Get the free Budget & Financial Planning Request for Faculty Start-up & ...

Get, Create, Make and Sign budget amp financial planning

How to edit budget amp financial planning online

Uncompromising security for your PDF editing and eSignature needs

How to fill out budget amp financial planning

How to fill out budget amp financial planning

Who needs budget amp financial planning?

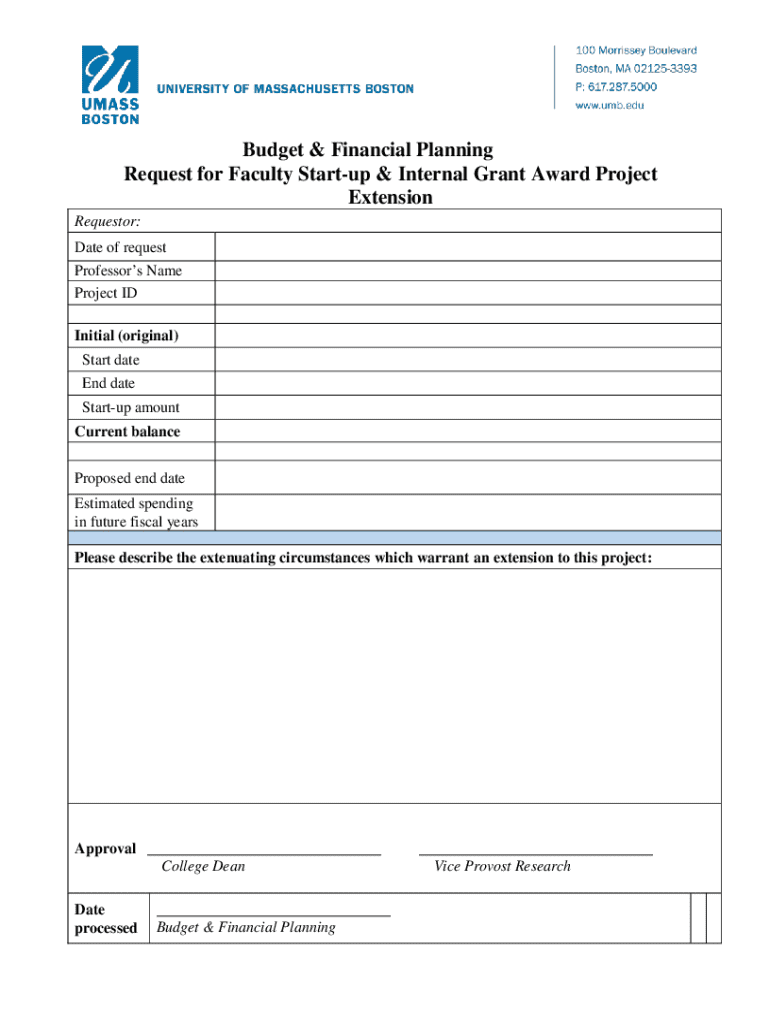

Comprehensive Guide to Budget and Financial Planning Form

Understanding the importance of budgeting and financial planning

Budgeting is not just a financial necessity—it's a strategic tool that empowers individuals and teams to manage their finances effectively. Proper budgeting allows for a clear overview of income versus expenses, promoting informed decision-making. The significance lies in its ability to enhance financial health, effectively manage cash flow, and provide a cushion against unforeseen expenses. Without a budget, staying in control of financial goals becomes nearly impossible.

Financial planning complements budgeting by laying down the action plan for achieving both short-term and long-term financial objectives. It's about defining financial goals and creating a pathway to reach them—whether that's saving for a home, planning for retirement, or managing day-to-day expenses efficiently. The combination of budgeting and financial planning cultivates a proactive approach to financial management that significantly reduces stress and enhances financial stability.

Overview of the budget and financial planning form

The budget and financial planning form is a comprehensive document designed to streamline your financial management process. Key features include sections for personal information, income, expenses, and savings goals, allowing users to capture and assess their financial status accurately. This form aids in keeping track of all financial aspects in one cohesive document, making it easier to make informed decisions.

Getting started: Accessing the budget and financial planning form

To access the budget and financial planning form via pdfFiller, you can follow a simple step-by-step process designed for ease of use. First, navigate to the pdfFiller website and sign in, or create a new account if you haven't already. Next, search for the budget and financial planning form in the search bar. Once located, you can open the form to begin customizing.

The form is equipped with interactive features, including editable fields, drop-down menus, and easy navigation tools. This makes the data entry process straightforward and user-friendly, enabling users of all skill levels to fill out and utilize the budget and financial planning form effectively.

Filling out the budget and financial planning form

Filling out the budget and financial planning form is a structured process that requires attention to detail. Each section plays a vital role in creating a thorough financial overview. Start with the personal information section; include your name, contact information, and any other identifying details that will help you maintain accurate records.

Next, identify your income sources. Consider various streams such as salaries, side hustles, or passive income—anything that contributes to your financial inflow. Then you move on to the expenses section, which is divided into fixed and variable expenses. Fixed expenses can include rent or mortgage payments, while variable expenses cover discretionary spending like entertainment or dining out. Finally, you'll set savings goals. Whether you're aiming to save for an emergency fund or a long-awaited vacation, be strategic in how you approach setting these goals to ensure attainability.

For reference, consider examples of each section filled out correctly. Seeing a fully filled form can inspire confidence as you tackle your own budgeting.

