shipyards Pension Fund involves several criteria, primarily centered on the financial health of the pension plan and the participant’s need for assistance. Regulatory frameworks, such as the American Rescue Plan Act, have introduced additional provisions that allow for greater access to these funds, which aims to mitigate the financial pressures faced by retirees.

The SFA application process

Successfully navigating the SFA application process is essential for participants in the Pacific Coast Shipyards Pension Fund who require assistance. Preparation is key, involving gathering the necessary documentation that supports your eligibility claim. This may include recent financial statements, proof of income, and documentation of any recent pension fund changes that affect your current financial situation.

Here’s a step-by-step guide to help you complete the SFA application accurately:

Submission instructions vary but typically allow for both online and postal options. It's vital to keep an eye on application deadlines, as missing these can delay or jeopardize your assistance.

Managing your application status

Once your application for Special Financial Assistance has been submitted, tracking its progress will give you peace of mind. The Pacific Coast Shipyards Pension Fund provides tools and portals for participants to monitor their application status. Regular updates will inform you if your application is under review, requires further action, or has been processed.

If additional information is requested, it's crucial to respond promptly. Maintaining open lines of communication with fund administrators can significantly aid in the expedition of your request. Always follow up with the specific details requested and ensure you provide the necessary documentation in a timely manner.

Common challenges and solutions

Navigating the SFA application process is not without its hurdles. Participants often encounter delays in processing their applications, which can be frustrating. Moreover, issues such as missing documentation or miscommunication regarding application requirements may arise. Such challenges can create setbacks in timely access to vital pension funds.

To overcome these challenges, proactive communication with fund administrators is advisable. Keeping well-organized records of your application status and all communications can streamline follow-ups. Best practices include:

Utilizing pdfFiller for your documentation needs

pdfFiller stands out as a leading solution for managing the documentation process related to the Pacific Coast Shipyards Pension Fund SFA Lock Form. Its robust features cater to both individuals and teams by allowing for seamless PDF editing, eSigning, and efficient document collaboration. These tools enhance the application experience, ensuring participants can focus on the financial details rather than bureaucratic headaches.

With interactive tools, pdfFiller provides specialized templates tailored for pension applications, allowing users to create, edit, and store forms securely online. This level of functionality can significantly simplify the SFA application process, enabling participants to submit accurate and complete documentation with minimal stress.

Conclusion: Take charge of your pension fund journey

Managing your interactions with the Pacific Coast Shipyards Pension Fund, especially regarding the SFA Lock Form, requires cultivating an informed and proactive attitude. By leveraging resources such as pdfFiller, you empower yourself to handle forms and documentation effectively. This empowerment is crucial for ensuring a smooth application process and maximizing your benefits.

Taking an active role not only streamlines your experience with the pension fund but also enhances your overall financial literacy. As you navigate this journey, remember that staying informed and utilizing digital tools will play a significant role in shaping your financial security for years to come.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pacific-coast-shipyards-pension-fund-sfa-lock?

Can I create an electronic signature for the pacific-coast-shipyards-pension-fund-sfa-lock in Chrome?

How do I fill out pacific-coast-shipyards-pension-fund-sfa-lock using my mobile device?

What is pacific-coast-shipyards-pension-fund-sfa-lock?

Who is required to file pacific-coast-shipyards-pension-fund-sfa-lock?

How to fill out pacific-coast-shipyards-pension-fund-sfa-lock?

What is the purpose of pacific-coast-shipyards-pension-fund-sfa-lock?

What information must be reported on pacific-coast-shipyards-pension-fund-sfa-lock?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.