Editing and customizing the form

pdfFiller provides robust editing tools to tailor the budget and financial planning form to meet your specific needs. You can easily edit text, modify existing templates, or even add additional fields to ensure that all relevant information is captured. Navigating these tools is straightforward: simply click on the text you wish to edit or select options from the toolbar to make customizations.

This adaptability is particularly beneficial for teams who may have varying financial complexities. Customizing the form can allow for a more relatable experience, helping everyone involved feel included and engaged in managing the budget. Leverage these capabilities to ensure the form reflects your individual or team’s financial circumstances.

Collaborating with others on your financial plan

Collaboration can enhance the effectiveness of a budget and financial planning form, especially for teams and households. pdfFiller enables users to invite collaborators, making it simple to add family members or team members into the planning process. With collaborative access, these individuals can provide input, suggest changes, or help with data entry, leading to a more well-rounded financial strategy.

When collaborating, consider tips such as setting a specific time for discussions, encouraging input from all parties, and being receptive to feedback. This engagement not only promotes accountability but also increases the likelihood of achieving financial goals. Regular check-ins can help ensure everyone stays on the same page.

Signing and securing your financial documents

Security is paramount when dealing with financial documents. pdfFiller’s eSign features allow you to securely sign your budget and financial planning form without any hassle. This digital signing process ensures that your document remains tamper-proof and is legally compliant, giving you peace of mind.

Maintaining confidentiality is also key—regularly review and update privacy settings to ensure that sensitive information is protected. Be aware of who has access to your financial documents and take necessary precautions to secure your data against unauthorized access.

Managing your budget and financial planning documents

Once you have filled out the budget and financial planning form, the next crucial step is managing these documents effectively. Within pdfFiller, organizing your forms is straightforward with the available file management features. You can categorize your documents based on date, type, or relevance, making retrieval quick and easy.

Best practices for document management include regularly reviewing files, updating your budget as needed, and archiving outdated forms. Your financial situation can change, and keeping your documents current ensures you are always aware of where you stand financially. Regular updates allow for timely adjustments to your financial plans, ensuring you remain on track toward your goals.

Common challenges and solutions in budgeting

Many individuals and teams face certain challenges in the budgeting process. Emotional barriers, such as fear of finances or a lack of motivation, can hinder progress. Recognizing these challenges is the first step toward overcoming them; it's essential to cultivate a positive mindset when approaching budgeting.

Unexpected expenses can also derail even the best-laid plans. If an emergency arises, having a designated ‘emergency fund’ can provide necessary support. Strategies such as reviewing your budget regularly and adjusting it accordingly can account for these variables to minimize their impact on overall financial health.

Resources for enhanced financial literacy

Gaining a strong grasp of budgeting and financial planning can significantly enhance your ability to utilize the budget and financial planning form effectively. Numerous online courses and workshops cater specifically to such topics, offering guidance on proper financial management techniques. You can find valuable information on platforms dedicated to personal finance.

In addition, there's an array of recommended reading materials that can offer profound insights into budgeting strategies, expert advice, and practical tips. Toolkits that encompass budgeting templates, calculators, and checking worksheets are also invaluable when trying to develop a comprehensive understanding of financial management.

Case studies: Success stories from users

Numerous individuals and teams have experienced significant successes using the budget and financial planning form available through pdfFiller. For instance, a small business used the form to outline their income and expenses comprehensively, which helped them identify areas for cost-cutting and ultimately increase profitability within a year. The tools facilitated collaborative efforts that engaged all team members in the budgeting process.

Users have shared valuable lessons learned from their journey, such as the importance of setting realistic savings goals, regularly checking in on progress, and being flexible in the budgeting process. These insights highlight how leveraging the budget and financial planning form can lead to empowered financial decision-making.

FAQs regarding the budget and financial planning form

Many users have questions regarding the budget and financial planning form. Common inquiries include 'What if I make a mistake while filling it out?' The answer: pdfFiller allows easy editing, so you can correct any errors effortlessly. Another question often asked is, 'Can I customize the form for my specific needs?' Yes, utilizing the editing tools will enable you to tailor the form precisely to your financial situation.

Troubleshooting is another common concern. Users can regularly refer to pdfFiller's help sections for guidance on accessing the form or navigating features. Clear answers and support ensure that everyone's experience with the budgeting tool is seamless.

Exploring additional tools within pdfFiller

In addition to the budget and financial planning form, pdfFiller offers a variety of related financial tools designed to enhance your budgeting efforts. For example, invoice templates, expense trackers, and financial report generators can complement your financial planning endeavors and provide a more comprehensive overview of your financial landscape.

Using these tools together enhances your ability to stay organized and informed about your financial situation, ultimately allowing for better strategic planning. Each tool integrates seamlessly with the budget and financial planning form, creating a cohesive platform for your financial documentation.

Your journey to financial health begins here

Getting started with the budget and financial planning form on pdfFiller is an essential step towards achieving financial health and security. The platform empowers users to take control of their financial situation by providing interactive, user-friendly tools that make document creation, management, and collaboration simple.

Whether you're a first-time user or have experience with financial planning, the budget and financial planning form has tools to meet your specific needs. Embrace this opportunity to gain insights into your finances and take control of your financial future with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify budget amp financial planning without leaving Google Drive?

How can I send budget amp financial planning for eSignature?

Can I create an eSignature for the budget amp financial planning in Gmail?

What is budget amp financial planning?

Who is required to file budget amp financial planning?

How to fill out budget amp financial planning?

What is the purpose of budget amp financial planning?

What information must be reported on budget amp financial planning?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.